Navigating the world of personal finance can feel daunting, especially for millennials who are just starting out in their careers. With student loan debt looming, the cost of living on the rise, and the allure of instant gratification, it’s easy to feel overwhelmed and stuck in a cycle of debt. But fear not! This guide is your ultimate blueprint for crushing debt and building wealth as a young professional, designed to help you take control of your financial future and achieve your financial goals.

This guide will equip you with practical strategies and actionable steps to conquer your debt, create a solid financial foundation, and unlock your full financial potential. We’ll delve into budgeting basics, smart saving techniques, and the power of investing, all tailored to the unique challenges and opportunities facing millennials. So, buckle up and get ready to embark on a journey toward financial freedom.

Understanding Your Financial Landscape

Navigating the complex world of personal finance can feel overwhelming, especially when you’re unsure where to start. But, don’t fret! Taking control of your financial well-being begins with understanding your current situation. This means taking a comprehensive look at your income, expenses, assets, and debts. This process, often referred to as a financial assessment, provides you with a clear picture of your financial landscape.

First, let’s delve into your income. This includes all sources of money coming into your life, such as your salary, wages, investments, and any other regular income streams. Be sure to factor in any potential income fluctuations, such as bonuses or overtime, for a more accurate assessment.

Next, it’s time to examine your expenses. These are all the outgoings you have, encompassing fixed costs like rent or mortgage payments, as well as variable expenses such as groceries, utilities, and entertainment. Categorize your expenses to identify areas where you might have room for savings.

Now, let’s assess your assets, which represent anything you own that has monetary value. This includes your home, car, savings accounts, investments, and even valuable possessions like jewelry. Understanding the value of your assets is crucial for determining your overall financial health.

Finally, we need to take stock of your debts. This includes any outstanding loans, credit card balances, and other financial obligations you owe. Be sure to include both the principal amount and any associated interest rates. Knowing the magnitude of your debts is essential for developing a strategy for managing and ultimately reducing them.

By taking the time to thoroughly analyze your financial landscape, you can gain a valuable understanding of your current financial standing. This knowledge empowers you to make informed decisions and create a personalized plan for achieving your financial goals. Remember, every journey begins with a single step, and taking control of your finances is the first step towards a secure and prosperous future.

Budgeting 101: Making Your Money Work for You

Are you tired of feeling constantly broke, even though you’re working hard? Do you struggle to make ends meet each month? You’re not alone. Many people struggle with managing their finances, but the good news is that it’s a skill that can be learned. Budgeting is the key to taking control of your finances and making your money work for you.

But what exactly is budgeting? It’s simply a plan for how you’ll spend your money each month. It involves tracking your income, identifying your expenses, and deciding where you want your money to go. By creating a budget, you can ensure that you’re spending within your means and reaching your financial goals.

The Benefits of Budgeting

Budgeting might seem like a chore, but it offers numerous benefits:

- Financial Control: You’ll know exactly where your money is going and how much you have available for different expenses.

- Reduced Stress: No more anxiety about bills or unexpected expenses. You’ll be prepared and less likely to rack up debt.

- Financial Security: By saving regularly, you’ll build an emergency fund and be better equipped to handle unexpected events.

- Goal Achievement: Whether it’s buying a house, taking a dream vacation, or retiring comfortably, a budget will help you allocate funds towards your goals.

Getting Started with Budgeting

Here’s a simple guide to get you started:

- Track Your Income and Expenses: This may involve using a spreadsheet, budgeting app, or simply keeping track of your receipts. The goal is to get a clear picture of how much money you earn and spend.

- Identify Your Needs vs. Wants: Distinguish between essential expenses (rent, utilities, groceries) and discretionary spending (dining out, entertainment). This will help you prioritize where to cut back.

- Create a Budget: Allocate your income to different categories, based on your needs and goals. Use a 50/30/20 rule (50% for needs, 30% for wants, 20% for savings and debt repayment).

- Review and Adjust: Your budget isn’t set in stone. It’s essential to review it regularly and make adjustments based on your changing circumstances.

Tips for Successful Budgeting

- Automate Savings: Set up automatic transfers from your checking account to your savings account.

- Use Cash or a Debit Card: This can help you stick to your budget, as you can’t spend more than what you have in cash or on your debit card.

- Negotiate Bills: Contact your service providers to see if you can get a lower rate on your bills.

- Avoid Impulse Buys: Give yourself a “cooling off” period before making any large purchases.

Tackling Debt Head-On: Strategies for Early Financial Freedom

Debt can feel like a heavy weight holding you back from achieving your financial goals. It can be overwhelming, stressful, and even discouraging. But don’t despair! There are effective strategies you can implement to tackle debt head-on and achieve early financial freedom. The journey to financial liberation may require discipline and patience, but the rewards are worth it.

First and foremost, it’s essential to understand the nature and extent of your debt. Create a comprehensive list of all your outstanding debts, including the principal amount, interest rate, minimum payment, and payment due date. This will provide you with a clear picture of your financial obligations.

Once you have a grasp of your debt landscape, you can start strategizing. A popular and effective approach is the “debt snowball method.” This involves listing your debts from smallest to largest, regardless of interest rate. You focus on paying off the smallest debt as quickly as possible while making minimum payments on the others. Once the smallest debt is paid off, you roll that payment amount onto the next smallest debt, creating momentum and a sense of accomplishment.

Another strategy is the “debt avalanche method.” This approach prioritizes debts with the highest interest rates first. While it may take longer to see progress on the initial debts, the avalanche method can ultimately save you more money in interest payments over time.

Besides choosing the right debt-reduction strategy, managing your income and expenses is crucial. Create a detailed budget that tracks your income and expenses. Identify areas where you can cut back on non-essential spending and allocate those funds towards debt repayment.

Seeking professional financial advice can be incredibly beneficial. A financial advisor can help you develop a personalized debt-reduction plan, identify potential savings opportunities, and provide guidance on managing your finances.

Negotiating with creditors is another option to consider. Contact your creditors and inquire about potential debt consolidation programs, interest rate reductions, or payment plan options. Be prepared to discuss your financial situation and demonstrate your willingness to manage your debt responsibly.

Remember, achieving financial freedom is a journey, not a destination. Be patient, persistent, and celebrate every milestone along the way. Tackling debt head-on requires discipline, commitment, and a belief in your ability to create a brighter financial future.

Investing for Beginners: Growing Your Wealth for the Future

Investing can seem intimidating, especially if you’re new to the world of finance. But it doesn’t have to be! Investing is simply the act of putting money into something with the hope of making a profit in the future. It’s a powerful tool that can help you reach your financial goals, whether it’s buying a home, funding your retirement, or achieving financial independence.

The earlier you start investing, the more time your money has to grow. Even if you only have a small amount to invest, every dollar counts. It’s about building good habits and taking control of your future.

Understanding the Basics

Before diving into specific investments, let’s grasp some fundamental concepts:

- Risk and Return: Higher risk investments typically offer the potential for higher returns, but also come with a greater chance of losing money. Conversely, lower-risk investments often have lower potential returns. It’s crucial to find the right balance for your comfort level and financial goals.

- Diversification: Don’t put all your eggs in one basket! Spreading your investments across different asset classes (like stocks, bonds, and real estate) can help reduce overall risk and increase potential returns over time.

- Compounding: This is the magic of investing! Imagine your investments earning interest, and that interest then earning more interest – your money grows exponentially over time. The earlier you start, the more the power of compounding works for you.

Types of Investments

There are many different types of investments, each with its own risk and return profile. Here are a few common ones for beginners:

- Stocks: Represent ownership in a company. You buy shares of a company hoping it will grow in value and generate profits through dividends.

- Bonds: Essentially loans you make to a company or government. You receive regular interest payments and get your principal back when the bond matures.

- Mutual Funds and Exchange-Traded Funds (ETFs): These funds pool money from multiple investors to buy a diversified basket of stocks or bonds. They offer convenience and diversification at a relatively low cost.

- Real Estate: Investing in property can provide rental income and long-term appreciation potential. However, it often requires a significant down payment and can be illiquid.

Getting Started

Ready to start investing? Here’s a simple roadmap:

- Set Financial Goals: Determine what you want to achieve with your investments, such as buying a home, funding your retirement, or reaching a specific financial target.

- Assess Your Risk Tolerance: How comfortable are you with potential losses? Your risk tolerance will guide your investment choices.

- Open a Brokerage Account: Choose a reputable online brokerage that offers tools, resources, and support for beginner investors.

- Start Small and Gradually Increase: Begin with a small investment amount and gradually increase as you gain confidence and experience.

- Do Your Research: Before investing in any asset, thoroughly research its history, potential risks, and growth prospects.

- Seek Professional Advice: Consider consulting a financial advisor for personalized guidance, especially if you’re new to investing or have complex financial needs.

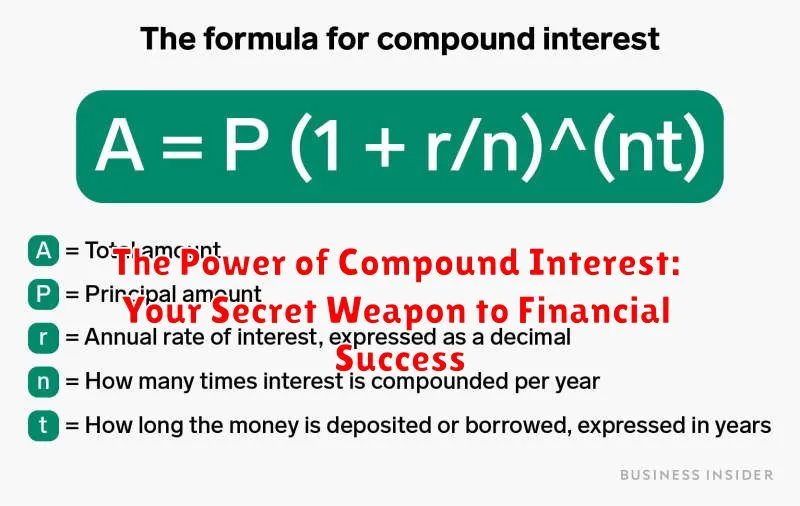

The Power of Compound Interest: Your Secret Weapon to Financial Success

In the realm of personal finance, few concepts are as powerful and transformative as compound interest. This seemingly simple mathematical principle holds the key to unlocking wealth accumulation and achieving your financial goals. Imagine a force that works tirelessly for you, growing your money exponentially over time – that’s the magic of compound interest.

Think of it as a snowball rolling downhill. The longer it rolls, the bigger it gets, gathering more snow along the way. Similarly, when interest earned on your investments is reinvested, it starts generating its own interest, creating a snowball effect that amplifies your returns. The earlier you start, the more time your money has to compound, leading to substantial wealth creation.

Let’s illustrate with an example. Suppose you invest $10,000 at an annual interest rate of 7%, compounded annually. After 20 years, your investment would grow to approximately $38,696. That’s almost four times your initial investment, all thanks to the power of compounding. The key takeaway here is that the longer you let your money grow, the more significant the impact of compound interest becomes.

To harness the power of compound interest, there are a few key strategies to consider:

- Start Early: The sooner you start investing, the more time your money has to grow. Even small, consistent contributions can make a significant difference over the long term.

- Invest Regularly: Automate your savings and invest consistently, regardless of market fluctuations. This allows you to take advantage of dollar-cost averaging, buying more shares when prices are low and fewer shares when prices are high.

- Seek Higher Returns: Aim for investments with higher potential returns, while considering the associated risks. A higher interest rate will accelerate the compounding effect.

- Minimize Fees: Keep investment fees as low as possible to maximize your returns. High fees can eat away at your profits, hindering the growth of your investments.

Compound interest is a powerful ally in your financial journey. By understanding its principles and implementing the right strategies, you can unlock the potential for significant wealth accumulation and achieve your financial aspirations. Remember, time is your greatest asset in this journey. The earlier you start, the more time your money has to work its magic, creating a legacy for you and your future generations.

Retirement Planning in Your 20s and 30s: It’s Not Too Early to Start

Retirement might seem like a distant concept in your 20s and 30s. You’re probably more focused on your career, building relationships, and enjoying life’s experiences. But the truth is, starting your retirement planning early can make a significant difference in your financial future. The power of compounding returns is real, and the earlier you start saving, the more time your money has to grow.

Don’t let the “too young” mindset hold you back. Even small, consistent contributions can add up over time. Think of it as investing in your future self. Imagine having the freedom to pursue your passions, travel the world, or simply enjoy a comfortable life without financial worries. Retirement planning is about more than just money; it’s about securing your future and achieving financial independence.

Here’s why starting early is crucial:

- The Magic of Compounding: Early contributions have more time to grow thanks to compounding interest. Imagine investing $100 a month at 7% interest for 40 years. That small amount can turn into over $500,000!

- Time is Your Ally: The longer you invest, the more time your money has to recover from market fluctuations. Early investment allows you to ride out the ups and downs of the market.

- Reduce Stress Later: Imagine facing retirement with a comfortable nest egg instead of worrying about finances. Planning early takes away the stress and uncertainty of later years.

Here are some practical steps you can take to start planning your retirement:

- Open a Retirement Account: Choose an account that aligns with your goals, like a traditional IRA, Roth IRA, or 401(k) if your employer offers it.

- Start Small and Be Consistent: Even small contributions made regularly can make a big difference. Try to automate your contributions for ease and consistency.

- Increase Contributions Gradually: As your income grows, consider gradually increasing your contributions to your retirement account. This allows you to save more over time.

- Seek Professional Advice: Consult with a financial advisor who can help you create a personalized retirement plan and tailor it to your specific needs.

Retirement planning doesn’t have to be overwhelming. Starting early and making consistent contributions can set you on the path to a financially secure future. Remember, the earlier you start, the better equipped you’ll be to enjoy a comfortable retirement and pursue the things that matter most to you.

Side Hustles and Passive Income: Boosting Your Earning Potential

In today’s economic landscape, many people are looking for ways to increase their earning potential and achieve financial stability. While a traditional full-time job can provide a steady income, it may not be enough to meet all of your financial goals. This is where side hustles and passive income come into play. These strategies offer a flexible and potentially lucrative path to supplementing your primary income and building wealth.

Side Hustles: Unleashing Your Entrepreneurial Spirit

Side hustles are activities that you undertake outside of your regular job, typically on a part-time basis. They allow you to explore your interests, develop new skills, and earn extra money. The beauty of side hustles is the sheer diversity of options available. From freelance writing and graphic design to virtual assistant work and online tutoring, the possibilities are endless.

The benefits of pursuing side hustles are numerous:

- Financial freedom: Side hustles can provide a much-needed financial boost, allowing you to pay off debt, save for a down payment on a house, or simply enjoy more financial flexibility.

- Skills development: Engaging in a side hustle can help you acquire new skills and broaden your knowledge base, which can be valuable for both your professional and personal life.

- Flexibility and control: Many side hustles offer the flexibility to work on your own terms, setting your own hours and choosing projects that align with your interests.

- Entrepreneurial experience: Side hustles provide a low-risk environment to test out entrepreneurial ideas and gain valuable business experience.

Passive Income: The Power of Automation

Passive income refers to revenue generated from sources that require minimal ongoing effort. Once you set up a passive income stream, it continues to produce income with little or no active involvement from you. This is a highly desirable form of income, as it allows you to build financial security while freeing up your time for other pursuits.

There are various ways to generate passive income, including:

- Investing in real estate: Rental properties can provide a steady stream of passive income.

- Creating online courses: Sharing your expertise through online courses can generate recurring revenue.

- Affiliate marketing: Promoting other companies’ products or services on your website or social media channels can earn you commissions.

- Investing in dividend-paying stocks: Investing in stocks that pay dividends can provide regular passive income.

Balancing Side Hustles and Passive Income with Your Existing Job

While side hustles and passive income offer great opportunities, it’s crucial to balance them with your existing job responsibilities and personal commitments. Here are some tips for effective management:

- Set realistic goals: Don’t overwhelm yourself with too many side hustles or passive income ventures. Start small and gradually scale up as you gain experience and see results.

- Prioritize and delegate: Identify your most valuable skills and allocate your time accordingly. Consider outsourcing or delegating tasks to free up your time and energy.

- Be mindful of your time: Make sure you’re not sacrificing sleep, health, or relationships for the sake of side hustles or passive income.

- Track your progress: Monitor your income and expenses for both your regular job and side hustles. This will help you assess your financial progress and make informed decisions.