Are you looking for a way to build wealth and secure your financial future? If so, investing in real estate may be the perfect solution for you. Real estate investing has long been a popular strategy for building wealth, and with good reason. Real estate is a tangible asset that can appreciate in value over time, providing you with a steady stream of passive income and a solid foundation for your financial security.

While the prospect of building a real estate empire might seem daunting, it doesn’t have to be. This beginner’s guide will provide you with everything you need to know to get started, from understanding the basics of real estate investing to learning how to identify profitable opportunities. Whether you’re a seasoned investor or just starting out, this comprehensive guide will equip you with the knowledge and strategies to successfully navigate the exciting world of real estate investment.

Understanding Your Investment Goals

Investing can be a daunting task, especially for beginners. With so many options available, it can be overwhelming to know where to start. However, the first step to successful investing is understanding your investment goals. This means defining what you hope to achieve with your investments and setting clear objectives.

Your investment goals should be specific, measurable, achievable, relevant, and time-bound (SMART). This will help you stay focused and motivated on your investment journey. Let’s explore some common investment goals:

Short-Term Goals

Short-term goals are typically achieved within a year or two. These goals might include:

- Saving for a down payment on a house

- Funding a vacation

- Paying off debt

For short-term goals, it’s important to choose investments that are relatively low-risk and provide a consistent return.

Long-Term Goals

Long-term goals are typically achieved over a period of 5 years or more. These goals might include:

- Retirement planning

- Saving for a child’s education

- Building wealth for the future

Long-term goals allow for more risk-taking, as you have more time to recover from potential losses. This could include investments in the stock market or real estate.

Other Considerations

In addition to your time horizon, it’s important to consider your risk tolerance when setting your investment goals. Risk tolerance refers to your willingness to accept potential losses in exchange for the possibility of higher returns.

If you are risk-averse, you might prefer to invest in low-risk options, such as bonds or fixed deposits. If you are comfortable with risk, you might consider investing in stocks or other higher-risk investments.

Finally, it’s crucial to consider your financial situation and lifestyle when setting your investment goals. Your investment goals should be aligned with your overall financial plan and should not put you in a precarious financial position.

By clearly defining your investment goals, you can choose the right investments for your needs and work towards achieving your financial aspirations.

Assessing Your Financial Readiness

Financial readiness is a crucial aspect of leading a successful and fulfilling life. It encompasses having the resources, knowledge, and strategies to manage your finances effectively and achieve your financial goals. Whether you’re planning for retirement, saving for a down payment on a house, or simply ensuring you have a financial safety net, assessing your current financial standing is the first step towards achieving your aspirations.

There are several key areas to evaluate when assessing your financial readiness:

1. Income and Expenses

Start by understanding your current income and expenses. Create a detailed budget that tracks all your sources of income and categorizes your expenditures. This will give you a clear picture of your financial situation and help you identify areas where you can potentially save money.

2. Debt Management

Analyze your outstanding debt, including credit card balances, student loans, and personal loans. Determine the interest rates and repayment terms associated with each debt. Prioritize paying down high-interest debt first to minimize the overall cost of borrowing.

3. Savings and Investments

Evaluate the amount of money you have saved for various goals, such as emergency funds, retirement, and future purchases. Review your investment portfolio, including stocks, bonds, and real estate, to assess its performance and diversification.

4. Financial Goals

Clearly define your financial goals, both short-term and long-term. This could include buying a home, starting a business, paying off debt, or achieving financial independence. Having specific goals provides direction and motivation for your financial planning.

5. Risk Tolerance

Understand your comfort level with risk when it comes to investing. A higher risk tolerance may lead to more aggressive investments, while a lower risk tolerance may favor more conservative options. Determine what level of risk aligns with your overall financial goals.

6. Insurance Coverage

Review your insurance policies, including health, life, disability, and homeowners or renters insurance. Ensure that you have adequate coverage to protect yourself and your assets from unexpected events.

By conducting a comprehensive assessment of your financial readiness, you can gain valuable insights into your current situation and identify areas for improvement. This knowledge will empower you to make informed financial decisions, develop a strategic plan, and work towards achieving your financial aspirations.

Exploring Different Real Estate Investment Strategies

Real estate investing has long been a popular avenue for individuals to build wealth and generate passive income. However, the landscape of real estate investment has evolved significantly in recent years, offering a diverse range of strategies to suit different risk tolerances, financial goals, and market conditions.

In this article, we will delve into some of the most common and effective real estate investment strategies, providing insights into their pros, cons, and key considerations.

1. Buy and Hold

This classic strategy involves purchasing a property and holding it for an extended period, typically for long-term appreciation and rental income. Buy-and-hold investors often target stable neighborhoods with a high demand for rentals.

Pros:

- Potential for long-term appreciation

- Passive income through rental payments

- Tax advantages through depreciation deductions

Cons:

- Requires substantial upfront capital

- Risk of market fluctuations and property value depreciation

- Ongoing maintenance and management costs

2. Fix and Flip

Fix-and-flip investors purchase distressed properties, renovate them, and then resell them for a profit. This strategy requires a keen eye for undervalued properties and the ability to manage renovation projects effectively.

Pros:

- Potential for rapid profit generation

- Flexibility to focus on specific types of properties

- Hands-on involvement in the renovation process

Cons:

- Higher risk due to uncertain renovation costs and market conditions

- Requires significant expertise in construction and renovation

- Potential for delays and unexpected expenses

3. House Hacking

House hacking involves purchasing a multi-unit property (duplex, triplex, or fourplex) and living in one unit while renting out the others. This strategy allows investors to offset mortgage payments and build equity while living in a relatively affordable location.

Pros:

- Low upfront costs compared to traditional buy-and-hold

- Potential to generate passive income from rental units

- Opportunity to live in a desirable location at a reduced cost

Cons:

- Limited to specific types of properties

- Responsibilities of being a landlord

- Potential for tenant issues and vacancies

4. Real Estate Investment Trusts (REITs)

REITs are publicly traded companies that own and operate income-producing real estate. Investors can purchase shares of REITs like stocks, providing them with diversification and liquidity in the real estate market.

Pros:

- Diversification and liquidity

- Potential for dividend income

- Access to a wide range of real estate assets

Cons:

- Limited control over individual properties

- Subject to market fluctuations and economic conditions

- Potential for lower returns than direct real estate investments

5. Crowdfunding

Real estate crowdfunding platforms allow investors to pool their funds together to invest in larger projects, such as commercial properties or apartment buildings. This strategy offers access to opportunities that were previously inaccessible to individual investors.

Pros:

- Lower investment minimums

- Access to unique and diverse investment opportunities

- Potential for higher returns than traditional real estate investments

Cons:

- Limited control over investments

- Higher risk due to potential for project failures

- Limited liquidity compared to public REITs

Researching the Market and Identifying Opportunities

In the dynamic realm of business, success hinges on a profound understanding of the market and the ability to identify lucrative opportunities. Market research serves as the cornerstone of this endeavor, providing valuable insights that guide strategic decision-making. It’s the process of gathering, analyzing, and interpreting data about consumers, competitors, and the overall market landscape.

The primary objective of market research is to uncover customer needs and preferences. By delving into the desires, motivations, and pain points of your target audience, you can tailor your products or services to resonate with their specific requirements. This involves understanding their demographics, psychographics, buying habits, and preferences.

Competitive analysis is another crucial aspect of market research. It involves studying your competitors’ strengths, weaknesses, strategies, and market share. By analyzing their offerings, pricing, marketing tactics, and customer satisfaction, you can gain valuable insights into the competitive landscape. This analysis helps you identify potential opportunities for differentiation and competitive advantage.

Furthermore, market research helps you uncover emerging trends and identify potential growth areas. By studying industry reports, consumer behavior patterns, and technological advancements, you can anticipate shifts in demand and identify opportunities for innovation. This proactive approach allows you to stay ahead of the curve and capitalize on emerging markets.

The benefits of conducting thorough market research are manifold. It enables businesses to:

- Reduce the risk of product or service failure.

- Develop effective marketing strategies.

- Optimize pricing and distribution channels.

- Identify new market segments and growth opportunities.

- Make data-driven decisions that enhance profitability.

Market research methods can be broadly categorized into two types: primary research and secondary research. Primary research involves collecting original data through surveys, interviews, focus groups, or experiments. Secondary research involves analyzing existing data from sources like industry reports, government databases, and competitor websites. The choice of research methods depends on the specific objectives of the research project and the available resources.

In conclusion, market research is an indispensable tool for businesses seeking to thrive in today’s competitive environment. By understanding your customers, analyzing your competitors, and identifying emerging trends, you can position yourself for success and achieve sustainable growth.

Building a Strong Team of Professionals

In the competitive business landscape, building a strong team of professionals is crucial for success. A well-rounded team can leverage diverse skills, perspectives, and experiences to achieve ambitious goals. This article will delve into key strategies for building a robust team of professionals.

1. Define Clear Roles and Responsibilities

The foundation of a cohesive team lies in clear role definition. Each member should understand their specific responsibilities and how their contributions align with the team’s overall objectives. Clear roles minimize confusion, eliminate overlapping efforts, and promote accountability.

2. Foster Open Communication

Effective communication is the lifeblood of a thriving team. Create an open and transparent environment where team members feel comfortable sharing ideas, concerns, and feedback. Regular team meetings, open-door policies, and active listening promote understanding and collaboration.

3. Encourage Collaboration and Teamwork

Break down silos and foster a culture of collaboration. Encourage team members to share knowledge, support each other, and work together towards common goals. Collaborative projects, team-building activities, and cross-functional interactions can strengthen bonds and promote teamwork.

4. Invest in Professional Development

Empower team members to grow by providing opportunities for professional development. Offer training programs, workshops, conferences, and mentoring initiatives to enhance their skills and knowledge. Investing in their development not only improves their individual capabilities but also strengthens the team as a whole.

5. Recognize and Reward Achievements

Recognize and celebrate individual and team successes. Positive reinforcement motivates team members and fosters a sense of accomplishment. Rewards can be tangible, such as bonuses or promotions, or intangible, such as public recognition or increased autonomy.

6. Promote Diversity and Inclusion

Building a diverse and inclusive team brings a wealth of perspectives, ideas, and experiences. Embrace diversity in all its forms, including gender, ethnicity, age, and cultural background. Create a welcoming and respectful environment where all voices are valued and heard.

7. Cultivate a Positive Team Culture

A positive team culture is characterized by mutual respect, trust, and support. Encourage team members to be supportive of each other, celebrate successes together, and create a work environment where they feel valued and appreciated.

8. Provide Feedback and Coaching

Regular feedback and coaching help team members improve their performance and achieve their full potential. Provide constructive feedback, both positive and negative, in a timely and constructive manner. Offer guidance, mentorship, and opportunities for growth.

9. Embrace Continuous Improvement

Continuously assess and improve team processes and performance. Regularly evaluate team dynamics, communication channels, and work methodologies to identify areas for improvement. Implement changes based on feedback and data to ensure ongoing effectiveness.

10. Lead by Example

Team leaders play a critical role in setting the tone for the team. Demonstrate the desired behaviors, values, and attitudes that you want to see in your team members. Be a role model for effective communication, collaboration, and professional conduct.

By implementing these strategies, organizations can build a strong team of professionals that is capable of driving innovation, achieving goals, and achieving sustainable success. A well-rounded team is an invaluable asset that can help organizations navigate challenges, adapt to change, and thrive in a dynamic and competitive environment.

Financing Your Real Estate Investments

Financing your real estate investments is crucial for maximizing your returns. Whether you’re buying a single-family home, a multi-family property, or a commercial building, securing the right financing can make or break your investment. Here’s a guide to understanding the different financing options available and how to choose the best one for your needs.

Types of Real Estate Loans

There are several types of loans specifically designed for real estate investments:

- Conventional Loans: These are the most common type of loan, offered by banks and credit unions. They typically require a down payment of 20% and have fixed or adjustable interest rates.

- FHA Loans: Backed by the Federal Housing Administration, these loans are designed for borrowers with lower credit scores and down payments as low as 3.5%. They often come with stricter eligibility requirements.

- VA Loans: Available to eligible veterans and active-duty military personnel, VA loans offer low interest rates and no down payment requirements.

- Hard Money Loans: These short-term loans are often used for fixer-uppers or properties that need renovation. They have higher interest rates and shorter repayment terms than traditional loans.

- Private Loans: Individuals or private lenders may offer financing for real estate investments. These loans can be tailored to the specific needs of the borrower and may have more flexible terms.

Factors to Consider When Choosing a Loan

Several factors should be considered when selecting a financing option:

- Credit Score: Your credit score will significantly impact your interest rate and loan approval. Improving your credit score can lead to lower interest rates and better loan terms.

- Down Payment: The amount of money you’re willing to put down will affect the loan amount and interest rate. A larger down payment usually translates to lower interest rates.

- Interest Rates: Interest rates can vary widely, so it’s essential to compare different lenders and loan types. Fixed interest rates provide stability, while adjustable rates can fluctuate.

- Loan Term: The length of the loan will impact your monthly payments. Longer terms generally mean lower monthly payments but higher overall interest costs.

- Loan Fees: Be aware of any origination fees, closing costs, or other fees associated with the loan.

- Property Type: Different loan types may be available for specific property types, such as residential, commercial, or industrial properties.

- Investment Strategy: The type of loan you choose should align with your overall investment strategy. For example, if you plan to renovate a property, a hard money loan might be suitable.

Tips for Securing Financing

Here are some tips to increase your chances of securing financing for your real estate investments:

- Build a Strong Credit Score: Pay your bills on time, keep credit utilization low, and avoid opening too many new credit accounts.

- Save for a Down Payment: Aim for at least 20% of the purchase price to qualify for the most favorable loan terms.

- Shop Around for Lenders: Compare interest rates, fees, and loan terms from different lenders to find the best deal.

- Get Pre-Approved: A pre-approval letter from a lender can show sellers that you’re a serious buyer and can make your offer more competitive.

- Have a Solid Investment Plan: Lenders want to see that you have a well-defined plan for the property, including how you plan to manage it and generate income.

Managing and Optimizing Your Portfolio for Maximum Returns

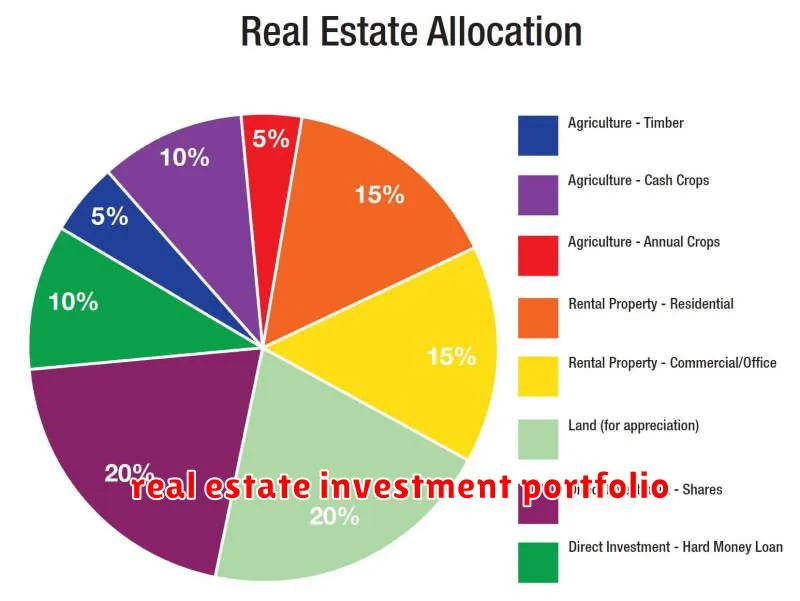

In the realm of finance, portfolio management stands as a cornerstone for achieving long-term financial goals. It involves the strategic allocation of assets across various investment vehicles, aiming to maximize returns while mitigating risk. A well-constructed and diligently managed portfolio is the foundation for a secure financial future. This article delves into the intricacies of portfolio management and optimization, providing insights into key strategies for maximizing returns.

Asset Allocation: The first step in portfolio management is determining the optimal asset allocation. This involves dividing your investment capital among different asset classes, such as stocks, bonds, real estate, and commodities. The specific allocation depends on factors such as your investment horizon, risk tolerance, and financial goals. A well-diversified portfolio typically includes a mix of assets with varying risk profiles, aiming to balance potential gains with potential losses.

Investment Selection: Once you have established your asset allocation, the next step is to select specific investments within each asset class. This involves researching and evaluating individual securities, such as stocks, bonds, and mutual funds. Consider factors like company performance, industry trends, and economic conditions when making investment choices.

Rebalancing: As markets fluctuate, your portfolio’s asset allocation can drift over time. Rebalancing involves periodically adjusting your portfolio to restore your original target allocations. This ensures that your investments remain aligned with your risk profile and financial goals. Rebalancing helps to prevent excessive exposure to certain assets and can improve long-term returns.

Risk Management: An integral part of portfolio optimization is managing risk. This involves identifying potential threats to your investments and implementing strategies to mitigate their impact. Risk management techniques include diversification, hedging, and stop-loss orders. By taking proactive steps to manage risk, you can protect your capital and enhance the overall resilience of your portfolio.

Monitoring and Evaluation: Regular monitoring and evaluation of your portfolio is crucial for making informed adjustments. This involves tracking performance, analyzing market trends, and reviewing your investment strategy periodically. By staying informed and making necessary adjustments, you can ensure that your portfolio remains aligned with your financial objectives.

Seeking Professional Advice: For complex portfolios or if you lack the expertise, seeking professional financial advice is highly recommended. A financial advisor can provide personalized guidance based on your specific circumstances, helping you develop a comprehensive investment plan and manage your portfolio effectively.

Legal and Tax Considerations for Real Estate Investors

Investing in real estate can be a lucrative endeavor, but it’s essential to understand the legal and tax implications before diving in. This article will explore key legal and tax considerations for real estate investors, helping you navigate the complexities and make informed decisions.

Legal Considerations:

Before purchasing any property, it’s crucial to understand the legal framework surrounding real estate transactions. This includes:

- Property Title: Ensuring a clear and marketable title is essential. A title search should be conducted to verify ownership and identify any liens or encumbrances.

- Zoning Laws: Understanding zoning regulations is crucial to determine the permitted use of the property and potential restrictions on renovations or additions.

- Building Codes: Complying with building codes is mandatory. Inspections and permits may be required for renovations or new construction.

- Environmental Regulations: Investors need to be aware of environmental laws, including those related to hazardous materials and waste disposal.

Tax Considerations:

Real estate investments can be subject to various taxes. Understanding these tax implications is crucial for maximizing returns and minimizing liabilities.

- Property Taxes: These are levied annually based on the assessed value of the property.

- Capital Gains Tax: When you sell a property for a profit, you may be subject to capital gains tax. The tax rate depends on factors like the holding period and your overall income.

- Depreciation: Depreciation allows you to deduct a portion of the cost of your property over time, reducing your taxable income. This can be beneficial for rental properties.

- Mortgage Interest Deduction: If you have a mortgage on your investment property, you may be able to deduct the interest paid on your mortgage, which can reduce your tax liability.

Legal Entities:

Choosing the right legal entity for your real estate investments can have significant tax and liability implications.

- Sole Proprietorship: This is the simplest structure, with the owner’s personal liability directly exposed.

- Partnership: Two or more individuals pool resources and share profits and losses. Liability can be joint and several.

- Limited Liability Company (LLC): Provides limited liability protection, separating the owner’s personal assets from business liabilities.

- S Corporation: Offers pass-through taxation while providing limited liability, but has strict operational requirements.

Tips for Managing Legal and Tax Risks:

To minimize legal and tax risks, consider these steps:

- Seek Professional Advice: Consult with a real estate attorney and a tax professional to ensure compliance with all applicable laws and regulations.

- Conduct Thorough Due Diligence: Before purchasing any property, conduct thorough research and due diligence to identify potential legal and environmental issues.

- Maintain Accurate Records: Keep meticulous records of all expenses, income, and transactions related to your real estate investments.

- Stay Informed: Stay updated on changes in tax laws and real estate regulations that may impact your investments.

Mitigating Risks in Real Estate Investment

Real estate investing can be a lucrative endeavor, but it’s also inherently risky. From market fluctuations to unforeseen property issues, there are a multitude of factors that can impact your investment. However, by taking proactive steps to mitigate these risks, you can increase your chances of success and protect your financial well-being.

One of the most important aspects of mitigating risk is conducting thorough due diligence. Before making any investment, it’s crucial to carefully examine the property itself, its location, and the surrounding market conditions. This includes obtaining a professional inspection to identify any potential issues, researching the property’s history and previous ownership, and analyzing market trends to assess the potential for future appreciation or depreciation.

Another key factor is diversification. By spreading your investments across multiple properties or asset classes, you can reduce the impact of any single investment going sour. This could involve purchasing properties in different geographical locations, investing in rental properties alongside commercial real estate, or even incorporating alternative investments like REITs (Real Estate Investment Trusts) into your portfolio.

It’s also essential to have a solid financial plan in place. This includes carefully budgeting for your investment, securing adequate financing, and understanding your cash flow needs. By having a clear financial strategy, you can ensure you have the resources to handle unexpected expenses or market downturns.

In addition to these proactive steps, it’s also important to be aware of potential legal and regulatory risks. Familiarize yourself with zoning laws, building codes, and any other applicable regulations that could impact your investment. Engaging with experienced professionals like attorneys and real estate agents can provide valuable guidance and help you navigate these complexities.

Ultimately, mitigating risk in real estate investing requires a combination of thorough research, careful planning, and a proactive approach. By taking the necessary steps to minimize potential downsides, you can enhance your chances of achieving long-term success in this rewarding and potentially profitable field.