The world of cryptocurrency is a captivating one, promising incredible returns and financial freedom. Yet, beneath the surface of its glittering potential lies a complex and often unpredictable landscape. Navigating the crypto maze can be both thrilling and daunting, with opportunities for significant gains intertwined with the risk of substantial losses. Understanding the inherent dangers of crypto investment is crucial for any individual hoping to successfully navigate this volatile market.

While the potential for wealth creation is alluring, it’s essential to remember that cryptocurrency investment is inherently risky. From the volatility of prices to the potential for scams and hacks, a multitude of factors can threaten your investment. This article will equip you with the knowledge to avoid common pitfalls and navigate the crypto market with greater confidence, focusing on crucial risks to consider and strategies for mitigating them.

Understanding Cryptocurrency Volatility

Cryptocurrency markets are known for their volatility, which can be both exciting and daunting for investors. Understanding the factors that contribute to this volatility is crucial for navigating the cryptocurrency landscape effectively.

One of the primary drivers of volatility is the decentralized nature of cryptocurrencies. Unlike traditional financial markets, which are heavily regulated and influenced by central banks, cryptocurrencies operate on peer-to-peer networks. This decentralized structure can lead to rapid price fluctuations as market sentiment and trading activity can shift quickly.

Another significant factor is the limited supply of most cryptocurrencies. Unlike fiat currencies, which can be printed by central banks, the supply of many cryptocurrencies is fixed or limited. This scarcity can drive up prices when demand increases, contributing to volatility.

News and events also play a major role in cryptocurrency volatility. Positive news, such as regulatory approvals or major partnerships, can boost prices. Conversely, negative news, such as hacks or regulatory crackdowns, can lead to significant drops in value.

Market speculation is another driver of volatility. The cryptocurrency market is known for attracting both retail and institutional investors, some of whom engage in speculative trading. This can lead to rapid price swings as investors buy and sell based on short-term market trends rather than long-term fundamentals.

While volatility can be a source of risk, it also presents opportunities for investors who understand how to manage it. By staying informed about market trends, analyzing fundamentals, and using risk management strategies, investors can navigate the cryptocurrency market and potentially reap significant rewards.

The Danger of FOMO Investing

FOMO, or the fear of missing out, is a powerful emotion that can drive people to make irrational decisions, especially when it comes to investing. While it’s natural to want to be part of the action and potentially profit from a rising market, it’s important to remember that investing should be a long-term strategy, not a short-term gamble.

When you invest based on FOMO, you’re likely to buy assets at inflated prices, without fully understanding the underlying fundamentals. This can lead to significant losses when the market corrects, as you’re likely to be holding assets that are overvalued and susceptible to a price drop.

The Psychology of FOMO Investing

FOMO investing is fueled by a combination of factors:

- Social Pressure: Seeing friends or colleagues making money in the market can create a sense of urgency to join in.

- Confirmation Bias: We tend to seek out information that confirms our existing beliefs, which can lead to an overestimation of the potential gains from investing.

- Herding Behavior: When everyone seems to be buying a particular asset, it can create a sense of safety in numbers, even if the underlying fundamentals don’t support the hype.

How to Avoid FOMO Investing

Here are some tips to avoid making investment decisions based on FOMO:

- Stick to your investment plan: Having a well-defined investment plan based on your financial goals and risk tolerance will help you stay disciplined and avoid chasing short-term gains.

- Do your own research: Before investing in any asset, take the time to understand the fundamentals, such as the company’s financials, industry trends, and competitive landscape.

- Don’t be afraid to miss out: It’s okay to let some opportunities pass you by. Remember that there will always be other investment opportunities in the market.

- Seek professional advice: If you’re not comfortable making investment decisions on your own, consult a financial advisor who can provide unbiased guidance.

FOMO investing is a dangerous habit that can lead to significant financial losses. By understanding the psychology behind it and taking steps to avoid it, you can make more informed investment decisions that align with your long-term financial goals.

Scams and Fraudulent Schemes

Scams and fraudulent schemes are pervasive in today’s digital world, targeting individuals and businesses alike. These schemes can take many forms, from online phishing attacks to elaborate Ponzi schemes. Understanding the common tactics employed by scammers is crucial to protecting yourself and your finances.

One common tactic is phishing, where scammers send emails or text messages that appear to be from legitimate sources, such as banks or government agencies. These messages often contain links that, when clicked, take victims to fake websites designed to steal personal information, such as login credentials, credit card details, or Social Security numbers.

Another prevalent scam is the advance-fee scam, where victims are promised a large sum of money in exchange for a small upfront payment. However, the promised money never materializes, and the victims lose their initial investment.

Pyramid schemes and Ponzi schemes are similar fraudulent schemes that rely on recruiting new members to pay off earlier investors. These schemes are unsustainable and eventually collapse, leaving many participants with significant financial losses.

Romance scams are particularly insidious, targeting vulnerable individuals seeking companionship or love. Scammers often create fake online profiles to build relationships with victims, then use emotional manipulation to extract money or personal information.

Protecting yourself from scams requires a combination of vigilance and awareness. Be skeptical of unsolicited offers that seem too good to be true, and never provide personal information to unknown sources. Verify the authenticity of any communication that requests sensitive data. It is also essential to stay informed about emerging scam trends and learn how to identify and avoid them.

Lack of Regulation and Security Risks

The rapid growth of the cryptocurrency industry has brought about a new wave of financial innovation and opportunity. However, the lack of comprehensive regulation and oversight has created significant security risks for investors and the broader financial system. This article delves into the key concerns surrounding lack of regulation and security risks in the cryptocurrency space.

Absence of Regulatory Frameworks

One of the primary challenges facing the cryptocurrency industry is the absence of clear and consistent regulatory frameworks. Unlike traditional financial markets, which are subject to stringent regulations, the cryptocurrency space operates largely in a self-regulated environment. This lack of oversight creates opportunities for fraud, market manipulation, and money laundering.

Vulnerability to Hacking and Theft

Cryptocurrency exchanges and wallets are highly vulnerable to hacking and theft due to the decentralized nature of blockchain technology. Hackers can exploit security flaws in platforms to gain unauthorized access to user accounts and steal crypto assets. Notable incidents, such as the 2017 theft from the Coincheck exchange, highlight the significant risks associated with storing cryptocurrency.

Lack of Investor Protection

The absence of regulatory protections leaves investors vulnerable to scams and losses. Without proper disclosure requirements, investors may be unaware of the true risks involved in cryptocurrency investments. In the absence of a regulatory framework, it is difficult to hold platforms accountable for losses incurred by investors.

Risk of Market Manipulation

The decentralized nature of cryptocurrencies can make them susceptible to market manipulation. Without a central authority to monitor and regulate trading activity, it is easier for individuals or groups to manipulate prices and create artificial volatility. This can harm investors who are unaware of such practices.

Legal Uncertainties

The lack of clear legal definitions for cryptocurrencies and their associated activities creates uncertainties for businesses, investors, and regulators alike. This legal ambiguity can hinder the development of a robust and sustainable cryptocurrency ecosystem.

Need for Regulatory Collaboration

To mitigate the risks and foster a safe and responsible cryptocurrency industry, regulatory collaboration is crucial. Governments and regulatory bodies must work together to develop comprehensive frameworks that balance innovation with investor protection. Such frameworks should address issues such as anti-money laundering, know your customer (KYC), and cybersecurity.

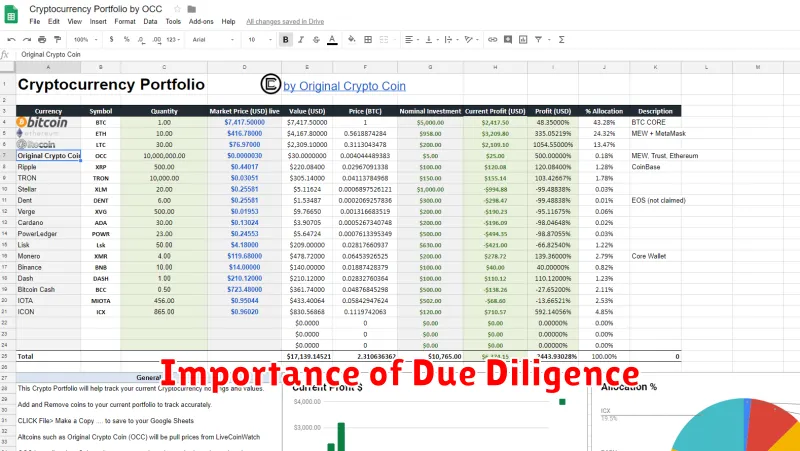

Importance of Due Diligence

Due diligence is a crucial process in any business transaction, especially when it comes to mergers and acquisitions (M&A). It is a comprehensive investigation that aims to uncover all relevant information about a target company before making a decision. The goal is to mitigate risk and ensure that the investment is sound.

The importance of due diligence cannot be overstated. It helps to identify any potential red flags that could affect the value of the target company or even lead to future legal issues. By conducting a thorough investigation, buyers can gain valuable insights into the target company’s:

- Financial health: Assessing the company’s financial statements, cash flow, and debt levels can reveal its overall financial strength and stability.

- Legal and regulatory compliance: Evaluating the company’s compliance with applicable laws and regulations can help identify any potential liabilities or legal risks.

- Management team and key personnel: Assessing the experience, skills, and track record of the company’s management team is crucial to understanding its ability to execute strategies and drive growth.

- Operations and technology: Examining the company’s operational efficiency, technology infrastructure, and intellectual property can provide insights into its competitive advantages and future potential.

- Market position and competitive landscape: Understanding the company’s market share, customer base, and competitive environment is essential to evaluating its long-term prospects.

By conducting due diligence, buyers can gain a comprehensive understanding of the target company’s strengths, weaknesses, opportunities, and threats. This information can then be used to make informed decisions about the investment, negotiate favorable terms, and mitigate potential risks.

Failure to conduct due diligence can have serious consequences, including:

- Overpaying for the target company: A lack of information can lead to inflated valuations and ultimately result in a loss for the buyer.

- Unforeseen liabilities: Hidden liabilities, such as pending lawsuits or environmental issues, can emerge after the acquisition, leading to financial losses and legal battles.

- Integration challenges: Without a clear understanding of the target company’s operations and culture, integration can be difficult and costly, impacting the overall success of the acquisition.

In conclusion, due diligence is an essential step in any business transaction, particularly in M&A. It provides buyers with valuable insights, mitigates risks, and helps to ensure a successful outcome. By conducting a thorough and comprehensive investigation, buyers can make informed decisions, negotiate favorable terms, and ultimately protect their investments.

Choosing the Right Exchange Platform

The world of cryptocurrency is constantly evolving, with new platforms and coins emerging every day. This makes choosing the right exchange platform a daunting task, as you need to consider various factors to find one that suits your needs and preferences.

Here are some key factors to consider when choosing a cryptocurrency exchange platform:

Security

Security is paramount when dealing with cryptocurrencies. Look for platforms that have robust security measures in place, such as:

- Two-factor authentication (2FA)

- Cold storage for a majority of their funds

- Regular security audits

- Insurance coverage against hacks

Fees

Trading fees can vary significantly between platforms. Consider the following:

- Trading fees: Fees charged on buy and sell orders.

- Withdrawal fees: Fees charged when withdrawing cryptocurrencies from the platform.

- Deposit fees: Fees charged when depositing cryptocurrencies into the platform.

Compare fees across different platforms and choose one with a fee structure that is transparent and reasonable.

Available Cryptocurrencies

Different platforms offer different cryptocurrencies. Ensure the platform you choose supports the coins you are interested in trading. The number of coins offered is an important factor, especially if you plan to diversify your portfolio.

User Interface and Experience

A user-friendly interface is essential for a smooth trading experience. Choose a platform with a clear and intuitive interface, making it easy to navigate and place orders.

Customer Support

Reliable customer support is crucial, especially if you encounter any issues or have questions. Look for platforms with responsive customer support channels, such as live chat, email, and phone support.

Regulations and Compliance

Ensure the platform you choose is regulated and compliant with relevant financial laws and regulations. This provides an extra layer of security and ensures the platform operates legally and ethically.

Other Features

Some additional features to consider include:

- Margin trading: Allows you to borrow funds to increase your trading power.

- Staking: Allows you to earn rewards by holding certain cryptocurrencies.

- Educational resources: Provides information and tutorials to help you learn more about cryptocurrencies.

Choosing the right cryptocurrency exchange platform is essential for a safe and successful trading experience. By considering the above factors, you can find a platform that meets your needs and helps you navigate the exciting world of cryptocurrencies.

Safeguarding Your Digital Assets

In the digital age, our lives are increasingly intertwined with our online presence. From banking to shopping, communication to entertainment, our digital assets are essential to our everyday lives. However, these assets are vulnerable to various threats, ranging from data breaches to malware attacks. Therefore, safeguarding your digital assets is crucial to protecting your privacy, security, and financial well-being.

One of the most important steps in safeguarding your digital assets is choosing strong passwords and using different ones for different accounts. Avoid using easily guessable passwords like your name or birthdate. Instead, opt for complex combinations of uppercase and lowercase letters, numbers, and symbols. Consider using a password manager to generate and store your passwords securely.

Another essential step is to be cautious about phishing scams. Phishing attempts to trick you into revealing sensitive information like your passwords or credit card details. Be wary of suspicious emails, links, or phone calls, and never click on unfamiliar links or open attachments from unknown senders.

Regularly update your software, including your operating system, antivirus, and web browser. Software updates often include security patches that can protect against known vulnerabilities. Additionally, be mindful of the websites and apps you visit and download. Stick to reputable sources and avoid downloading software from unknown or untrusted websites.

Enable two-factor authentication (2FA) for your online accounts whenever possible. 2FA adds an extra layer of security by requiring you to enter a code sent to your phone or email in addition to your password. This makes it significantly harder for unauthorized individuals to access your accounts.

Back up your data regularly to prevent data loss due to hardware failure, malware attacks, or accidental deletion. Consider using cloud storage services or external hard drives to create backups of your important files and documents.

In addition to these individual measures, you can further enhance your digital security by staying informed about emerging threats and best practices. Stay updated on cybersecurity news and read articles from reputable sources.

Diversification: Not Putting All Eggs in One Basket

The saying “Don’t put all your eggs in one basket” perfectly encapsulates the concept of diversification, especially when it comes to investing. Diversification is a strategy that aims to reduce risk by spreading investments across different asset classes, industries, and geographical locations.

Imagine you have a basket full of eggs. If you drop the basket, all the eggs break. This is similar to investing in just one stock or asset. If that investment performs poorly, you could lose all your money. However, if you have a basket of different eggs, even if some break, you’ll still have some left. This is the idea behind diversification. It helps protect your portfolio from significant losses in case one investment fails.

Why Diversify?

Here are some key benefits of diversification:

- Reduced Risk: By spreading investments across different assets, you lessen the impact of any single investment’s poor performance.

- Increased Returns: A diversified portfolio can potentially generate higher returns over the long term. Different investments have varying risk and return profiles, and by combining them, you can achieve a balanced portfolio.

- Peace of Mind: Knowing your portfolio is diversified can give you peace of mind, especially during volatile market conditions.

Types of Diversification

Diversification can be achieved in several ways:

- Asset Class Diversification: Investing in different asset classes, such as stocks, bonds, real estate, and commodities, helps to mitigate risk. Each asset class reacts differently to economic events, so a diversified portfolio can provide stability.

- Industry Diversification: Investing in companies from different industries reduces exposure to specific industry risks. For example, investing in technology and healthcare can help mitigate losses if one industry experiences a downturn.

- Geographic Diversification: Investing in companies from different countries or regions can help to reduce the impact of economic or political events in one particular area.

How to Diversify

There are many ways to diversify your portfolio, depending on your investment goals, risk tolerance, and time horizon. You can:

- Invest in mutual funds or exchange-traded funds (ETFs): These funds pool money from multiple investors to buy a diversified basket of securities, making it easier to gain exposure to various asset classes and industries.

- Create a portfolio of individual stocks and bonds: This allows you to select specific investments based on your research and preferences. However, it requires more time and effort.

- Consider alternative investments: These include real estate, precious metals, and collectibles, which can offer different risk and return characteristics compared to traditional investments.

Remember, diversification is not a guarantee against losses, but it’s a crucial strategy to manage risk and potentially enhance returns over the long term. Consult a financial advisor to create a diversification strategy that aligns with your individual needs and goals.

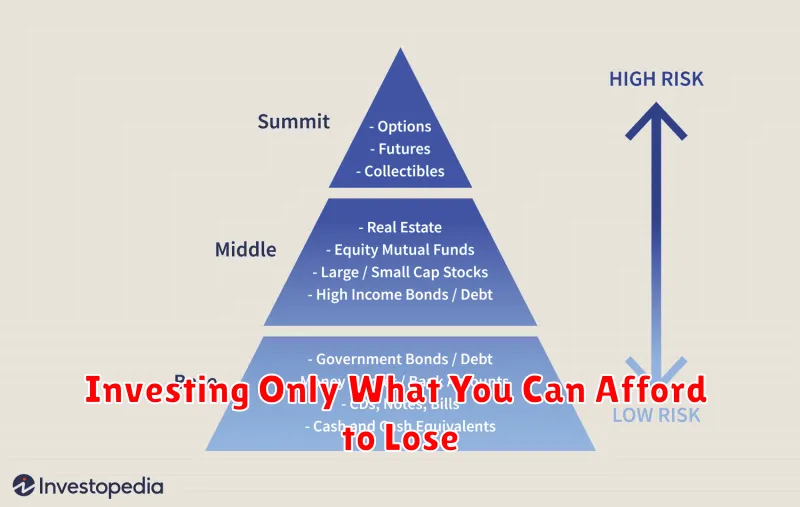

Investing Only What You Can Afford to Lose

Investing can be a great way to grow your wealth over time. However, it is important to remember that investing always carries some risk. You could lose some or all of your investment. That’s why it’s essential to only invest what you can afford to lose. This means that you should never invest money that you need for essential expenses, such as your rent, mortgage, food, or medical bills.

If you are considering investing, there are a few things you should do first:

- Determine your investment goals. What are you hoping to achieve with your investments? Are you saving for retirement, a down payment on a house, or your child’s education?

- Assess your risk tolerance. How comfortable are you with the possibility of losing money? The higher your risk tolerance, the more likely you are to invest in riskier assets, such as stocks. If you have a low risk tolerance, you may want to stick to safer investments, such as bonds or cash.

- Do your research. Before investing in anything, it is important to do your research and understand the risks involved.

Once you have a good understanding of your goals, risk tolerance, and the investments you are considering, you can start to build a portfolio. A diversified portfolio, which includes a variety of assets, is a good way to reduce risk. It is important to review your portfolio regularly and make adjustments as needed.

Investing can be a rewarding experience, but it’s important to remember that it’s also a risk. By following these tips, you can help ensure that you’re only investing what you can afford to lose and that you’re on the right track to achieving your financial goals.