Are you ready to take control of your financial future and build lasting wealth? Investing in the stock market can be a powerful tool for achieving your long-term financial goals. But navigating the complexities of the market can feel daunting, especially for beginners. This comprehensive guide will equip you with the knowledge and strategies you need to confidently invest in the stock market and secure a prosperous future.

From understanding the basics of investing to developing a winning strategy, this guide will cover all aspects of long-term wealth building. We’ll delve into essential topics like diversifying your portfolio, selecting the right investments, managing risk, and navigating market volatility. Whether you’re a seasoned investor or just starting your journey, this resource will provide valuable insights and actionable steps to help you achieve financial independence and secure your future.

Understanding the Fundamentals of Stock Market Investing

The stock market can be a daunting prospect for those new to investing. It can seem like a complex and risky world where only experienced professionals can succeed. However, the truth is that anyone can learn the basics of investing and start building a portfolio that works for them. This article will provide a comprehensive guide to understanding the fundamentals of stock market investing, from the different types of investments to how to choose the right stocks for you.

What is the Stock Market?

The stock market is a marketplace where publicly traded companies issue and sell shares of their ownership to investors. These shares, or stocks, represent a piece of the company’s value. When you buy stock, you become a part owner of that company, and you are entitled to a portion of its profits.

Why Invest in the Stock Market?

There are many reasons why people choose to invest in the stock market. Here are a few of the most common:

- Potential for Growth: Stocks have the potential to grow in value over time, providing investors with a return on their investment.

- Income: Some companies pay dividends, which are regular payments made to shareholders. This can provide investors with a steady stream of income.

- Inflation Hedge: Stocks tend to perform well during periods of inflation, which can help preserve the purchasing power of your investments.

- Liquidity: Stocks are relatively easy to buy and sell, providing investors with access to their funds when they need them.

Types of Stock Market Investments

There are a wide variety of stock market investments available to investors. Some of the most common types include:

- Individual Stocks: These are shares of individual companies that you can buy and sell on stock exchanges.

- Mutual Funds: These are funds that pool money from multiple investors to buy a diversified portfolio of stocks. They provide a convenient way to invest in a variety of companies without having to manage individual stocks.

- Exchange-Traded Funds (ETFs): These are funds that track a specific index or sector of the stock market. They are similar to mutual funds but are traded on stock exchanges like individual stocks.

- Index Funds: These are funds that track a specific market index, such as the S&P 500. They offer a way to invest in the overall market without having to choose individual stocks.

Choosing the Right Stocks

Choosing the right stocks for your portfolio is a crucial aspect of investing. Here are some factors to consider:

- Financial Performance: Look for companies with strong financial performance, including consistent earnings growth, healthy debt levels, and positive cash flow.

- Industry Outlook: Consider the long-term growth potential of the industry in which the company operates.

- Management Team: Evaluate the experience, expertise, and track record of the company’s management team.

- Valuation: Determine if the stock is priced fairly based on its fundamentals. Look at metrics like price-to-earnings ratio and price-to-book ratio.

Risk and Return

It’s important to remember that stock market investing involves risk. The value of your investments can go up or down, and there’s always the possibility of losing money. However, the potential for return is also high, and over the long term, stocks have historically outperformed other asset classes. The level of risk you’re willing to take should be based on your individual circumstances, investment goals, and time horizon.

Diversification

A key principle of investing is diversification. This means spreading your investments across different asset classes, sectors, and companies to reduce your overall risk. By diversifying, you can mitigate the impact of any single investment underperforming.

Conclusion

Investing in the stock market can be a rewarding experience, but it requires knowledge, research, and discipline. By understanding the fundamentals of stock market investing, you can make informed decisions and build a portfolio that aligns with your financial goals. Remember to invest for the long term, stay disciplined, and seek advice from a qualified financial advisor if needed.

Setting Realistic Investment Goals and Risk Tolerance

Investing is an essential part of building a secure financial future. It allows your money to grow over time, helping you reach your financial goals. However, before you dive into the world of investments, it’s crucial to establish clear and realistic investment goals and understand your risk tolerance.

Defining Your Investment Goals

Your investment goals should be specific, measurable, achievable, relevant, and time-bound (SMART). For example, instead of saying “I want to invest my money,” consider specific goals like:

- Save for retirement in 20 years.

- Buy a house within the next 5 years.

- Fund your child’s college education.

Once you’ve identified your goals, you can determine the timeframe you need to reach them, the amount of money you’ll need to invest, and the expected return on your investments.

Understanding Your Risk Tolerance

Risk tolerance refers to your ability and willingness to accept potential losses in exchange for the possibility of higher returns. It’s essential to assess your risk tolerance before making any investment decisions.

Consider factors like:

- Your age: Younger investors typically have a longer time horizon and can afford to take on more risk.

- Your financial situation: Your income, expenses, and debt levels can affect your risk tolerance.

- Your investment experience: Investors with more experience may be more comfortable with higher risk.

- Your emotional outlook: How do you react to market fluctuations?

Matching Goals with Risk Tolerance

Once you’ve defined your investment goals and assessed your risk tolerance, you can start to match them. For example:

- Long-term goals: If you’re saving for retirement, you can typically tolerate more risk. You have a longer time horizon to recover from potential market downturns.

- Short-term goals: For short-term goals like a down payment on a house, you’ll likely want to take on less risk. You need to ensure your money is safe and readily available.

Creating a Diversified Portfolio

A diversified portfolio consists of different types of investments with varying levels of risk. This helps to mitigate overall risk and balance potential losses. Consider investing in a combination of:

- Stocks: Offer the potential for higher returns but come with higher risk.

- Bonds: Generally considered less risky than stocks but offer lower potential returns.

- Real estate: Can provide diversification and potential for long-term appreciation.

- Commodities: Raw materials like gold and oil can act as a hedge against inflation.

Regularly Review and Adjust

It’s important to regularly review your investment goals and risk tolerance. As your life circumstances change, your goals and tolerance may also need to be adjusted. Remember, investing is a long-term journey, and it’s essential to stay committed to your plan and make adjustments as needed.

By setting realistic investment goals, understanding your risk tolerance, and creating a diversified portfolio, you can make informed investment decisions that align with your financial aspirations.

Developing a Sound Investment Strategy for Long-Term Growth

In the realm of finance, the pursuit of long-term growth is a common goal for individuals and institutions alike. To achieve this objective, crafting a sound investment strategy is paramount. A well-defined strategy provides a roadmap for navigating the complexities of the financial markets, mitigating risks, and maximizing returns over time. This article delves into the key elements of developing a robust investment strategy that can propel your portfolio towards enduring success.

Defining Your Financial Goals

Before embarking on any investment journey, it is essential to establish clear and quantifiable financial goals. These goals serve as the guiding principles for your investment decisions. Ask yourself: What are you saving for? When do you need the money? How much do you aim to accumulate? Examples of financial goals include retirement planning, purchasing a home, funding your child’s education, or securing a comfortable financial cushion for unexpected events.

Understanding Your Risk Tolerance

Every investor has a unique risk tolerance, which reflects their willingness to accept potential losses in pursuit of higher returns. Identifying your risk tolerance is crucial for selecting appropriate investment vehicles. A risk-averse investor may prefer low-risk investments like bonds or money market accounts, while a risk-tolerant investor might embrace equities or alternative investments that offer the potential for greater gains.

Building a Diversified Portfolio

Diversification is a fundamental principle of investment management. It involves spreading your investments across various asset classes, such as stocks, bonds, real estate, and commodities. By diversifying, you reduce the impact of any single asset class on your portfolio’s overall performance. A well-diversified portfolio helps to mitigate risks and enhance long-term growth potential.

Selecting Investment Vehicles

Once you have defined your goals, assessed your risk tolerance, and established a diversified portfolio, you need to choose specific investment vehicles. These can include individual stocks, mutual funds, exchange-traded funds (ETFs), real estate, or other asset classes. Your investment choices should align with your goals, risk profile, and time horizon.

Regular Monitoring and Rebalancing

A sound investment strategy requires ongoing monitoring and rebalancing. Market conditions constantly evolve, and your portfolio’s asset allocation may need adjustments over time. Periodically review your investments, analyze their performance, and make necessary adjustments to ensure your strategy remains aligned with your goals and risk tolerance.

Seeking Professional Advice

For complex investment decisions or those involving substantial sums of money, it is advisable to seek professional advice from a qualified financial advisor. A financial advisor can provide personalized guidance, tailor investment strategies to your specific needs, and offer valuable insights into market trends and opportunities.

Conclusion

Developing a sound investment strategy is an iterative process that requires careful consideration of your financial goals, risk tolerance, and investment horizon. By following the steps outlined above, you can create a robust framework for achieving long-term financial success. Remember that consistency, discipline, and a long-term perspective are key to navigating the financial markets and building wealth over time.

Choosing the Right Investment Vehicles: Stocks, Bonds, ETFs

Investing is essential for building wealth and achieving your financial goals. However, the vast array of investment vehicles available can be overwhelming. Choosing the right investment vehicle depends on your individual circumstances, risk tolerance, and investment goals. This article will delve into three popular investment vehicles: stocks, bonds, and exchange-traded funds (ETFs), highlighting their key features, risks, and suitability for different investors.

Stocks

Stocks represent ownership in a company. When you buy a stock, you become a shareholder and have the right to share in the company’s profits through dividends or potential capital appreciation. Stocks are generally considered higher risk than bonds, but they also offer the potential for higher returns.

There are two main types of stocks:

Common stock gives shareholders voting rights and the potential for dividends.

Preferred stock offers a fixed dividend payment but usually doesn’t come with voting rights.

Advantages of Stocks

- Potential for high returns: Stocks can appreciate in value significantly, offering substantial returns over the long term.

- Dividends: Some companies pay dividends, providing investors with regular income streams.

- Ownership in a company: Owning stock makes you a part owner of the company, giving you a stake in its success.

Disadvantages of Stocks

- High risk: Stock prices can fluctuate significantly, making them a volatile investment.

- No guaranteed returns: There is no guarantee of profits from stocks, and you could lose your entire investment.

- Time-consuming: Picking individual stocks requires extensive research and ongoing monitoring.

Bonds

Bonds represent a loan you make to a company or government. When you buy a bond, you are lending money and receiving interest payments over a set period. Bonds are generally considered less risky than stocks, but they also offer lower returns.

Advantages of Bonds

- Lower risk than stocks: Bonds are generally considered less volatile and more stable than stocks.

- Regular interest payments: Bonds provide regular interest payments, generating predictable income.

- Lower risk of principal loss: Bonds are less likely to lose value than stocks, making them a suitable option for conservative investors.

Disadvantages of Bonds

- Lower returns than stocks: Bond returns are typically lower than stock returns.

- Interest rate risk: Interest rates can rise, lowering the value of existing bonds.

- Default risk: There is a risk that the issuer of the bond may default on their payments.

Exchange-Traded Funds (ETFs)

Exchange-traded funds (ETFs) are investment funds that trade on stock exchanges like individual stocks. ETFs typically track a specific market index, sector, or commodity, providing investors with diversified exposure to a basket of assets.

Advantages of ETFs

- Diversification: ETFs offer diversification by investing in a wide range of assets within a single investment.

- Low fees: ETFs generally have lower expense ratios than actively managed mutual funds.

- Liquidity: ETFs are highly liquid, meaning they can be bought and sold easily.

Disadvantages of ETFs

- Market risk: ETFs track underlying indexes, so they can be affected by market fluctuations.

- No active management: ETFs are passively managed, meaning they don’t have managers making active investment decisions.

- Limited customization: ETFs typically track a specific index or sector, limiting customization options.

Choosing the Right Investment Vehicle for You

The best investment vehicle for you depends on your individual circumstances, risk tolerance, and investment goals. Consider the following factors when making your decision:

- Your investment goals: What are you hoping to achieve with your investment? Short-term growth, long-term wealth building, retirement planning, or income generation?

- Your risk tolerance: How comfortable are you with the potential for losses?

- Your time horizon: How long do you plan to invest your money?

- Your investment knowledge and experience: Do you have the time and expertise to manage individual stocks, or would you prefer a more passive approach with ETFs?

It is always recommended to consult with a financial advisor who can help you create a personalized investment plan tailored to your needs.

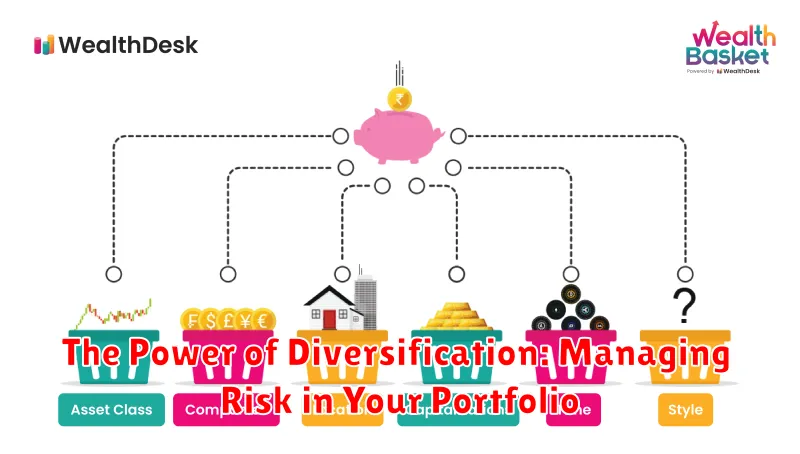

The Power of Diversification: Managing Risk in Your Portfolio

In the realm of investing, risk is an inherent factor that cannot be entirely eliminated. While aiming for high returns is tempting, it’s crucial to recognize that higher returns often come hand-in-hand with increased risk. Diversification emerges as a powerful strategy to mitigate this risk and enhance portfolio stability.

Diversification essentially involves spreading your investments across a range of assets, industries, and geographies. By doing so, you reduce the impact of any single investment’s performance on your overall portfolio. Think of it as building a sturdy foundation for your financial future, where no single brick bears the entire weight.

Why Diversification Matters

Imagine investing solely in technology stocks. If the tech sector experiences a downturn, your entire portfolio could suffer significant losses. However, if you diversify across different sectors, such as healthcare, energy, or consumer staples, you’re less vulnerable to industry-specific risks.

Diversification also helps manage market volatility. Some asset classes, like stocks, tend to be more volatile than others, such as bonds. By holding a mix of both, you can smooth out the ups and downs of your portfolio, providing a more consistent return over time.

Types of Diversification

Diversification can be achieved in various ways:

- Asset Class Diversification: Allocating investments across different asset classes like stocks, bonds, real estate, and commodities.

- Sector Diversification: Spreading investments across various industries, such as technology, healthcare, energy, and finance.

- Geographic Diversification: Investing in assets from different countries or regions to minimize exposure to single-country risks.

- Style Diversification: Including investments with different growth and value characteristics, such as large-cap and small-cap stocks.

The Benefits of Diversification

Diversification offers a multitude of benefits:

- Reduced Risk: By spreading investments, you lower the impact of any single investment’s poor performance.

- Increased Returns: Diversification allows you to capture potential growth opportunities across multiple asset classes and industries.

- Improved Sleep: Knowing your portfolio is well-diversified can provide peace of mind during market fluctuations.

Conclusion

Diversification is not a magic bullet, but it’s a powerful tool to manage risk in your portfolio. By spreading your investments across different asset classes, sectors, and geographies, you can create a more resilient and stable financial future. Remember, a diversified portfolio is essential for long-term investment success.

Fundamental Analysis: Evaluating Companies for Investment

Fundamental analysis is a method of evaluating a company’s intrinsic value by examining its financial statements, business model, management team, and competitive landscape. It involves assessing the company’s past performance, present condition, and future prospects to determine whether its stock price is justified and whether it’s a good investment.

Key Areas of Fundamental Analysis:

- Financial Statement Analysis: This involves reviewing the company’s balance sheet, income statement, and cash flow statement to understand its profitability, liquidity, solvency, and efficiency.

- Business Model Analysis: This examines the company’s core business, products or services, revenue streams, and competitive advantages.

- Management Analysis: This evaluates the quality of the company’s management team, their experience, track record, and vision for the future.

- Industry Analysis: This assesses the attractiveness of the industry in which the company operates, considering factors such as growth potential, competitive intensity, and regulatory environment.

Benefits of Fundamental Analysis:

- Identify Undervalued Stocks: By uncovering companies with strong fundamentals and low market valuations, investors can potentially find undervalued stocks with high growth potential.

- Make Informed Investment Decisions: Understanding a company’s financial health and business prospects allows investors to make informed decisions about whether to buy, sell, or hold its stock.

- Reduce Risk: By focusing on companies with strong fundamentals, investors can reduce the risk of losing money due to poor financial performance or management.

Key Metrics Used in Fundamental Analysis:

- Earnings Per Share (EPS): Measures a company’s profitability per share of outstanding stock.

- Price-to-Earnings Ratio (P/E): Compares a company’s stock price to its earnings per share.

- Return on Equity (ROE): Measures a company’s profitability relative to its shareholder equity.

- Debt-to-Equity Ratio: Measures a company’s level of financial leverage.

- Free Cash Flow (FCF): Represents the cash flow available to a company after paying for operating expenses and capital expenditures.

Considerations for Fundamental Analysis:

- Time-Consuming: Thorough fundamental analysis requires significant time and effort.

- Subjective: Different analysts may interpret financial data and company information differently.

- Future Uncertainty: Predicting future performance is inherently uncertain, and past performance is not necessarily indicative of future results.

Conclusion:

Fundamental analysis is a valuable tool for investors seeking to make informed decisions about their investments. By understanding a company’s fundamentals, investors can identify potential opportunities and mitigate risks. It’s important to note that fundamental analysis is not foolproof and should be combined with other forms of investment analysis, such as technical analysis and market sentiment.

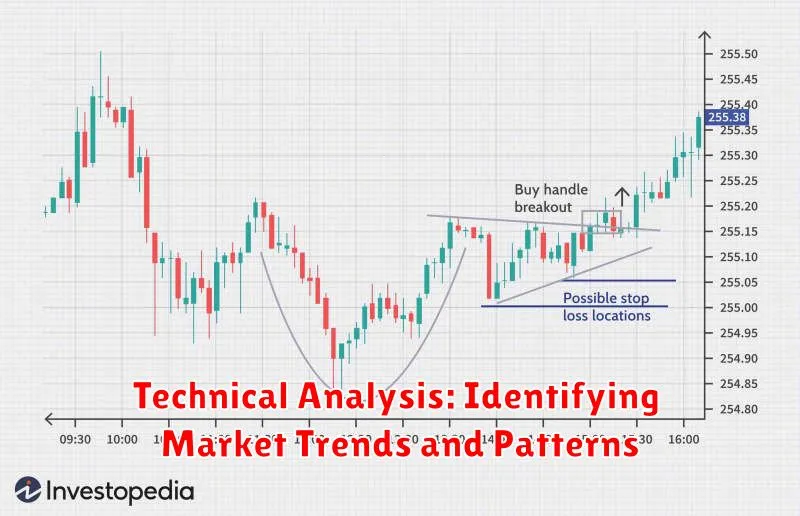

Technical Analysis: Identifying Market Trends and Patterns

Technical analysis is a method of evaluating securities by analyzing past market data, primarily price and volume. It is a form of chart analysis that relies on the assumption that past price movements can predict future price movements. Technical analysts use charts and indicators to identify trends, patterns, and other signals that can help them make informed trading decisions.

The main principles of technical analysis are:

- Market Action Discounts Everything: All known and unknown information is reflected in the price of a security.

- Prices Move in Trends: Prices tend to move in trends, which can be identified using chart patterns and indicators.

- History Repeats Itself: Past price patterns and trends tend to repeat themselves.

Types of Technical Analysis

There are two main types of technical analysis:

- Trend Analysis: This type of analysis focuses on identifying the direction of the overall market or a specific security. It uses indicators such as moving averages and trendlines to determine the trend.

- Pattern Analysis: This type of analysis looks for recurring patterns in price charts, such as head and shoulders, double tops, and triangles. These patterns can be used to identify potential buy and sell signals.

Technical Indicators

Technical indicators are mathematical calculations that are applied to historical price data. They can be used to identify trends, momentum, and overbought or oversold conditions. Some common technical indicators include:

- Moving Averages: Calculated by averaging the closing prices of a security over a specified period.

- Relative Strength Index (RSI): Measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

- MACD: A trend-following momentum indicator that shows the relationship between two moving averages.

- Bollinger Bands: A measure of volatility that uses moving averages and standard deviations.

Benefits of Technical Analysis

Technical analysis can provide several benefits for traders and investors:

- Identify Market Trends: Technical analysis can help you identify trends in the market and capitalize on them.

- Generate Trading Signals: Indicators and chart patterns can generate buy and sell signals, providing trading opportunities.

- Manage Risk: Stop-loss orders and other risk management strategies can be used in conjunction with technical analysis.

- Objective Decision Making: Technical analysis can help you make more objective trading decisions based on data rather than emotions.

Limitations of Technical Analysis

While technical analysis can be a valuable tool, it is important to remember that it has limitations:

- Not Perfect: Technical analysis is not a foolproof method, and it can generate false signals.

- Subjective Interpretation: Chart patterns and indicators can be interpreted differently by different analysts.

- Lagging Data: Technical analysis relies on past data, which can be lagging behind current market conditions.

- Doesn’t Account for Fundamental Factors: Technical analysis does not consider fundamental factors such as earnings, economic conditions, and company news.

Conclusion

Technical analysis is a powerful tool that can be used to identify market trends, patterns, and trading opportunities. It can be beneficial for traders and investors who want to make more informed decisions. However, it is important to use technical analysis in conjunction with other forms of analysis and to understand its limitations.

Long-Term Investing Strategies: Value Investing, Growth Investing

Investing for the long term is a crucial aspect of achieving financial goals. It involves making strategic decisions that can generate substantial returns over an extended period. Two popular long-term investing strategies are Value Investing and Growth Investing. Understanding the nuances of each approach can help you make informed investment decisions that align with your financial objectives.

Value Investing

Value investing focuses on identifying undervalued securities. This strategy emphasizes buying stocks of companies that are trading below their intrinsic value. Value investors believe that the market sometimes misprices securities, creating opportunities to purchase them at a discount. They look for companies with strong fundamentals, such as robust earnings, a solid track record, and a sound financial position. Value investors are often willing to hold investments for a longer period, allowing time for the market to recognize the intrinsic value of the company.

Here are some key characteristics of value investing:

- Focus on undervalued stocks: Value investors seek companies whose share prices are trading below their estimated intrinsic value.

- Emphasis on fundamentals: They analyze financial statements, industry trends, and management quality to identify companies with strong fundamentals.

- Long-term perspective: Value investors often hold investments for several years, allowing time for the market to recognize their intrinsic value.

- Patience and discipline: This strategy requires patience and discipline as it may take time for undervalued stocks to appreciate in value.

Growth Investing

Growth investing prioritizes companies with high growth potential. These companies are often characterized by rapid revenue and earnings growth, innovative products or services, and a strong market position. Growth investors aim to capture the potential upside of these companies as they expand their operations and market share. Growth stocks typically command higher valuations due to their expected future growth.

Here are some key characteristics of growth investing:

- Focus on growth potential: Growth investors seek companies with high growth potential, evidenced by rapid revenue and earnings growth.

- Emphasis on innovation: They look for companies with innovative products or services that have the potential to disrupt existing markets.

- High valuations: Growth stocks often trade at higher valuations than value stocks due to their expected future growth.

- Risk tolerance: Growth investing involves higher risk, as the potential for high returns is often accompanied by a greater risk of losses.

Comparing Value Investing and Growth Investing

The following table highlights the key differences between value investing and growth investing:

| Characteristic | Value Investing | Growth Investing |

|---|---|---|

| Focus | Undervalued stocks | High growth potential |

| Investment Criteria | Strong fundamentals, low valuation, proven track record | Rapid revenue and earnings growth, innovative products or services, strong market position |

| Valuation | Lower valuations | Higher valuations |

| Risk | Lower risk | Higher risk |

| Time Horizon | Long-term | Long-term |

Choosing the Right Strategy

The best investing strategy for you depends on your individual financial goals, risk tolerance, and time horizon. Consider the following factors when deciding:

- Risk Tolerance: How much risk are you comfortable taking with your investments? Value investing is generally considered less risky than growth investing.

- Time Horizon: How long do you plan to invest? Both strategies are best suited for long-term investing, but growth stocks may require a longer time horizon to fully realize their potential.

- Financial Goals: What are your financial goals? Do you want to accumulate wealth over time, generate income, or prepare for retirement? Value investing is often used for wealth accumulation, while growth investing may be more suitable for those seeking higher returns.

It’s important to remember that both value investing and growth investing can be successful strategies when executed properly. It’s crucial to conduct thorough research, diversify your portfolio, and consult with a financial advisor to make informed investment decisions.

Managing Your Emotions: Avoiding Common Investment Mistakes

Investing can be a rewarding journey, but it can also be fraught with emotional pitfalls. Our emotions, often acting as our internal compass, can lead us astray in the financial world. We all experience fear, greed, and other powerful feelings that can cloud our judgment and lead us to make rash investment decisions. Understanding how these emotions influence our behavior is crucial to avoiding common investment mistakes.

Fear: The Paralyzing Grip

Fear, a natural human response to uncertainty, can paralyze us into inaction. When the market dips, fear might prompt us to sell our investments, locking in losses and missing out on potential future growth. This is a common reaction known as the fear of missing out (FOMO) – a powerful motivator that can push us to make hasty decisions without proper consideration. Instead of succumbing to fear, investors should strive to maintain a long-term perspective, understanding that market fluctuations are inevitable.

Greed: The Alluring Siren’s Call

Greed, the insatiable desire for more, can lead us to chase risky investments, hoping for quick gains. This can lead to investing in speculative assets or chasing “hot” stocks, often with disastrous consequences. When greed takes hold, we tend to ignore risk and overestimate potential returns. To combat greed, investors should stick to a well-defined investment strategy, focusing on diversification and long-term growth.

Overconfidence: The Illusion of Control

Overconfidence, a sense of unwarranted certainty in our abilities, can lead us to make impulsive decisions. We might believe we have a knack for picking winning stocks, ignoring the inherent uncertainty of the market. This overconfidence can lead to overtrading, incurring higher transaction costs and potentially missing out on long-term gains. To counter overconfidence, investors should acknowledge their limitations, seek professional advice when necessary, and stay informed about market trends.

Loss Aversion: The Pain of Losing

Loss aversion, the tendency to feel the pain of a loss more strongly than the pleasure of an equivalent gain, can make us overly cautious. We might hold onto underperforming investments, hoping they recover, rather than cutting our losses and re-allocating our funds. This can lead to missed opportunities for growth and a reluctance to take calculated risks. To overcome loss aversion, investors should be willing to admit mistakes, cut losses when necessary, and focus on the overall performance of their portfolio.

Conclusion

Managing our emotions is crucial to successful investing. By recognizing the influence of fear, greed, overconfidence, and loss aversion, we can make more informed and rational decisions. By staying calm, sticking to a well-defined strategy, and seeking professional advice when needed, we can navigate the emotional rollercoaster of the financial world and achieve our long-term investment goals.

The Importance of Patience and Discipline in Long-Term Investing

In the realm of finance, patience and discipline are not merely virtues but essential pillars for achieving long-term investment success. While the allure of quick profits and market volatility may tempt investors to deviate from their strategies, it’s crucial to understand that true wealth creation takes time, consistency, and a unwavering commitment to a well-defined plan.

Patience is the cornerstone of long-term investing. The stock market is inherently unpredictable, with upswings and downturns being an integral part of its dynamic nature. Investors who can navigate these fluctuations with composure, avoiding impulsive decisions based on short-term market movements, are more likely to reap the rewards of a well-diversified portfolio over the long haul.

Complementing patience is discipline. Discipline entails adhering to your investment strategy, resisting the temptation to chase hot trends or panic sell during market corrections. It involves regularly reviewing and adjusting your portfolio based on your long-term goals and risk tolerance, rather than reacting to daily market noise.

Compounding, the eighth wonder of the world, as Albert Einstein famously called it, is a testament to the power of patience and discipline. It’s the snowball effect of earning returns on your investments, which in turn generate further returns. Over time, even small, consistent gains can accumulate into substantial wealth.

In the realm of long-term investing, it’s essential to remember that time is your greatest ally. The longer you invest, the more time compounding has to work its magic. Patience allows you to ride out market fluctuations, while discipline ensures you stay the course, reaping the benefits of a long-term investment horizon.

In conclusion, patience and discipline are the cornerstones of a successful long-term investment strategy. They empower you to weather market storms, avoid impulsive decisions, and harness the power of compounding to build lasting wealth. Embracing these virtues will pave the way for a secure financial future.

Seeking Professional Financial Advice When Needed

In today’s complex and ever-changing economic landscape, it can be challenging to navigate the intricacies of personal finance. From managing debt to planning for retirement, financial decisions can have a profound impact on your future well-being. While some individuals may feel confident in handling their finances independently, seeking professional financial advice can prove invaluable for many.

When to Seek Professional Financial Advice:

- Major life events: Significant life events, such as getting married, having a child, buying a home, or experiencing a job loss, can necessitate a reevaluation of your financial goals and strategies.

- Complex financial situations: If you find yourself dealing with complex financial matters, such as inheritance, trusts, or investments, seeking expert guidance can help you make informed decisions and avoid costly mistakes.

- Lack of financial knowledge: If you’re not comfortable managing your finances or lack the necessary knowledge and experience, a financial advisor can provide valuable support and education.

- Retirement planning: Planning for retirement requires careful consideration of factors such as savings, investments, and expenses. A professional can help you create a personalized retirement plan that aligns with your goals and risk tolerance.

- Debt management: If you’re struggling with debt, a financial advisor can help you develop a debt reduction strategy and explore options for consolidating or restructuring your loans.

Benefits of Seeking Professional Financial Advice:

Seeking professional financial advice offers numerous benefits, including:

- Objectivity and expertise: Financial advisors provide an unbiased perspective and leverage their knowledge and experience to guide you through financial decisions.

- Personalized strategies: They tailor their advice to your individual circumstances, goals, and risk tolerance, ensuring that your financial plan is aligned with your needs.

- Increased accountability: Having a financial advisor can increase your accountability to your financial goals and provide ongoing support and motivation.

- Peace of mind: Knowing that your finances are being managed by a professional can alleviate stress and provide peace of mind.

Finding the Right Financial Advisor:

When choosing a financial advisor, it’s crucial to conduct thorough research and ensure they are qualified and reputable. Consider factors such as their experience, credentials, fees, and communication style. Seek referrals from trusted sources, read online reviews, and schedule initial consultations with potential advisors to assess their fit with your needs.

Conclusion:

Seeking professional financial advice can be a wise decision, especially during times of significant life changes or when dealing with complex financial matters. A qualified advisor can provide invaluable guidance, expertise, and support, helping you achieve your financial goals and secure your future. Remember to do your due diligence when choosing a financial advisor and ensure they are a good fit for your specific needs and circumstances.