The stock market, a dynamic and unpredictable realm, holds the potential for substantial financial growth, but navigating its complexities can be daunting. To thrive in this competitive landscape, aspiring and seasoned investors alike must equip themselves with the right tools.

This comprehensive guide will delve into the essential stock market investment tools that can empower you to make informed decisions, manage your portfolio effectively, and ultimately, achieve your financial goals. We’ll explore a range of resources, from fundamental analysis tools to advanced charting platforms, all designed to provide you with the knowledge and insights needed to master the market.

Understanding the Basics of the Stock Market

The stock market is a complex and often intimidating world, but understanding its basics can be a rewarding and potentially profitable endeavor. In essence, the stock market is a marketplace where people buy and sell shares of publicly traded companies. These shares, also known as stocks, represent ownership in a company, and their prices fluctuate based on various factors like company performance, market sentiment, and economic conditions.

When you buy a stock, you’re essentially buying a tiny piece of that company. If the company does well, the value of your stock can increase, potentially leading to profit when you sell it. Conversely, if the company performs poorly, your stock’s value might decrease, resulting in a loss. The stock market is driven by supply and demand, with prices influenced by the number of buyers and sellers in the market.

There are two main types of stock markets: primary and secondary markets. The primary market is where companies initially sell their shares to the public through an initial public offering (IPO). The secondary market, where most trading takes place, is where investors buy and sell existing shares amongst themselves.

Investing in the stock market can offer the potential for significant returns, but it also comes with inherent risks. The value of stocks can fluctuate wildly, and there’s always a chance of losing money. Before investing, it’s crucial to understand your risk tolerance and do thorough research on the companies you’re considering.

To participate in the stock market, you’ll need to open a brokerage account. Brokers act as intermediaries between investors and the stock market, facilitating trades and providing tools for managing your investments. There are numerous brokerage platforms available, offering different features and fees, so it’s essential to choose one that aligns with your needs and investment goals.

Choosing the Right Brokerage Account

Investing in the stock market can be a daunting task for beginners. It can be difficult to know where to start and how to choose the right platform for you. One of the most important decisions you will make is selecting a brokerage account.

A brokerage account allows you to buy and sell stocks, bonds, ETFs, mutual funds, and other securities. There are many different types of brokerage accounts available, and each one has its own features and fees. It’s important to choose an account that meets your needs and fits your budget.

Things to Consider When Choosing a Brokerage Account

Here are some important things to consider when choosing a brokerage account:

- Fees: Brokerage accounts charge different fees for trading, account maintenance, and other services. Be sure to compare the fees of different brokers before making a decision. Some brokers offer commission-free trades, which can save you money in the long run.

- Investment Options: Different brokerage accounts offer different investment options. Some accounts only allow you to trade stocks, while others offer access to a wider range of investments, such as bonds, ETFs, and mutual funds.

- Research Tools: If you’re a beginner investor, it’s important to choose a brokerage account that offers research tools to help you make informed investment decisions. These tools can include market data, analyst reports, and stock screeners.

- Customer Service: You should choose a brokerage account with a reputable customer service team that can help you with any questions or problems you may have.

- Mobile App: If you want to trade on the go, it’s important to choose a brokerage account with a user-friendly mobile app. Many brokers offer mobile apps that allow you to trade, check your portfolio, and access research tools from your smartphone or tablet.

- Minimum Investment Requirements: Some brokerage accounts have minimum investment requirements. Make sure you meet these requirements before opening an account. This is particularly important for those new to investing.

It’s also essential to remember that each investor is different and what works for one person may not work for another. Don’t be afraid to experiment with different brokers to find one that meets your specific needs.

Types of Brokerage Accounts

There are several different types of brokerage accounts available, each with its own unique features and benefits. Some common types of brokerage accounts include:

- Traditional Brokerage Accounts: These are the most common type of brokerage account. They offer a wide range of investment options and are typically used by both novice and experienced investors.

- Robo-Advisors: Robo-advisors are automated investment platforms that use algorithms to create and manage investment portfolios. They are a good option for investors who want a hands-off approach to investing.

- Cash Accounts: Cash accounts are brokerage accounts that only allow you to trade with funds you have already deposited. This is a good option for investors who want to avoid margin debt.

- Margin Accounts: Margin accounts allow you to borrow money from your broker to invest in securities. This can allow you to leverage your investments, but it also carries a higher risk of losing money.

- Retirement Accounts: Retirement accounts, such as IRAs and 401(k)s, are designed to help you save for retirement. These accounts offer tax advantages and can be a good option for long-term investors.

It’s important to understand the differences between each type of account and choose one that aligns with your financial goals.

Research and Compare

Once you’ve identified the key factors to consider, you can start researching different brokers and comparing their offerings. There are many online resources that can help you with this, such as investment websites and financial publications. Don’t hesitate to reach out to customer support for any questions or concerns you have.

Remember that opening a brokerage account is an important decision. Make sure you take the time to understand your options and choose the best one for your individual needs.

Essential Stock Research and Analysis Tools

Investing in the stock market can be a daunting task, especially for beginners. With countless stocks to choose from and a plethora of financial data available, it can be overwhelming to know where to start. Fortunately, several essential tools can simplify the process and empower investors to make informed decisions. These tools provide valuable insights into company performance, market trends, and financial data, enabling investors to identify potential investment opportunities and manage risk.

1. Financial News Websites and Apps

Staying up-to-date on financial news is crucial for investors. Websites like Bloomberg, Reuters, and MarketWatch provide real-time market updates, company news, and expert analysis. Mobile apps like CNBC and Yahoo Finance offer convenient access to financial information on the go.

2. Stock Screeners

Stock screeners are invaluable for investors seeking to filter through a vast number of stocks based on specific criteria. Platforms like Finviz, TradingView, and Google Finance allow investors to screen stocks based on factors such as price, market capitalization, sector, industry, and financial ratios. This helps narrow down potential investments to a manageable list.

3. Fundamental Analysis Tools

Fundamental analysis involves assessing a company’s financial health and its ability to generate future profits. Tools like Morningstar, GuruFocus, and Tiingo provide detailed financial statements, key ratios, and analyst ratings. These insights help investors understand a company’s strengths and weaknesses, as well as its potential growth prospects.

4. Technical Analysis Platforms

Technical analysis focuses on chart patterns and price trends to predict future price movements. Platforms like TradingView, StockCharts, and MetaTrader offer advanced charting tools, indicators, and real-time data for technical analysis. These platforms help investors identify support and resistance levels, trendlines, and other patterns that can signal potential trading opportunities.

5. Portfolio Management Tools

Portfolio management tools help investors track their investments, analyze performance, and make informed decisions. Platforms like Personal Capital, E*TRADE, and Schwab provide comprehensive portfolio tracking, asset allocation analysis, and performance reporting. These tools enable investors to monitor their overall portfolio performance and make adjustments as needed.

6. Social Media Platforms

Social media platforms like Twitter and Reddit can be valuable resources for investors seeking real-time market updates, company news, and insights from other investors. However, it’s crucial to exercise caution and be wary of misinformation or biased opinions.

7. Financial Calculators

Financial calculators can help investors make informed decisions about investing, saving, and retirement planning. Websites like Investopedia and Bankrate offer a wide range of calculators, including compound interest calculators, retirement planning calculators, and loan calculators.

By leveraging these essential tools, investors can enhance their research and analysis capabilities, make informed decisions, and navigate the complexities of the stock market with greater confidence. Remember, investing involves risk, and it’s crucial to conduct thorough research and seek professional advice when necessary.

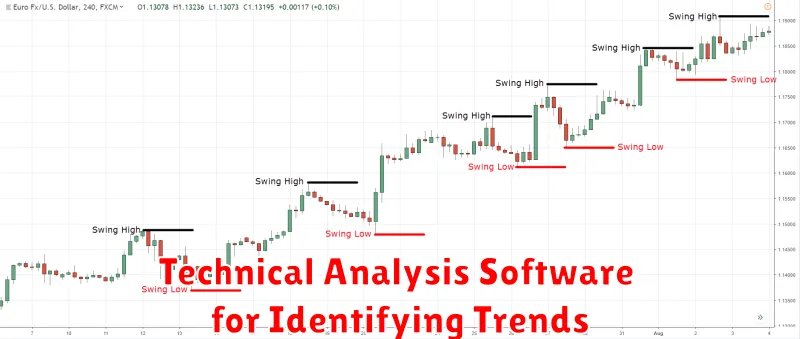

Technical Analysis Software for Identifying Trends

Technical analysis is a method of forecasting future price movements in financial markets based on the study of past market data, primarily price and volume. Technical analysts use charts and other tools to identify patterns and trends in price movements, hoping to predict future price action. Technical analysis is a valuable tool for traders of all levels, from beginners to professionals. It can help you to identify potential trading opportunities, manage risk, and develop a more disciplined trading approach.

There are many different technical analysis software programs available on the market, each with its own strengths and weaknesses. Some of the most popular technical analysis software programs include:

TradingView

TradingView is a popular cloud-based charting platform that offers a wide range of technical indicators and drawing tools. It is also a social platform where traders can share their ideas and analysis with others. TradingView is a great choice for traders of all levels, from beginners to professionals. It’s free to use for basic charting and analysis, but there are paid subscription options available for more advanced features.

MetaTrader 4 (MT4)

MetaTrader 4 is a popular trading platform used by many brokers. It offers a wide range of technical analysis tools, including indicators, drawing tools, and automated trading strategies. MT4 is a powerful platform that can be used by both beginners and experienced traders. It’s free to download and use, but some features may require a paid subscription.

NinjaTrader

NinjaTrader is a powerful platform that offers a wide range of technical analysis tools, including indicators, drawing tools, and automated trading strategies. NinjaTrader is a good choice for traders who want a platform with a wide range of features. It’s free to download and use, but some features may require a paid subscription.

StockCharts.com

StockCharts.com is a website that provides a wide range of charting tools and technical indicators. It is a good choice for traders who are looking for a website with a wide range of charting tools and technical indicators. It’s free to use for basic charting and analysis, but there are paid subscription options available for more advanced features.

When choosing technical analysis software, it is important to consider your individual needs and trading style. Some factors to consider include the price, the features offered, and the ease of use. You should also consider the software’s compatibility with your broker and trading platform.

Technical analysis software can be a valuable tool for traders of all levels. It can help you to identify potential trading opportunities, manage risk, and develop a more disciplined trading approach. The right technical analysis software can help you to improve your trading performance and reach your financial goals.

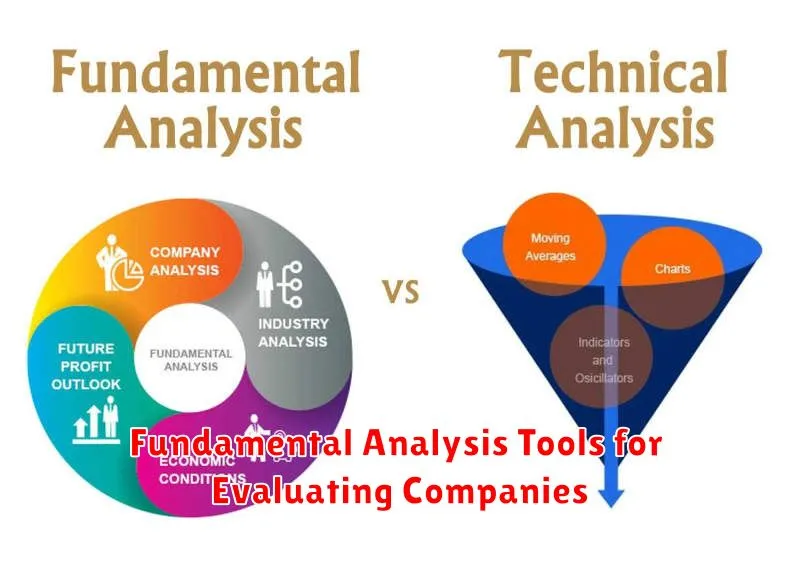

Fundamental Analysis Tools for Evaluating Companies

Fundamental analysis is a method of evaluating a company’s intrinsic value by examining its financial statements, management, competitive landscape, and industry. This approach is essential for investors seeking long-term growth and stability. By understanding a company’s underlying fundamentals, investors can make more informed decisions about whether to buy, sell, or hold a stock.

Here are some key fundamental analysis tools that investors use to evaluate companies:

Financial Statements

The most crucial aspect of fundamental analysis is scrutinizing a company’s financial statements. These reports provide a window into the company’s financial health, performance, and future prospects. Here are the primary financial statements used:

- Income Statement: Shows a company’s revenues, expenses, and net income (or loss) over a specific period. Investors can analyze factors like revenue growth, profit margins, and operating expenses to understand profitability.

- Balance Sheet: Presents a snapshot of a company’s assets, liabilities, and equity at a specific point in time. It reveals the company’s financial structure and how it is financed. Investors can analyze key ratios like liquidity and debt-to-equity to understand financial health.

- Statement of Cash Flows: Tracks a company’s cash inflows and outflows over a period. It reveals how much cash the company generates from its operations, investing, and financing activities. Investors can use this information to assess a company’s cash flow generation and potential for future growth.

Financial Ratios

Financial ratios provide a standardized way to compare a company’s performance with its peers or its own historical data. They highlight relationships between different financial variables and provide insights into various aspects of a company’s operations.

Some common financial ratios used for fundamental analysis include:

- Profitability Ratios: Measure a company’s ability to generate profits. Examples include gross profit margin, operating profit margin, and return on equity.

- Liquidity Ratios: Indicate a company’s ability to meet its short-term financial obligations. Examples include current ratio, quick ratio, and cash ratio.

- Solvency Ratios: Assess a company’s ability to meet its long-term financial obligations. Examples include debt-to-equity ratio, times interest earned ratio, and debt-to-asset ratio.

- Valuation Ratios: Compare a company’s current market value to its underlying fundamentals. Examples include price-to-earnings ratio (P/E), price-to-book ratio (P/B), and price-to-sales ratio (P/S).

Management Analysis

Understanding a company’s management team and its leadership quality is critical for assessing its future prospects. This analysis involves:

- Management Experience: Assessing the experience and track record of the management team is essential. Experienced and capable managers can drive growth and improve operational efficiency.

- Management Compensation: Analyzing executive compensation can provide insight into their alignment with shareholders’ interests. High compensation packages might raise concerns about excessive spending or misaligned incentives.

- Corporate Governance: Evaluating a company’s corporate governance practices ensures accountability and transparency in decision-making.

Industry Analysis

Understanding the industry in which a company operates is crucial. It provides context for its performance and future prospects.

- Industry Growth: A growing industry presents opportunities for a company to expand its business. Stagnant or declining industries might limit growth prospects.

- Competitive Landscape: Understanding the competitive landscape helps identify a company’s market share, pricing power, and potential for future challenges.

- Industry Trends: Staying abreast of industry trends and technological advancements can help assess a company’s ability to adapt and innovate.

Economic Analysis

A broader economic analysis can provide insights into a company’s operating environment and potential risks.

- Macroeconomic Factors: Factors such as interest rates, inflation, and economic growth can impact a company’s profitability and growth prospects.

- Regulatory Environment: Regulations and government policies can influence a company’s operations and costs.

- Global Events: Global events like pandemics, political instability, or trade wars can create uncertainty and affect a company’s performance.

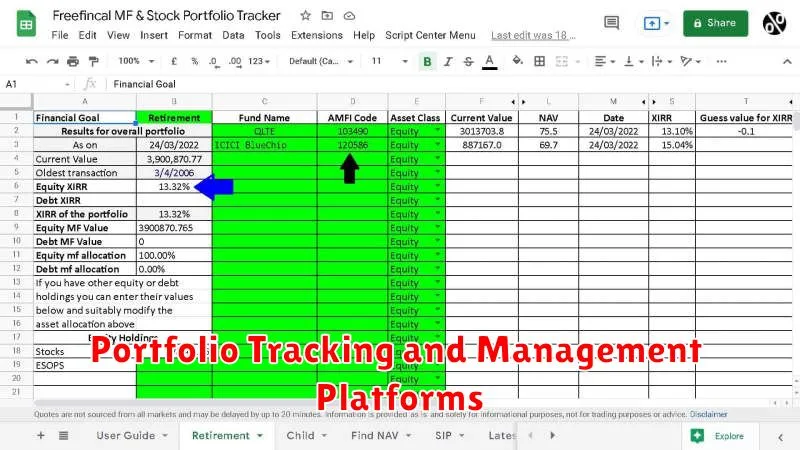

Portfolio Tracking and Management Platforms

In today’s dynamic financial landscape, it’s crucial for investors of all levels to have a comprehensive understanding of their investment portfolios. Portfolio tracking and management platforms provide invaluable tools for investors to monitor, analyze, and optimize their holdings. These platforms offer a wide range of features designed to simplify the investment process and empower individuals to make informed decisions.

Key Features of Portfolio Tracking and Management Platforms

Portfolio tracking and management platforms typically encompass a variety of features, including:

- Account Aggregation: Centralized view of all your investment accounts, including stocks, bonds, mutual funds, ETFs, and real estate.

- Real-Time Portfolio Performance: Track your portfolio’s performance in real time, with updated valuations and returns.

- Performance Analytics: Detailed analysis of your portfolio’s performance, including historical returns, risk metrics, and asset allocation breakdowns.

- Goal Setting and Planning: Set financial goals, such as retirement savings, education expenses, or buying a home, and track your progress towards achieving them.

- Investment Research: Access in-depth research reports, company news, and market analysis to support your investment decisions.

- Automated Rebalancing: Automatically rebalance your portfolio to maintain your desired asset allocation.

- Tax Optimization: Tools to help minimize your tax liability on investment gains and losses.

- Personalized Recommendations: AI-powered insights and recommendations tailored to your investment goals and risk tolerance.

Benefits of Using Portfolio Tracking and Management Platforms

Utilizing a portfolio tracking and management platform offers numerous advantages for investors, such as:

- Improved Transparency and Control: Gain a comprehensive understanding of your investments and how they’re performing.

- Data-Driven Decision-Making: Make informed investment decisions based on real-time data and performance analytics.

- Enhanced Efficiency: Streamline your investment management process and save time on manual tasks.

- Reduced Risk: Proactive monitoring and rebalancing can help mitigate investment risks.

- Increased Investment Confidence: Gain peace of mind knowing your portfolio is being actively tracked and managed.

Choosing the Right Platform

When selecting a portfolio tracking and management platform, it’s essential to consider factors such as:

- Features and Functionality: Ensure the platform offers the features that align with your investment needs.

- Account Integration: Verify if the platform supports the types of accounts you have.

- User Interface and Experience: Choose a platform with a user-friendly interface that is easy to navigate.

- Security and Privacy: Ensure the platform protects your financial data with robust security measures.

- Cost: Compare pricing plans and determine the best value for your investment.

Real-Time Market News and Data Feeds

In today’s fast-paced financial world, access to real-time market news and data is crucial for making informed investment decisions. Whether you’re a seasoned trader or an individual investor, staying ahead of the curve requires constant monitoring of market trends, economic indicators, and company announcements. Fortunately, numerous services provide real-time market news and data feeds, empowering investors to navigate the market with confidence.

Real-time market news refers to up-to-the-minute reports, articles, and analyses covering various financial markets, including stocks, bonds, commodities, and currencies. These feeds provide investors with insights into market movements, breaking news events, and expert opinions. Some key sources of real-time market news include:

- Financial News Websites: Websites such as Bloomberg, Reuters, and Yahoo Finance offer comprehensive real-time coverage of financial markets.

- Financial News Channels: Television channels like CNBC and Bloomberg TV broadcast real-time market updates, interviews with industry experts, and analysis of market trends.

- Financial News Apps: Mobile applications like MarketWatch, Investing.com, and StockTwits provide on-the-go access to real-time market news and data.

Real-time market data encompasses a wide range of numerical information, including:

- Stock Quotes: Real-time stock quotes display current prices, trading volume, and other essential data for individual stocks.

- Market Indices: Indices such as the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite provide real-time snapshots of broader market performance.

- Economic Indicators: Real-time data on economic indicators like inflation, unemployment, and GDP growth can reveal insights into the overall health of the economy.

- Company Financials: Access to real-time company financial data, such as earnings reports, balance sheets, and income statements, enables investors to gauge a company’s performance and potential.

Real-time market news and data feeds are essential for investors seeking to stay ahead of the curve. By leveraging these services, investors can gain a competitive edge in the market, make informed decisions, and potentially improve their investment outcomes. However, it’s crucial to remember that real-time information can be overwhelming, so it’s important to choose reliable sources, filter the information strategically, and use it to complement your overall investment strategy.

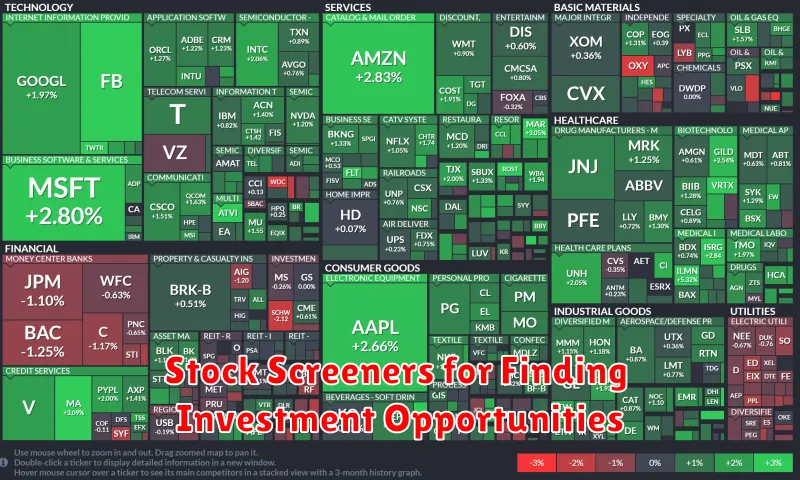

Stock Screeners for Finding Investment Opportunities

In the vast and dynamic world of stock investing, finding promising opportunities can be a daunting task. With thousands of companies listed on various exchanges, sifting through data and identifying potential winners requires meticulous research and analysis. This is where stock screeners come in handy, offering a powerful tool for investors to streamline their search and pinpoint investment opportunities that align with their specific criteria.

A stock screener is essentially a software application that allows users to filter and sort a list of stocks based on predefined parameters. These parameters can include factors like:

- Financial metrics: Price-to-earnings ratio (P/E), price-to-book ratio (P/B), dividend yield, revenue growth, profit margin, etc.

- Industry: Technology, healthcare, finance, energy, consumer goods, etc.

- Market capitalization: Large-cap, mid-cap, small-cap, micro-cap

- Technical indicators: Moving averages, relative strength index (RSI), MACD, Bollinger Bands, etc.

- Other factors: Analyst ratings, insider trading activity, debt levels, etc.

By combining these criteria, investors can create customized screens that highlight stocks that meet their desired investment profile. For example, a value investor might screen for stocks with low P/E ratios and high dividend yields, while a growth investor might focus on companies with strong revenue growth and high profit margins.

Stock screeners offer a number of benefits for investors:

- Efficiency: Screeners automate the process of filtering through vast amounts of data, saving investors time and effort.

- Objectivity: Screeners remove subjective biases from the investment selection process, helping investors make more rational decisions.

- Customization: Investors can tailor screens to their specific investment strategies and preferences.

- Backtesting: Many screeners allow investors to test their strategies on historical data, evaluating their effectiveness before putting real money at risk.

- Access to real-time data: Most screeners provide access to up-to-date financial information, ensuring that investors are making decisions based on the most recent data.

However, it’s important to note that stock screeners should not be relied upon solely for investment decisions. They are merely tools to narrow down the list of potential opportunities. Investors should always conduct thorough due diligence on any stock before making an investment.

There are numerous stock screeners available in the market, both free and paid. Some popular options include:

- Finviz: A comprehensive screener with a wide range of filters and customizable options.

- TradingView: A popular platform for charting and technical analysis, which also offers a built-in stock screener.

- Yahoo Finance: A well-known financial website that provides a basic stock screener.

- Google Finance: Another popular source of financial data, offering a simple screener for filtering stocks.

- Stock Rover: A paid screener with advanced features and in-depth analysis.

Ultimately, the best stock screener for an investor will depend on their individual needs and investment goals. It’s essential to choose a screener that provides the features and data that are most relevant to your investment strategy.

Educational Resources for Continuous Learning

In today’s rapidly changing world, continuous learning is no longer just a recommendation; it’s a necessity. Whether you’re looking to enhance your professional skills, expand your knowledge, or simply explore new interests, there’s an abundance of educational resources available at your fingertips. From online courses to libraries and podcasts, the options are truly limitless.

One of the most accessible and convenient ways to learn is through online courses. Platforms like Coursera, edX, and Udemy offer a diverse range of courses, from programming and data science to photography and creative writing. These platforms often provide certificates upon completion, making them a valuable investment for career advancement.

For those who prefer a more traditional learning environment, libraries remain a valuable resource. With access to a vast collection of books, journals, and other materials, libraries offer a quiet space for focused study. Many libraries also host events and workshops, providing opportunities for engagement and interaction with other learners.

Beyond traditional learning formats, podcasts have emerged as a popular way to acquire knowledge on the go. With podcasts dedicated to every imaginable topic, from history and science to business and personal development, there’s something for everyone. Podcasts offer a convenient way to learn while commuting, exercising, or simply relaxing.

Finally, mentorship plays a crucial role in continuous learning. Finding a mentor, whether it be a colleague, teacher, or someone in your field of interest, can provide valuable guidance and support. Mentors can share their experiences, offer advice, and help you navigate challenges.

Continuous learning is a journey, not a destination. By embracing the diverse range of resources available, you can embark on a lifelong pursuit of knowledge and growth.

Risk Management Tools for Protecting Your Investments

Investing can be a rewarding endeavor, but it also carries inherent risks. To safeguard your investments and maximize your returns, it is crucial to implement effective risk management strategies. Fortunately, numerous tools and techniques are available to help you navigate the complexities of the investment landscape and mitigate potential losses.

One fundamental risk management tool is diversification. By spreading your investments across different asset classes, industries, and geographical regions, you can reduce the impact of any single investment performing poorly. For instance, investing in a mix of stocks, bonds, real estate, and commodities can help cushion your portfolio against market fluctuations.

Another vital tool is asset allocation. This involves determining the proportion of your portfolio allocated to each asset class. By carefully considering your risk tolerance, investment goals, and time horizon, you can create an asset allocation strategy that aligns with your financial objectives. For example, a young investor with a long-term investment horizon might allocate a larger portion of their portfolio to stocks, while a retired individual seeking income might favor bonds.

Risk assessment is a crucial step in managing investment risk. By identifying and evaluating potential risks, you can develop strategies to mitigate them. This involves analyzing factors such as market volatility, interest rate changes, economic conditions, and company-specific risks. Tools like sensitivity analysis and stress testing can help quantify the potential impact of various risk scenarios.

Stop-loss orders are valuable risk management tools that can automatically sell a security when its price falls below a predetermined level. This helps limit potential losses in case of a sudden market downturn. However, it’s essential to set stop-loss orders at appropriate levels to avoid triggering them prematurely due to normal market fluctuations.

Portfolio rebalancing is a proactive risk management technique that involves periodically adjusting your asset allocation to maintain your desired risk profile. As market conditions change and investments fluctuate in value, rebalancing helps ensure that your portfolio stays aligned with your investment goals. Regular rebalancing can help avoid excessive concentration in any particular asset class and prevent significant deviations from your original investment strategy.

Beyond these specific tools, financial education plays a vital role in risk management. By understanding investment concepts, market dynamics, and risk tolerance, you can make informed decisions and avoid common investment pitfalls. Continuous learning and research are essential to staying ahead of market trends and mitigating potential risks.

In conclusion, utilizing a combination of these tools and techniques can significantly enhance your investment outcomes. By implementing a comprehensive risk management strategy, you can protect your investments from adverse market conditions and maximize your chances of achieving long-term financial success.