Are you interested in joining the world of cryptocurrency investing but unsure where to start? The cryptocurrency market has experienced tremendous growth in recent years, offering exciting opportunities for potential investors. However, navigating this volatile market can be daunting, especially for beginners. This beginner’s guide will equip you with the essential knowledge and strategies to invest in cryptocurrency safely and confidently in 2023.

We’ll delve into fundamental concepts such as understanding different cryptocurrencies, choosing the right exchange platform, and implementing risk management strategies. You’ll learn about the importance of diversifying your portfolio, setting realistic expectations, and protecting your investments from scams. By the end of this guide, you’ll have a solid foundation for making informed decisions and navigating the world of cryptocurrency investing with ease.

Understanding the Risks of Cryptocurrency

Cryptocurrency has become increasingly popular in recent years, but it’s important to understand the risks involved before investing. While the potential for high returns is enticing, there are several factors that can significantly impact your investment.

Volatility

One of the most significant risks associated with cryptocurrency is its extreme volatility. The value of cryptocurrencies can fluctuate wildly in a short period, making it challenging to predict their future performance. This volatility can lead to substantial losses for investors, especially those who are not prepared for it.

Security Risks

Cryptocurrency exchanges and wallets are often targeted by hackers, who can steal funds or personal information. This is because the decentralized nature of cryptocurrency can make it difficult to secure assets and prevent theft. Additionally, the use of private keys for accessing funds can be a security concern if they are lost or stolen.

Regulatory Uncertainty

The regulatory landscape surrounding cryptocurrency is still evolving, and this uncertainty can create challenges for investors. Different countries have different regulations, and these regulations can change frequently. This lack of clarity can make it difficult for investors to understand their rights and obligations.

Scams and Fraud

The cryptocurrency industry has seen its share of scams and fraud. Investors should be wary of investment opportunities that promise unrealistic returns or involve unknown or untrustworthy entities. It’s crucial to do your research and only invest in reputable projects.

Lack of Regulation

The lack of centralized regulation in the cryptocurrency industry can also be a risk factor. Without proper oversight, it can be difficult to ensure fair trading practices and protect investors from exploitation. This lack of regulation can also make it challenging to resolve disputes or recover lost funds.

Environmental Concerns

The mining of cryptocurrencies can have a significant environmental impact due to the massive energy consumption involved. This is especially true for Bitcoin, which uses a proof-of-work mining algorithm that requires significant energy to process transactions. Some cryptocurrencies are developing solutions to address these concerns, but it remains a significant risk for environmentally conscious investors.

It’s important to remember that investing in cryptocurrency is a high-risk endeavor. While the potential for rewards can be significant, it’s crucial to understand the risks involved before making any investment decisions. Conduct thorough research, diversify your portfolio, and invest only what you can afford to lose.

Choosing the Right Cryptocurrency Exchange

The cryptocurrency market is rapidly growing, with new investors flocking to the space every day. One of the first things you’ll need to do is choose a cryptocurrency exchange, which is a platform where you can buy, sell, and trade cryptocurrencies. But with so many exchanges out there, how do you choose the right one for you?

Here are some factors to consider when choosing a cryptocurrency exchange:

Fees

All exchanges charge fees for trading cryptocurrencies. These fees can vary significantly, so it’s important to compare different exchanges to find the one with the lowest fees. Fees can be charged on a per-trade basis, as a percentage of the trade amount, or as a flat fee. Some exchanges also charge withdrawal fees, which are fees charged for withdrawing cryptocurrencies from your account.

Security

Security is paramount when choosing a cryptocurrency exchange. You’ll want to choose an exchange that has a strong track record of security and that takes measures to protect your funds. Look for an exchange that uses two-factor authentication (2FA), cold storage, and other security features. You should also research the exchange’s history to see if it has been hacked or compromised in the past.

Coin Selection

Different exchanges offer different cryptocurrencies. Some exchanges offer a wide variety of coins, while others only offer a few popular coins. Make sure the exchange you choose offers the cryptocurrencies you’re interested in trading.

User Interface

The user interface (UI) of an exchange is important. You’ll want to choose an exchange with a UI that is easy to navigate and understand. The exchange should have a user-friendly interface that makes it easy to buy, sell, and trade cryptocurrencies. It should also have clear instructions and tutorials to help you get started.

Customer Support

Customer support is important in case you have any problems with the exchange. Look for an exchange that has responsive and helpful customer support. You should be able to reach out to customer support via email, phone, or live chat.

Regulation

Not all cryptocurrency exchanges are regulated. It’s important to choose an exchange that is regulated by a reputable financial authority. Regulation helps to ensure that the exchange is operating fairly and securely. Look for an exchange that is licensed and regulated in your jurisdiction.

Trading Features

Different exchanges offer different trading features. Some exchanges offer advanced features, such as margin trading, futures trading, and options trading. Other exchanges only offer basic trading features. Choose an exchange that offers the features you need and are comfortable using. You should consider the features offered by the exchange, such as trading tools, order types, and charts.

Choosing the right cryptocurrency exchange is an important decision. By considering the factors above, you can find an exchange that meets your needs and helps you achieve your investment goals.

Researching Different Cryptocurrencies

The world of cryptocurrency is vast and ever-evolving. With so many different cryptocurrencies available, it can be overwhelming to know where to start. Whether you’re a seasoned investor or just curious about the space, thorough research is crucial before investing in any cryptocurrency.

Here are some key factors to consider when researching different cryptocurrencies:

Understanding the Technology

Before diving into any cryptocurrency, it’s essential to understand the technology behind it. This includes:

- Blockchain: The underlying technology that powers most cryptocurrencies. It’s a decentralized and immutable ledger that records all transactions.

- Consensus Mechanism: The method used to validate transactions and maintain the integrity of the blockchain. Common examples include Proof-of-Work (PoW) and Proof-of-Stake (PoS).

- Smart Contracts: Automated agreements written in code that execute automatically when certain conditions are met.

Market Capitalization and Trading Volume

Understanding a cryptocurrency’s market capitalization and trading volume can give you insights into its popularity and liquidity:

- Market Capitalization: The total value of all circulating coins in a given cryptocurrency. A higher market cap generally indicates a more established and mature cryptocurrency.

- Trading Volume: The amount of cryptocurrency traded within a specific timeframe. High trading volume suggests greater liquidity and accessibility.

Project Team and Development

The team behind a cryptocurrency plays a significant role in its success. Research the team’s experience, expertise, and track record. Consider factors like:

- Team Members: Their backgrounds, expertise, and experience in the blockchain industry.

- Whitepaper: A document that outlines the project’s goals, technology, and roadmap.

- Community Engagement: The level of community involvement and support for the project.

Use Cases and Applications

Consider the real-world applications and use cases of a particular cryptocurrency. What problem does it solve? How is it being used? Examples include:

- Decentralized Finance (DeFi): Cryptocurrency-based financial applications that offer alternative financial services.

- Non-Fungible Tokens (NFTs): Unique digital assets that represent ownership of digital or physical items.

- Payments: Cryptocurrency can be used as a means of payment for goods and services.

Risk Assessment

It’s crucial to understand the risks associated with investing in cryptocurrencies. These risks include:

- Volatility: Cryptocurrencies are highly volatile and can experience significant price fluctuations.

- Security: Cryptocurrencies can be susceptible to hacks and scams.

- Regulation: The regulatory landscape for cryptocurrencies is constantly evolving.

By thoroughly researching different cryptocurrencies and understanding the key factors mentioned above, you can make informed decisions about which ones align with your investment goals and risk tolerance. Remember, investing in cryptocurrencies involves inherent risks, so it’s crucial to only invest what you can afford to lose.

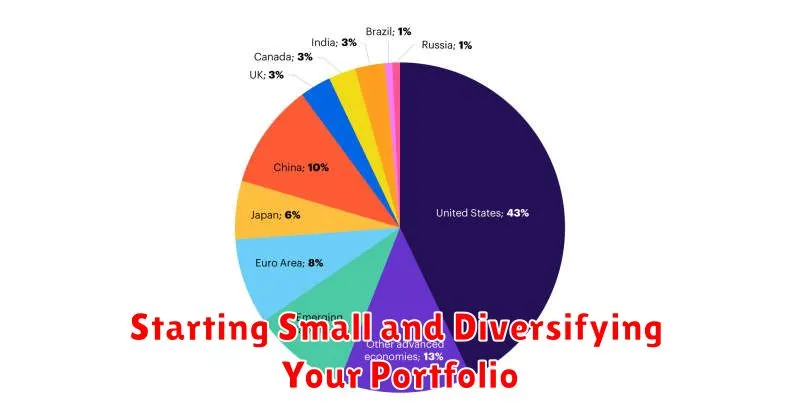

Starting Small and Diversifying Your Portfolio

In the realm of investing, the concept of diversification plays a pivotal role in mitigating risk and maximizing returns. It involves spreading your investments across a variety of asset classes, industries, and geographical locations. While the idea of diversification is widely recognized, many individuals, particularly those just starting their investment journey, find themselves grappling with the question: How do I begin diversifying my portfolio when I have limited capital?

The good news is that you don’t need a fortune to embark on the path of diversification. Even with a modest sum, you can strategically allocate your funds across different asset classes to build a solid foundation for your financial future. Here’s a practical guide to starting small and diversifying your portfolio:

1. Define Your Investment Goals and Risk Tolerance

Before diving into specific investments, it’s crucial to have a clear understanding of your investment goals and risk tolerance. What are you saving for? How long is your investment horizon? How comfortable are you with potential fluctuations in your portfolio’s value?

For instance, if you’re saving for retirement decades from now, you can afford to take on higher risk. But if you’re saving for a down payment on a house in a few years, you’ll likely want to prioritize stability and lower risk.

2. Start with Low-Cost Index Funds or Exchange-Traded Funds (ETFs)

Index funds and ETFs are excellent options for beginners because they offer instant diversification at a low cost. These funds track a specific market index, such as the S&P 500 or the Nasdaq 100, providing exposure to a broad range of companies across different sectors.

Index funds typically have low expense ratios, which are the annual fees charged by the fund manager. ETFs are similar to index funds but are traded on stock exchanges like individual stocks, offering flexibility and potential for intraday trading.

3. Consider Investing in Fractional Shares

For those seeking to diversify further, fractional shares provide a compelling solution. Fractional shares allow you to buy portions of individual stocks, even if you don’t have enough money to purchase a whole share. This gives you access to a broader range of companies without needing a large sum to invest.

4. Explore Dividend-Paying Stocks

Dividend-paying stocks offer a regular stream of income in addition to potential capital appreciation. By investing in companies that consistently pay dividends, you can generate passive income while simultaneously building your portfolio.

When selecting dividend-paying stocks, focus on companies with a strong track record of profitability, consistent dividend payments, and a sustainable business model.

5. Don’t Neglect the Importance of Bonds

Bonds are fixed-income securities that offer a relatively stable source of income. They are considered less risky than stocks and can help balance out your portfolio’s overall volatility. While bonds may not generate the same level of returns as stocks, they provide a crucial element of diversification and can help protect your capital during market downturns.

6. Explore Real Estate Investment Trusts (REITs)

REITs are companies that own and operate income-producing real estate properties. By investing in REITs, you can gain exposure to the real estate market without directly owning property. REITs offer diversification benefits, as they invest in a wide range of properties, including apartments, offices, and shopping malls.

7. Consider International Exposure

As the global economy continues to grow, investing in international markets can enhance your portfolio’s diversification. By allocating a portion of your investments to foreign stocks or ETFs, you can tap into the growth potential of emerging markets and reduce your dependence on the U.S. economy.

8. Stay Disciplined and Rebalance Regularly

Once you have established a diversified portfolio, it’s essential to maintain discipline and rebalance it regularly. Rebalancing involves adjusting your asset allocation to ensure it aligns with your original investment goals and risk tolerance.

As your investments grow, the proportions of different asset classes may shift. Rebalancing helps restore your intended asset allocation, keeping your portfolio on track and mitigating excessive risk.

Keeping Your Cryptocurrency Secure

In the ever-evolving world of cryptocurrency, security is paramount. With the rise of digital assets, the threat of theft and fraud has become a significant concern. While cryptocurrency offers numerous benefits, such as decentralization and transparency, it also presents unique challenges in safeguarding your investments.

To protect your cryptocurrency, it is crucial to adopt a comprehensive approach that encompasses various security measures. Here are some essential tips to keep your digital assets safe:

1. Use Strong Passwords and Two-Factor Authentication

A strong password is the first line of defense against unauthorized access to your cryptocurrency accounts. Avoid using common or easily guessable passwords. Instead, opt for a combination of uppercase and lowercase letters, numbers, and symbols. Additionally, enable two-factor authentication (2FA) whenever possible. This adds an extra layer of security by requiring you to enter a code sent to your phone or email in addition to your password.

2. Secure Your Hardware Wallet

Hardware wallets are physical devices that store your private keys offline, making them highly secure. Unlike software wallets, hardware wallets are not susceptible to malware or hacking attempts. When using a hardware wallet, it is vital to protect the device itself from physical damage or theft. Keep it in a safe place and ensure it is not connected to the internet when not in use.

3. Be Wary of Phishing Scams

Phishing scams are a common tactic used by cybercriminals to steal cryptocurrency. They often send emails or messages that appear to be from legitimate sources, such as cryptocurrency exchanges or wallet providers, but contain malicious links or attachments. Be cautious about clicking on links or opening attachments from unknown senders. Always verify the legitimacy of any request for personal information or cryptocurrency transfers.

4. Regularly Update Software and Security Patches

Keeping your software and operating systems up-to-date is essential for maintaining robust security. Software updates often include security patches that address vulnerabilities and protect against malware. Make sure to enable automatic updates for all your software, including your cryptocurrency wallet and antivirus software.

5. Avoid Using Public Wi-Fi for Sensitive Transactions

Public Wi-Fi networks are often unsecured and vulnerable to hacking. When conducting cryptocurrency transactions, avoid using public Wi-Fi as it can expose your private keys and other sensitive information. Stick to secure private networks or consider using a VPN for added security.

6. Research and Choose Reputable Exchanges and Wallets

Not all cryptocurrency exchanges and wallets are created equal. When choosing a platform, it is crucial to research its reputation, security features, and track record. Look for exchanges and wallets with a proven history of security and customer support.

7. Store Your Cryptocurrency in Multiple Wallets

Diversifying your cryptocurrency holdings across multiple wallets can enhance security. By dividing your assets, you reduce the risk of losing everything in a single hacking incident. This approach can also make it more challenging for hackers to gain access to all your funds.

8. Back Up Your Private Keys and Recovery Phrases

It is crucial to back up your private keys and recovery phrases in a safe and secure location. These are essential for accessing your cryptocurrency in case you lose your device or forget your password. Keep them offline, preferably in a physical location, and never share them with anyone.

9. Be Mindful of Social Media Interactions

Beware of suspicious activities on social media platforms. Be cautious of individuals who offer financial advice or investment opportunities without proper credentials or a verified track record. Avoid sharing your private keys, recovery phrases, or financial information online, as these can be easily compromised.

10. Stay Informed About Emerging Security Threats

The cryptocurrency landscape is constantly evolving, and new security threats emerge regularly. Stay informed about the latest security best practices, vulnerabilities, and scams. Subscribe to reputable cryptocurrency news sources and security forums to stay up-to-date on the latest developments.

By following these security tips, you can significantly reduce the risk of losing your cryptocurrency to theft or fraud. Remember that vigilance and a proactive approach to security are crucial in the world of digital assets.

Recognizing and Avoiding Cryptocurrency Scams

The world of cryptocurrency is rapidly evolving, attracting both investors and scammers alike. As the popularity and value of digital currencies soar, so too does the prevalence of scams designed to prey on unsuspecting individuals. Recognizing and avoiding these scams is crucial for protecting your hard-earned money and safeguarding your digital assets.

One common tactic employed by scammers is the creation of fake cryptocurrency exchanges. These platforms mimic legitimate exchanges but are designed to steal your funds. They may offer attractive investment opportunities, but they ultimately fail to deliver on their promises, disappearing with your investments. To avoid such scams, research the exchange thoroughly, verify its legitimacy through reputable sources, and never share your private keys or sensitive information with anyone.

Another prevalent scam is the pump-and-dump scheme. In this scenario, scammers manipulate the price of a cryptocurrency by artificially inflating its value through coordinated buying activity. They then sell their holdings at the inflated price, leaving unsuspecting investors holding worthless assets. Be cautious of sudden and unexplained price surges, particularly for lesser-known cryptocurrencies. Always conduct thorough research and due diligence before investing in any digital asset.

Phishing attacks are another common threat in the cryptocurrency space. Scammers send emails or messages that appear to be from legitimate sources, such as exchanges or wallets, enticing you to click on malicious links or provide your login credentials. These links can lead to fake websites designed to steal your information. Be wary of suspicious links or requests for sensitive information. Verify the source of any communication before clicking on links or sharing personal details.

Social media scams are becoming increasingly sophisticated. Scammers create fake profiles or impersonate influencers, promoting fraudulent investment opportunities or promising high returns on cryptocurrency investments. Do your research before investing based on social media recommendations, and always be skeptical of promises of guaranteed profits or unrealistic returns.

To protect yourself from cryptocurrency scams, it’s essential to stay informed about the latest scams and techniques. Regularly update your security software and be vigilant about suspicious activity. Educate yourself about the fundamentals of cryptocurrency and the risks involved. Remember, if something sounds too good to be true, it probably is. Be cautious, do your research, and always prioritize the security of your digital assets.

Staying Updated on Cryptocurrency News and Regulations

The cryptocurrency market is constantly evolving, with new projects emerging, regulations changing, and market trends shifting rapidly. Staying informed about the latest developments is crucial for anyone involved in this dynamic space, whether you’re a seasoned investor, a curious newcomer, or simply interested in the future of finance.

This article will provide you with a comprehensive guide on how to stay updated on cryptocurrency news and regulations. We will cover various sources of information, including news websites, social media platforms, blogs, and podcasts. We will also explore tools and techniques for monitoring regulatory changes and navigating the complex landscape of cryptocurrency laws.

Reliable News Sources for Cryptocurrency Updates

There are numerous reputable news sources dedicated to covering the cryptocurrency world. These websites provide in-depth analysis, breaking news, and expert opinions. Here are some of the top choices:

- CoinDesk: A leading news platform offering comprehensive coverage of blockchain technology and cryptocurrency markets.

- Cointelegraph: A well-established news source with a global reach, covering a wide range of cryptocurrency topics.

- The Block: A respected news outlet providing in-depth reporting and analysis on blockchain and cryptocurrency trends.

- Decrypt: A popular website focusing on the intersection of cryptocurrency and culture.

- Bitcoin Magazine: A veteran publication dedicated to Bitcoin and its ecosystem.

Social Media as a Cryptocurrency Information Hub

Social media platforms have become important channels for cryptocurrency news and discussions. While it’s essential to be cautious about misinformation, these platforms can offer valuable insights and real-time updates.

Follow influential figures in the cryptocurrency space, such as developers, investors, and analysts. Engage in discussions, ask questions, and participate in online communities. Be sure to verify information from multiple sources and critically evaluate any claims made on social media.

Cryptocurrency Blogs and Podcasts

Blogs and podcasts offer valuable perspectives on cryptocurrency news and regulations. Many experts and industry leaders share their insights, analysis, and opinions through these mediums. Here are some popular options:

- CoinTelegraph’s Blog: Features a variety of articles on blockchain, cryptocurrency, and related topics.

- The Bitcoin Podcast: A long-running podcast focused on Bitcoin and its impact on the world.

- The Crypto Daily Podcast: A daily podcast covering the latest cryptocurrency news and events.

- Unchained: A podcast hosted by Laura Shin, a well-known cryptocurrency journalist.

Monitoring Regulatory Changes

Cryptocurrency regulations are constantly evolving. Staying informed about these changes is crucial for navigating the legal landscape and mitigating potential risks. Here are some resources to monitor regulatory developments:

- Official Government Websites: Visit the websites of relevant regulatory bodies in your jurisdiction, such as the Securities and Exchange Commission (SEC) in the United States or the Financial Conduct Authority (FCA) in the United Kingdom.

- Specialized Regulatory News Sources: Several news websites and publications focus on legal and regulatory issues related to cryptocurrency.

- Cryptocurrency Industry Associations: Organizations like the Blockchain Association and the Crypto Council for Innovation provide updates on regulatory matters and advocate for industry interests.

Utilizing Cryptocurrency Research Tools

Various tools and platforms can assist you in staying updated on cryptocurrency news and regulations. These tools provide comprehensive data, analysis, and research capabilities.

- CoinMarketCap: A comprehensive website providing real-time cryptocurrency prices, market capitalization, and historical data.

- CoinGecko: A similar platform to CoinMarketCap, offering detailed information on various cryptocurrencies.

- TradingView: A charting platform widely used by traders and investors for technical analysis and market research.

- CryptoCompare: A platform providing data, analysis, and comparisons of cryptocurrencies and exchanges.

Navigating the Complexity of Cryptocurrency Laws

Cryptocurrency regulations differ significantly across countries and jurisdictions. It’s essential to understand the laws and regulations that apply to your specific situation. This includes:

- Taxation: Determine the tax implications of buying, selling, and holding cryptocurrencies in your country.

- KYC/AML Compliance: Understand the know-your-customer (KYC) and anti-money laundering (AML) regulations applicable to cryptocurrency exchanges and wallets.

- Securities Laws: Familiarize yourself with the classification of cryptocurrencies as securities or commodities under your jurisdiction’s laws.

Considering a Cryptocurrency Investment Strategy

Cryptocurrencies have taken the world by storm, captivating investors with their potential for high returns and disruptive technology. However, navigating the crypto space can be daunting, with a plethora of options and a volatile market. If you’re considering adding crypto to your investment portfolio, a well-defined strategy is essential.

First and foremost, understand your risk tolerance. Cryptocurrencies are highly volatile, and prices can fluctuate dramatically within short periods. Be realistic about your ability to handle potential losses and avoid investing more than you can afford to lose.

Next, delve into fundamental analysis. Research the underlying technology, team, and use cases of each cryptocurrency. Consider factors like blockchain scalability, tokenomics, and community support.

Diversification is key in any investment portfolio, and crypto is no exception. Spreading your investments across multiple cryptocurrencies can mitigate risk and potentially increase returns.

A common approach is to allocate your portfolio based on market capitalization. Larger-cap cryptocurrencies like Bitcoin and Ethereum tend to be more stable, while smaller-cap altcoins offer higher potential growth but also greater volatility.

Consider long-term investment goals. If you’re aiming for long-term growth, you might choose to hold cryptocurrencies for extended periods, weathering market fluctuations. Short-term trading requires a different strategy and potentially higher risk tolerance.

Don’t neglect security. Choose reputable cryptocurrency exchanges and wallets, and implement strong security measures such as two-factor authentication.

Finally, stay informed. The cryptocurrency market is constantly evolving, so stay updated on industry news, regulatory changes, and technological advancements.