Ready to take control of your finances and achieve your financial goals? In 2024, it’s more important than ever to have a solid understanding of personal finance. With the ever-changing economic landscape, it can be challenging to navigate the world of money management. But fear not! This ultimate guide will equip you with the knowledge and tools to level up your finances and create a secure financial future for yourself.

From budgeting and saving to investing and debt management, we’ll cover all the essential aspects of personal finance. Whether you’re a seasoned financial pro or just starting your financial journey, this guide will provide you with actionable tips and strategies to make informed decisions about your money. So, buckle up and get ready to embark on a transformative journey towards financial freedom!

Understanding Your Financial Landscape

In the vast and often complex world of finance, it’s crucial to have a solid understanding of your own financial landscape. This means taking stock of your income, expenses, assets, and debts to gain a clear picture of your current financial situation.

Understanding your financial landscape is the first step towards achieving your financial goals. Whether you’re aiming for retirement security, a down payment on a home, or simply reducing debt, having a strong foundation in your finances is essential.

1. Track Your Income and Expenses

The most basic element of understanding your financial landscape is keeping track of your income and expenses. This involves documenting all sources of income, such as salary, investments, or side hustles, and meticulously recording all your expenditures.

There are various tools and methods available to aid in this process, including budgeting apps, spreadsheets, or even simply using a pen and paper. The key is to be consistent and accurate in tracking your financial flows.

2. Assess Your Assets

Assets represent what you own, and understanding their value is crucial to determining your overall financial position. Assets can include anything from real estate and vehicles to stocks, bonds, and even personal possessions.

It’s essential to regularly evaluate your assets to ensure they are aligned with your financial goals. For example, if you have a large amount of cash on hand, you might consider investing it for potential growth.

3. Analyze Your Debts

Debt is an inescapable reality for many, and understanding your debt obligations is critical to managing your finances effectively. This involves identifying all your outstanding debts, such as loans, credit card balances, or student loans.

Analyzing your debts should include evaluating the interest rates, repayment terms, and overall impact on your financial health. High-interest debt should be prioritized for repayment to minimize interest charges.

4. Develop a Financial Plan

Once you have a clear picture of your financial landscape, you can start developing a comprehensive financial plan. This plan should outline your short-term and long-term financial goals, as well as the strategies you’ll use to achieve them.

A financial plan should be dynamic and adaptable, as your circumstances may change over time. Regularly review and adjust your plan to ensure it remains relevant to your evolving needs.

5. Seek Professional Guidance

While gaining a comprehensive understanding of your financial landscape is essential, seeking professional guidance can prove immensely beneficial. A financial advisor can provide tailored advice based on your individual circumstances.

An advisor can help you with budgeting, investment strategies, debt management, and retirement planning, among other areas. By working with a professional, you can gain confidence and clarity in navigating your financial journey.

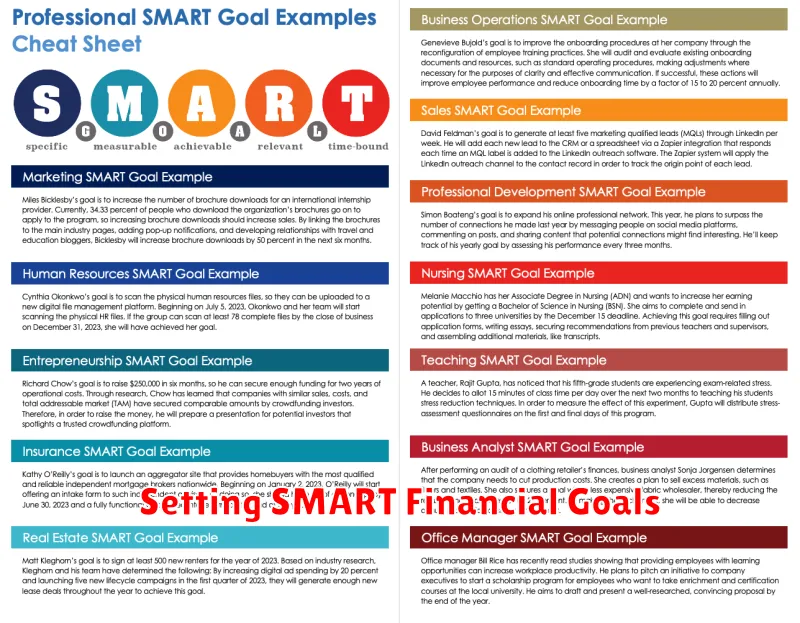

Setting SMART Financial Goals

Setting financial goals is essential for achieving financial stability and reaching your desired financial future. However, simply having goals isn’t enough. To truly make progress, your goals need to be SMART: Specific, Measurable, Attainable, Relevant, and Time-bound.

Specific

A specific goal clearly defines what you want to achieve. Instead of saying “I want to save more money,” specify “I want to save $5,000 for a down payment on a house.” By being specific, you eliminate ambiguity and give yourself a clear target to work towards.

Measurable

A measurable goal allows you to track your progress. For example, instead of “I want to invest more,” set a goal like “I want to invest $100 per month in the stock market.” You can then measure your success by tracking your monthly investments and observing the growth of your portfolio.

Attainable

While it’s important to set ambitious goals, it’s also crucial to ensure they are attainable. Don’t set a goal that’s unrealistic for your current financial situation. If you’re struggling to make ends meet, aiming to save $10,000 a year might be too ambitious. Start with smaller, more achievable goals and gradually increase your aspirations as you progress.

Relevant

Your financial goals should align with your values and priorities. If you dream of traveling the world, saving for a vacation fund is more relevant than investing in the stock market. Make sure your goals are aligned with your overall life plan and contribute to your overall happiness.

Time-bound

Having a deadline adds urgency and accountability. Instead of saying “I want to pay off my credit card debt,” set a goal like “I want to pay off my credit card debt in 12 months.” This deadline forces you to take action and prioritize your debt repayment plan.

Examples of SMART Financial Goals:

- Specific: Save $10,000 for a down payment on a house.

- Measurable: Invest $500 per month in a Roth IRA.

- Attainable: Pay off $500 of credit card debt each month.

- Relevant: Start a college savings fund for your child.

- Time-bound: Increase my emergency fund to $1,000 within six months.

By setting SMART financial goals, you’ll increase your chances of achieving your financial aspirations. Remember to review and adjust your goals regularly as your circumstances change and you progress towards your objectives.

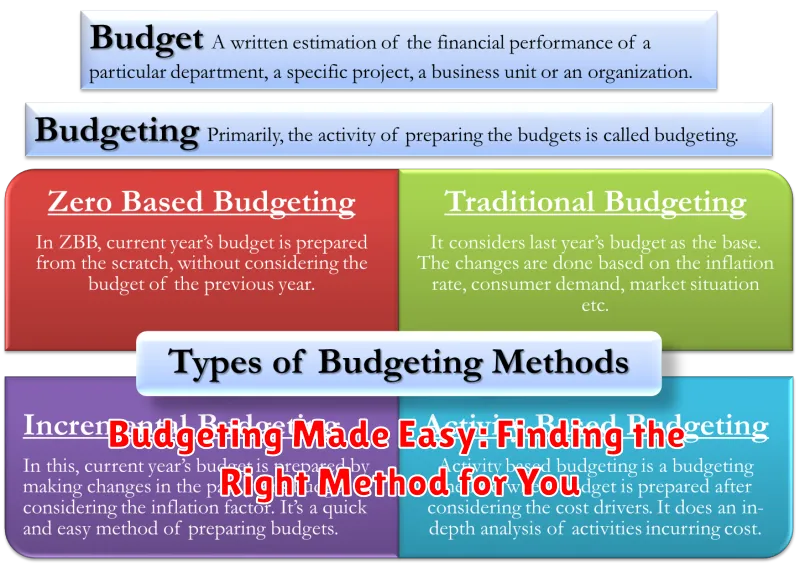

Budgeting Made Easy: Finding the Right Method for You

Budgeting is a crucial aspect of personal finance, helping you manage your money effectively and achieve your financial goals. However, with countless budgeting methods available, it can be overwhelming to find the one that suits your needs and preferences. This article will guide you through popular budgeting methods, highlighting their pros and cons to help you find the right fit for your financial journey.

The 50/30/20 Method

This simple method divides your after-tax income into three categories:

- Needs (50%): Essential expenses such as housing, utilities, groceries, and transportation.

- Wants (30%): Non-essential expenses like dining out, entertainment, and shopping.

- Savings and Debt Repayment (20%): Allocated for future goals, emergency funds, and debt reduction.

Pros: Easy to understand and implement.

Cons: Can be inflexible and may not cater to specific financial goals.

The Zero-Based Budgeting Method

This method involves meticulously allocating every dollar of your income, ensuring zero balance remains at the end of the month. This involves tracking all expenses and assigning them specific categories.

Pros: Encourages conscious spending, promotes financial discipline, and allows for detailed expense tracking.

Cons: Can be time-consuming and requires meticulous record-keeping.

The Envelope System

This method involves dividing your cash into labeled envelopes for specific expense categories, such as groceries, entertainment, and transportation. Once the money in an envelope runs out, you refrain from spending in that category until the next pay period.

Pros: Encourages spending within limits and visualizes cash flow.

Cons: Less suitable for digital transactions and may require carrying multiple envelopes.

The 50/30/20 Method

This method divides your after-tax income into three categories:

- Needs (50%): Essential expenses such as housing, utilities, groceries, and transportation.

- Wants (30%): Non-essential expenses like dining out, entertainment, and shopping.

- Savings and Debt Repayment (20%): Allocated for future goals, emergency funds, and debt reduction.

Pros: Easy to understand and implement.

Cons: Can be inflexible and may not cater to specific financial goals.

Tackling Debt Head-On: Strategies for Debt Reduction

Debt can be a heavy burden, weighing on your mind and hindering your financial progress. Whether it’s credit card debt, student loans, or other obligations, taking control of your finances and reducing debt is a crucial step towards financial freedom. This article will explore effective strategies to tackle debt head-on and pave the way for a brighter financial future.

1. Create a Realistic Budget

The first step in tackling debt is to understand your financial situation. Create a detailed budget that accurately reflects your income and expenses. This will help you identify areas where you can cut back and free up funds for debt repayment. Track your spending and identify areas where you can reduce unnecessary expenses.

2. Prioritize Your Debts

Not all debts are created equal. Some debts, like those with high interest rates, can snowball quickly. Prioritize your debts by focusing on those with the highest interest rates first. Consider using strategies like the snowball method or the avalanche method to systematically pay down your debts. The snowball method focuses on paying off the smallest debts first, while the avalanche method targets debts with the highest interest rates.

3. Increase Your Income

To accelerate debt repayment, consider increasing your income. Explore opportunities for a raise or promotion at your current job, or look for a new job that offers a higher salary. You can also supplement your income through side hustles, such as freelance work, driving for a ride-sharing service, or selling goods online.

4. Negotiate with Creditors

If you’re struggling to make payments, don’t hesitate to reach out to your creditors. Negotiate a lower interest rate, a temporary reduction in payments, or a debt consolidation plan. Many creditors are willing to work with borrowers who are facing financial hardship.

5. Seek Professional Advice

Sometimes, tackling debt can feel overwhelming. Consider seeking professional financial advice from a certified financial planner or credit counselor. These experts can provide personalized guidance, help you create a comprehensive debt reduction plan, and connect you with resources to improve your financial well-being.

6. Avoid New Debt

While you’re working towards reducing your debt, it’s crucial to avoid accumulating new debt. Resist the temptation to use credit cards, take out personal loans, or engage in any other activities that could increase your financial obligations. Focus on paying down existing debt and building a strong foundation for financial stability.

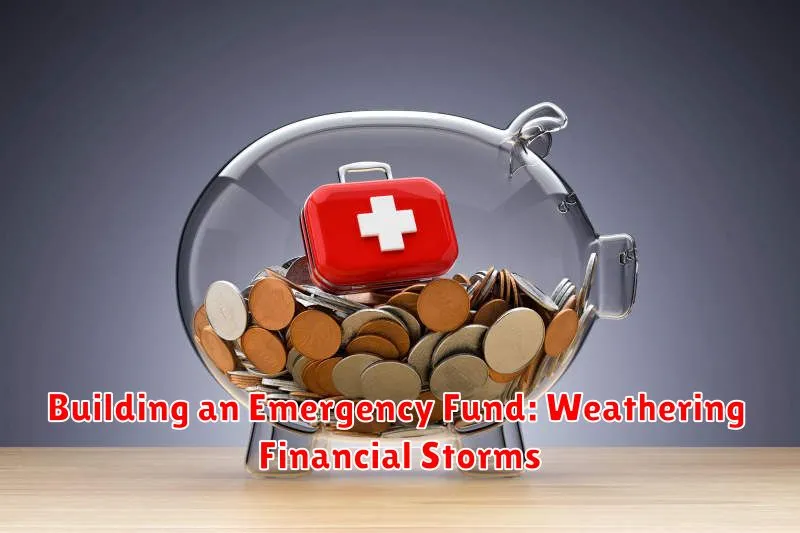

Building an Emergency Fund: Weathering Financial Storms

Life is unpredictable, and unexpected financial emergencies can arise at any time. A job loss, a medical emergency, or a major car repair can quickly throw your finances into disarray. That’s why having an emergency fund is crucial for maintaining financial stability and peace of mind. An emergency fund is a safety net that provides a financial cushion to cover unexpected expenses without jeopardizing your long-term financial goals.

Why is an Emergency Fund Essential?

An emergency fund serves as a vital financial lifeline. It allows you to:

- Cover unexpected expenses: Unforeseen events like medical bills, car repairs, or home repairs can quickly drain your savings. An emergency fund provides a buffer to avoid dipping into your retirement savings or taking on high-interest debt.

- Maintain financial stability: When faced with a financial crisis, having an emergency fund prevents you from making rash decisions, such as taking out a payday loan or selling assets at a loss. It allows you to stay afloat and navigate through difficult times without compromising your financial well-being.

- Reduce stress and anxiety: Knowing that you have a financial cushion to fall back on in times of need provides peace of mind and reduces the stress associated with unexpected expenses.

How Much Do You Need in Your Emergency Fund?

The recommended amount for an emergency fund varies depending on individual circumstances, such as your income, expenses, and dependents. However, a general rule of thumb is to have 3-6 months of essential living expenses saved up. This amount should cover your essential costs, such as rent or mortgage payments, utilities, groceries, and transportation.

Building Your Emergency Fund: A Step-by-Step Guide

Building an emergency fund may seem daunting, but it’s achievable with a strategic approach. Follow these steps to get started:

- Assess Your Current Savings: Determine how much you have already saved and identify any potential sources of funds, such as a tax refund or a bonus.

- Set a Realistic Goal: Calculate your desired emergency fund amount based on your 3-6 month target. Start with a smaller goal if needed, and gradually increase it over time.

- Create a Budget: Track your income and expenses to identify areas where you can cut back and allocate more funds towards your emergency fund.

- Automate Savings: Set up automatic transfers from your checking account to your savings account each month. This helps to ensure regular contributions to your emergency fund.

- Find Additional Income Streams: Explore ways to earn extra income, such as a side hustle or selling unwanted items. Every dollar you earn can be directed towards your emergency fund.

- Be Patient and Consistent: Building an emergency fund takes time and effort. Stay committed to your savings goals and avoid withdrawing from your emergency fund for non-essential expenses.

Maintaining Your Emergency Fund

Once you’ve built your emergency fund, it’s essential to maintain it. Regularly review your budget and ensure you’re contributing enough to cover your needs. As your income and expenses change, adjust your savings goals accordingly.

The Importance of a Well-Funded Emergency Fund

An emergency fund is not just about weathering financial storms; it’s about having the freedom to pursue your dreams and goals without being burdened by unexpected expenses. With a robust emergency fund, you can feel secure in your financial future and confidently face whatever challenges may come your way.

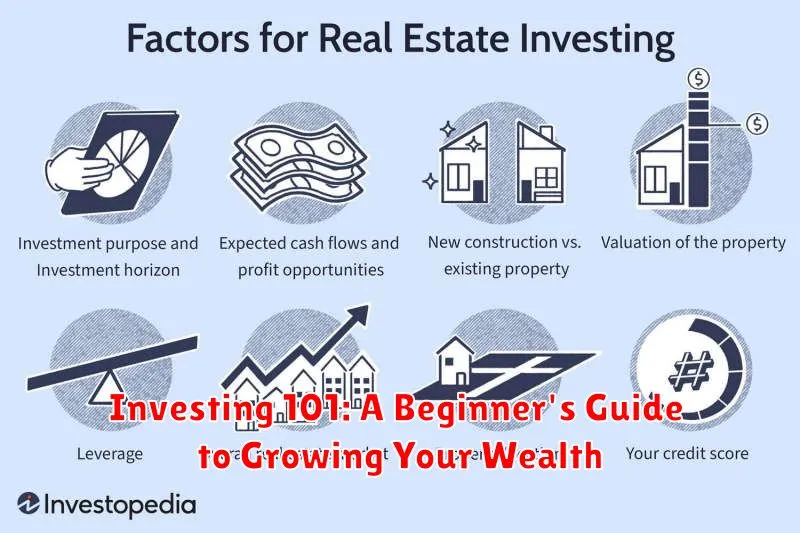

Investing 101: A Beginner’s Guide to Growing Your Wealth

Investing can seem like a daunting task, especially for beginners. The world of stocks, bonds, and mutual funds can feel overwhelming. But, investing is essential for building wealth and achieving your financial goals. This beginner’s guide will provide you with the fundamentals you need to get started.

What is Investing?

Investing is essentially putting money into an asset with the expectation of generating a return. This return can come in the form of dividends, interest, or capital appreciation. In simple terms, you’re hoping that your investment will grow in value over time.

Why Invest?

Investing offers numerous advantages:

- Growth potential: Investments can provide higher returns compared to traditional savings accounts.

- Beat inflation: Inflation erodes the purchasing power of your money over time. Investing can help you stay ahead of inflation.

- Long-term financial security: Investing can help you build a nest egg for retirement, education, or other significant life events.

Types of Investments:

There are various investment options available, each with its own risks and rewards. Here are some common types:

- Stocks: Represent ownership in a company. You gain a share of the company’s profits and potential appreciation in value.

- Bonds: Loans you make to a company or government. You receive regular interest payments and the principal amount back at maturity.

- Mutual funds: Pooled investments that allow you to diversify across a basket of stocks, bonds, or other assets.

- Exchange-traded funds (ETFs): Similar to mutual funds, but they trade on stock exchanges like individual stocks.

- Real estate: Investing in physical property can provide rental income and appreciation potential.

Getting Started:

Here are some steps to take when starting your investment journey:

- Define your financial goals: Determine what you want to achieve with your investments (e.g., retirement, a down payment on a house).

- Assess your risk tolerance: How comfortable are you with potential fluctuations in your investments?

- Research and choose investments: Do your due diligence and understand the risks and potential rewards of different investment options.

- Open an investment account: Choose a reputable brokerage or financial institution to hold your investments.

- Start small and diversify: Don’t invest more than you can afford to lose, and spread your investments across different asset classes.

Remember:

Investing involves risks, and there’s no guarantee of profits. However, by starting early, investing regularly, and doing your research, you can significantly increase your chances of achieving your financial goals.

Retirement Planning: Securing Your Financial Future

Retirement planning is a crucial aspect of financial well-being. It involves preparing financially for the time when you cease working, ensuring you have enough resources to maintain your desired lifestyle. A well-structured retirement plan can provide peace of mind and financial security during your golden years.

Key Elements of Retirement Planning

Retirement planning encompasses several key elements:

- Determining your financial goals: What kind of lifestyle do you envision in retirement? How much income will you need to cover expenses such as housing, healthcare, travel, and leisure activities?

- Estimating your retirement expenses: Consider factors like inflation, healthcare costs, and potential changes in your living expenses.

- Saving and investing: A disciplined approach to saving and investing is vital. Choose investments aligned with your risk tolerance and time horizon.

- Retirement accounts: Utilize retirement savings accounts such as 401(k)s, IRAs, and Roth IRAs to maximize tax benefits and potential returns.

- Social Security benefits: Understand your eligibility and benefits under the Social Security program.

- Healthcare planning: Plan for healthcare expenses, considering factors like Medicare eligibility, health insurance options, and potential long-term care needs.

- Estate planning: Ensure your assets are distributed according to your wishes through wills, trusts, and other legal documents.

Benefits of Retirement Planning

Retirement planning offers significant benefits, including:

- Financial security: A well-planned retirement ensures you have enough resources to cover your expenses without jeopardizing your lifestyle.

- Peace of mind: Knowing you have a solid financial foundation for retirement reduces stress and allows you to enjoy your later years.

- Flexibility: Retirement planning can provide flexibility in pursuing your passions and interests.

- Legacy planning: You can plan for the future of your loved ones through estate planning.

Starting Your Retirement Planning Journey

To embark on your retirement planning journey, consider these steps:

- Seek professional advice: Consult a financial advisor who can provide personalized guidance.

- Set realistic goals: Determine your desired lifestyle and estimate your expenses.

- Start saving early and consistently: The power of compounding works best over time.

- Review your plan regularly: Adjust your strategy as your circumstances change.

Retirement planning is an ongoing process that requires commitment and attention. By taking proactive steps and seeking professional guidance, you can secure your financial future and enjoy a fulfilling retirement.

Maximizing Savings: Tips and Tricks

In today’s economic climate, it’s more important than ever to be mindful of our spending habits and find ways to maximize our savings. Whether you’re aiming to reach a financial goal, build an emergency fund, or simply enjoy a more financially secure future, adopting effective saving strategies can make a significant difference.

Here are some valuable tips and tricks to help you boost your savings potential:

1. Set Clear Financial Goals

Having a clear vision of what you’re saving for provides motivation and direction. Define specific goals, such as buying a house, funding your retirement, or taking a dream vacation. Break down your goals into smaller, achievable milestones to track your progress and maintain enthusiasm.

2. Create a Realistic Budget

Track your income and expenses to understand where your money goes. Utilize budgeting tools like spreadsheets, apps, or even pen and paper. Analyze your spending patterns and identify areas where you can cut back. This allows you to allocate funds effectively and prioritize your savings goals.

3. Automate Your Savings

Setting up automatic transfers from your checking account to your savings account is a powerful strategy. By automating the process, you eliminate the temptation to spend the money and ensure consistent contributions. Even small, regular transfers can add up significantly over time.

4. Explore Savings Accounts and Investment Options

Research different savings account options, such as high-yield savings accounts or certificates of deposit (CDs), to maximize your interest earnings. Consider exploring investment opportunities like mutual funds or index funds to grow your savings over the long term. Consult a financial advisor for personalized guidance.

5. Look for Ways to Reduce Expenses

Evaluate your recurring expenses, such as subscriptions, utilities, and entertainment. Negotiate lower rates, cancel unnecessary services, and explore cost-effective alternatives. By reducing your expenses, you free up more funds to allocate towards your savings goals.

6. Take Advantage of Employer-Sponsored Retirement Plans

If your employer offers a 401(k) or similar retirement plan, take full advantage of it. Contributing regularly allows you to benefit from tax advantages and potentially employer matching contributions, accelerating your savings growth.

7. Embrace the “No Spend” Challenge

Periodically challenge yourself to go without spending money for a certain period, such as a weekend or a week. This can help you break bad spending habits and gain a new perspective on your consumption patterns. It’s also a great opportunity to explore free or low-cost activities.

8. Seek Out Additional Income Streams

Consider taking on a side hustle, freelancing, or selling unused items to generate extra income. Even a small amount of additional income can significantly boost your savings potential. Look for opportunities that align with your interests and skills.

9. Reward Your Progress

Celebrate your savings milestones to stay motivated. Treat yourself to a small reward, such as a nice dinner or a weekend getaway, to acknowledge your hard work and dedication to reaching your financial goals.

10. Be Patient and Persistent

Building savings takes time and consistency. Stay committed to your plan, even when facing setbacks or temptations to overspend. Remember that every small saving effort contributes to your overall financial wellbeing.

The Power of Automation: Streamlining Your Finances

In today’s fast-paced world, time is a precious commodity. We’re constantly juggling work, family, and personal responsibilities, leaving little room for tedious tasks like managing our finances. Thankfully, technology has come to the rescue with the rise of financial automation. Automation refers to the use of software and algorithms to perform repetitive financial tasks without human intervention. By leveraging automation, we can reclaim our time and gain control over our financial lives.

One of the most significant benefits of automation is its ability to streamline bill payments. Imagine never missing a deadline again! Automated bill payment systems can be set up to automatically deduct funds from your account and pay bills on time, eliminating the risk of late fees and penalties. This frees up your time and mental energy, allowing you to focus on other priorities.

Another area where automation shines is budgeting. With automated budgeting tools, you can categorize your spending, track your progress towards financial goals, and receive personalized insights. These tools can analyze your spending patterns and identify areas where you can save money. By automating your budgeting, you gain a clear understanding of your financial situation and make informed decisions about your finances.

Investing can also be automated, allowing you to build wealth without constantly monitoring the market. Robo-advisors are automated platforms that use algorithms to create and manage investment portfolios based on your risk tolerance and financial goals. These services are becoming increasingly popular, offering a convenient and affordable way to invest for the future.

The benefits of financial automation extend beyond time savings and efficiency. By automating tasks, you reduce the risk of human error, leading to more accurate and reliable financial management. Automation can also enhance your financial security by providing real-time alerts and notifications, enabling you to detect and address any suspicious activity early on.

In conclusion, financial automation empowers individuals to take control of their finances, simplify their lives, and achieve their financial goals. With the right tools and strategies, you can harness the power of automation to streamline your finances and create a more secure and prosperous future.

Protecting Your Assets: Insurance Essentials

In the unpredictable world we live in, safeguarding our hard-earned assets is crucial. Insurance plays a vital role in protecting our financial well-being, providing a safety net against unforeseen events. From protecting your home and car to securing your health and financial future, understanding the different types of insurance and their benefits is essential.

Types of Insurance

The world of insurance encompasses a wide array of options, each designed to address specific risks. Here’s a breakdown of some common types:

This policy covers your dwelling, belongings, and liability in case of fire, theft, or natural disasters. Homeowners insurance is essential for homeowners, while renters insurance protects your possessions and liability while renting.

This is a legal requirement in most states and covers damages to your vehicle, injuries to others, and medical expenses in case of an accident. Auto insurance provides financial protection and peace of mind on the road.

Health insurance covers medical expenses, such as doctor visits, hospital stays, and prescription drugs. Choosing the right health plan is essential to ensure you have access to affordable and comprehensive healthcare.

This policy provides financial protection for your loved ones in case of your death. Life insurance can help pay off debts, cover living expenses, and ensure financial security for your family.

Disability insurance provides income replacement if you become unable to work due to an injury or illness. This policy can help maintain your standard of living and prevent financial hardship during a challenging time.

Importance of Insurance

Insurance serves as a financial safety net against a wide range of potential risks. It provides the following benefits:

- Financial Protection: Insurance safeguards your assets and helps you recover financially from unexpected events.

- Peace of Mind: Knowing you have insurance coverage can reduce stress and anxiety, giving you peace of mind about potential risks.

- Legal Compliance: Some insurance policies, such as auto insurance, are legally required.

- Risk Management: Insurance allows you to manage and mitigate risk by transferring financial responsibility to the insurance company.

Choosing the Right Insurance

Selecting the right insurance policies is crucial to ensure adequate coverage and value for your money. Here are some factors to consider:

- Your Individual Needs: Evaluate your specific risks, assets, and financial situation.

- Coverage Options: Compare different policies and their coverage levels, deductibles, and premiums.

- Reputation of Insurance Companies: Choose reputable companies with a history of reliable service and prompt claims processing.

- Consult with a Financial Advisor: Seeking professional advice can help you make informed decisions about your insurance needs.

Insurance is an essential part of a comprehensive financial plan. By understanding the different types of insurance and their benefits, you can make informed decisions to protect your assets and secure your financial future.

Staying Informed: Resources for Financial Literacy

In today’s world, it’s more important than ever to be financially literate. With the ever-increasing complexity of the financial system, it can be difficult to navigate the world of investing, saving, and budgeting. However, with the right resources, you can gain the knowledge and skills you need to make informed financial decisions.

Here are some resources that can help you on your journey to financial literacy:

Government Websites

Government websites offer a wealth of information about financial topics. For example, the Consumer Financial Protection Bureau (CFPB) provides resources on a wide range of financial topics, including credit, debt, and mortgages. The Internal Revenue Service (IRS) website offers information about taxes and tax filing.

Non-profit Organizations

Non-profit organizations like the National Foundation for Credit Counseling (NFCC) and the National Endowment for Financial Education (NEFE) provide free or low-cost resources on financial topics such as budgeting, saving, and debt management. These organizations often offer workshops and counseling services.

Financial Literacy Websites

There are many websites dedicated to providing financial literacy information. Some popular options include:

- Investopedia: A comprehensive resource for investing and financial information.

- Mint: A personal finance website that offers budgeting tools and financial tracking.

- NerdWallet: A website that provides comparisons and reviews of financial products and services.

Books and Podcasts

There are numerous books and podcasts that can help you learn about personal finance. Some popular options include:

- The Total Money Makeover by Dave Ramsey

- Rich Dad Poor Dad by Robert Kiyosaki

- The Psychology of Money by Morgan Housel

- Planet Money podcast

- The Money Show podcast

Financial Advisors

While you can gain a lot of information through these resources, working with a financial advisor can be extremely beneficial. A financial advisor can provide personalized guidance and help you develop a plan to reach your financial goals.

By taking advantage of the resources available, you can become more informed about your finances and make better financial decisions. Remember that financial literacy is an ongoing process, so it’s important to continue learning and updating your knowledge.