Are you looking to take control of your finances and achieve your financial goals? If so, you’re not alone. Many people struggle with managing their money effectively. The good news is that you don’t have to navigate this alone. The world of personal finance is vast and can seem intimidating, but with the right knowledge and tools, you can empower yourself to make informed decisions that will lead to a more secure and prosperous future. One of the best ways to gain this knowledge is by reading personal finance books written by experts in the field.

There are countless books available, each offering unique insights and strategies for managing your money. Whether you’re a beginner just starting to explore the world of finance or a seasoned investor looking to refine your approach, these books can provide the guidance and inspiration you need to unlock your financial potential and elevate your money game. This article will delve into some of the most highly-regarded personal finance books that can help you achieve financial freedom and build a strong foundation for a brighter future.

Why Reading Personal Finance Books is Crucial

In today’s world, managing finances effectively is more important than ever. While it might seem daunting, taking control of your financial future is achievable. One of the most effective ways to achieve this is by reading personal finance books. These books offer valuable insights, practical advice, and proven strategies to help you build a solid financial foundation.

Reading personal finance books provides a plethora of benefits that can transform your financial well-being. It can empower you to make informed decisions, set realistic goals, and navigate the complex world of money with confidence. By investing in your financial literacy, you can unlock the potential for a brighter financial future.

Benefits of Reading Personal Finance Books:

- Increased Financial Knowledge: Personal finance books educate you on essential concepts such as budgeting, saving, investing, debt management, and retirement planning.

- Improved Financial Habits: By learning about sound financial principles, you can develop positive habits like spending less than you earn, saving regularly, and investing wisely.

- Enhanced Decision-Making: Understanding your financial situation allows you to make informed decisions about spending, borrowing, and investing, ultimately leading to better outcomes.

- Goal Setting and Achievement: These books provide frameworks for setting financial goals and creating actionable plans to reach them, giving you the roadmap to achieve your financial aspirations.

- Reduced Financial Stress: Knowledge is power, and understanding your finances can reduce anxiety and stress associated with money management.

- Building a Secure Future: By taking control of your finances, you can build a more secure future, ensuring financial stability for yourself and your family.

Choosing the Right Personal Finance Books:

With a wide range of books available, it’s essential to select those that align with your specific needs and interests. Consider factors like your financial situation, experience level, and learning style when making your choice.

Look for books written by reputable authors with proven expertise in personal finance. Check reviews from other readers to get an idea of the book’s effectiveness and value.

Remember, reading personal finance books is not a one-time event. It’s an ongoing process that requires commitment and action. By consistently seeking financial knowledge and applying what you learn, you can pave the path to a brighter financial future.

Top Picks for Beginners: Building a Strong Foundation

Embarking on a coding journey can be both exciting and daunting. The vast array of programming languages and frameworks can seem overwhelming, especially for beginners. To navigate this landscape effectively, it’s essential to choose languages that offer a solid foundation and a gentle learning curve. Here are some top picks for beginners, designed to equip you with the skills and knowledge needed to build a strong foundation in coding:

1. Python

Python consistently ranks among the most popular and beginner-friendly programming languages. Its clear syntax, extensive libraries, and versatility make it an excellent choice for various applications, including web development, data science, and machine learning. Python’s emphasis on readability and a vast community support system makes it an ideal language to start your coding journey.

2. JavaScript

If you’re interested in web development, JavaScript is a must-learn language. It’s used to add interactivity and dynamic features to websites, making them more engaging and user-friendly. JavaScript’s popularity and widespread adoption make it a valuable skill for any aspiring web developer. It’s a powerful language with a rich ecosystem of frameworks and libraries to explore.

3. Java

Java is a robust and widely used object-oriented programming language. Its strong focus on platform independence and enterprise-level applications makes it a sought-after language in the corporate world. Although Java might have a slightly steeper learning curve compared to Python, its solid foundation and widespread application make it a valuable investment for your coding career.

4. HTML and CSS

While not strictly programming languages, HTML and CSS are fundamental building blocks for web development. HTML (HyperText Markup Language) defines the structure and content of a webpage, while CSS (Cascading Style Sheets) controls its visual presentation. Mastering these languages is essential for creating visually appealing and functional websites.

5. C#

C# is a versatile and powerful object-oriented programming language. It’s widely used for developing Windows applications, games, and web services. C#’s syntax is relatively easy to understand, and its close integration with the .NET framework makes it a strong choice for building robust and scalable applications.

Investing Essentials: Books to Grow Your Wealth

Investing is a crucial aspect of building wealth and securing your financial future. However, navigating the world of investments can be daunting, especially for beginners. Fortunately, numerous resources can guide you on this journey, and one of the most valuable assets is a well-written book on investing.

A good investing book can provide you with the foundational knowledge, strategies, and insights needed to make informed investment decisions. Whether you’re a complete novice or an experienced investor looking to refine your approach, there’s a book out there that can help you reach your financial goals.

For Beginners:

If you’re just starting, it’s essential to grasp the basics of investing. These books offer a solid foundation:

- “The Intelligent Investor” by Benjamin Graham: Considered the bible of value investing, this classic guide emphasizes long-term, disciplined investing, focusing on intrinsic value rather than market trends.

- “The Little Book of Common Sense Investing” by John C. Bogle: A straightforward approach to investing, advocating for low-cost index funds as the foundation of a diversified portfolio.

- “Rich Dad Poor Dad” by Robert Kiyosaki: While not strictly an investing book, it offers valuable insights into financial literacy, challenging conventional wisdom and emphasizing financial independence.

For Intermediate Investors:

Once you’ve grasped the basics, you can delve into more advanced strategies and concepts:

- “You Can Be a Stock Market Genius” by Joel Greenblatt: Explores various investing techniques, including arbitrage, spin-offs, and special situations, offering alternative approaches beyond traditional market investments.

- “One Up On Wall Street” by Peter Lynch: A legendary investor shares his insights into finding undervalued companies and capitalizing on growth opportunities.

- “The Psychology of Money” by Morgan Housel: Examines the behavioral aspects of investing, highlighting the importance of patience, discipline, and understanding market psychology.

For Advanced Investors:

For experienced investors seeking to refine their strategies and explore more complex investment vehicles, these books offer valuable perspectives:

- “Security Analysis” by Benjamin Graham and David Dodd: A comprehensive guide to fundamental analysis, delving into financial statements and business valuation to identify undervalued companies.

- “The Essays of Warren Buffett” by Warren Buffett: A collection of essays and letters written by one of the most successful investors in history, offering insights into his investing philosophy and principles.

- “Margin of Safety” by Seth Klarman: Explores the concept of margin of safety, emphasizing the importance of investing with a significant buffer to mitigate risks.

Investing is a lifelong learning journey. By reading these books, you can gain invaluable knowledge and develop a solid foundation for making wise investment decisions.

Mastering Money Management: Budgeting and Saving Guides

In today’s world, financial stability is paramount. Whether you’re a student, a young professional, or a seasoned individual, managing your money effectively is a skill that can significantly impact your future. This article will guide you through the essentials of budgeting and saving, empowering you to take control of your finances.

Understanding Budgeting

A budget is a financial roadmap that outlines how you plan to allocate your income. It helps you track your expenses, identify areas where you can save, and achieve your financial goals. Here’s a simple budgeting process:

- Track Your Income: Begin by listing all your income sources, including salary, investments, and any other recurring income.

- List Your Expenses: Categorize your expenses into fixed costs (rent, utilities, loan payments) and variable costs (groceries, entertainment, dining). Use a spreadsheet or budgeting app to track your spending.

- Create a Budget: Allocate your income across your essential expenses, leaving some room for savings and discretionary spending.

- Monitor and Adjust: Regularly review your budget to ensure you’re sticking to it. Make adjustments as needed, based on changes in your income or expenses.

Effective Saving Strategies

Saving is crucial for achieving financial security. Here are some proven strategies:

- Set SMART Goals: Define specific, measurable, achievable, relevant, and time-bound savings goals. Having clear objectives motivates you to save consistently.

- Automate Your Savings: Set up automatic transfers from your checking account to your savings account on a regular basis. This removes the temptation to spend the money.

- Emergency Fund: Build an emergency fund to cover unexpected expenses, such as medical bills or car repairs. Aim for at least 3-6 months’ worth of living expenses.

- Retirement Planning: Begin saving for retirement as early as possible. Take advantage of employer-sponsored retirement plans and consider investing in a Roth IRA or traditional IRA.

Tips for Saving Money

Saving doesn’t mean depriving yourself of enjoyment. Here are some tips to save money without sacrificing your lifestyle:

- Shop Around for Deals: Compare prices for everything from groceries to insurance. Look for discounts, coupons, and cashback offers.

- Cook More Meals at Home: Eating out frequently can significantly impact your budget. Cooking meals at home allows you to control the ingredients and portions.

- Reduce Unnecessary Spending: Identify areas where you can cut back, such as subscriptions you don’t use, excessive shopping, or expensive hobbies.

- Negotiate Bills: Don’t be afraid to negotiate with your service providers, such as phone, internet, and insurance companies, to get better rates.

Conclusion

Mastering money management is a lifelong journey. By embracing budgeting and saving strategies, you can build a solid financial foundation and achieve your financial goals. Remember, consistency is key, and every small step you take contributes to your long-term success.

Debt-Free Journey: Resources for Eliminating Debt

Carrying debt can be a significant burden, weighing heavily on your finances and mental well-being. However, it’s not an insurmountable obstacle. Embarking on a debt-free journey is possible with the right resources and a dedicated mindset. This article provides a comprehensive guide to the tools and support systems available to help you conquer debt and achieve financial freedom.

First, it’s essential to understand the different types of debt you may be carrying. Common forms include:

- Credit Card Debt: High-interest rates can quickly snowball. Prioritize paying off these debts first.

- Student Loans: Depending on your loan type, you might have options for repayment plans or forgiveness programs.

- Personal Loans: Typically have lower interest rates than credit cards but can still be a burden. Explore consolidation options.

- Medical Bills: Negotiate payment plans or seek assistance from charities or government programs.

Once you’ve assessed your debt situation, it’s time to develop a strategy for repayment. Popular methods include:

- Debt Snowball: Prioritize paying off the smallest debts first, building momentum and motivation.

- Debt Avalanche: Focus on paying off the debt with the highest interest rate first, minimizing overall interest costs.

- Debt Consolidation: Combine multiple debts into one loan with a potentially lower interest rate, making repayment simpler.

Alongside these strategies, consider these crucial resources:

- Budgeting Apps and Tools: Mint, YNAB, and Personal Capital help you track spending, create budgets, and monitor progress.

- Credit Counseling Agencies: Non-profit organizations offer free or low-cost counseling, debt management plans, and education.

- Financial Advisors: Professional guidance can be valuable, particularly if you have complex debt situations.

Navigating debt can be challenging, but remember that it’s achievable with the right knowledge and resources. Take charge of your financial future and start your debt-free journey today!

Retirement Planning: Securing Your Financial Future

Retirement planning is an essential aspect of personal finance that involves preparing for your financial needs and goals during your golden years. It’s never too early to start planning for your retirement, as even small contributions over time can accumulate into a substantial nest egg.

The importance of retirement planning cannot be overstated. It ensures that you have sufficient financial resources to enjoy your retirement years comfortably and without financial stress. Retirement planning allows you to achieve your goals, such as traveling, pursuing hobbies, or supporting loved ones.

Here are some key elements of effective retirement planning:

1. Determine Your Retirement Goals

Start by defining your retirement goals. What do you envision your retirement lifestyle to be like? Consider your desired living expenses, travel plans, and any other financial aspirations you may have. This will give you a clear picture of your financial needs.

2. Estimate Your Retirement Expenses

Based on your retirement goals, estimate your annual expenses during retirement. Account for housing, healthcare, food, transportation, entertainment, and other costs. Remember that inflation can impact your expenses over time, so it’s crucial to factor in its potential effects.

3. Calculate Your Retirement Savings Needs

Once you have estimated your retirement expenses, you can calculate how much you need to save to meet those needs. Consider factors like your expected retirement age, investment returns, and the length of your retirement. Online retirement calculators can help you with these calculations.

4. Develop a Savings Plan

Create a comprehensive savings plan that outlines your contributions, investment strategies, and timeline. Determine the amount you can afford to save each month and allocate these funds towards your retirement goals.

5. Choose Investment Options

Select investment options that align with your risk tolerance, time horizon, and financial goals. Diversify your portfolio across different asset classes, such as stocks, bonds, and real estate, to manage risk and potentially maximize returns.

6. Review and Adjust Your Plan Regularly

Retirement planning is an ongoing process. It’s essential to review your plan regularly, at least annually, to adjust for changes in your circumstances, market conditions, and goals. Consider adjusting your contributions, investment strategies, and spending habits as needed.

7. Seek Professional Guidance

If you need assistance with retirement planning, consider consulting a financial advisor. They can provide personalized guidance based on your specific situation and help you develop a comprehensive and effective plan.

Retirement planning is a critical step towards securing your financial future. By following these guidelines, you can create a solid foundation for a comfortable and fulfilling retirement.

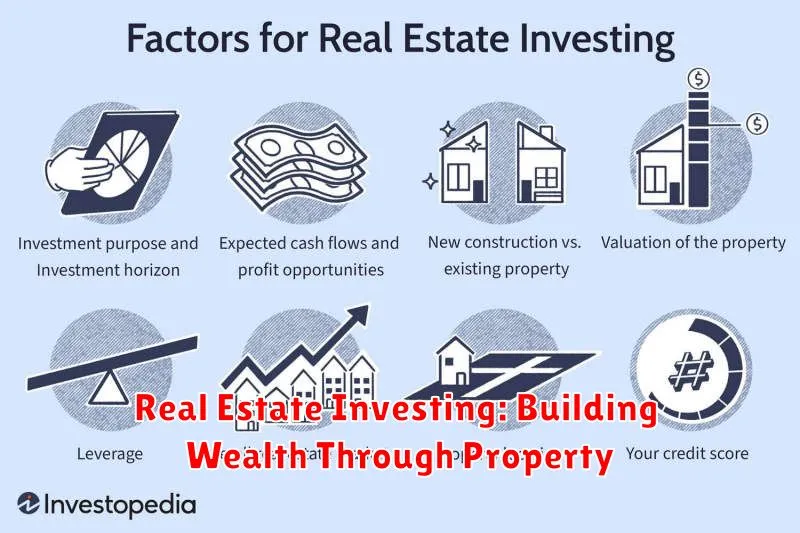

Real Estate Investing: Building Wealth Through Property

Real estate investing has long been a popular avenue for building wealth. It offers a tangible asset with the potential for appreciation, income generation, and tax advantages. Whether you’re a seasoned investor or just starting out, understanding the fundamentals of real estate investing is essential for making informed decisions and achieving your financial goals.

Types of Real Estate Investments

The world of real estate investing encompasses a wide range of options, each with its own characteristics and risk profiles. Some common types include:

- Residential Properties: This includes single-family homes, townhouses, and condominiums. These properties are often attractive for rental income or potential appreciation.

- Commercial Properties: These properties are used for business purposes, such as office buildings, retail spaces, and industrial warehouses.

- Land: Investing in raw land can be a long-term strategy, as its value may increase due to development or zoning changes.

- Real Estate Investment Trusts (REITs): These are companies that own and operate income-producing real estate. They offer investors a way to diversify their portfolio and gain exposure to the real estate market.

Benefits of Real Estate Investing

Investing in real estate can offer several advantages, including:

- Potential for Appreciation: Real estate values tend to increase over time, providing the potential for capital gains.

- Income Generation: Rental properties can provide a steady stream of passive income.

- Tax Advantages: Real estate investments offer various tax deductions and benefits, such as depreciation and mortgage interest.

- Tangible Asset: Unlike stocks or bonds, real estate is a tangible asset that you can physically own and control.

Key Considerations

While real estate investing can be lucrative, it’s important to be aware of the potential challenges:

- Market Volatility: Real estate values can fluctuate, and economic downturns can impact property prices.

- Maintenance Costs: Owning and managing properties comes with ongoing maintenance and repair expenses.

- Liquidity: Real estate can be less liquid than other investments, meaning it may take longer to sell.

- Risk Tolerance: Real estate investing requires a certain level of risk tolerance, as there’s no guarantee of returns.

Getting Started with Real Estate Investing

If you’re interested in exploring real estate investing, here are some steps to consider:

- Educate Yourself: Learn about different types of real estate investments, market trends, and financing options.

- Set Realistic Goals: Determine your investment objectives, risk tolerance, and financial resources.

- Build a Team: Work with experienced professionals, such as a real estate agent, attorney, and accountant.

- Start Small: Consider investing in a small property or a fractional share in a larger property.

- Monitor Your Investments: Regularly review your portfolio and make adjustments as needed.

Conclusion

Real estate investing can be a rewarding path to building wealth. By understanding the fundamentals, carefully considering your options, and taking a strategic approach, you can position yourself for success in this dynamic market.

Entrepreneurship and Side Hustles: Books for Financial Freedom

Are you looking to break free from the 9-to-5 grind and achieve financial independence? Entrepreneurship and side hustles can be powerful tools on your journey to financial freedom. But navigating the world of business and starting your own ventures can be daunting. That’s where the right books can come in.

These books offer valuable insights, strategies, and practical advice to help you:

- Identify your unique value proposition

- Develop a winning business plan

- Master the art of marketing and sales

- Overcome common challenges and obstacles

- Build a sustainable and profitable business

Whether you’re just starting out or looking to take your existing ventures to the next level, these books can provide the guidance you need to succeed.

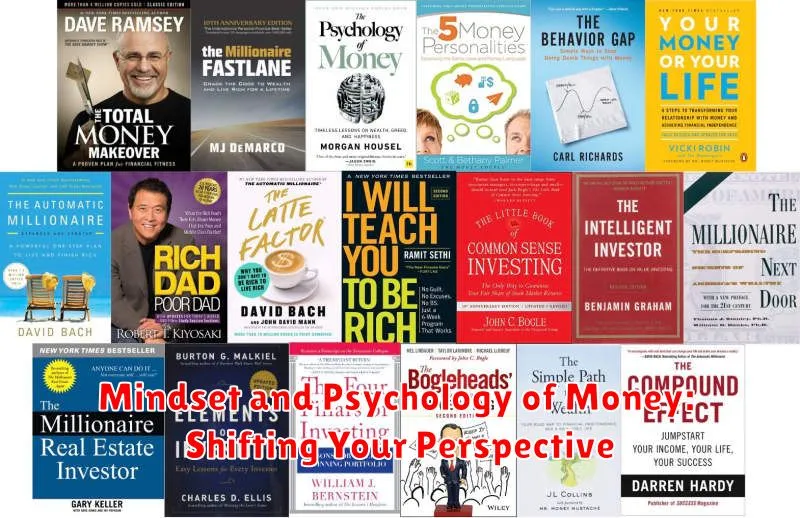

Mindset and Psychology of Money: Shifting Your Perspective

The way we think about money profoundly impacts our financial decisions and ultimately, our financial well-being. Mindset and psychology of money are crucial elements that shape our relationship with finances. It’s not just about numbers; it’s about the beliefs, values, and emotions we associate with money.

Understanding your money mindset is the first step towards financial freedom. Do you view money as a scarce resource or a tool for growth? Do you fear losing it or embrace the opportunities it presents? These seemingly subtle differences can have a significant impact on your financial choices.

Psychology of money delves into the emotional and behavioral aspects of our financial decisions. We often make irrational choices influenced by biases, fears, and societal pressures. For instance, the “fear of missing out” (FOMO) can lead to impulsive investments or spending, while the “sunk cost fallacy” might cause us to hold onto losing investments longer than we should.

By becoming aware of these psychological influences, we can begin to shift our perspectives and make more informed financial decisions. Here are some strategies to cultivate a healthy money mindset:

- Challenge your beliefs: Question your assumptions about money and identify any limiting beliefs that might be holding you back.

- Practice gratitude: Appreciate what you have and focus on the positive aspects of your financial situation.

- Set realistic goals: Break down your financial goals into smaller, achievable steps to avoid feeling overwhelmed.

- Educate yourself: Learn about personal finance principles and develop a solid understanding of how money works.

- Seek professional guidance: Consider working with a financial advisor who can provide objective advice and support.

Shifting your mindset and understanding the psychology of money is an ongoing journey. It requires self-awareness, reflection, and a commitment to continuous learning. By taking control of your financial narrative, you can create a more fulfilling and secure future for yourself and your loved ones.

Classic Reads: Timeless Wisdom for Financial Success

In the ever-evolving world of finance, it can be easy to get caught up in the latest trends and strategies. However, some principles remain timeless, and their wisdom can guide us towards financial success. Here are some classic reads that offer invaluable insights into building wealth, managing money, and achieving financial independence.

“The Richest Man in Babylon” by George S. Clason: This timeless classic, originally published in 1926, presents financial wisdom in the form of parables set in ancient Babylon. It emphasizes the importance of saving, budgeting, and investing, principles that remain relevant today. The book’s simple yet profound teachings make it an excellent starting point for anyone seeking to improve their financial literacy.

“The Intelligent Investor” by Benjamin Graham: Considered the bible of value investing, this book by Benjamin Graham, Warren Buffett’s mentor, outlines a systematic approach to investing. Graham emphasizes the importance of buying undervalued stocks with a margin of safety, a principle that has stood the test of time. While some concepts may seem outdated, the underlying principles remain relevant and offer valuable insights for long-term investors.

“Your Money or Your Life” by Vicki Robin and Joe Dominguez: This book challenges the traditional approach to money and encourages readers to re-evaluate their relationship with it. It emphasizes the importance of mindful spending, aligning spending with values, and achieving financial independence through intentional living. The book offers practical tools and techniques to gain control over your finances and live a life of purpose and fulfillment.

“The Millionaire Next Door” by Thomas J. Stanley and William D. Danko: This groundbreaking book sheds light on the habits and characteristics of millionaires in the United States. It debunks common myths about wealth and highlights the importance of hard work, frugality, and long-term planning. The book provides valuable insights into the mindset and behaviors that lead to financial success.

These are just a few of the many classic reads that offer timeless wisdom for financial success. Whether you’re just starting your financial journey or looking to refine your approach, these books can provide valuable guidance and inspiration.