The real estate market is a complex and dynamic one, constantly shifting with economic trends and market forces. For aspiring and seasoned investors alike, navigating this landscape can be a daunting task. However, the right knowledge can be your most valuable asset, empowering you to make informed decisions and maximize your returns. Investing in knowledge through the guidance of expert authors is crucial for achieving real estate success.

This guide will delve into the world of real estate books, highlighting the best resources for both aspiring and seasoned investors. Whether you’re just starting out or seeking to refine your existing strategies, these books offer invaluable insights, practical tips, and proven techniques to help you navigate the intricacies of the real estate market. Get ready to empower yourself with knowledge and unlock your potential for real estate success.

Getting Started in Real Estate Investing

Real estate investing can be a lucrative and rewarding endeavor, but it can also be daunting for beginners. With the right knowledge and strategy, you can navigate the world of real estate and achieve your financial goals. Here’s a comprehensive guide to help you get started.

1. Define Your Investment Goals

Before diving into the real estate market, it’s crucial to clarify your investment objectives. What are you hoping to achieve? Are you seeking passive income, long-term appreciation, or a combination of both? Consider your risk tolerance, financial resources, and time commitment. Setting clear goals will guide your investment decisions and keep you focused.

2. Educate Yourself

Real estate investing is not just about buying and selling properties. It requires a solid understanding of various aspects, including:

- Market analysis: Researching local market trends, property values, and rental demand.

- Financing: Understanding mortgage options, interest rates, and loan requirements.

- Property management: Learning about tenant screening, lease agreements, and maintenance responsibilities.

- Tax laws: Familiarizing yourself with tax deductions and regulations related to real estate investments.

3. Choose an Investment Strategy

There are numerous investment strategies available, each with its own risks and rewards. Some popular options include:

a. Buy and Hold

This strategy involves purchasing properties and holding them for the long term, aiming for rental income and appreciation. It’s generally considered a lower-risk approach.

b. Flipping

Flipping involves buying properties, renovating them, and quickly reselling them for a profit. This strategy requires a significant upfront investment and expertise in renovation.

c. Wholesaling

Wholesaling involves finding properties under market value and selling them to other investors for a fee. This strategy requires strong negotiation skills and a network of buyers.

4. Analyze and Evaluate Properties

Once you’ve chosen an investment strategy, it’s time to start evaluating properties. Conduct thorough research, including:

a. Location Analysis

Consider the neighborhood’s demographics, amenities, crime rates, and future development plans. A desirable location is crucial for attracting tenants or buyers.

b. Property Condition

Assess the property’s physical condition, including structural integrity, plumbing, electrical systems, and appliances. Consider potential repair costs and future maintenance needs.

c. Financial Analysis

Calculate the potential return on investment (ROI), considering purchase price, renovation costs, mortgage payments, property taxes, and insurance.

5. Secure Financing

Financing is often essential for real estate investments. Consult with mortgage lenders to explore available options and determine the best financing structure for your specific goals.

6. Manage Your Properties

If you’re investing in rental properties, proper management is vital. This includes:

a. Tenant Screening

Thoroughly screen tenants to minimize risks of non-payment or property damage.

b. Lease Agreements

Draft comprehensive lease agreements that protect both your rights and your tenants’ rights.

c. Maintenance and Repairs

Respond promptly to maintenance requests and ensure the property is kept in good condition.

7. Stay Informed and Adapt

The real estate market is constantly evolving. Stay informed about market trends, legal changes, and best practices to make informed decisions and adapt your investment strategy as needed.

Remember, real estate investing requires commitment, research, and patience. With a well-defined plan, thorough due diligence, and a willingness to learn, you can navigate the market and build a successful real estate portfolio.

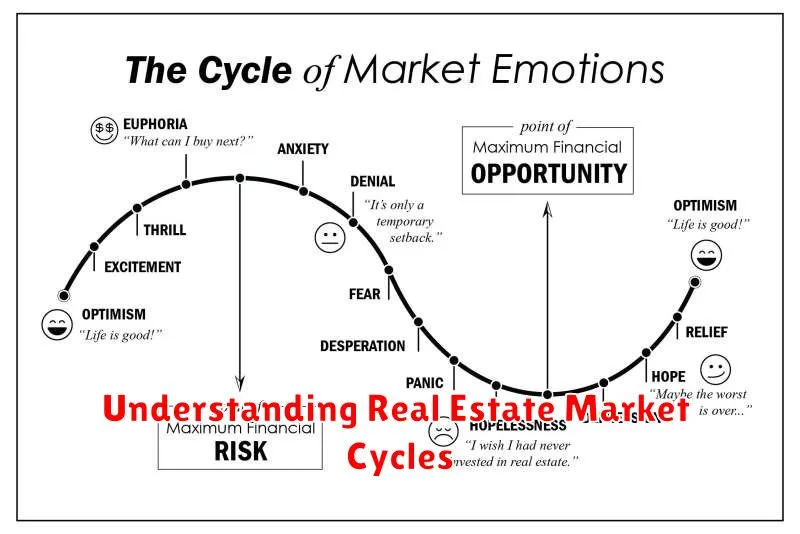

Understanding Real Estate Market Cycles

The real estate market is cyclical in nature, experiencing periods of growth, stability, and decline. Understanding these cycles is crucial for investors, buyers, and sellers alike, as it can provide valuable insights into market trends and potential future movements. By analyzing historical data and current market conditions, individuals can make informed decisions that align with their financial goals.

Expansion is characterized by rising home prices, increased demand, and low interest rates. This period is often driven by economic growth, job creation, and low mortgage rates, leading to a favorable environment for real estate investments. As demand outpaces supply, prices continue to climb, attracting more buyers and encouraging further investment.

Peak marks the high point of the real estate cycle, where home prices reach their maximum value. This phase is often characterized by limited inventory, competitive bidding wars, and high seller confidence. As prices reach unsustainable levels, the market begins to show signs of cooling down.

Contraction sees a slowdown in market activity, as home prices start to decline. This phase can be triggered by factors such as rising interest rates, economic instability, or changes in government policies. Reduced demand, increased inventory, and a shift in buyer sentiment contribute to a cooling market.

Trough represents the lowest point of the cycle, where home prices have reached their minimum value. The market is characterized by low demand, abundant inventory, and hesitant buyers. During this phase, investors and buyers may find attractive opportunities due to discounted prices and fewer competing offers.

Understanding these cycles is essential for navigating the real estate market. By analyzing historical trends, monitoring current economic indicators, and staying informed about market news, individuals can make strategic decisions that optimize their returns and minimize risks. Whether you’re a seasoned investor or a first-time buyer, a grasp of market cycles can empower you to make sound decisions and achieve your real estate goals.

Financing Your Real Estate Investments

Investing in real estate can be a lucrative venture, but it often requires significant upfront capital. This is where financing comes into play, enabling you to leverage your funds and acquire properties that might otherwise be out of reach. Understanding the different financing options available and their implications is crucial for maximizing your returns and minimizing risks.

Traditional Mortgages: The most common type of financing for real estate investments is a traditional mortgage. These loans are typically offered by banks and credit unions, with interest rates and terms varying based on factors such as your credit score, down payment amount, and loan-to-value ratio. While traditional mortgages can provide substantial funding, they often require significant upfront costs, including a down payment and closing expenses.

Private Lending: Private lenders, such as individual investors or specialized lending firms, offer alternative financing options. Private loans can be attractive for investors who may not qualify for traditional mortgages due to factors such as limited credit history or unconventional investment strategies. However, interest rates and terms can be higher than traditional mortgages, and the loan process may be more complex.

Hard Money Loans: Hard money loans are short-term loans secured by real estate. They are often used by investors who need quick funding for rehabilitation or flipping projects. Hard money lenders typically charge higher interest rates and fees than traditional lenders, but they can be a valuable option for investors seeking fast access to capital.

Seller Financing: In some cases, sellers may be willing to provide financing to buyers, known as seller financing. This can be beneficial for both parties, as the seller can receive a stream of payments and the buyer can avoid the challenges of securing traditional financing. Seller financing can also be more flexible in terms of loan terms and qualification requirements.

Crowdfunding: Crowdfunding platforms allow investors to pool their funds and invest in real estate projects collectively. This approach can be particularly beneficial for investors seeking exposure to large-scale projects with lower investment thresholds. Crowdfunding platforms often offer diverse investment opportunities, from commercial properties to residential developments.

Choosing the Right Financing: The optimal financing strategy for your real estate investment depends on various factors, including your investment goals, financial situation, and the type of property you are targeting. It is essential to carefully evaluate different financing options, considering interest rates, loan terms, fees, and potential risks. Consulting with a financial advisor or real estate professional can provide valuable guidance and ensure you make informed decisions.

Finding and Analyzing Profitable Properties

Investing in real estate can be a lucrative venture, but it’s essential to carefully analyze and select profitable properties. By following a strategic approach, you can increase your chances of success.

First, you need to define your investment goals and objectives. What are you looking for in a property? What kind of return on investment are you seeking? This will help you narrow down your search and focus on properties that align with your goals.

Next, it’s crucial to research the local market. Understanding the supply and demand dynamics, as well as factors like zoning regulations, local economy, and infrastructure, is essential. Look at recent property sales and rental data to assess the market’s potential for appreciation and rental income.

Once you’ve identified potential properties, conduct a thorough due diligence analysis. This involves reviewing the property’s condition, obtaining necessary permits, and estimating potential renovation costs. Don’t neglect factors like property taxes, insurance, and ongoing maintenance expenses.

It’s also essential to consider the financial aspects of the investment. Determine the purchase price, financing options, and potential rental income. Use a financial calculator or spreadsheet to estimate your potential return on investment, including cash flow and appreciation.

Finally, you must factor in the risks associated with real estate investing. These may include market fluctuations, vacancy rates, and unexpected repairs. By understanding and mitigating these risks, you can improve your overall investment strategy.

Remember that finding and analyzing profitable properties requires diligence, research, and a thorough understanding of the market. By following these steps and conducting a comprehensive analysis, you can make informed decisions and increase your chances of success in real estate investment.

Property Management Strategies for Success

In the ever-evolving landscape of real estate, effective property management is paramount to success. Whether you’re a seasoned investor or a first-time landlord, implementing robust strategies is crucial to maximize returns, minimize risks, and cultivate long-term prosperity. This comprehensive guide delves into key strategies that empower property managers to excel in their endeavors.

1. Thorough Tenant Screening:

A solid foundation for successful property management lies in a comprehensive tenant screening process. Implementing a thorough screening protocol is essential to identify reliable and responsible tenants. This involves carefully reviewing credit history, criminal background checks, rental history, and income verification. By meticulously evaluating these factors, property managers can make informed decisions and reduce the risk of potential issues.

2. Clear and Concise Lease Agreements:

A well-defined lease agreement serves as the cornerstone of a harmonious landlord-tenant relationship. The lease should clearly outline the terms and conditions of the rental agreement, encompassing rent payments, responsibilities, lease duration, and any applicable rules or regulations. By fostering transparency and mutual understanding, a robust lease agreement mitigates potential disputes and establishes a framework for a smooth rental experience.

3. Regular Property Maintenance:

Maintaining the property in optimal condition is vital for attracting and retaining tenants. Implementing a proactive maintenance program involves addressing repairs promptly, performing routine inspections, and conducting preventative measures. By prioritizing maintenance, property managers can prevent minor issues from escalating into major problems, safeguarding the property’s value and preserving tenant satisfaction.

4. Effective Communication:

Open and consistent communication is the lifeblood of successful property management. Maintaining clear and regular communication with tenants is crucial for addressing concerns, providing updates, and fostering a positive rapport. Implementing a system for prompt response to inquiries, maintaining clear communication channels, and scheduling regular interactions can significantly enhance tenant satisfaction and cultivate a harmonious relationship.

5. Financial Management:

Sound financial management is the bedrock of successful property investment. Implementing a robust accounting system, tracking income and expenses meticulously, and adhering to a clear budget are essential for maximizing profitability. Employing software solutions, automating financial processes, and seeking professional financial advice can streamline operations and enhance financial transparency.

6. Marketing and Advertising:

Attracting quality tenants necessitates effective marketing and advertising strategies. Leveraging online platforms, social media, and traditional marketing channels to showcase the property’s unique features can attract potential tenants. High-quality photos, engaging descriptions, and strategic online listings are essential for capturing attention and generating interest.

7. Legal Compliance:

Staying abreast of local laws and regulations is paramount to responsible property management. Adhering to fair housing laws, tenant rights, and property maintenance standards ensures compliance and mitigates legal risks. Consulting with legal professionals and staying informed about relevant legislation can provide valuable guidance and safeguard your investments.

Legal and Tax Considerations for Real Estate Investors

Real estate investing can be a lucrative venture, but it’s essential to be aware of the legal and tax implications involved. Understanding these aspects can help you make informed decisions, protect your investments, and maximize your returns. This article will delve into key legal and tax considerations for real estate investors.

1. Property Ownership and Title

The way you hold title to your real estate property is crucial. Understanding the different types of ownership is essential for managing legal and tax implications. Here are some common options:

- Sole Proprietorship: The simplest form, where the individual owns and operates the property directly. All income and expenses flow through the owner’s personal tax return.

- Partnership: Two or more individuals pool resources to own and operate the property. The partnership agreement outlines the ownership structure and profit/loss sharing.

- Limited Liability Company (LLC): A hybrid entity that offers some liability protection for the owners. Profits and losses are passed through to the owners’ personal tax returns, but the LLC itself is not subject to corporate tax rates.

- Corporation: A separate legal entity with its own tax obligations. Profits and losses are taxed at the corporate level and then potentially again when distributed to shareholders as dividends.

Choosing the right ownership structure depends on factors such as your investment goals, liability concerns, and tax strategy. Consulting with an attorney and accountant can provide personalized guidance based on your specific situation.

2. Zoning and Land Use Regulations

Before investing in a property, it’s essential to understand the applicable zoning and land use regulations. These laws dictate how the property can be used, and any violations can result in fines or legal action. Some key points to consider include:

- Zoning Districts: These define the permissible types of uses for a property, such as residential, commercial, or industrial.

- Building Codes: These establish construction standards and safety requirements that must be met.

- Environmental Regulations: These address issues like pollution, hazardous materials, and wetlands protection.

It’s crucial to verify that the intended use of the property aligns with local regulations and to obtain necessary permits or variances if required. Failure to comply with these regulations can lead to significant legal and financial consequences.

3. Property Taxes

Real estate investors are responsible for paying property taxes, which vary depending on the location and value of the property. It’s essential to budget for these expenses and understand how they impact your overall return on investment. Here are some key aspects to consider:

- Tax Assessment: The property’s value is assessed by local authorities, which determines the tax rate.

- Tax Liens: If property taxes are not paid, a lien can be placed on the property, which can lead to foreclosure if not resolved.

- Deductions: Depending on the type of investment property, certain property tax deductions may be available for tax purposes.

Staying informed about property tax rates and deadlines is crucial for avoiding penalties and maintaining ownership of your investment property.

4. Capital Gains Taxes

When you sell a real estate investment property, you may be subject to capital gains taxes on any profit you realize. The tax rate on capital gains depends on how long you held the property and your overall tax bracket.

- Short-Term Capital Gains: Profits from properties held for less than one year are taxed at your ordinary income tax rate.

- Long-Term Capital Gains: Profits from properties held for over one year are taxed at preferential rates, typically lower than ordinary income tax rates.

Understanding the different capital gains tax rates and potential deductions can help you minimize your tax liability when selling your investment property.

5. Insurance

Adequate insurance coverage is essential to protect your real estate investment from various risks. Here are some key types of insurance to consider:

- Property Insurance: Covers damage to the property from events like fire, theft, or natural disasters.

- Liability Insurance: Protects you from lawsuits arising from injuries or damage caused on the property.

- Flood Insurance: Required in areas prone to flooding.

- Renters Insurance: For tenants who are responsible for personal belongings in rental properties.

The specific insurance needs will vary depending on the type of property and your investment strategy. Consult with an insurance agent to determine appropriate coverage levels and policies.

6. Legal Contracts and Agreements

Navigating real estate investments involves numerous legal contracts and agreements. Understanding their terms and conditions is crucial for protecting your interests. Some common agreements include:

- Purchase Agreement: Outlines the terms and conditions of buying a property.

- Lease Agreement: Defines the terms of renting out a property.

- Management Agreement: Outlines the responsibilities of a property manager if you choose to hire one.

Reviewing all contracts carefully and seeking legal advice when needed can help you avoid potential disputes and ensure a smooth and successful investment process.

7. Tenant Laws and Landlord-Tenant Rights

If you’re planning to rent out your investment property, you must be familiar with state and local tenant laws and landlord-tenant rights. Understanding these laws is essential for:

- Tenant Screening: Legally screening prospective tenants for creditworthiness and rental history.

- Lease Agreements: Ensuring your lease agreements comply with applicable laws.

- Eviction Procedures: Following proper procedures for evicting tenants who violate lease terms or fail to pay rent.

- Landlord-Tenant Disputes: Resolving any disputes with tenants fairly and legally.

Staying informed about relevant tenant laws and seeking legal advice can help you navigate these complexities and avoid legal issues.

8. Environmental Considerations

Environmental issues are increasingly important in real estate investing. Here are some key points to consider:

- Environmental Audits: Conducting environmental audits before purchasing a property can identify potential hazards or liabilities.

- Environmental Regulations: Complying with applicable environmental regulations regarding waste disposal, pollution, and resource conservation.

- Green Building Practices: Adopting green building practices can enhance the value and sustainability of your property.

Addressing environmental considerations proactively can protect your investment, reduce legal risks, and contribute to a more sustainable future.

Conclusion

Navigating the legal and tax complexities of real estate investing is essential for maximizing returns and minimizing risks. By understanding the key considerations outlined above, you can make informed decisions, protect your investments, and achieve long-term success in the real estate market.

Building a Successful Real Estate Portfolio

Investing in real estate can be a lucrative endeavor, but it requires careful planning and execution. Building a successful real estate portfolio involves a strategic approach to acquiring, managing, and growing your properties over time. This article will delve into the key elements of building a successful real estate portfolio, providing insights and tips for investors of all levels.

1. Define Your Investment Goals and Strategy

Before embarking on your real estate investment journey, it’s crucial to define your goals and develop a clear investment strategy. Ask yourself: What are your financial objectives? What type of properties are you interested in? What is your risk tolerance? Are you seeking long-term appreciation, rental income, or a combination of both?

2. Conduct Thorough Market Research

Thorough market research is essential for identifying promising investment opportunities. Analyze local market trends, including supply and demand, rental rates, property values, and economic growth prospects. This information will help you make informed decisions about where and what to invest in.

3. Secure Funding and Financing

Financing is often a key factor in real estate investments. Explore different financing options, including conventional mortgages, private loans, and hard money loans. Consider your credit score, debt-to-income ratio, and overall financial situation when choosing a loan product.

4. Acquire Properties Wisely

When acquiring properties, focus on undervalued or under-performing assets with potential for appreciation or rental income. Consider properties with strong fundamentals, such as desirable locations, good rental demand, and potential for renovations or improvements. It’s also important to conduct thorough due diligence before making an offer, including property inspections and title searches.

5. Implement Effective Property Management

Effective property management is crucial for maximizing returns and minimizing risks. This includes finding reliable tenants, collecting rent, maintaining the property, and handling any repairs or issues promptly. Consider hiring a professional property manager if you lack the time or expertise to handle these tasks yourself.

6. Diversify Your Portfolio

Diversification is a key principle of investing, and it applies to real estate as well. Consider investing in different property types, locations, and markets to spread your risk. This strategy can help mitigate losses in the event of a downturn in one particular market or asset class.

7. Stay Informed and Adapt to Market Changes

The real estate market is constantly evolving, so it’s essential to stay informed about industry trends, economic conditions, and regulatory changes. Be prepared to adapt your investment strategy as needed to capitalize on new opportunities or mitigate potential risks.

8. Be Patient and Persistent

Building a successful real estate portfolio takes time and patience. It’s important to have a long-term perspective and avoid making impulsive decisions based on short-term market fluctuations. Persistence and a commitment to your investment goals are essential for long-term success.

Learning from Real Estate Experts

Navigating the complex world of real estate can be daunting, especially for first-time buyers or sellers. The market is constantly shifting, regulations change, and making informed decisions requires expert knowledge. That’s where real estate professionals come in. These experts possess a wealth of experience and insights that can be invaluable to anyone looking to buy, sell, or invest in property.

One of the most significant advantages of working with a real estate expert is their market expertise. They have a deep understanding of local trends, pricing strategies, and inventory availability. Whether you’re buying or selling, this knowledge can help you achieve the best possible outcome. They can advise on fair market values, identify potential red flags, and negotiate effectively on your behalf.

Beyond market knowledge, real estate professionals offer valuable connections within the industry. They often have relationships with lenders, inspectors, contractors, and other professionals who can contribute to a smooth and successful transaction. This network can save you time and effort, simplifying the process and providing you with access to the best resources available.

Perhaps the most important aspect of working with a real estate expert is their guidance and support. They are there to answer your questions, explain complex procedures, and navigate the emotional and logistical challenges that often arise in real estate transactions. Their expertise and advice can provide you with the confidence and reassurance you need to make informed decisions.

Learning from real estate experts is not only about gaining knowledge but also about building a strong foundation for your future real estate endeavors. Whether you’re a first-time buyer, seasoned investor, or simply looking for guidance, their insights and expertise can empower you to make informed decisions and achieve your real estate goals.