Are you ready to invest in the stock market but feel overwhelmed by the complexities and potential risks? It’s normal to feel this way. The stock market can be a daunting world, especially for beginners. But don’t worry, with the right knowledge and a little bit of guidance, you can navigate the market with confidence and avoid common pitfalls.

In this article, we’ll explore some of the most common stock market investment mistakes that investors make. By understanding these errors, you can avoid them and set yourself up for success. Get ready to learn about crucial topics like timing the market, following the herd, and chasing hot stocks. We’ll delve into why these practices are often detrimental and provide practical tips to help you make informed decisions.

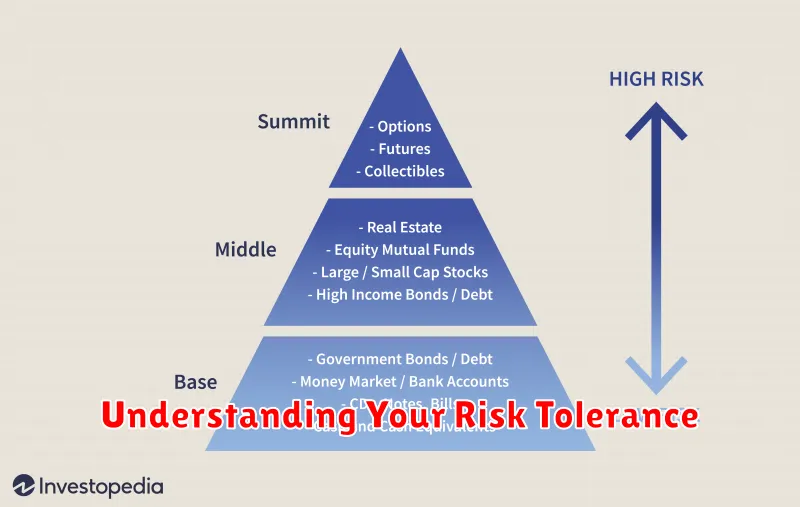

Understanding Your Risk Tolerance

Investing can be an intimidating prospect, especially for those new to the world of finance. One of the most crucial aspects of investing is understanding your risk tolerance. This refers to your capacity and willingness to accept potential losses in exchange for the possibility of higher returns. It’s a fundamental concept that can significantly impact your investment decisions and overall financial well-being.

Determining your risk tolerance involves a careful assessment of your individual circumstances and financial goals. It’s not simply a matter of being “risk-averse” or “risk-seeking.” There are several factors to consider:

- Time horizon: How long do you plan to invest your money? Longer time horizons generally allow for greater risk-taking, as you have more time to recover from potential losses.

- Financial goals: What are you saving for? Short-term goals, like a down payment on a house, typically require a more conservative approach, while long-term goals, like retirement, can afford greater risk.

- Current financial situation: Your current financial situation, including your income, expenses, and debt levels, can influence your risk tolerance. If you have a stable income and low debt, you may be more comfortable taking on risk.

- Personal comfort level: Ultimately, your risk tolerance is subjective and depends on your individual level of comfort with potential losses.

There are numerous ways to assess your risk tolerance. You can:

- Take an online quiz: Several online quizzes can help you gauge your risk tolerance based on a series of questions about your investment goals and financial situation.

- Talk to a financial advisor: A qualified financial advisor can provide personalized guidance on assessing your risk tolerance and developing an investment strategy that aligns with your goals and comfort level.

Understanding your risk tolerance is crucial for making informed investment decisions. By accurately assessing your risk tolerance, you can choose investments that are appropriate for your circumstances and financial goals. Remember, there’s no right or wrong answer when it comes to risk tolerance, and what matters most is finding a strategy that aligns with your individual needs and comfort level.

Emotional Investing and Its Pitfalls

Emotional investing is the act of making investment decisions based on feelings rather than on rational analysis. This can lead to a number of pitfalls, such as buying high and selling low, making rash decisions, and holding on to losing investments for too long.

One of the biggest pitfalls of emotional investing is that it can lead to herding behavior. When investors see others making money in a particular asset class, they may be tempted to jump on the bandwagon without doing their own due diligence. This can lead to them buying at the top of the market and then selling at the bottom when prices start to fall.

Another pitfall is that emotional investing can lead to overconfidence. Investors who have made money in the past may become overconfident and take on too much risk. This can lead to them losing money when the market turns against them.

Emotional investing can also lead to fear. When the market is down, investors may panic and sell their investments at a loss. This can lead to them missing out on the rebound when the market recovers.

There are a number of things investors can do to avoid the pitfalls of emotional investing. One is to develop a sound investment strategy and stick to it, regardless of what the market is doing. Another is to avoid checking their portfolio too often, as this can lead to emotional decisions.

Investors should also focus on the long term, rather than trying to time the market. This will help them to ride out market fluctuations and achieve their financial goals.

Finally, investors should consider seeking professional advice from a financial advisor. A financial advisor can help them to develop an investment strategy, manage their risk, and make informed investment decisions.

The Importance of Diversification

In the realm of finance, diversification is a fundamental principle that holds significant weight. It refers to the strategy of allocating investments across various asset classes, industries, and geographical locations. This approach aims to mitigate risk by spreading investments and reducing the impact of any single investment’s performance on the overall portfolio.

Diversification is akin to not putting all your eggs in one basket. By spreading your investments, you reduce the likelihood of losing everything if one particular investment performs poorly. It is a prudent approach that helps to manage risk and enhance the potential for long-term returns.

Imagine a portfolio solely invested in a single stock. If that company experiences financial difficulties, your entire investment could be wiped out. However, with diversification, your portfolio would consist of various investments, including stocks, bonds, real estate, and commodities. If one investment underperforms, the others might compensate, thus cushioning the overall portfolio from substantial losses.

Diversification plays a crucial role in both risk management and portfolio optimization. By reducing the concentration of risk, it allows investors to pursue higher returns with greater confidence. It’s a powerful tool that can help investors achieve their financial goals while navigating the uncertainties of the market.

While diversification can be an effective strategy, it’s essential to understand that it doesn’t eliminate risk entirely. There will always be inherent risks associated with investing. However, by spreading investments across different asset classes, industries, and regions, investors can significantly reduce their exposure to specific risks and enhance the overall resilience of their portfolios.

Chasing Short-Term Gains

In the relentless pursuit of success, we often find ourselves caught in the whirlwind of short-term gains. The allure of immediate gratification, the desire for quick wins, and the fear of missing out can lead us down a path that prioritizes fleeting rewards over long-term value. While there’s nothing inherently wrong with seeking immediate results, it’s crucial to recognize the potential pitfalls of solely focusing on the short term.

The pursuit of short-term gains can manifest in various ways. We might prioritize tasks that promise immediate rewards, neglecting those that require patience and perseverance. We might make impulsive decisions based on fleeting emotions, overlooking the potential consequences. We might compromise our values and principles in exchange for quick wins. This relentless focus on the present can lead to a lack of foresight, hindering our ability to plan for the future and build a solid foundation for long-term success.

One of the biggest challenges of chasing short-term gains is the potential for sacrificing long-term goals. When we prioritize immediate rewards, we may neglect the investments needed for sustainable growth. We may prioritize quick fixes over addressing the root causes of problems, ultimately perpetuating a cycle of short-term gains followed by long-term setbacks. This pattern can lead to a sense of stagnation, as we constantly find ourselves treading water instead of making meaningful progress.

Furthermore, chasing short-term gains can lead to a culture of instant gratification, where patience and delayed gratification are seen as weaknesses. This can create a cycle of dependency on external validation and a fear of missing out. We may feel pressured to constantly keep up with the Joneses, sacrificing our own values and priorities in the process. This can lead to feelings of dissatisfaction, anxiety, and a sense of being trapped in a never-ending chase for the next quick win.

To break free from the cycle of short-term gains, it’s essential to adopt a long-term perspective. This means prioritizing investments that will yield long-term value, even if they don’t offer immediate rewards. It means cultivating patience and perseverance, embracing the process of growth, and understanding that success is often the result of consistent effort over time. It also means recognizing that our worth is not defined by fleeting achievements but by our commitment to pursuing our goals with integrity and purpose.

Overlooking Company Fundamentals

In the realm of investment, it’s easy to get swept away by the allure of short-term gains and market trends. However, it’s crucial to remember that long-term success hinges on a strong foundation, one built upon the fundamentals of the companies you invest in. Overlooking these fundamentals can lead to costly mistakes and ultimately hinder your investment journey.

Ignoring company fundamentals is akin to building a house on shifting sand. While the initial appearance may seem stable, the lack of a solid base will inevitably lead to instability and potential collapse. Similarly, investing without considering the underlying health and prospects of a company can expose you to significant risk.

Fundamental analysis involves delving deeper into the core aspects of a company, such as its financial health, management team, competitive landscape, and industry trends. By understanding these factors, you can gain valuable insights into a company’s ability to generate profits, manage risks, and deliver sustainable returns for its shareholders.

When you overlook company fundamentals, you’re essentially investing blindly. You’re relying on market sentiment and short-term fluctuations to guide your decisions, rather than a thorough understanding of the company’s underlying strengths and weaknesses. This approach can lead to poor investment choices, as you might end up investing in companies that are fundamentally flawed or overvalued.

Moreover, focusing solely on short-term gains can distract you from the bigger picture. You might miss out on the opportunity to invest in companies with long-term growth potential, simply because they haven’t yet captured the attention of the market. By neglecting company fundamentals, you risk missing out on potentially rewarding investments that could deliver substantial returns over time.

In the end, a successful investment strategy requires a balanced approach. While market trends and technical analysis can provide valuable insights, it’s essential to supplement them with a thorough understanding of the fundamentals of the companies you invest in. By delving deeper into the core aspects of a company, you can make informed decisions that align with your investment goals and mitigate unnecessary risk.

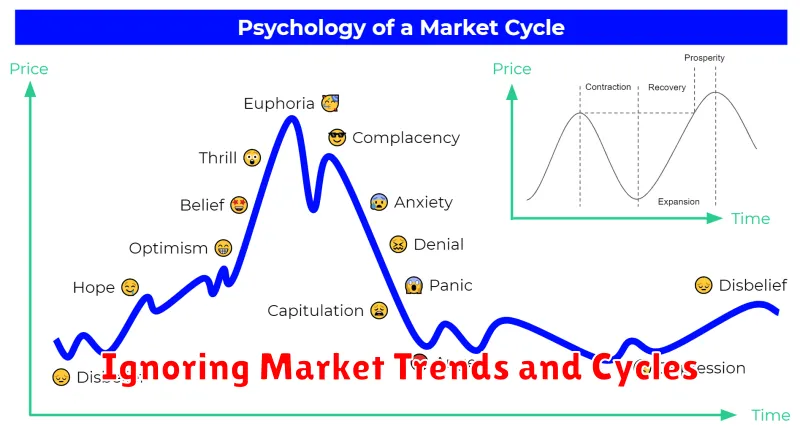

Ignoring Market Trends and Cycles

The stock market, much like the tides of the ocean, experiences predictable ebbs and flows. These fluctuations, known as market cycles, are driven by a multitude of factors such as economic growth, inflation, interest rates, and investor sentiment. While it’s tempting to chase short-term gains and ignore these patterns, understanding and adapting to market trends is crucial for long-term investment success.

Ignoring market trends can lead to several pitfalls. One common mistake is buying high and selling low, a recipe for financial disaster. When markets are bullish, it’s easy to get caught up in the excitement and invest without due diligence. However, this often results in buying at inflated prices, leaving investors vulnerable to substantial losses when the market corrects.

Another consequence of ignoring market cycles is the potential for missed opportunities. When markets are in a downturn, it can be tempting to stay on the sidelines and wait for better times. However, this can mean missing out on buying opportunities at discounted prices, potentially limiting future returns.

Furthermore, ignoring market trends can lead to emotional decision-making. When markets are volatile, it’s natural to experience fear and anxiety. This can lead to rash decisions based on emotions rather than logic, further compounding losses.

Therefore, it’s essential to develop a sound investment strategy that accounts for market cycles. This may involve diversifying your portfolio, adjusting asset allocation based on market conditions, and adopting a long-term perspective.

By recognizing and adapting to market trends, investors can navigate the ups and downs of the market more effectively and improve their chances of achieving their financial goals.

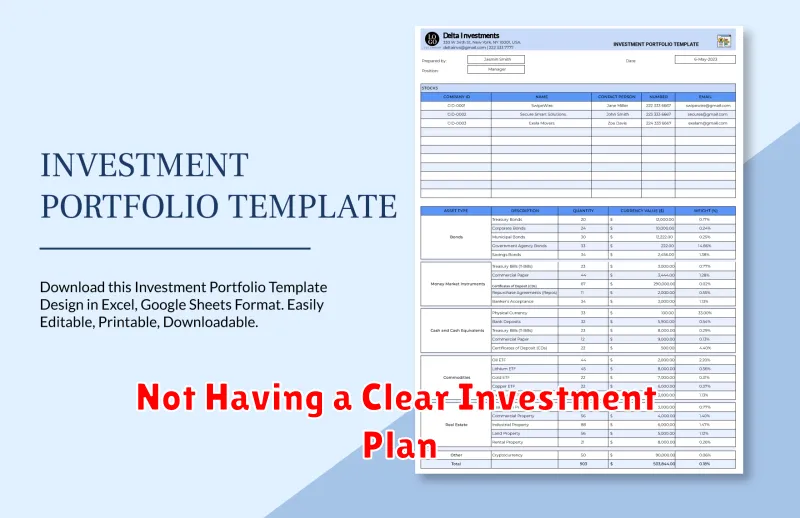

Not Having a Clear Investment Plan

One of the biggest mistakes people make when it comes to investing is not having a clear plan. Without a plan, it’s easy to get caught up in the hype of the market and make impulsive decisions that can lead to losses. A good investment plan should outline your investment goals, your risk tolerance, and your time horizon. It should also include a strategy for how you will achieve your goals.

Ignoring Your Risk Tolerance

Every investor has a different risk tolerance. Some people are comfortable taking on more risk, while others prefer to play it safe. It’s important to know your own risk tolerance before you start investing. If you’re not comfortable with the level of risk you’re taking on, you’re more likely to panic and sell your investments at the wrong time.

Investing Based on Emotion

Investing is a long-term game, and it’s important to stay calm and rational. Don’t let your emotions get the best of you. If you see the market going down, don’t panic and sell your investments. Instead, try to remember your investment goals and stick to your plan.

Not Diversifying Your Portfolio

Diversification is one of the most important principles of investing. It means spreading your investments across different asset classes, such as stocks, bonds, and real estate. This helps to reduce your risk by ensuring that you’re not putting all your eggs in one basket. You can diversify your portfolio by investing in mutual funds or exchange-traded funds (ETFs).

Not Doing Your Research

Before you invest in anything, it’s important to do your research. Understand the risks involved, the potential returns, and the company’s financial history. There are many resources available to help you learn about investing, including websites, books, and financial advisors.

Not Reviewing Your Portfolio Regularly

Once you’ve created your investment portfolio, it’s important to review it regularly. Make sure your investments are still aligned with your goals and your risk tolerance. You may also need to rebalance your portfolio from time to time to keep your asset allocation in line with your plan.

Trading Too Much

It’s tempting to try to time the market, but it’s often a losing strategy. Trying to predict the market’s movements can be difficult, and even experienced investors can make mistakes. The more you trade, the more transaction costs you’ll incur, and the more likely you are to make a mistake. It’s generally best to buy and hold your investments for the long term, rather than trying to trade in and out of the market frequently.

Falling for Stock Market Hype

The stock market can be a thrilling place, full of excitement and potential for profit. But it can also be a dangerous place, filled with hype and misinformation that can lead investors astray. It’s important to remember that the stock market is not a casino, and that there is no guarantee of returns. In fact, there is a very real risk of losing money. So how can you protect yourself from falling for stock market hype?

One of the biggest mistakes that investors make is getting caught up in the herd mentality. When everyone is talking about a particular stock or sector, it can be easy to get swept up in the excitement and buy in without doing your research. But just because everyone else is doing it doesn’t mean it’s the right thing to do for you.

Another common mistake is falling for “hot tips”. These are often shared by friends, family members, or even strangers online, and they can seem like a sure thing. However, it’s important to remember that hot tips are often based on speculation or rumors, and they can quickly turn into losses.

Instead of chasing hype, focus on making informed decisions. Do your research, understand the risks involved, and only invest in companies that you truly believe in. Remember that the stock market is a long-term game, and that you shouldn’t expect to get rich quickly. Be patient, stay disciplined, and you’ll be more likely to achieve your financial goals.

Timing the Market – A Fool’s Errand?

The allure of market timing, the art of buying low and selling high, is undeniable. It promises the potential for outsized returns and the avoidance of painful losses. But in practice, market timing is a notoriously difficult endeavor, and many experts believe it’s a fool’s errand. The reality is that the market’s direction is inherently unpredictable, and attempting to time its movements can often lead to missed opportunities and subpar returns.

One major challenge is the inherent unpredictability of the market. Predicting market peaks and troughs requires a deep understanding of economic, political, and social factors. The stock market is influenced by a multitude of variables, making it highly susceptible to unexpected events, such as global pandemics, geopolitical tensions, or sudden changes in investor sentiment.

Even seasoned professionals with access to sophisticated tools and extensive data struggle to consistently time the market. A study by J.P. Morgan found that investors who attempted to time the market between 1995 and 2014 actually underperformed the overall market by an average of 1.6% per year. The reason? Missing out on even a small portion of market gains can significantly erode investment returns over time.

Instead of chasing fleeting market fluctuations, a buy-and-hold strategy is often considered a more effective approach. This involves investing in a diversified portfolio of assets and holding them for the long term, regardless of short-term market volatility. This strategy allows investors to ride out market cycles and benefit from long-term growth, minimizing the impact of market timing errors.

Of course, this isn’t to say that market timing is entirely impossible. There are instances where investors might benefit from adjusting their portfolios based on specific economic indicators or market trends. However, these situations are rare and require a high degree of market expertise and analytical skills.

For the average investor, attempting to time the market is likely to lead to more headaches than profits. It’s important to focus on building a well-diversified portfolio, investing for the long term, and staying disciplined in the face of market fluctuations. The beauty of a buy-and-hold strategy lies in its simplicity and its proven track record of generating consistent returns over time.

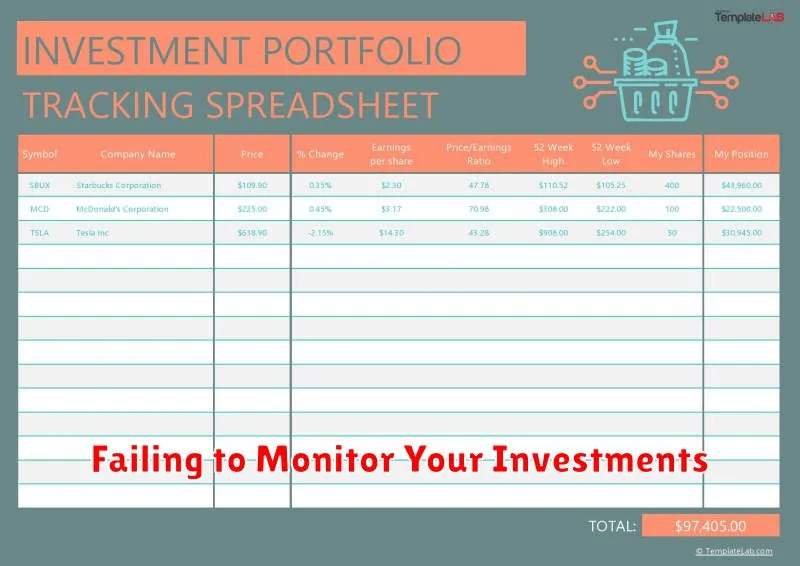

Failing to Monitor Your Investments

Investing is a marathon, not a sprint. It requires patience, discipline, and a willingness to constantly monitor your portfolio. One of the biggest mistakes investors make is failing to monitor their investments regularly. This can lead to significant losses, missed opportunities, and a lack of control over your financial future.

When you fail to monitor your investments, you’re essentially putting your money on autopilot. You’re not actively engaging with your portfolio and making informed decisions based on market conditions. This can result in several problems:

- Missed opportunities: The market is constantly changing, and there are always new opportunities emerging. If you’re not monitoring your portfolio, you may miss out on these opportunities.

- Unnecessary losses: Investments can fluctuate in value, and if you’re not monitoring your portfolio, you may not be aware of losses until it’s too late. This can be especially problematic if your investments are declining significantly or performing poorly compared to other investments.

- Lack of control: When you fail to monitor your investments, you’re essentially giving up control over your financial future. This can be unsettling, especially during times of market volatility.

So, how often should you monitor your investments? The frequency depends on your individual needs and risk tolerance. As a general rule, it’s good practice to review your portfolio at least quarterly. This will give you a good understanding of how your investments are performing and whether any adjustments need to be made.

In addition to regular monitoring, you should also be aware of any major market events or economic news that could affect your investments. For example, if there’s a sudden spike in interest rates or a recession, you may need to make adjustments to your portfolio to mitigate the impact.

Monitoring your investments doesn’t have to be a time-consuming task. There are many online tools and resources available that can make the process easier. You can also speak to a financial advisor who can help you develop a monitoring strategy that meets your individual needs.

By making monitoring a regular part of your investment routine, you can stay on top of your portfolio, identify potential problems, and take advantage of emerging opportunities. Don’t let your investments fall by the wayside. Take the time to monitor them and ensure your financial future is in your hands.

Not Seeking Professional Advice When Needed

There are many times in life where we are faced with difficult decisions. These decisions may be about our personal life, our work, or even our finances. And sometimes, we feel like we can handle it all on our own. But there are times when it’s essential to seek professional advice.

There are many reasons why seeking professional advice is important. First, professionals have expertise in their fields. They have studied and worked in their chosen area for years, and they have a deep understanding of the issues that you may be facing. Second, professionals can offer an objective perspective. When we are faced with a difficult decision, we often get caught up in our own emotions and may not be able to think clearly. A professional can help us to see the situation from a different angle and make a more informed decision.

Finally, professionals can provide support. Facing a difficult decision can be stressful, and having someone to talk to and offer guidance can be invaluable. There are many different types of professionals who can offer advice, including:

- Financial advisors

- Therapists

- Lawyers

- Doctors

- Accountants

If you are facing a difficult decision, don’t be afraid to seek professional advice. It can make all the difference in the world.