Are you intrigued by the stock market but intimidated by its complexities? You’re not alone. Many people dream of financial freedom and wealth creation, but the world of stocks can seem like a confusing maze. But it doesn’t have to be! This beginner’s guide will demystify the market and equip you with the knowledge you need to confidently navigate the exciting world of stock investing.

Whether you’re just starting your investing journey or want a fresh perspective on your existing portfolio, this guide will walk you through the fundamentals of stock investing. We’ll cover everything from understanding basic concepts like stocks, bonds, and mutual funds to exploring different investment strategies and managing your risk. By the end, you’ll have a solid foundation for making informed investment decisions and building a prosperous future.

Understanding the Basics: What is the Stock Market?

The stock market, a bustling world of numbers and investments, often seems like a complex maze. However, at its core, it’s a simple concept: a platform where people buy and sell shares of publicly traded companies. These shares, also known as stocks, represent ownership in a company.

Imagine a company, let’s say Apple, decides to raise money for expansion. They sell a portion of their ownership to the public, offering shares. Investors purchase these shares, becoming partial owners of Apple. The price of a share is determined by market forces—how much investors are willing to pay for it based on the company’s performance and future prospects.

The stock market acts as a marketplace where these shares are traded. It’s a dynamic environment where prices fluctuate constantly, driven by various factors like news, economic indicators, and investor sentiment. It’s crucial to understand that investing in the stock market involves inherent risks, as the value of your shares can go up or down.

However, the stock market also offers opportunities for potential growth and wealth creation. By investing in companies you believe in, you can participate in their success and potentially earn returns. This is why the stock market is considered a crucial engine of economic growth, providing funds for companies to innovate and expand, ultimately contributing to the overall prosperity of the economy.

Types of Stock Markets

There are different types of stock markets, each with its own characteristics:

- Primary Market: This is where companies first issue their shares to the public. It’s the initial public offering (IPO) stage, where companies raise capital for their operations.

- Secondary Market: This is where existing shares are traded between investors. It’s the most active part of the stock market, where prices fluctuate based on supply and demand.

Key Terms to Know

Here are some essential terms associated with the stock market:

- Bull Market: A period of rising stock prices, characterized by optimism and investor confidence.

- Bear Market: A period of declining stock prices, often driven by economic uncertainty or negative sentiment.

- Dividend: A portion of a company’s profits distributed to its shareholders.

- Index: A benchmark that tracks the performance of a specific group of stocks, such as the S&P 500 or the Dow Jones Industrial Average.

Understanding the stock market and its workings is essential for anyone considering investing. It’s a complex system with its own language and dynamics, but with the right knowledge and approach, it can be a powerful tool for financial growth.

Setting Realistic Investment Goals

Investing is a crucial part of building financial security, but it can be daunting if you don’t know where to start. A key element of successful investing is setting realistic goals.

Without specific goals, your investment journey might feel aimless and less motivated. Here’s a breakdown of what to consider when setting realistic investment goals:

1. Define your “Why”

Start by asking yourself, “Why am I investing?” Your motivation will guide your investment choices. Common reasons include:

- Retirement planning

- Saving for a down payment on a house

- Funding your children’s education

- Building wealth for the future

2. Determine your Time Horizon

Your investment time horizon refers to the length of time you plan to keep your money invested. The longer your time horizon, the more risk you can typically take on.

For example, if you’re saving for retirement in 30 years, you have more time to recover from market fluctuations than someone saving for a down payment in 5 years.

3. Assess your Risk Tolerance

Risk tolerance refers to your comfort level with the possibility of losing money.

Consider factors such as:

- Your financial situation

- Your investment knowledge

- Your personal preferences

4. Set Specific, Measurable, Achievable, Relevant, and Time-Bound (SMART) Goals

SMART goals are well-defined and make it easier to track your progress. For instance, instead of “I want to invest more,” a more specific goal would be “I will invest $500 per month for the next 5 years.”

5. Be Flexible and Adapt

Life is unpredictable. Your circumstances and goals may change over time. Be prepared to review and adjust your investment strategy accordingly.

6. Seek Professional Advice

If you’re unsure about setting realistic investment goals, don’t hesitate to seek professional advice from a financial advisor.

A financial advisor can help you create a personalized investment plan that aligns with your individual needs and objectives.

Choosing the Right Brokerage Account

Investing in the stock market can be a great way to grow your wealth over time. But before you can start investing, you need to choose a brokerage account. With so many different brokerage firms out there, it can be tough to know where to start. Here are a few things to keep in mind when choosing a brokerage account.

What are your investment goals?

The first step is to figure out what your investment goals are. Are you looking to invest in stocks, bonds, mutual funds, or ETFs? Do you want to trade actively or just invest for the long term? Once you know what you want to invest in, you can start narrowing down your choices.

What are your trading needs?

If you plan on trading actively, you’ll need a brokerage account that offers a wide range of trading tools and features. This might include things like real-time quotes, charting software, and order types. If you’re a long-term investor, you might not need all of these features.

What are the fees?

Brokerage firms charge different fees for their services. Some firms charge commissions on trades, while others offer commission-free trading. There may also be other fees, such as account maintenance fees or inactivity fees. Be sure to compare the fees of different brokerage firms before making a decision.

What is the customer service like?

When you’re investing your money, you want to know that you can rely on your brokerage firm. Look for a firm with a strong reputation for customer service. You can read online reviews or ask other investors for their recommendations.

What is the research and educational resources?

Some brokerage firms offer a wide range of research and educational resources to help investors make informed decisions. This might include things like market analysis, investment ideas, and financial education courses. If you’re new to investing, you might want to choose a firm that offers these resources.

What is the user experience?

The user experience of a brokerage account is important. You want a platform that is easy to use and navigate. You should also consider whether the platform offers mobile trading capabilities.

Other factors to consider

In addition to the factors listed above, there are a few other things you might want to consider when choosing a brokerage account:

- Minimum deposit requirements: Some brokerage firms have minimum deposit requirements. Be sure to check this before opening an account.

- Account types: Brokerage firms offer different types of accounts, such as individual retirement accounts (IRAs), taxable brokerage accounts, and joint accounts. Choose the account type that best meets your needs.

- Investment options: Make sure the brokerage firm offers the investment options you’re looking for. Some firms offer a wider range of investment products than others.

Choosing the right brokerage account for you

Once you’ve considered all of the factors listed above, you can start to narrow down your choices. It’s important to choose a brokerage account that meets your individual needs and investment goals.

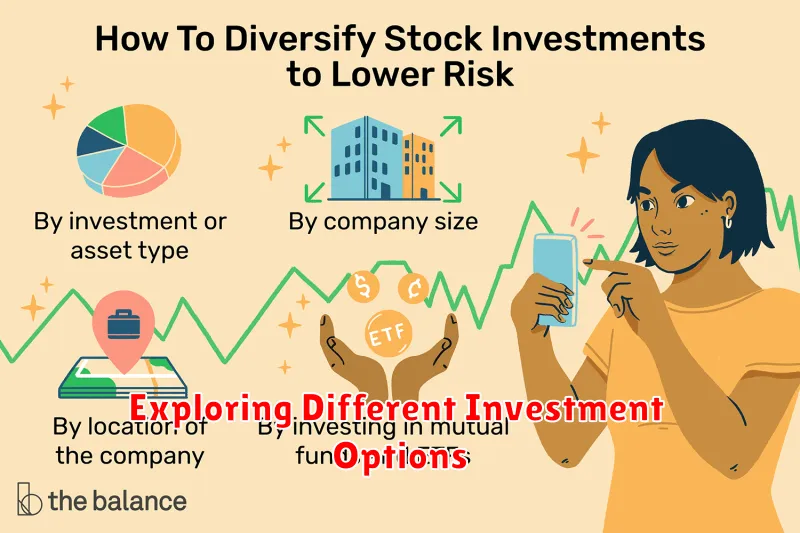

Exploring Different Investment Options

Investing is an essential part of building a secure financial future. It allows you to grow your wealth over time and achieve your financial goals. However, with numerous investment options available, it can be overwhelming to choose the right one for your needs. This article aims to explore some common investment options, shedding light on their features, potential benefits, and risks.

Stocks

Stocks represent ownership in a company. When you buy stocks, you become a shareholder and are entitled to a portion of the company’s profits. Stock prices can fluctuate based on factors such as company performance, economic conditions, and market sentiment. While stocks have the potential for high returns, they also carry higher risk compared to other investments.

Bonds

Bonds are debt securities issued by corporations or governments. When you invest in bonds, you are essentially lending money to the issuer in exchange for fixed interest payments. Bonds generally offer lower returns than stocks but are considered less risky. They are often considered a more conservative investment option for those seeking steady income.

Mutual Funds

Mutual funds are investment vehicles that pool money from multiple investors to purchase a diversified portfolio of securities. This diversification helps reduce risk, as investments are spread across different assets. Mutual funds are managed by professional fund managers who make investment decisions on behalf of the investors.

Exchange-Traded Funds (ETFs)

Exchange-traded funds (ETFs) are similar to mutual funds but are traded on stock exchanges like individual stocks. ETFs offer the same diversification benefits as mutual funds but typically have lower fees and more flexibility in trading.

Real Estate

Real estate is another popular investment option, offering the potential for appreciation and rental income. Owning property can provide a sense of security and stability. However, real estate investments can be illiquid and require significant capital.

Gold

Gold is a precious metal that has been used as a form of currency and a store of value for centuries. Gold is considered a safe-haven asset, meaning its value tends to rise during times of economic uncertainty. While gold can provide portfolio diversification, it typically doesn’t generate income like other investments.

Choosing the Right Investment Option

The best investment option for you depends on your individual circumstances, financial goals, risk tolerance, and time horizon. It’s important to conduct thorough research, consult with a financial advisor, and create a well-diversified investment portfolio that aligns with your objectives.

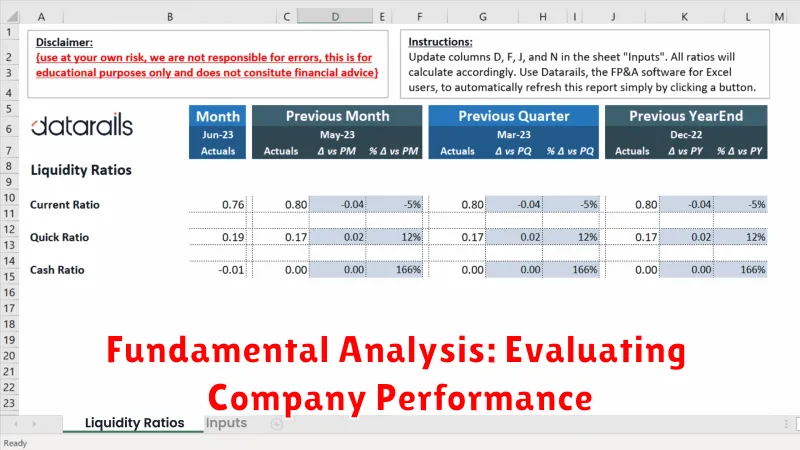

Fundamental Analysis: Evaluating Company Performance

Fundamental analysis is a method of evaluating a company’s intrinsic value by examining its financial statements, management, industry, and overall economic environment. It helps investors understand the underlying health and prospects of a company to make informed investment decisions. Unlike technical analysis, which focuses on price patterns and trading volume, fundamental analysis delves into the fundamentals of a business to assess its true worth.

Key Financial Ratios

Fundamental analysis relies heavily on financial ratios, which provide insights into various aspects of a company’s performance. Some common ratios include:

- Profitability ratios (e.g., gross profit margin, operating profit margin, net profit margin) measure a company’s ability to generate profits from its sales.

- Liquidity ratios (e.g., current ratio, quick ratio) assess a company’s ability to meet its short-term financial obligations.

- Solvency ratios (e.g., debt-to-equity ratio, interest coverage ratio) gauge a company’s ability to meet its long-term financial obligations.

- Efficiency ratios (e.g., inventory turnover ratio, accounts receivable turnover ratio) measure how efficiently a company manages its assets.

- Valuation ratios (e.g., price-to-earnings ratio, price-to-book ratio) compare a company’s stock price to its underlying fundamentals.

Beyond Financial Statements

While financial ratios are crucial, fundamental analysis goes beyond just numbers. Investors also consider:

- Management quality: Experienced and ethical management can significantly impact a company’s performance.

- Industry outlook: Understanding the growth potential and competitive landscape of the industry in which a company operates is essential.

- Economic environment: Economic factors such as inflation, interest rates, and government regulations can affect a company’s profitability.

- Competitive advantage: Identifying a company’s unique strengths and competitive advantages helps assess its ability to maintain its position in the market.

Benefits of Fundamental Analysis

Fundamental analysis offers several benefits for investors:

- Identifies undervalued companies: By analyzing a company’s fundamentals, investors can discover companies trading below their intrinsic value.

- Reduces investment risk: Understanding a company’s financial health and prospects helps minimize the risk of investing in a poorly performing business.

- Provides long-term perspective: Unlike technical analysis, fundamental analysis focuses on long-term factors that drive a company’s value.

- Improves investment decision-making: A comprehensive fundamental analysis provides a solid foundation for making informed investment choices.

Conclusion

Fundamental analysis is a powerful tool for evaluating company performance and making informed investment decisions. By delving into a company’s financials, management, industry, and economic environment, investors can gain a deeper understanding of its true value and identify investment opportunities. While it requires time and effort, fundamental analysis can be a valuable asset for any investor seeking to achieve long-term success.

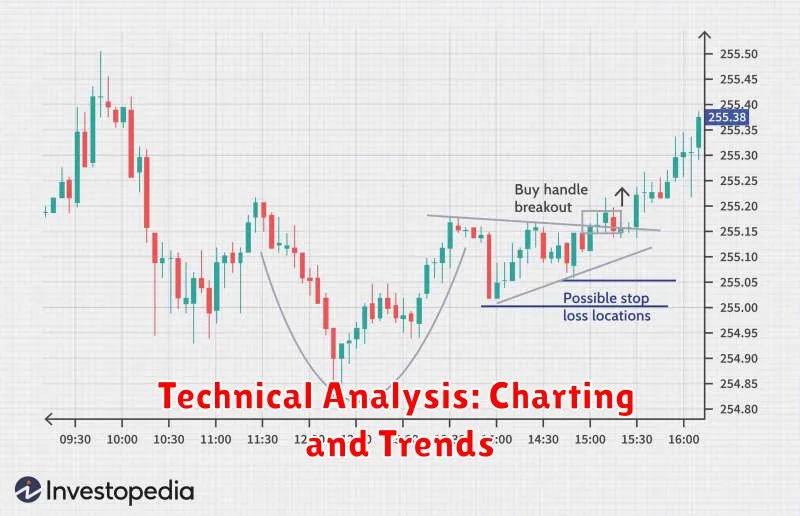

Technical Analysis: Charting and Trends

Technical analysis is a method of forecasting the future price movement of a financial instrument by studying past price data. This method is used by traders to identify trading opportunities and manage risk. Technical analysts believe that price movements are not random, but rather follow identifiable patterns and trends.

Technical analysis is based on the idea that all information about a financial instrument is already reflected in its price. This includes information about the company’s fundamentals, the overall market conditions, and the sentiment of traders. By studying the price charts, technical analysts can identify these patterns and trends, which can help them to predict future price movements.

Charting

Charting is a key part of technical analysis. Technical analysts use various types of charts to visualize price movements over time. Some of the most common chart types include:

- Line Charts: A line chart simply connects the closing prices of a financial instrument over a period of time.

- Bar Charts: A bar chart shows the opening, high, low, and closing prices of a financial instrument for each trading period.

- Candlestick Charts: Candlestick charts are similar to bar charts, but they also provide information about the trading range of the financial instrument during the period.

Trends

Technical analysts identify trends in the price charts to determine the direction of future price movements. There are three main types of trends:

- Uptrend: An uptrend is characterized by a series of higher highs and higher lows. This indicates that the price is moving upwards.

- Downtrend: A downtrend is characterized by a series of lower highs and lower lows. This indicates that the price is moving downwards.

- Sideways Trend: A sideways trend is characterized by a lack of a clear direction. The price is moving within a range, but there is no clear uptrend or downtrend.

Technical Indicators

Technical indicators are mathematical calculations that are used to analyze price data. These indicators can help to identify trends, support and resistance levels, and potential buy or sell signals. Some popular technical indicators include:

- Moving Averages: Moving averages are calculated by averaging the price of a financial instrument over a specified period of time. They can help to smooth out price fluctuations and identify trends.

- Relative Strength Index (RSI): The RSI is a momentum indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset.

- MACD: The Moving Average Convergence Divergence (MACD) is a trend-following momentum indicator that shows the relationship between two moving averages of prices.

Conclusion

Technical analysis can be a valuable tool for traders, but it is important to note that it is not a foolproof system. The past performance of a financial instrument does not guarantee future results. Technical analysis should be used in conjunction with other methods of market analysis, such as fundamental analysis.

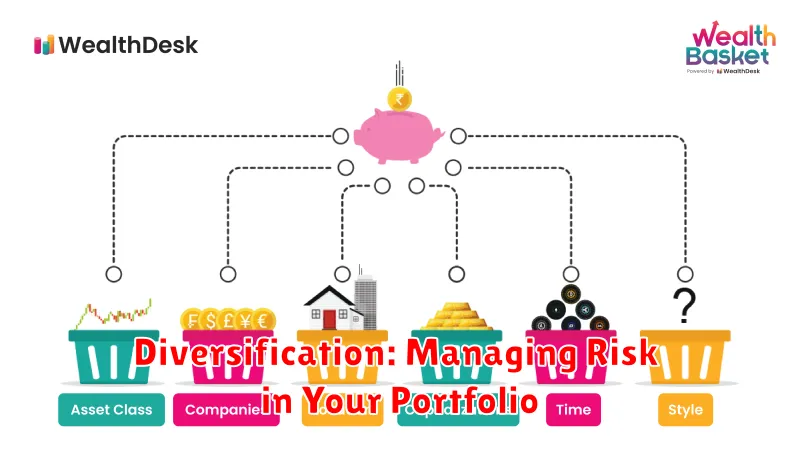

Diversification: Managing Risk in Your Portfolio

Diversification is a key principle in investing. It involves spreading your investments across different asset classes, sectors, and geographies to reduce risk. By not putting all your eggs in one basket, you can protect yourself from potential losses and increase the chances of achieving your investment goals.

There are several types of diversification, including:

- Asset Class Diversification: Investing in different asset classes, such as stocks, bonds, real estate, and commodities.

- Sector Diversification: Investing in companies from different industries, such as technology, healthcare, and energy.

- Geographic Diversification: Investing in companies from different countries or regions.

Diversification can help reduce risk by:

- Reducing Volatility: By spreading your investments across different assets, you can minimize the impact of any single asset’s performance on your overall portfolio.

- Lowering Correlation: Different asset classes often move in different directions. When one asset class is performing poorly, another may be performing well, helping to offset losses.

- Improving Returns: Diversification can help you achieve higher returns over the long term by exposing you to different growth opportunities.

Here are some tips for diversifying your portfolio:

- Start Early: The earlier you start diversifying, the more time your investments have to grow and offset potential losses.

- Don’t Be Afraid to Invest in Different Asset Classes: Explore different asset classes, such as stocks, bonds, real estate, and commodities, to find those that align with your risk tolerance and investment goals.

- Consider Exchange-Traded Funds (ETFs): ETFs are a convenient way to diversify your portfolio by investing in a basket of different stocks or bonds.

- Rebalance Your Portfolio Regularly: As your portfolio grows, you may need to rebalance it to maintain your desired asset allocation.

Diversification is an essential strategy for managing risk and achieving your investment goals. By following these tips, you can create a well-diversified portfolio that can help you weather market fluctuations and achieve long-term success.

Long-Term vs. Short-Term Investing Strategies

Investing is an essential aspect of financial planning, and it involves putting money into assets with the expectation of generating returns. While the ultimate goal is to grow your wealth, the approaches to achieving this vary based on your investment horizon and risk tolerance. Two contrasting strategies stand out: long-term investing and short-term investing.

Long-term investing, often referred to as “buy and hold,” entails holding investments for an extended period, typically five years or more. This approach prioritizes growth and is less concerned with short-term market fluctuations. Investors focus on building a diversified portfolio of assets such as stocks, bonds, and real estate, anticipating that they will appreciate in value over time.

Short-term investing, on the other hand, involves frequent buying and selling of securities, aiming to capitalize on short-term price movements. Day traders, swing traders, and scalpers are examples of short-term investors. This strategy requires greater market knowledge, technical analysis skills, and a higher risk tolerance as it involves frequent trading and potential for losses.

Here’s a detailed comparison between long-term and short-term investing strategies:

Long-Term Investing

Pros

- Potential for higher returns: Over the long term, the stock market has historically delivered positive returns, allowing investors to benefit from compounding growth.

- Lower risk: Holding investments for an extended period mitigates the impact of short-term market volatility.

- Tax advantages: Long-term capital gains are taxed at lower rates than short-term gains.

- Lower trading costs: Fewer trades mean lower transaction fees.

Cons

- Slower growth: It takes time for investments to compound and generate substantial returns.

- Opportunity cost: Funds tied up in long-term investments may not be available for immediate needs.

- Market downturns: While long-term returns are generally positive, investors may experience periods of market decline.

Short-Term Investing

Pros

- Faster returns: The potential for quick profits is higher in short-term trading.

- Flexibility: Short-term investors have the flexibility to adapt their strategies based on market conditions.

- High returns potential: Skilled short-term investors can exploit market inefficiencies and generate significant returns.

Cons

- Higher risk: Short-term trading is highly volatile and exposes investors to substantial losses.

- Higher trading costs: Frequent trading leads to higher transaction fees.

- Tax implications: Short-term capital gains are taxed at higher rates than long-term gains.

- Requires expertise: Successful short-term trading requires extensive market knowledge, technical analysis skills, and disciplined trading strategies.

The choice between long-term and short-term investing depends on individual circumstances, financial goals, risk tolerance, and investment knowledge. Long-term investing is generally suitable for investors with a long-term horizon and a lower risk tolerance, while short-term trading is more appropriate for investors with a higher risk tolerance and the expertise to navigate the market’s volatility.

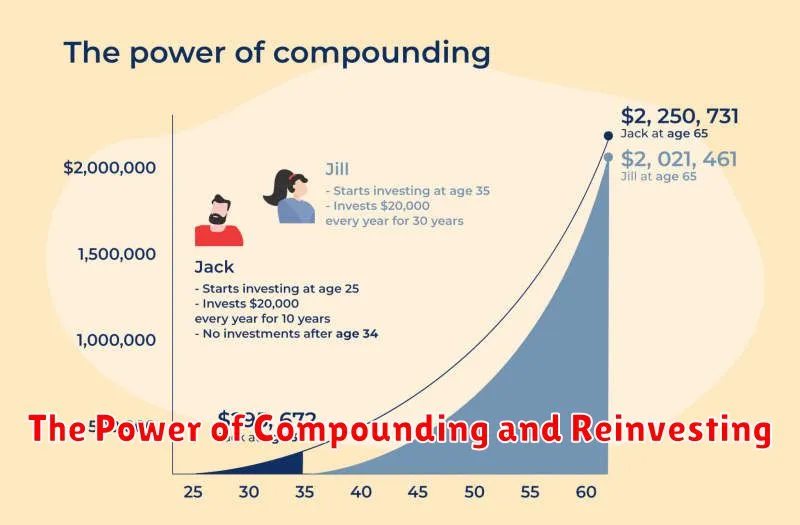

The Power of Compounding and Reinvesting

In the realm of personal finance, one of the most potent concepts that can propel your wealth forward is the magic of compounding and reinvesting. It’s a simple yet profound principle that allows your money to work for you, generating returns that grow exponentially over time. To understand this concept, imagine a seed that, when planted, sprouts into a small sapling. Over time, with consistent care and nourishment, this sapling transforms into a mighty tree, bearing even more seeds. This cyclical process mirrors the magic of compounding and reinvesting.

Think of your initial investment as the seed. When you reinvest your earnings, you’re essentially planting more seeds. These new seeds, combined with the original investment, then generate more returns, creating a snowball effect. With each cycle, the snowball grows larger, and your wealth multiplies at an accelerating pace. The key here lies in the power of time, which allows the compounding effect to work its wonders. The longer you let your investments grow, the more significant the returns will be.

The beauty of compounding and reinvesting lies in its ability to overcome inflation. Inflation erodes the purchasing power of money over time, but compounding can outpace it. As your investment grows, its returns also grow, outpacing the rate at which inflation erodes the value of your money. This principle is often referred to as “earning interest on interest” or “compound interest“.

To harness the power of compounding, it’s crucial to invest in assets that have the potential to generate consistent returns over the long term. Stocks, bonds, and real estate are some examples of such assets. However, it’s important to remember that investing comes with inherent risks, and past performance is not a guarantee of future results. Therefore, it’s essential to conduct thorough research, diversify your investments, and consult with a financial advisor to develop a sound investment strategy that aligns with your financial goals and risk tolerance.

The power of compounding and reinvesting is not just about maximizing financial gains; it’s also about fostering a mindset of financial discipline and long-term thinking. By consistently reinvesting your earnings, you’re demonstrating commitment to your financial goals and building a solid foundation for a secure future. So, embrace the magic of compounding and watch your wealth blossom over time.

Staying Informed: Market News and Resources

In today’s dynamic business landscape, staying informed about market trends and developments is crucial for success. Accessing reliable and timely information empowers businesses to make informed decisions, identify opportunities, and navigate potential challenges. This article will delve into essential market news sources and valuable resources that can help you stay ahead of the curve.

Financial News Websites

Financial news websites provide real-time updates on market movements, company announcements, economic indicators, and expert analysis. Some reputable sources include:

- Bloomberg

- Reuters

- Wall Street Journal

- Financial Times

- Investopedia

Industry-Specific Publications

Industry-specific publications offer in-depth coverage of trends, technologies, and challenges within particular sectors. These publications provide valuable insights tailored to your industry, helping you understand competitive landscapes and emerging opportunities.

Government Agencies and Regulatory Bodies

Government agencies and regulatory bodies release important data, reports, and announcements that impact businesses. Keep an eye on:

- U.S. Securities and Exchange Commission (SEC)

- Federal Reserve

- U.S. Department of Commerce

- National Bureau of Economic Research (NBER)

Social Media Platforms

Social media platforms have become significant sources of market insights. Follow industry leaders, thought leaders, and influencers to gain access to their perspectives, news updates, and discussions.

Market Research Firms

Market research firms conduct comprehensive studies and analyses to provide in-depth understanding of specific industries, consumer behavior, and market trends. Their reports offer valuable data and insights to support strategic decision-making.

Industry Events and Conferences

Attending industry events and conferences provides opportunities to network with peers, hear from experts, and stay abreast of the latest developments. These events offer a platform for knowledge sharing and idea generation.

Professional Associations

Professional associations offer members access to industry-specific resources, publications, and networking opportunities. They also often host events and webinars to keep members informed about market trends and best practices.

By leveraging these diverse resources, you can stay informed about market news and developments, making informed decisions and gaining a competitive edge in your industry.

Emotional Control: Avoiding Common Pitfalls

Emotional control is a critical skill for navigating life’s challenges and fostering healthy relationships. However, the path to mastering emotional control can be fraught with pitfalls, leading to frustration and setbacks. Understanding common pitfalls and developing strategies to overcome them is key to achieving emotional stability and well-being.

One prevalent pitfall is suppressing emotions. While it might seem like a quick fix to avoid discomfort, suppressing emotions often backfires. Bottled-up emotions can manifest in unhealthy ways, such as outbursts, anxiety, or physical ailments. Instead of suppression, focus on acknowledging and validating your feelings, even if they’re unpleasant.

Another common pitfall is overgeneralizing. When experiencing a negative emotion, it’s easy to fall into the trap of believing it represents a broader truth about yourself or your life. Statements like “I’m always failing” or “I’m never good enough” are examples of overgeneralization. Challenge these thoughts by considering evidence to the contrary and focusing on specific situations rather than sweeping judgments.

Catastrophizing is another pitfall to watch out for. This involves imagining the worst-case scenario in every situation, fueling anxiety and fear. When faced with a stressful situation, try to identify the most likely outcome and focus on practical steps you can take to manage the situation. Remind yourself that most problems have solutions, and catastrophizing only hinders your ability to find them.

Should statements can also impede emotional control. These are rigid rules and expectations that we place on ourselves and others. When someone doesn’t meet our “should” standards, it can lead to resentment and anger. Instead of focusing on rigid expectations, try to be flexible and accept that people, including yourself, will make mistakes.

Lastly, blaming others is a common pitfall that can hinder emotional control. When we blame others for our problems, we relinquish control over our own emotions and reactions. Take responsibility for your feelings and actions, even when dealing with difficult situations. This empowers you to find solutions and build healthier relationships.

By recognizing and actively addressing these common pitfalls, you can cultivate greater emotional control. This journey requires patience, self-awareness, and a commitment to personal growth. As you develop healthier emotional habits, you’ll experience greater peace, resilience, and fulfillment in all areas of your life.