Are you looking to take control of your financial future and conquer the stock market? The stock market can be a daunting world, filled with jargon and complex strategies. But it doesn’t have to be! With the right knowledge and guidance, you can navigate the markets with confidence and achieve your investment goals. The key lies in equipping yourself with the best investment books available, written by seasoned experts who share their wisdom and proven techniques.

This guide will introduce you to a curated selection of investment books that will empower you to make informed decisions, understand market dynamics, and build a solid investment portfolio. Whether you’re a beginner or a seasoned investor, these books will provide valuable insights, strategies, and practical advice to help you achieve financial success. Get ready to unlock the secrets to stock market mastery and embark on a journey of smart, profitable investing.

Why Knowledge is Power in the Stock Market

The stock market can be a daunting and complex world, filled with jargon and seemingly endless data. It’s easy to feel overwhelmed, especially for newcomers. However, one thing remains constant: knowledge is power. The more you understand about the stock market, the better equipped you are to make informed decisions and potentially achieve financial success.

Investing without proper knowledge can be akin to driving a car without knowing how to operate it. You might stumble upon a few lucky turns, but ultimately, you’re likely to end up lost and potentially even crash. The stock market is no different. Without understanding fundamental analysis, technical analysis, market trends, and risk management, you are essentially gambling with your money.

Investing in the stock market is not about making a quick buck. It’s a long-term strategy that requires patience, discipline, and a thorough understanding of the market dynamics. By gaining knowledge, you can learn to:

- Identify potential investments: Knowledge empowers you to distinguish between promising companies with strong fundamentals and those that might be overvalued or risky.

- Make informed decisions: You can analyze financial statements, understand market trends, and make rational investment choices based on data and research.

- Manage risk: Understanding different risk profiles and strategies enables you to protect your investments and navigate market volatility effectively.

- Develop a winning strategy: You can create a personalized investment plan tailored to your financial goals, risk tolerance, and time horizon.

The beauty of the stock market is that knowledge is readily available. There are countless resources available, from books and online courses to financial news outlets and expert opinions. It’s up to you to seek out this information, analyze it critically, and apply it to your own investment journey.

Remember, knowledge is not just about reading books or attending seminars. It’s also about continuous learning and adapting to market changes. The stock market is constantly evolving, and staying informed is crucial for success. By embracing lifelong learning, you can unlock the potential of this powerful tool for achieving your financial goals.

Fundamental Analysis: Unveiling the Value of Stocks

In the dynamic world of finance, investing in the stock market can be a rewarding endeavor. However, navigating the complexities of this market demands a keen understanding of the underlying value of companies. Here, fundamental analysis emerges as a crucial tool, enabling investors to delve into the financial health and intrinsic worth of a business, ultimately guiding investment decisions.

At its core, fundamental analysis focuses on evaluating the financial statements of a company, including its income statement, balance sheet, and cash flow statement. By dissecting these reports, investors gain insights into the company’s profitability, solvency, and operational efficiency. This data provides a robust foundation for assessing the company’s past performance and future prospects.

One key aspect of fundamental analysis is examining a company’s profitability ratios. These ratios, such as gross profit margin and net profit margin, reveal the company’s ability to generate profits from its sales. Understanding these ratios allows investors to gauge the company’s efficiency and pricing power.

Another crucial element is assessing the company’s financial leverage. By analyzing debt-to-equity ratios and interest coverage ratios, investors can determine the company’s reliance on debt and its capacity to service its obligations. This information sheds light on the company’s financial stability and risk profile.

Beyond financial statements, fundamental analysis also involves evaluating the company’s competitive landscape, management team, and industry outlook. Understanding the company’s competitive advantages, the experience and expertise of its management, and the growth potential of its industry provides a comprehensive view of its long-term prospects.

Fundamental analysis is not a static process but rather an ongoing effort. As a company evolves, its financial performance and market dynamics change, necessitating regular reevaluation of its intrinsic value. By staying informed about the company’s developments, investors can adjust their investment strategies accordingly.

In conclusion, fundamental analysis is a powerful tool that empowers investors to make informed decisions. By meticulously analyzing a company’s financial health, competitive landscape, and future prospects, investors can uncover the true value of stocks and maximize their returns. Embracing a fundamental approach to investing is essential for navigating the complexities of the stock market and achieving financial success.

Technical Analysis: Reading the Language of Charts and Patterns

Technical analysis is a method of evaluating securities by analyzing past market data, primarily price and volume. Unlike fundamental analysis, which focuses on a company’s financial performance, technical analysis seeks to identify trends and patterns in price movements to predict future price movements. This is done by looking at charts that depict the historical performance of a security and identifying various technical indicators and patterns.

The core premise behind technical analysis is that market action discounts everything. This means that all known and unknown information about a company is already reflected in its price. Therefore, studying past price patterns can provide valuable insights into the future direction of the security. While technical analysis is not a foolproof method, it can be a valuable tool for investors and traders, particularly when used in conjunction with fundamental analysis.

Key Principles of Technical Analysis

Technical analysis relies on several key principles, including:

- Price action is the most important factor: Technical analysts believe that price movements are the best reflection of market sentiment and can be used to predict future price movements.

- History tends to repeat itself: Technical analysis assumes that market patterns and trends tend to repeat themselves over time. Identifying these patterns can help predict future price movements.

- Trends are your friends: Identifying the prevailing trend in a security’s price can be a powerful tool for making trading decisions. Riding the trend can increase the probability of successful trades.

Common Technical Indicators

There are numerous technical indicators that can be used to analyze charts and make trading decisions. Some of the most common indicators include:

- Moving averages: These are lines plotted on a chart that represent the average price of a security over a specific period. They can be used to identify trends and potential support and resistance levels.

- Relative strength index (RSI): This indicator measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset.

- MACD: The Moving Average Convergence Divergence indicator is a trend-following momentum indicator that shows the relationship between two moving averages of prices.

Technical Chart Patterns

In addition to technical indicators, technical analysis also utilizes various chart patterns to predict future price movements. These patterns are formed by the way prices move on a chart and can be categorized as bullish, bearish, or neutral.

Here are some common chart patterns:

- Head and shoulders: A bearish pattern that indicates a reversal of an uptrend.

- Double top: Another bearish pattern indicating a reversal of an uptrend.

- Cup and handle: A bullish pattern that indicates a continuation of an uptrend.

- Triangle: A consolidation pattern that can be bullish or bearish, depending on the breakout direction.

Limitations of Technical Analysis

While technical analysis can be a valuable tool, it’s important to understand its limitations:

- Not foolproof: Technical analysis is not a guaranteed method for predicting future price movements.

- Subjective interpretations: Different traders may interpret the same chart patterns differently.

- Lagging indicator: Technical indicators are based on past data, which can lead to delayed signals.

Conclusion

Technical analysis can be a valuable tool for understanding market sentiment, identifying trends, and making trading decisions. However, it’s important to use it in conjunction with other methods, such as fundamental analysis, and be aware of its limitations. By combining technical and fundamental analysis, investors can make more informed investment decisions.

Value Investing: Finding Undervalued Gems in the Market

In the ever-fluctuating world of finance, finding the next big investment can feel like searching for a needle in a haystack. While many investors chase the allure of growth stocks and high-flying tech companies, a time-tested and often rewarding approach lies in value investing. Value investing, as its name suggests, focuses on identifying undervalued companies with the potential to deliver significant returns over time. By taking a contrarian stance and looking beyond the hype, value investors seek to uncover hidden gems often overlooked by the market.

The fundamental principle behind value investing is simple: buy low, sell high. Value investors believe that market prices can sometimes deviate significantly from a company’s true intrinsic value. This disparity arises due to various factors, including market sentiment, short-term fluctuations, and investor overreaction. By meticulously analyzing financial statements, assessing management quality, and understanding the underlying business, value investors aim to identify companies trading below their intrinsic worth.

One key aspect of value investing is the focus on financial metrics. Value investors pay close attention to factors like price-to-earnings ratio (P/E), price-to-book ratio (P/B), and dividend yield. These metrics help them gauge a company’s financial health, profitability, and potential for future growth. By comparing these metrics against industry averages and historical trends, value investors can determine whether a company is truly undervalued.

Another crucial element of value investing is patience. Finding undervalued companies requires thorough research and a long-term outlook. Unlike growth investors who may seek quick gains, value investors are willing to hold their positions for extended periods, allowing their investments to compound over time. This patient approach enables them to ride out market fluctuations and reap the rewards of long-term value creation.

However, value investing is not without its challenges. The market can remain irrational for extended periods, and undervalued companies may take time to appreciate in value. Additionally, identifying truly undervalued companies requires a deep understanding of financial analysis and the ability to navigate complex market dynamics. Despite these challenges, value investing remains a compelling approach for investors seeking to build wealth steadily and sustainably.

Growth Investing: Capitalizing on High-Potential Companies

Growth investing is a popular strategy that focuses on identifying and investing in companies that are expected to experience rapid growth in earnings and revenue. This strategy can be particularly rewarding for investors who are willing to take on higher risk in pursuit of higher returns. However, it is crucial to understand the risks associated with growth investing before diving in.

One of the main advantages of growth investing is the potential for high returns. Companies with strong growth prospects are often able to generate significant profits as they expand their operations. Investors who can identify these companies early on can benefit from the potential for substantial capital appreciation.

Another advantage of growth investing is the opportunity to invest in innovative and disruptive businesses. These companies are often developing new products or services that have the potential to revolutionize their industries. By investing in these businesses, investors can potentially gain exposure to the latest technological advancements and trends.

However, growth investing also comes with its fair share of risks. One of the biggest risks is that the company may not meet its growth expectations. This can happen due to a variety of factors, such as increased competition, changes in consumer demand, or unforeseen economic challenges. If a company fails to grow as expected, its stock price may decline significantly.

Another risk associated with growth investing is that these companies are often highly valued. This means that their stock prices are already reflecting their potential for future growth. If the company fails to live up to expectations, the stock price could fall sharply, resulting in significant losses for investors.

To mitigate these risks, investors should focus on investing in companies with strong fundamentals, such as a proven track record of innovation, a strong management team, and a solid financial position. It is also important to diversify investments across a range of growth companies to reduce the impact of any single company’s underperformance.

Growth investing is a potentially rewarding strategy for investors who are willing to take on higher risk in pursuit of higher returns. However, it is crucial to understand the risks involved and to carefully research potential investments before making any decisions. By doing so, investors can increase their chances of success in this dynamic and exciting investment style.

Dividend Investing: Creating Passive Income Streams

Dividend investing is a popular strategy for investors looking to generate passive income. When you invest in a company that pays dividends, you receive a portion of the company’s profits on a regular basis. These payments can provide a consistent stream of income that can be used to supplement your existing income, pay down debt, or invest further.

There are several benefits to dividend investing. First, it provides a way to generate passive income without having to actively manage your investments. You can simply buy and hold dividend-paying stocks, and the dividends will come to you automatically. Second, dividends can help to offset inflation. The value of your investments may fluctuate over time, but dividends can provide a steady stream of income that helps to preserve your purchasing power. Finally, dividends can be a sign of a company’s financial strength. Companies that pay dividends are typically profitable and have a strong track record of generating cash flow.

Before investing in dividends, it is important to understand the risks involved. The value of your investments can go down as well as up, and dividends can be cut or suspended if a company’s financial performance declines. It is also important to consider the tax implications of dividend income. Dividends are typically taxed as ordinary income.

If you are considering dividend investing, it is important to do your research and choose companies that have a solid track record of paying dividends. You should also consider the following factors:

- Dividend yield: The dividend yield is the annual dividend payment divided by the stock price. A higher dividend yield means that you are receiving a larger percentage of your investment back in dividends.

- Dividend growth rate: Companies that consistently increase their dividends over time are more attractive to investors. This is because it indicates that the company is profitable and has a strong financial position.

- Payout ratio: The payout ratio is the percentage of a company’s earnings that are paid out as dividends. A high payout ratio can be a sign that a company is not reinvesting enough of its earnings back into the business.

- Financial strength: It is important to choose companies that have a strong financial position. This means looking for companies with a low debt-to-equity ratio, strong cash flow, and a history of profitability.

Dividend investing can be a great way to generate passive income and build wealth over time. By carefully selecting dividend-paying stocks, you can create a diversified portfolio that provides a steady stream of income and helps to protect your purchasing power.

Risk Management: Protecting Your Portfolio from Losses

In the dynamic realm of finance, where market fluctuations and unforeseen events are constant companions, risk management emerges as an indispensable tool for investors seeking to safeguard their portfolios from potential losses. It encompasses a comprehensive strategy that aims to identify, assess, and mitigate the various risks associated with investments. By adopting a robust risk management framework, investors can enhance their chances of achieving their financial goals while minimizing the impact of adverse events.

Understanding Risk

Before embarking on a risk management journey, it’s crucial to grasp the fundamental concept of risk itself. In finance, risk refers to the possibility of an investment outcome differing from the expected return. It encompasses a wide spectrum of factors, including:

- Market Risk: Fluctuations in market prices due to economic conditions, geopolitical events, or investor sentiment.

- Credit Risk: The likelihood of a borrower defaulting on their debt obligations.

- Liquidity Risk: The difficulty in converting an investment into cash quickly without a significant price decline.

- Operational Risk: The possibility of losses arising from internal or external factors, such as fraud, system failures, or natural disasters.

The Importance of Risk Management

Risk management is not about avoiding risk altogether; rather, it’s about taking calculated risks and managing them effectively. By implementing sound risk management practices, investors can reap numerous benefits, including:

- Preservation of Capital: Minimizing the potential for significant losses, thereby protecting hard-earned investments.

- Enhanced Returns: By taking calculated risks, investors can potentially achieve higher returns over the long term.

- Improved Sleep at Night: Knowing that their portfolios are well-protected against adverse events can provide investors with peace of mind.

- Enhanced Investment Decision-Making: A robust risk management framework provides a structured approach to evaluating investment opportunities and making informed decisions.

Key Principles of Risk Management

Effective risk management involves several key principles:

- Identify Risks: Conduct a comprehensive assessment of potential risks associated with your portfolio.

- Quantify Risks: Determine the potential magnitude and probability of each identified risk.

- Mitigate Risks: Implement strategies to reduce or eliminate the impact of identified risks.

- Monitor and Review: Regularly monitor the effectiveness of your risk management plan and make adjustments as needed.

Risk Management Strategies

Investors can employ a variety of risk management strategies, tailored to their individual investment goals, risk tolerance, and financial circumstances. Some common strategies include:

- Diversification: Spreading investments across different asset classes, industries, and geographies to reduce concentration risk.

- Asset Allocation: Determining the optimal mix of assets in a portfolio to align with investment objectives and risk tolerance.

- Hedging: Employing financial instruments, such as derivatives, to offset potential losses from adverse market movements.

- Stop-Loss Orders: Setting predetermined price levels at which to sell an investment to limit potential losses.

- Insurance: Obtaining insurance policies to protect against specific risks, such as property damage or personal liability.

Conclusion

Risk management is an essential aspect of successful investing. By understanding the nature of risk, implementing sound strategies, and regularly monitoring their portfolios, investors can enhance their chances of achieving their financial goals while protecting their investments from potential losses. It’s important to remember that risk management is an ongoing process that requires constant vigilance and adaptability in the ever-changing financial landscape.

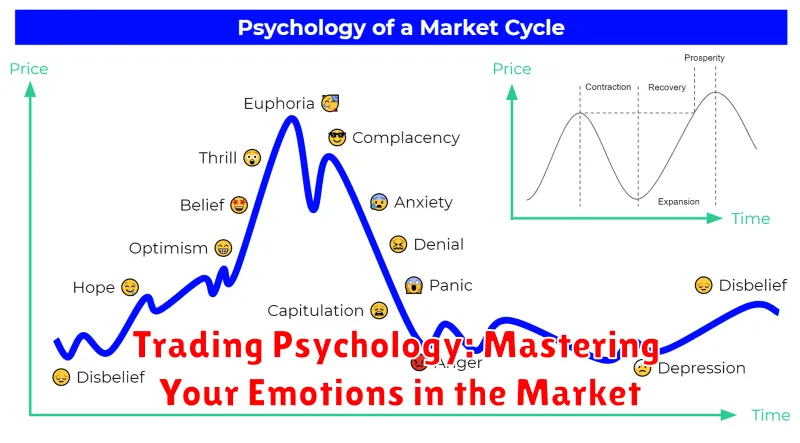

Trading Psychology: Mastering Your Emotions in the Market

Trading is a game of probabilities and risk management, but it also involves a significant psychological component. Emotional control is crucial for success in the market. Your emotions can cloud your judgment and lead to impulsive decisions that can be detrimental to your trading strategy.

The financial markets are inherently volatile, and it’s natural to experience emotions like fear, greed, excitement, and frustration. However, it’s critical to recognize that these emotions are not your allies in the trading game. When fear grips you, it can lead to selling assets prematurely, missing out on potential gains. On the other hand, greed can lead to holding onto losing positions for too long, hoping for a rebound that may never come.

Here are some practical tips to help you master your trading psychology:

- Develop a Trading Plan: A well-defined trading plan serves as a roadmap for your actions. It outlines your entry and exit points, risk management strategies, and emotional guidelines. Adhering to your plan helps you make rational decisions even when emotions are running high.

- Keep a Trading Journal: Document your trades, including the rationale behind your decisions and the emotions you experienced. Reviewing your journal can identify recurring patterns and help you understand the impact of your emotions on your trading performance.

- Embrace Risk Management: Effective risk management strategies are essential for protecting your capital. Set stop-loss orders to limit your losses on any given trade and stick to your predefined risk parameters.

- Practice Mindfulness and Meditation: Mindfulness techniques and meditation can help you become more aware of your emotions and develop greater control over them. By observing your thoughts and feelings without judgment, you can learn to separate emotions from rational decision-making.

- Avoid Overtrading: Taking too many trades can increase your risk and expose you to emotional fatigue. Focus on a limited number of high-quality trading opportunities that align with your trading plan.

Mastering your trading psychology is an ongoing journey, and it takes time and effort to develop emotional discipline. By recognizing your emotional triggers, implementing sound risk management strategies, and adopting mindfulness practices, you can improve your trading performance and make more informed decisions in the market.

Building a Winning Investment Strategy: Tailored to Your Goals

In the realm of finance, a well-crafted investment strategy is paramount to achieving financial success. It’s not just about picking stocks or chasing the latest trends; it’s about understanding your individual circumstances, goals, and risk tolerance, and then crafting a plan that aligns with those factors.

A winning investment strategy is not a one-size-fits-all solution. It’s personalized, taking into account your unique financial situation, goals, and risk appetite. Here’s a breakdown of key steps to consider:

1. Define Your Financial Goals

Before you invest a single dollar, it’s crucial to define your financial goals. What are you saving for? Retirement, a down payment on a house, your child’s education, or something else entirely? Having clear, measurable objectives will guide your investment choices and keep you motivated along the way.

2. Assess Your Risk Tolerance

Investment risk is the possibility that your investment could lose value. Your risk tolerance is your ability to stomach potential losses. Are you comfortable with volatile investments that have the potential for higher returns, or do you prefer a more conservative approach with lower potential returns but greater stability? Understanding your risk tolerance is key to selecting the right investment mix.

3. Determine Your Time Horizon

Your time horizon is the length of time you plan to keep your investments. Long-term investors have the luxury of weathering market fluctuations, while short-term investors may need to be more cautious. The longer your time horizon, generally the more risk you can take on, as you have more time to recover from potential downturns.

4. Diversify Your Portfolio

Don’t put all your eggs in one basket. Diversification means spreading your investments across different asset classes, such as stocks, bonds, real estate, and commodities. This helps to reduce risk by mitigating the impact of any single investment performing poorly.

5. Rebalance Regularly

Over time, your portfolio can become unbalanced as certain investments perform better than others. Regularly rebalancing your portfolio brings it back in line with your original asset allocation, ensuring that your risk exposure remains aligned with your goals and risk tolerance.

6. Monitor and Adjust

The financial markets are constantly evolving, so it’s essential to monitor your portfolio regularly and make adjustments as needed. Review your asset allocation, adjust your investment strategy, and make changes based on market conditions and your own evolving circumstances.

The Future of Investing: Emerging Trends and Technologies

The investment landscape is constantly evolving, driven by technological advancements, shifting market dynamics, and changing investor preferences. As we venture into the future, several emerging trends and technologies are poised to reshape the way we invest, offering both exciting opportunities and potential challenges.

Artificial Intelligence (AI) and Machine Learning (ML) are rapidly transforming investment analysis and portfolio management. AI algorithms can analyze vast amounts of data from various sources, including financial news, social media, and market trends, to identify patterns and predict future movements. This empowers investors with data-driven insights, potentially leading to more informed decisions.

Robo-advisors, powered by AI, are gaining popularity as they offer automated investment advice and portfolio management services at a fraction of the cost of traditional financial advisors. These platforms leverage algorithms to create customized investment plans based on individual risk tolerance, financial goals, and investment horizons.

Blockchain technology, the underlying technology behind cryptocurrencies, has the potential to revolutionize the investment industry. It enables secure and transparent transactions, reducing the need for intermediaries and potentially lowering transaction costs.

Environmental, Social, and Governance (ESG) investing is gaining significant traction as investors increasingly prioritize investments that align with their values. ESG factors encompass a wide range of environmental, social, and governance issues that companies address, such as climate change, human rights, and corporate governance practices.

Alternative investments, such as private equity, hedge funds, and real estate, are becoming more accessible to individual investors through platforms that offer fractional ownership and reduced investment minimums. This trend expands investment opportunities and potentially improves portfolio diversification.

While these emerging trends offer exciting possibilities for investors, it’s crucial to approach them with caution. Understanding the risks and complexities associated with new technologies and investment strategies is essential. Investors should conduct thorough research, seek professional advice when needed, and prioritize a well-diversified investment portfolio.