The blockchain space is booming, with new projects springing up every day. This presents a thrilling opportunity for investors seeking to capitalize on the next big thing, but it also comes with a significant challenge – navigating the vast and sometimes overwhelming landscape of projects to find the best ones for their portfolios. It’s not just about picking the most hyped coin; it’s about identifying projects with strong fundamentals, a passionate community, and a clear path to achieving their goals.

This article will serve as your guide to navigating the blockchain boom, offering insights into key factors to consider when evaluating projects and showcasing some of the most promising names currently shaping the decentralized future. From the latest developments in decentralized finance (DeFi) to the innovative uses of non-fungible tokens (NFTs) and beyond, we’ll explore the cutting-edge projects driving the industry forward and empower you to make informed investment decisions in this dynamic space.

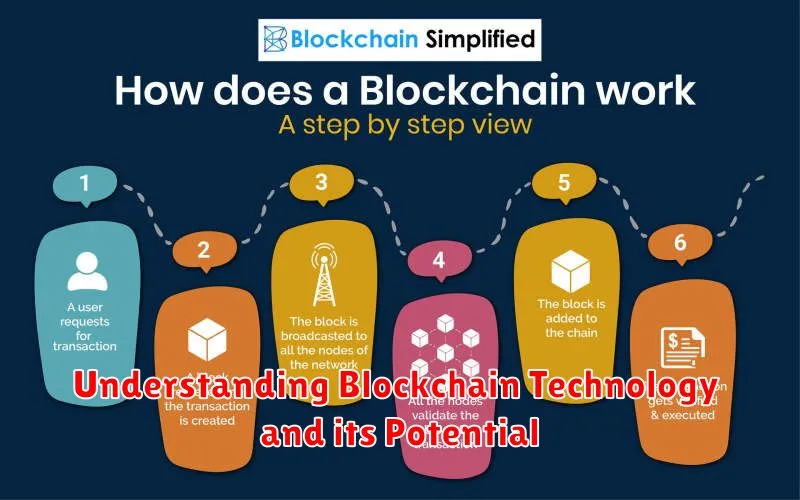

Understanding Blockchain Technology and its Potential

Blockchain technology has emerged as a revolutionary force, transforming various industries and creating new possibilities. It’s a decentralized, immutable ledger that records transactions across a network of computers. This distributed ledger technology (DLT) enables secure and transparent transactions, eliminating the need for a central authority.

Key Features of Blockchain

Blockchain technology boasts several key features that distinguish it from traditional systems:

- Decentralization: Blockchain is distributed across multiple computers, eliminating reliance on a single point of failure.

- Immutability: Once a transaction is recorded on the blockchain, it cannot be altered or deleted, ensuring data integrity.

- Transparency: All transactions are publicly visible, fostering trust and accountability.

- Security: The decentralized nature and cryptographic algorithms employed by blockchain make it highly secure and resistant to tampering.

Applications of Blockchain

The potential applications of blockchain technology are vast and diverse, spanning across industries:

Financial Services

Blockchain is revolutionizing the financial industry. Cryptocurrencies, like Bitcoin and Ethereum, leverage blockchain for secure and efficient transactions. It also enables faster and cheaper international payments, smart contracts, and decentralized finance (DeFi).

Supply Chain Management

Blockchain can enhance supply chain transparency and traceability, allowing businesses to track goods from origin to destination. This reduces fraud, improves efficiency, and increases consumer confidence.

Healthcare

Blockchain can securely store and share patient medical records, enabling faster access to information and enhancing data privacy. It can also facilitate secure and transparent drug traceability.

Government and Voting

Blockchain can improve election integrity by providing a tamper-proof and verifiable system for voting. It can also streamline government services and enhance transparency in public records.

Challenges and Future of Blockchain

While blockchain offers significant benefits, it also faces challenges. Scalability, regulatory uncertainty, and the need for user education are some key areas that need to be addressed. Nevertheless, blockchain is expected to play a crucial role in shaping the future of various industries, driving innovation and transforming the way we interact with technology.

As blockchain technology continues to evolve, it holds the promise of a more secure, transparent, and efficient future. Understanding its capabilities and potential applications is essential for individuals and organizations alike. Embracing this transformative technology will pave the way for a new era of innovation and progress.

Evaluating Blockchain Projects: Key Factors to Consider

In the ever-evolving landscape of technology, blockchain has emerged as a transformative force, promising to revolutionize various industries. With its decentralized and secure nature, blockchain has captured the attention of entrepreneurs, investors, and developers alike. However, navigating the vast and rapidly growing ecosystem of blockchain projects can be daunting. To make informed decisions, it is crucial to evaluate projects meticulously, considering key factors that can determine their success and potential.

Team and Expertise: The success of any blockchain project hinges on the capabilities and experience of its team. A strong team with diverse skillsets, including developers, engineers, business strategists, and marketing professionals, is essential for building and launching a successful project. Evaluate the team’s track record, expertise in relevant fields, and their commitment to the project’s long-term success.

Technology and Innovation: Blockchain technology is constantly evolving, and projects that offer innovative solutions and advancements in the field are likely to attract greater interest and investment. Explore the project’s technology stack, its unique features, and its potential to address real-world challenges. Consider the project’s scalability, security, and its ability to adapt to future advancements.

Use Case and Market Demand: A strong use case and significant market demand are essential for any blockchain project to gain traction. Evaluate the project’s target market, the problem it aims to solve, and its potential for widespread adoption. Research the competitive landscape and analyze the project’s competitive advantage.

Tokenomics and Value Proposition: The tokenomics of a blockchain project refers to its token distribution, utility, and economic model. Understand the project’s token design, its purpose within the ecosystem, and its potential for generating value. Evaluate the token’s utility, its potential for appreciation, and the risks associated with its price volatility.

Community and Engagement: A thriving community is vital for the success of any blockchain project. Assess the project’s community engagement, its online presence, and the level of interaction among its users. Strong community support can drive adoption, provide valuable feedback, and contribute to the project’s long-term growth.

Transparency and Governance: Transparency and good governance are crucial for building trust and credibility in blockchain projects. Evaluate the project’s transparency regarding its development, funding, and decision-making processes. Analyze its governance structure, the roles of key stakeholders, and its commitment to responsible practices.

Regulatory Landscape: The regulatory landscape for blockchain projects is evolving rapidly. Consider the project’s compliance with relevant regulations, its strategy for navigating regulatory challenges, and its potential impact on its future development.

By carefully evaluating blockchain projects based on these factors, individuals and investors can make informed decisions and navigate the complex world of decentralized technologies. Remember that due diligence is crucial in the blockchain space, and thorough research can mitigate risks and maximize potential returns.

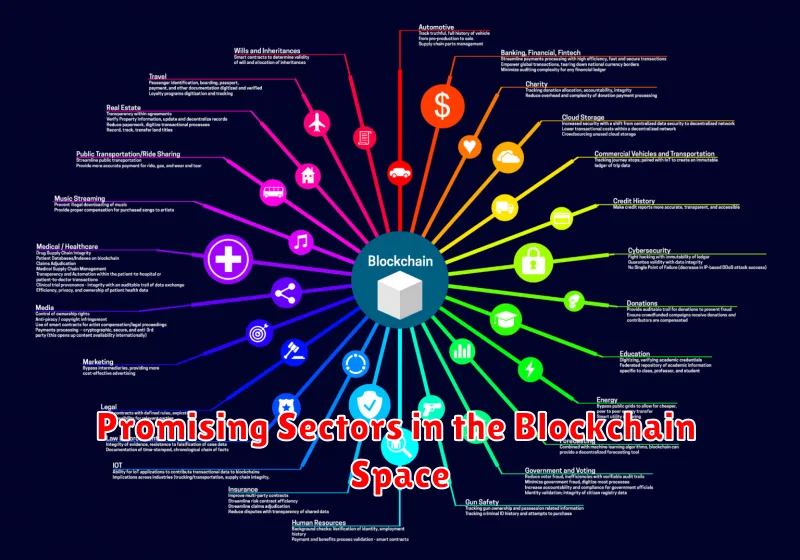

Promising Sectors in the Blockchain Space

The blockchain technology, renowned for its decentralized and secure nature, has rapidly gained momentum and permeated various sectors, presenting transformative opportunities. While cryptocurrencies have captured the mainstream imagination, blockchain’s potential extends far beyond digital currencies. Let’s explore some of the most promising sectors where blockchain is poised to make a significant impact:

1. Supply Chain Management

Supply chains are often complex and opaque, susceptible to inefficiencies and fraud. Blockchain offers a transparent and tamper-proof ledger that can revolutionize supply chain management. By recording transactions and tracking goods across the entire supply chain, blockchain provides real-time visibility, enhances trust, and reduces the risk of counterfeiting. This technology can streamline processes, improve efficiency, and ensure the authenticity and origin of products.

2. Healthcare

The healthcare industry faces challenges with data security, interoperability, and patient privacy. Blockchain can address these issues by creating secure and decentralized platforms for storing and sharing patient records. With blockchain, patients can control their health data, while healthcare providers can securely access it, enabling better coordination of care and improving patient outcomes. Blockchain can also facilitate secure and transparent drug supply chains, reducing the risk of counterfeit medications.

3. Finance

The financial sector is embracing blockchain for its potential to enhance efficiency, reduce costs, and improve security. Blockchain can streamline cross-border payments, facilitate faster and more cost-effective settlements, and enable new financial instruments. Decentralized finance (DeFi) applications built on blockchain are revolutionizing traditional financial services, offering access to loans, insurance, and other financial products without intermediaries.

4. Identity Management

Managing digital identities is crucial in today’s interconnected world, but traditional methods are often vulnerable to fraud and identity theft. Blockchain can create secure and verifiable digital identities that are tamper-proof and portable. This can improve the efficiency of identity verification, reduce the risk of fraud, and enhance user privacy.

5. Voting

Blockchain’s immutability and transparency make it an ideal technology for secure and verifiable voting systems. By utilizing blockchain, votes can be recorded securely, preventing tampering and ensuring the integrity of elections. This can enhance voter confidence and promote fair and democratic elections.

6. Gaming

Blockchain is transforming the gaming industry by introducing new possibilities for player ownership, in-game economies, and decentralized governance. Players can own and trade virtual assets using blockchain, creating new revenue streams and fostering a more participatory gaming experience. Blockchain can also facilitate fairer and more transparent gaming experiences by eliminating centralized control and promoting community ownership.

The potential applications of blockchain are vast and continue to evolve. As the technology matures and adoption increases, these promising sectors are likely to witness significant advancements, shaping the future of various industries.

Top Blockchain Projects by Market Capitalization

The world of blockchain is rapidly evolving, with new projects emerging every day. However, some projects have consistently held their position as leaders in the market, attracting significant investment and user adoption. Here’s a look at some of the top blockchain projects by market capitalization, providing insights into their unique features and potential impact on the future of the industry.

1. Bitcoin (BTC)

Bitcoin remains the most valuable cryptocurrency by market capitalization, serving as the original and most established blockchain project. Its decentralized nature, limited supply, and robust network security have made it a popular store of value and a symbol of the broader cryptocurrency movement.

2. Ethereum (ETH)

Ethereum’s powerful smart contract functionality has made it a popular platform for building decentralized applications (dApps). The platform’s native cryptocurrency, Ether, is used for transaction fees and as a fuel for various DeFi protocols.

3. Binance Coin (BNB)

Binance Coin (BNB) is the native token of the Binance cryptocurrency exchange, one of the largest platforms globally. BNB is used for trading fees, platform services, and various DeFi applications.

4. Tether (USDT)

Tether (USDT) is a stablecoin pegged to the US dollar, offering price stability for users. It is widely used in the cryptocurrency ecosystem as a means of exchange and reducing volatility.

5. USD Coin (USDC)

USD Coin (USDC) is another prominent stablecoin pegged to the US dollar, offering similar benefits as Tether. Its popularity stems from its transparency and regulatory compliance efforts.

6. Cardano (ADA)

Cardano is a proof-of-stake blockchain platform focusing on scalability, security, and sustainability. It aims to provide a secure and efficient platform for developing dApps and smart contracts.

7. Solana (SOL)

Solana stands out for its high transaction speed and low fees. Its unique Proof of History consensus mechanism enables fast and scalable operations, making it attractive for building high-performance dApps.

8. XRP (XRP)

XRP is the native token of Ripple, a blockchain technology company focusing on cross-border payments. Its fast and cost-effective transactions have made it a popular choice for financial institutions.

9. Polkadot (DOT)

Polkadot is a blockchain platform designed for interoperability. It connects different blockchains, allowing them to communicate and share data.

10. Dogecoin (DOGE)

Dogecoin (DOGE) started as a meme coin but has gained significant traction in the cryptocurrency community. Its community-driven approach and popularity have propelled it to become a notable cryptocurrency.

This list represents a snapshot of the top blockchain projects by market capitalization. The cryptocurrency market is dynamic, and rankings can change frequently. It’s crucial to conduct thorough research and understand the intricacies of each project before investing.

View the latest market capitalization rankings

Exploring Decentralized Finance (DeFi) Opportunities

Decentralized finance, or DeFi, is a rapidly evolving space that is revolutionizing the way we interact with financial services. It leverages blockchain technology to offer a wide range of financial applications, including lending, borrowing, trading, and insurance, without the need for traditional intermediaries like banks or brokers. This creates a more open, accessible, and transparent financial system, empowering individuals to take control of their finances.

Key Benefits of DeFi

DeFi offers several advantages over traditional finance:

- Transparency and Security: Blockchain technology provides a transparent and immutable ledger, ensuring the security and authenticity of transactions. This eliminates the risk of fraud or manipulation associated with centralized systems.

- Accessibility: DeFi platforms are often open to anyone with an internet connection, regardless of their location or credit history. This fosters financial inclusion and empowers individuals who may have limited access to traditional financial services.

- Innovation and Efficiency: The decentralized nature of DeFi allows for rapid innovation and development of new financial products and services. This fosters a competitive landscape that leads to greater efficiency and lower costs.

Popular DeFi Applications

Here are some popular examples of DeFi applications:

- Lending and Borrowing: Platforms like Aave and Compound allow users to lend or borrow cryptocurrencies, earning interest on their deposits or accessing loans with competitive rates.

- Decentralized Exchanges (DEXs): DEXs like Uniswap and SushiSwap enable peer-to-peer trading of cryptocurrencies without the need for centralized intermediaries. This offers greater privacy and control over funds.

- Stablecoins: Stablecoins like Tether (USDT) and USD Coin (USDC) are cryptocurrencies pegged to fiat currencies, providing stability and reducing volatility in DeFi applications.

- Yield Farming: Yield farming involves providing liquidity to DeFi platforms in exchange for rewards. This allows users to generate passive income by lending their crypto assets.

Risks and Considerations

While DeFi offers numerous opportunities, it’s important to be aware of the associated risks:

- Volatility: The cryptocurrency market is highly volatile, and DeFi applications are susceptible to price fluctuations.

- Smart Contract Risks: DeFi relies on smart contracts, which are computer programs that can be vulnerable to bugs or exploits.

- Regulation: The regulatory landscape for DeFi is still evolving, and there is uncertainty about how it will impact the industry in the future.

Conclusion

DeFi is a revolutionary force in the financial world, offering exciting opportunities for individuals and institutions alike. While it’s important to understand the risks involved, DeFi’s potential for innovation, accessibility, and transparency is undeniable. As the space continues to develop, we can expect to see even more exciting applications and innovations in the future.

Non-Fungible Tokens (NFTs) and their Investment Potential

Non-fungible tokens (NFTs) have exploded in popularity in recent years, becoming a prominent force in the digital asset landscape. These unique digital assets, often representing ownership of digital or physical items, have captured the attention of investors, collectors, and creators alike. While their potential is undeniable, understanding their investment potential is crucial for anyone considering venturing into the world of NFTs.

NFTs derive their value from their uniqueness and scarcity. Unlike traditional assets, NFTs cannot be replicated or exchanged for identical copies. This inherent scarcity makes them highly valuable for collectors and investors seeking exclusive digital ownership. The emergence of blockchain technology, particularly Ethereum, has provided a secure and transparent platform for creating and trading NFTs, further enhancing their appeal.

The investment potential of NFTs stems from various factors. First, their potential for appreciation is substantial. As NFTs become more widely adopted, demand is expected to increase, driving up their value. The success of iconic NFTs like the Bored Ape Yacht Club and CryptoPunks demonstrates the potential for significant gains. Second, NFTs offer diverse use cases beyond collectibles. They can represent ownership of digital art, music, video games, virtual real estate, and even physical assets like real estate properties, expanding their investment potential into various sectors.

However, it is essential to acknowledge the risks associated with investing in NFTs. The market is highly volatile and subject to speculation, making price fluctuations unpredictable. Additionally, the regulatory landscape surrounding NFTs is still evolving, potentially leading to legal uncertainties. Moreover, the technical complexities of blockchain technology may pose challenges for new investors.

Before investing in NFTs, it is crucial to conduct thorough research, understand the underlying technology, and assess the potential risks and rewards. Seek guidance from reputable financial advisors and stay updated on industry trends. It’s also vital to prioritize investing in projects with strong fundamentals, active communities, and clear use cases. As with any investment, diversification is essential to mitigate risk.

Despite the risks, NFTs offer a unique opportunity for investors to gain exposure to a burgeoning digital asset class. With careful consideration, due diligence, and a long-term investment strategy, NFTs can potentially become a valuable asset in a diversified portfolio. However, always remember that investments in NFTs, like any other investment, involve inherent risks and should be undertaken with careful consideration.

The Metaverse and Blockchain Gaming Projects

The metaverse is a collective term for shared virtual worlds where users can interact with each other and digital objects. Blockchain technology is used to create decentralized and secure platforms for gaming, which can lead to new and innovative experiences for players.

Blockchain Gaming: A New Era of Games

Blockchain gaming projects are bringing a new wave of innovation to the gaming industry. These games often use cryptocurrencies as in-game currency and allow players to own and trade digital assets, such as NFTs, which represent ownership of virtual items. This creates a more engaging and rewarding experience for players, who can earn and trade value within the game.

How the Metaverse is Changing Gaming

The metaverse is merging with blockchain gaming to create immersive and engaging experiences. Players can interact with each other in virtual spaces, participate in events, and even earn income through various activities. This is transforming the traditional gaming model into a more interactive and rewarding experience.

Examples of Blockchain Gaming Projects in the Metaverse

- Axie Infinity: A popular blockchain game that allows players to earn tokens by breeding and battling digital creatures.

- The Sandbox: A virtual world where players can create and monetize their own experiences, using NFTs and other blockchain technologies.

- Decentraland: A virtual world where users can own land and create their own experiences, using blockchain technology.

Benefits of Blockchain Gaming in the Metaverse

- Transparency and Security: Blockchain technology provides a transparent and secure ledger for transactions, ensuring fairness and accountability.

- Player Ownership: Players can own and trade digital assets, which gives them more control and rewards for their efforts.

- New Revenue Streams: Blockchain gaming creates new revenue streams for developers and players, allowing them to earn and monetize their contributions.

Challenges of Blockchain Gaming in the Metaverse

Despite the potential of blockchain gaming in the metaverse, there are also challenges to address. These include:

- Scalability: Blockchain technology is still evolving, and its scalability needs to improve to handle the increasing demand of metaverse games.

- Regulation: The legal landscape for blockchain gaming is still developing, and regulators need to establish clear guidelines for these projects.

- User Adoption: Mass adoption of blockchain gaming requires more user-friendly interfaces and accessible onboarding processes.

The Future of Blockchain Gaming in the Metaverse

Blockchain gaming in the metaverse is still in its early stages, but it has the potential to revolutionize the gaming industry. With continued innovation and adoption, these projects can create new and immersive experiences for players, driving the future of entertainment and virtual worlds.

Investing in Blockchain: Risks and Considerations

Blockchain technology has gained immense popularity in recent years, revolutionizing various industries. With its potential to disrupt traditional systems, many investors are eager to capitalize on this emerging market. However, before diving into blockchain investments, it is crucial to understand the associated risks and considerations.

Volatility and Market Fluctuations

One of the most significant risks associated with blockchain investments is their inherent volatility. The prices of cryptocurrencies, which are often used to represent blockchain assets, can fluctuate wildly in short periods. This extreme volatility makes it difficult to predict future market trends and can lead to substantial losses if not managed carefully.

Regulatory Uncertainty

The regulatory landscape surrounding blockchain technology is constantly evolving. Different jurisdictions have varying regulations and policies, creating uncertainty for investors. Changes in regulations can significantly impact the value of blockchain assets and potentially create legal and compliance challenges.

Security Risks

Blockchain technology is generally considered secure, but it is not immune to security threats. Hackers and cybercriminals are constantly seeking vulnerabilities to exploit. The theft of cryptocurrencies or the manipulation of blockchain systems can result in substantial financial losses for investors.

Lack of Standardization

The blockchain industry is still relatively young and fragmented. There is a lack of standardized protocols and practices, making it difficult to compare different blockchain platforms and projects. This lack of standardization can lead to confusion and complexity for investors.

Due Diligence is Essential

Before investing in any blockchain project, it is crucial to conduct thorough due diligence. Research the project’s team, technology, market potential, and financial viability. Evaluate the project’s whitepaper, tokenomics, and community engagement. It is also essential to understand the underlying risks and potential rewards associated with the investment.

Diversification and Risk Management

Diversifying your blockchain portfolio across different projects and asset classes can help mitigate risks. It is also crucial to implement proper risk management strategies, such as setting stop-loss orders and allocating capital wisely. Consider your risk tolerance and investment goals before making any decisions.

Conclusion

Investing in blockchain offers exciting opportunities but also comes with inherent risks. By understanding the key considerations and conducting thorough due diligence, investors can make informed decisions and navigate the complexities of this rapidly evolving market. It is essential to remember that blockchain investments should be treated with caution and only a portion of your overall investment portfolio should be allocated to this sector.

Choosing the Right Platforms for Blockchain Investments

The world of blockchain technology is constantly evolving, with new platforms and projects emerging daily. This makes it challenging for investors to determine which platforms are worth investing in. In this article, we’ll explore some crucial factors to consider when choosing the right platforms for your blockchain investments.

1. Understand the Platform’s Purpose and Technology

Before investing in any blockchain platform, it’s essential to understand its purpose and the underlying technology. Ask yourself these questions:

- What problem is the platform solving?

- What is the platform’s unique selling proposition?

- What type of blockchain technology does it use (e.g., Proof-of-Work, Proof-of-Stake)?

- What is the platform’s scalability and security?

A thorough understanding of these aspects will help you assess the platform’s potential for long-term success.

2. Research the Development Team and Community

The team behind a blockchain platform is crucial to its success. Research the team’s experience, expertise, and track record. A strong team with a proven history of delivering results is a good sign.

Additionally, consider the platform’s community. A vibrant and active community can contribute to the platform’s development and adoption. Look for platforms with strong community support.

3. Analyze the Tokenomics

Tokenomics refers to the economics of a cryptocurrency or token. It’s essential to understand how the token is used within the platform, its supply and distribution, and its potential value.

Consider factors such as:

- Token utility: What is the token used for within the platform?

- Token supply: What is the total supply of tokens?

- Token distribution: How are the tokens distributed among the team, investors, and the community?

- Token governance: How are decisions made about the token and the platform?

4. Evaluate the Platform’s Market Potential

The market potential of a blockchain platform is crucial for its long-term growth. Consider factors such as:

- Target market: Who is the platform’s target audience?

- Competition: What other platforms are competing in the same space?

- Adoption rate: How quickly is the platform being adopted by users?

A platform with a large and growing target market, a strong competitive advantage, and a high adoption rate has a higher potential for success.

5. Understand the Risks Involved

Investing in blockchain platforms comes with inherent risks. Be aware of the following:

- Market volatility: The cryptocurrency market is known for its volatility, which can result in significant price fluctuations.

- Regulatory uncertainty: The regulatory landscape for blockchain technology is still evolving, and changes in regulations can impact platform operations.

- Security risks: Blockchain platforms are susceptible to security breaches, which can lead to losses.

Do your due diligence and understand the risks before investing.

Conclusion

Choosing the right platforms for blockchain investments requires careful research and analysis. By considering the factors discussed above, you can make informed investment decisions and maximize your chances of success in the ever-evolving world of blockchain technology.

Staying Updated on Blockchain Trends and Regulations

The blockchain industry is rapidly evolving, with new trends and regulations emerging constantly. To stay ahead of the curve, it’s essential for individuals and businesses to keep informed about the latest developments. This article will provide insights into how to stay updated on blockchain trends and regulations.

1. Follow Key Industry Publications and Websites

Numerous reputable publications and websites dedicated to blockchain technology offer valuable insights and analysis. Some of the leading resources include:

- CoinDesk: A leading news platform covering blockchain and cryptocurrency news.

- Cointelegraph: A comprehensive source for blockchain and crypto news, analysis, and opinion pieces.

- The Block: A data-driven media platform focused on the business of blockchain.

- CryptoSlate: A news website covering blockchain, crypto, and Web3.

- Bitcoin Magazine: A long-standing publication dedicated to Bitcoin and the broader blockchain ecosystem.

2. Engage with Blockchain Communities and Forums

Participating in online communities and forums provides an excellent way to connect with blockchain enthusiasts, developers, and experts. Engaging in discussions and sharing insights can help you gain valuable perspectives and stay informed about current trends.

- Reddit: Multiple subreddits dedicated to blockchain, cryptocurrency, and specific blockchain projects.

- Discord: Numerous blockchain-related Discord servers offer community support and discussions.

- Telegram: Several blockchain projects have official Telegram groups for announcements and community interactions.

3. Attend Blockchain Events and Conferences

Conferences and events provide opportunities to network with industry leaders, learn about new technologies, and gain insights from experts. Attending blockchain conferences can help you stay abreast of the latest trends and regulations.

- Consensus: A major blockchain conference held annually in New York City.

- EthCC: A leading Ethereum-focused conference held in Paris.

- Devcon: An annual Ethereum developer conference.

4. Monitor Regulatory Developments

Governments worldwide are actively developing regulations for blockchain technology, which can impact businesses and individuals. Keeping up-to-date with regulatory changes is crucial for compliance and future planning.

- Financial Action Task Force on Money Laundering (FATF): The FATF’s guidelines on virtual assets and their service providers shape regulatory approaches globally.

- National regulatory bodies: Check websites of relevant national regulatory bodies for announcements and guidance on blockchain and cryptocurrency regulations.

5. Explore Online Learning Platforms

Numerous online platforms offer courses and resources on blockchain technology, including its applications, development, and regulatory landscape. Engaging in online learning can enhance your understanding of blockchain and keep you informed about evolving trends.

- Coursera: Offers a variety of courses on blockchain and cryptocurrency.

- Udemy: Provides a comprehensive selection of blockchain courses for beginners and advanced learners.

- EdX: Offers online courses and programs on blockchain technology from renowned universities.

Staying updated on blockchain trends and regulations is essential for anyone interested in this transformative technology. By leveraging the resources mentioned above, individuals and businesses can stay informed about the latest developments and navigate the ever-changing blockchain landscape effectively.