Taking control of your finances is a crucial step toward achieving financial freedom and a secure future. Whether you’re just starting out or looking to improve your current financial habits, understanding the essential basics of personal finance is paramount. This comprehensive guide, “Personal Finance 101: Essential Basics Everyone Should Know“, aims to provide you with a solid foundation to manage your money effectively.

From budgeting and saving to investing and debt management, we’ll cover the key concepts and strategies that can empower you to make informed financial decisions. By grasping these fundamental principles, you can navigate the complexities of personal finance with confidence, optimize your financial well-being, and work towards achieving your financial goals.

Understanding Your Financial Situation

It’s important to understand your financial situation, but it can be a daunting task. You may not know where to start, and the process can feel overwhelming. However, understanding your finances can help you make better decisions about your money, achieve your financial goals, and live a more fulfilling life.

The first step to understanding your finances is to gather all of your financial information. This includes your income, expenses, assets, and debts. You can use a spreadsheet, personal finance software, or a budgeting app to organize this information.

Once you have gathered your financial information, you can start to analyze it. Here are some key things to look for:

- Income: This is the money you earn from your job, investments, or other sources.

- Expenses: This is the money you spend on things like housing, food, transportation, and entertainment.

- Assets: These are things you own that have value, such as your home, car, and investments.

- Debts: This is the money you owe to others, such as credit card debt, student loans, and mortgages.

After you have analyzed your financial information, you can start to make a plan. This plan should include your short-term and long-term financial goals. It should also outline how you will achieve those goals.

Here are some common financial goals:

- Pay off debt: This could include credit card debt, student loans, or other types of debt.

- Save for retirement: This is important for ensuring that you have enough money to live on when you stop working.

- Save for a down payment on a home: This can help you achieve the dream of homeownership.

- Save for your children’s education: This will help you provide your children with the opportunity to attend college or trade school.

- Start a business: This can be a great way to achieve financial independence and pursue your passions.

Once you have set your financial goals, you can start to create a budget. A budget is a plan for how you will spend your money each month. It should include all of your income and expenses.

Here are some tips for creating a budget:

- Track your spending for a month or two to see where your money is going.

- Create a list of your essential expenses, such as rent, utilities, and groceries.

- Allocate money to your financial goals, such as retirement savings or paying down debt.

- Review your budget regularly and make adjustments as needed.

By understanding your financial situation, creating a budget, and setting financial goals, you can take control of your finances and build a brighter financial future.

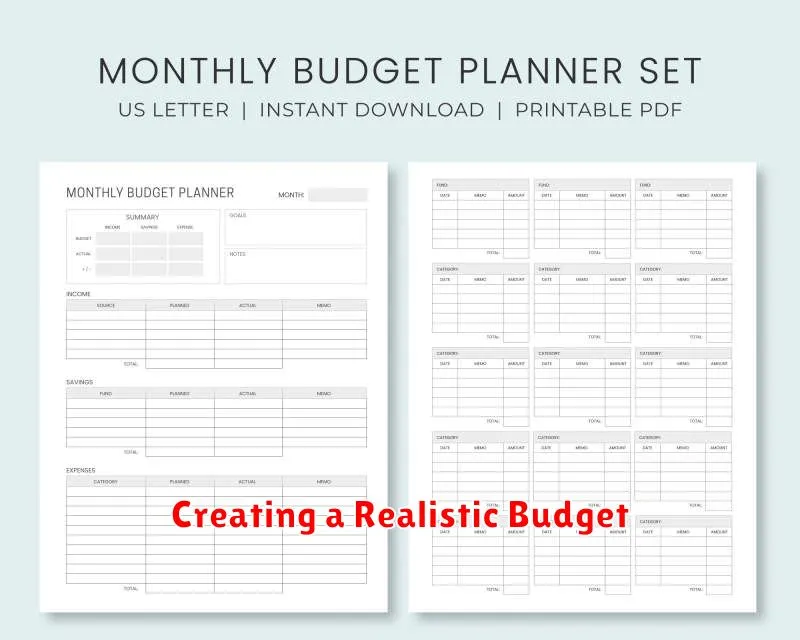

Creating a Realistic Budget

Creating a budget can seem like a daunting task, but it’s essential for managing your finances effectively. A well-crafted budget helps you track your income and expenses, identify areas where you can save money, and achieve your financial goals. Here’s a comprehensive guide to creating a realistic budget that works for you.

1. Track Your Expenses

Before you can create a budget, you need to understand where your money is going. For a month or two, keep a detailed record of all your expenses. This includes everything from groceries and rent to entertainment and subscriptions. There are numerous budgeting apps available that can make this process easier.

2. Determine Your Income

Once you have a clear picture of your expenses, you need to know how much money you bring in. This includes your regular salary, any part-time income, and any other sources of income like investments or side hustles.

3. Create a Budget Template

Now that you have your income and expenses documented, it’s time to create your budget. There are many free budget templates available online, or you can create your own using a spreadsheet program like Excel. Your budget should include:

- Income: List all your income sources and their amounts.

- Fixed Expenses: These are expenses that stay relatively the same each month, like rent, mortgage payments, car payments, and insurance.

- Variable Expenses: These are expenses that fluctuate from month to month, like groceries, dining out, entertainment, and gas.

- Savings Goals: Set specific savings goals, such as an emergency fund, retirement savings, or a down payment on a house.

4. Allocate Your Money

After you have a template, allocate your income to different categories. Start with your fixed expenses. Then, allocate funds for your variable expenses, taking into account your average spending from the previous months. Finally, allocate a portion of your income towards savings goals.

5. Review and Adjust

Your budget is not set in stone. It’s important to review your budget regularly, at least once a month, to see how you’re doing. If you’re overspending in certain areas, adjust your budget accordingly. If you’re consistently under budget in other areas, consider increasing your savings goals or allocating funds to other priorities.

6. Be Realistic and Flexible

Creating a realistic budget requires honesty about your spending habits. Don’t set unrealistic goals that are difficult to maintain. It’s also important to be flexible. Life is full of unexpected expenses. Build a buffer into your budget to account for emergencies.

Building an Emergency Fund

An emergency fund is a crucial part of personal finance. It’s a safety net that provides financial stability during unexpected events, such as job loss, medical emergencies, or car repairs. Without an emergency fund, you might find yourself resorting to high-interest loans or selling assets to cover unexpected expenses. This can lead to a cycle of debt and financial stress.

Why is an Emergency Fund Important?

Having an emergency fund provides several benefits:

- Peace of Mind: Knowing you have a financial cushion can reduce stress and anxiety during challenging times.

- Financial Stability: An emergency fund prevents you from taking on unnecessary debt or liquidating investments during an emergency.

- Time to Plan: It gives you time to find a new job, explore alternative solutions, or plan your recovery.

How Much Should You Save?

A common recommendation is to have 3-6 months’ worth of essential expenses saved in an emergency fund. This amount can vary based on your individual circumstances, such as your financial stability, job security, and dependents.

Tips for Building Your Emergency Fund

Here are some tips to help you build your emergency fund:

- Set a Goal: Determine how much you need to save and set a specific target amount.

- Automate Savings: Set up automatic transfers from your checking account to your savings account on a regular basis.

- Reduce Expenses: Identify areas where you can cut back on spending and redirect those funds to your emergency fund.

- Increase Income: Explore opportunities to increase your income through a side hustle, freelance work, or asking for a raise.

- Be Patient: Building an emergency fund takes time, so be patient and consistent with your savings efforts.

Managing Debt Effectively

Debt can be a significant burden, impacting your financial well-being and overall peace of mind. However, with effective strategies, you can manage your debt responsibly and work towards a debt-free future. Here are some key tips to help you navigate the path to financial freedom:

1. Understand Your Debt

The first step to managing debt is to fully understand what you owe. Create a list of all your debts, including the principal amount, interest rate, minimum payment, and due date. This will give you a clear picture of your overall financial situation.

2. Prioritize Your Debt

Once you have a comprehensive debt list, prioritize your debts based on their interest rates. Focus on paying down debts with the highest interest rates first, as these will cost you the most in the long run. This strategy, known as the avalanche method, can save you significant amounts in interest charges.

3. Create a Budget

Developing a realistic budget is essential for managing debt effectively. Track your income and expenses to identify areas where you can cut back. Allocate a portion of your income towards debt repayment and stick to your budget as much as possible.

4. Negotiate with Creditors

If you are struggling to make your payments, don’t hesitate to contact your creditors. They may be willing to work with you to modify your payment plan or lower your interest rate. This can help you stay current on your payments and avoid further financial stress.

5. Consider Debt Consolidation

Debt consolidation involves combining multiple debts into a single loan with potentially lower interest rates. This can simplify your repayments and potentially save you money on interest charges. However, it’s important to carefully research different consolidation options and ensure you choose a loan with favorable terms.

6. Avoid New Debt

Once you are working towards reducing your debt, it’s crucial to avoid accumulating new debt. Resist the temptation to make impulse purchases or use credit cards for non-essential items. This will allow you to focus your efforts on paying down existing debt faster.

7. Seek Professional Help

If your debt seems overwhelming, consider seeking professional advice from a credit counselor or financial advisor. They can provide personalized guidance, negotiate with creditors on your behalf, and develop a customized debt management plan.

Managing debt effectively requires discipline, planning, and commitment. By following these tips and taking action, you can gradually reduce your debt burden and pave the way for a more secure financial future.

Saving for Retirement: Start Early

Retirement may seem far off, but it’s never too early to start planning. The sooner you begin saving, the more time your money has to grow. The magic of compound interest works in your favor, allowing your investments to generate earnings that then earn more earnings, leading to significant wealth accumulation over time.

One of the most effective ways to save for retirement is through a 401(k) or IRA. These retirement accounts offer tax advantages, such as tax-deferred growth or tax-free withdrawals in retirement. Many employers also offer matching contributions to 401(k) plans, which means they will contribute a certain amount for every dollar you contribute. This is essentially free money, so take advantage of it whenever possible.

Here are some tips for maximizing your retirement savings:

- Start early: The earlier you start saving, the more time your money has to grow. Even small contributions can make a big difference over the long term.

- Save consistently: Aim to save a percentage of your income each month. Even if you can only afford a small amount, consistency is key.

- Consider automatic contributions: Set up automatic contributions to your retirement accounts so you don’t have to think about it. This helps you stay on track and avoids missing contributions.

- Invest wisely: Choose investments that align with your risk tolerance and time horizon. Diversify your portfolio across different asset classes to reduce risk.

- Don’t touch your retirement savings early: Unless absolutely necessary, avoid withdrawing from your retirement accounts before retirement. Early withdrawals often come with penalties and taxes.

Saving for retirement is a journey, not a sprint. Don’t be discouraged if you haven’t started yet or if you’re behind on your savings goals. The important thing is to take action and make saving a priority. The sooner you begin, the better your financial future will be.

The Power of Investing

Investing is the process of allocating money to assets with the expectation of generating income or appreciation in value over time. It’s a fundamental pillar of financial planning, enabling individuals to build wealth, achieve financial goals, and secure their future.

The power of investing lies in its ability to compound returns. Compounding refers to the process of earning interest on both the principal amount and accumulated interest. Over time, this exponential growth can create significant wealth. For example, even a small investment made early in life can grow into a substantial sum over decades, thanks to the magic of compounding.

Investing also helps you beat inflation. Inflation erodes the purchasing power of money over time. By investing, you can potentially outpace inflation and preserve the real value of your savings. When your investments grow at a rate higher than the inflation rate, you are essentially increasing your purchasing power.

There are various investment options available, each with its own risk and return profile. Some popular investment choices include:

- Stocks: Shares of ownership in publicly traded companies.

- Bonds: Loans made to governments or corporations.

- Mutual funds: Pooled investments that allow investors to diversify their portfolio.

- Real estate: Ownership of properties such as homes or commercial buildings.

- Commodities: Raw materials such as gold, oil, and agricultural products.

Choosing the right investments for you depends on your financial goals, risk tolerance, and time horizon. It’s essential to conduct thorough research and consider seeking advice from a qualified financial advisor.

Investing is not without risks, but the potential rewards can be substantial. By understanding the fundamentals of investing and making informed decisions, you can harness the power of compounding to build a solid financial foundation for your future.

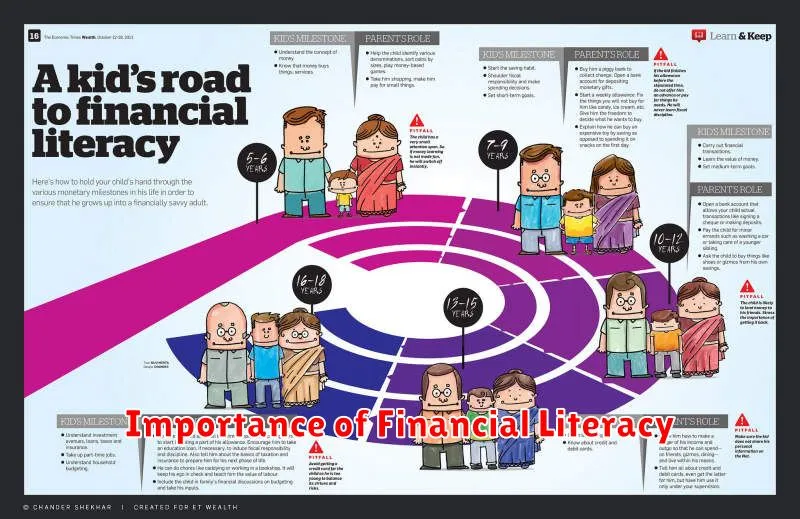

Importance of Financial Literacy

In today’s complex and ever-changing economic landscape, financial literacy has become a critical skill for individuals of all ages. Financial literacy refers to the ability to understand and manage one’s financial affairs effectively. It encompasses a wide range of concepts, including budgeting, saving, investing, debt management, and financial planning. Possessing strong financial literacy empowers individuals to make informed decisions about their money, secure their financial future, and achieve their financial goals.

Making Informed Financial Decisions

Financial literacy is fundamental for making informed financial decisions. Individuals with a strong understanding of financial concepts are better equipped to evaluate different financial products and services, such as loans, credit cards, investments, and insurance policies. They can compare interest rates, fees, and terms to choose the most suitable options for their specific needs. By understanding the risks and rewards associated with different financial choices, individuals can make decisions that align with their financial goals and avoid costly mistakes.

Managing Debt and Avoiding Financial Stress

Debt management is another crucial aspect of financial literacy. Individuals with financial literacy skills are aware of the dangers of excessive debt and can develop strategies to manage it effectively. They can create budgets that prioritize debt repayment, explore options for debt consolidation or refinancing, and avoid accumulating unnecessary debt in the future. By managing debt responsibly, individuals can reduce financial stress, improve their credit scores, and enhance their overall financial well-being.

Saving and Investing for the Future

Saving and investing are essential for building a secure financial future. Financial literacy provides individuals with the knowledge and tools to develop effective saving and investment strategies. They can learn about different investment options, such as stocks, bonds, and mutual funds, and determine the appropriate asset allocation for their risk tolerance and financial goals. By investing wisely, individuals can grow their wealth over time and achieve financial independence.

Achieving Financial Goals

Financial goals can range from purchasing a home or starting a business to planning for retirement or funding a child’s education. Financial literacy enables individuals to set realistic financial goals, develop strategies to achieve them, and track their progress over time. By understanding the relationship between income, expenses, and savings, individuals can create a roadmap to achieve their financial aspirations.

Empowering Individuals and Families

Financial literacy empowers individuals and families to take control of their finances and make informed decisions about their financial well-being. It promotes financial independence, reduces financial vulnerability, and enables individuals to make sound choices that benefit their present and future. By investing in financial education, individuals can gain the knowledge and skills necessary to navigate the complexities of the financial world and build a secure and prosperous future.

Protecting Your Assets: Insurance Basics

Insurance is a fundamental aspect of financial planning, offering a safety net against unforeseen events that could potentially devastate your finances. It acts as a shield, protecting your assets and providing financial stability in times of need. This article delves into the basics of insurance, explaining its importance, different types, and essential considerations for choosing the right coverage.

Understanding Insurance

Insurance is a contract between an individual (policyholder) and an insurance company (insurer). The policyholder pays premiums to the insurer in exchange for financial protection against specific risks. When an insured event occurs, the insurer agrees to compensate the policyholder for the financial loss, subject to the terms and conditions of the policy.

Types of Insurance

The world of insurance encompasses a wide range of policies designed to cater to different needs. Here are some of the most common types:

- Health Insurance: Covers medical expenses, including hospitalization, surgery, and medication.

- Life Insurance: Provides financial protection to beneficiaries upon the policyholder’s death.

- Property Insurance: Protects against damage or loss to your home, belongings, or other property due to events like fire, theft, or natural disasters.

- Auto Insurance: Covers damages and liabilities resulting from accidents involving your vehicle.

- Liability Insurance: Protects you from financial losses arising from legal claims made against you due to injuries or damages caused by you or your property.

- Disability Insurance: Provides income replacement if you become unable to work due to illness or injury.

Choosing the Right Insurance

Selecting the right insurance policy is crucial for maximizing your financial protection. Here are some factors to consider:

- Your individual needs and circumstances: Assess your assets, liabilities, and potential risks.

- Coverage options and limits: Compare different policies and choose the one that offers the most appropriate coverage for your needs.

- Premiums and deductibles: Balance affordability with the level of coverage.

- Reputation and financial stability of the insurer: Research the insurer’s track record and financial strength.

Benefits of Insurance

Insurance offers numerous advantages, including:

- Financial protection: Protects your assets from financial losses caused by unforeseen events.

- Peace of mind: Knowing you have insurance provides peace of mind and reduces anxiety about potential risks.

- Legal protection: Provides legal defense and financial coverage in case of lawsuits.

- Access to healthcare: Health insurance allows access to essential medical services and treatments.

- Financial stability for loved ones: Life insurance ensures financial security for your family in your absence.

Estate Planning: Securing Your Legacy

Estate planning is a crucial aspect of financial planning that ensures your assets are distributed according to your wishes after your passing. It’s a comprehensive process that involves creating legal documents like wills, trusts, and powers of attorney, outlining your desires for your property, finances, and even your healthcare decisions. By taking the time to craft an effective estate plan, you can provide peace of mind knowing your loved ones will be taken care of and your legacy will be protected.

The benefits of estate planning extend beyond just financial security. It offers a comprehensive strategy for managing your affairs and ensuring your wishes are respected, even when you are unable to express them personally. Estate planning empowers you to:

- Minimize Taxes: Proper estate planning can help you minimize estate taxes and ensure your heirs inherit the maximum amount of your assets.

- Avoid Probate: Probate is a court process that can be time-consuming and expensive. By establishing trusts or other strategies, you can potentially avoid probate altogether.

- Protect Your Loved Ones: Estate planning allows you to designate guardians for your minor children and ensure their well-being in case of your passing.

- Control Your Medical Decisions: You can create advance directives, such as a living will or a durable power of attorney for healthcare, outlining your wishes for medical treatment in the event of incapacitation.

- Preserve Family Harmony: A well-structured estate plan can prevent potential disputes among family members regarding your assets.

Creating an estate plan involves several key components, each with its own specific purpose. Here are some essential elements to consider:

- Will: A will is a legal document that specifies how your assets should be distributed upon your death. It designates beneficiaries, executors, and guardians for minor children. While not mandatory in all jurisdictions, it’s crucial for ensuring your wishes are carried out.

- Trust: A trust is a legal arrangement where assets are held by a trustee for the benefit of beneficiaries. Trusts can help you manage assets, minimize taxes, and protect assets from creditors.

- Power of Attorney: A power of attorney grants someone else the authority to make financial and legal decisions on your behalf if you become incapacitated.

- Advance Directives: Advance directives, such as a living will or durable power of attorney for healthcare, provide instructions regarding your medical care in the event of your incapacitation.

The process of estate planning involves consulting with professionals like attorneys, financial advisors, and tax experts. It’s crucial to choose qualified professionals who understand your specific needs and goals. They can guide you through the complexities of estate planning and create a customized plan tailored to your unique circumstances.

Estate planning is an ongoing process that requires periodic review and adjustments. As your life circumstances change, such as marriage, divorce, birth of children, or changes in your financial situation, your estate plan should be reviewed and updated to reflect these shifts. This ensures that your plan continues to meet your needs and reflects your current wishes.