Are you looking for a proven path to financial freedom and wealth accumulation? Look no further than real estate. The real estate market has historically been a consistent source of wealth creation, offering investors a tangible asset that can appreciate in value over time. From single-family homes to multi-family units, commercial properties, and even land, the opportunities to build wealth through property are vast and diverse.

This comprehensive guide will be your roadmap to unlocking the real estate riches that await you. We’ll delve into the fundamentals of real estate investing, exploring various strategies, providing practical tips, and offering insights into market trends. Whether you’re a seasoned investor or a first-time buyer, this guide will empower you to make informed decisions and achieve your financial goals through the power of property investment.

Understanding the Power of Real Estate Investment

Real estate investment has long been considered a cornerstone of a diversified portfolio, offering the potential for substantial returns and long-term financial security. This article delves into the key aspects of real estate investment, exploring its benefits, risks, and strategies to help you make informed decisions.

Why Invest in Real Estate?

The allure of real estate investment lies in its multifaceted advantages:

- Passive Income: Rental properties generate a consistent stream of income, potentially exceeding the returns from traditional investments.

- Appreciation: Over time, real estate values tend to appreciate, providing capital gains when you sell.

- Tax Benefits: Various tax deductions are available for real estate investors, including mortgage interest, property taxes, and depreciation.

- Inflation Hedge: Real estate can act as a hedge against inflation, as rents and property values generally rise with inflation.

- Tangible Asset: Unlike stocks or bonds, real estate is a tangible asset you can physically own and occupy.

Risks and Considerations

While the potential rewards are significant, real estate investment also comes with inherent risks:

- Market Volatility: Real estate values can fluctuate, influenced by factors like economic conditions and interest rates.

- Vacancy Risk: Rental properties may experience periods of vacancy, resulting in lost income.

- Maintenance Expenses: Maintaining rental properties requires significant ongoing costs, including repairs, utilities, and property taxes.

- Liquidity Risk: Selling real estate can be time-consuming and may require significant effort.

Types of Real Estate Investment

The real estate investment landscape is diverse, offering various options to suit different risk appetites and investment goals:

- Residential Properties: Single-family homes, multi-family dwellings, and townhouses are popular choices for rental income and appreciation.

- Commercial Properties: Office buildings, retail spaces, and industrial facilities offer the potential for higher returns but also higher risk.

- REITs (Real Estate Investment Trusts): REITs are publicly traded companies that own and operate real estate, providing investors with access to a diversified portfolio.

- Real Estate Crowdfunding: This allows investors to contribute smaller amounts to real estate projects, enabling participation in larger ventures.

Strategies for Success

To maximize the potential of your real estate investment, consider these strategies:

- Thorough Research: Analyze market trends, property values, and potential rental income before making any investments.

- Diversification: Spread your investments across different property types and locations to mitigate risk.

- Financial Planning: Secure adequate financing, manage cash flow effectively, and plan for potential expenses.

- Professional Advice: Consult with experienced real estate professionals, including agents, brokers, and financial advisors.

Identifying Profitable Property Types for Wealth Generation

Real estate investing has long been a popular strategy for building wealth, offering a diverse range of options to suit various investment goals. However, navigating the complexities of the market and pinpointing profitable property types can be daunting for newcomers and seasoned investors alike. This article aims to provide a comprehensive guide to identifying lucrative real estate investments, exploring the factors influencing profitability, and highlighting the most promising property types for wealth generation.

Understanding the Factors Influencing Profitability

Profitability in real estate investing is driven by a multitude of interconnected factors, each contributing to the overall financial outcome of an investment. Key factors include:

- Location: The location of a property is paramount, as it dictates factors such as demand, rental rates, appreciation potential, and access to amenities and infrastructure. Prime locations with high demand and limited supply typically command higher rental yields and appreciation rates.

- Property Type: Different property types exhibit varying levels of profitability, influenced by factors such as demand, supply, maintenance costs, and tenant demographics.

- Single-family Homes: Offer the potential for higher rental income and appreciation, but require more maintenance and management responsibilities.

- Multi-family Units: Provide a more stable income stream through diversification of tenants, but may have higher upfront costs.

- Commercial Properties: Can generate significant income through leasing to businesses, but require thorough market research and tenant screening.

- Vacation Rentals: Offer high potential returns, but require careful consideration of location, seasonality, and operational costs.

- Market Conditions: The overall economic climate and housing market trends play a significant role in influencing investment profitability. Factors such as interest rates, inflation, and employment levels can impact demand, pricing, and rental yields.

- Investment Strategy: The specific investment strategy employed can also affect profitability. Options include:

- Buy and Hold: Long-term strategy focused on generating rental income and capital appreciation over time.

- Fix and Flip: Short-term strategy involving purchasing distressed properties, renovating them, and selling for a profit.

- Wholesaling: Acquiring properties under market value and selling them to investors for a fee.

Exploring Profitable Property Types

The most profitable property types often vary depending on the specific market and investment goals. However, some consistently emerge as promising options:

- High-Demand Areas: Properties located in areas with strong job markets, growing populations, and limited housing supply tend to attract high demand, driving rental rates and appreciation potential.

- Short-Term Rentals: Vacation rentals in popular tourist destinations can generate substantial income, particularly in areas with high seasonality.

- Multi-Family Properties: Multi-family units offer diversification of income streams and potential for increased returns through economies of scale.

- Mixed-Use Developments: Combining residential, commercial, and retail spaces within a single development can create a synergistic environment with higher demand and potential for increased profitability.

- Emerging Markets: Investing in emerging markets with high growth potential can offer substantial long-term returns, but requires thorough research and understanding of local market dynamics.

Conclusion:

Identifying profitable property types for wealth generation requires a thorough understanding of the market, its driving forces, and the specific investment goals. By considering the factors discussed above, investors can make informed decisions and navigate the complexities of the real estate market to achieve their desired financial outcomes.

Financing Your Real Estate Journey: Mortgages and Loans

The dream of owning a home is a common aspiration, but navigating the financial landscape can be daunting. One of the most crucial aspects of this journey is understanding the various financing options available, particularly mortgages and loans. These financial tools are essential for making your real estate dreams a reality.

Mortgages: The Cornerstone of Homeownership

A mortgage is a secured loan specifically designed to finance the purchase of real estate. It’s a long-term loan, typically spanning 15 to 30 years, that allows you to borrow a significant amount of money, typically 80% or more of the property’s value. This loan is secured by the property itself, meaning the lender has the right to foreclose on the property if you default on your payments.

Understanding the different types of mortgages is key to choosing the right one for your needs:

- Fixed-Rate Mortgages: Offer predictable monthly payments with a fixed interest rate throughout the loan term, providing financial stability.

- Adjustable-Rate Mortgages (ARMs): Feature an initial fixed interest rate that adjusts periodically based on market conditions. These can be advantageous in periods of low interest rates, but carry the risk of higher payments later on.

- FHA Loans: Backed by the Federal Housing Administration, FHA loans offer lower down payment requirements and more lenient credit score standards, making homeownership accessible to a wider range of borrowers.

- VA Loans: Available to eligible veterans and active-duty military personnel, VA loans offer no down payment requirements and competitive interest rates.

Loans: Alternative Financing Options

While mortgages are the standard for home financing, there are other loan options that can be valuable depending on your situation:

- Home Equity Loans: These loans use your home’s equity (the difference between your home’s value and the amount you owe on it) as collateral. They offer lower interest rates than personal loans but come with the risk of losing your home if you default.

- Personal Loans: Unsecured loans that can be used for various purposes, including home improvements. While easier to qualify for, they typically have higher interest rates than mortgages.

Navigating the Application Process

Applying for a mortgage or loan involves several steps:

- Gather Financial Documents: Prepare your credit report, income statements, and bank statements to showcase your financial stability.

- Choose a Lender: Research different lenders, compare interest rates and loan terms, and choose the one that best fits your needs.

- Submit an Application: Provide the required information to the lender and await their decision.

- Closing: Once approved, you’ll finalize the loan agreement, sign documents, and receive the funds to complete your purchase.

Tips for Successful Financing

- Improve Your Credit Score: A good credit score is crucial for securing favorable loan terms. Pay bills on time, manage your debt responsibly, and avoid unnecessary credit applications.

- Save for a Down Payment: Aim to save a substantial down payment to reduce your loan amount and monthly payments.

- Shop Around: Compare interest rates and fees from multiple lenders to find the best offer.

- Consult with a Financial Advisor: Seek professional guidance to understand your options and develop a personalized financing strategy.

Mastering the Art of Property Valuation

Property valuation, also known as real estate appraisal, is the process of determining the market value of a piece of real estate. It’s a crucial aspect of various real estate transactions, including buying, selling, financing, and taxation. Accurately assessing the value of a property requires a combination of skills, knowledge, and experience, making it a complex and multifaceted field.

What Factors Influence Property Value?

Numerous factors contribute to the value of a property, and appraisers must carefully consider each to arrive at an accurate valuation. Here are some key factors:

- Location: This is arguably the most significant factor, encompassing the neighborhood, proximity to amenities, schools, transportation, and overall desirability of the area.

- Property Size and Type: The size of the lot, square footage of the building, and type of property (e.g., single-family home, condo, commercial building) all play a role.

- Condition and Age: The overall condition of the property, including its maintenance, updates, and age, significantly impacts its value. Well-maintained and recently renovated properties tend to command higher prices.

- Market Conditions: The current state of the real estate market, including supply and demand, interest rates, and economic conditions, has a major influence on property values.

- Comparable Sales: Appraisers rely on recent sales of similar properties in the area to establish a benchmark for valuation. This is known as the “comparative market analysis” (CMA).

- Amenities and Features: Features like swimming pools, garages, finished basements, and landscaping can add value to a property.

Types of Property Valuations:

Depending on the purpose of the valuation, different methods are employed. Here are some common types:

- Market Value Appraisal: This is the most common type and aims to determine the price a willing buyer would pay and a willing seller would accept in an open market transaction.

- Tax Appraisal: This is used for property tax purposes and often employs a different methodology compared to market value appraisals.

- Insurance Appraisal: This determines the cost to replace a property in case of damage or destruction, which is crucial for insurance purposes.

Importance of Professional Appraisals:

It’s highly recommended to engage a qualified and licensed property appraiser for any significant real estate transaction. Professional appraisers bring a wealth of experience, knowledge, and objectivity to the valuation process, ensuring accuracy and fairness. This is particularly crucial for:

- Buying or Selling a Property: An appraisal provides a realistic estimate of the property’s value, helping buyers negotiate a fair price and sellers set appropriate asking prices.

- Securing a Mortgage: Lenders require appraisals to assess the collateral for the loan and ensure its value is sufficient to cover the loan amount.

- Estate Planning: Appraisals are essential for estate planning and tax purposes, accurately valuing assets for inheritance purposes.

Conclusion:

The Power of Leverage in Real Estate Investing

Leverage, in the context of real estate investing, refers to the use of borrowed money to amplify returns. It’s a powerful tool that can help investors acquire properties they might not otherwise be able to afford, increasing their potential profits. This strategy involves using a loan to purchase a property, with the aim of generating rental income or appreciation that exceeds the cost of borrowing.

The most common form of leverage in real estate is through mortgages. By obtaining a mortgage, investors can use a relatively small down payment to acquire a property with a significantly higher value. The difference between the purchase price and the loan amount represents the leverage.

Imagine an investor with $100,000 to invest. They could purchase a $100,000 property outright or choose to leverage their funds. By taking out a mortgage for $800,000 and paying a $200,000 down payment, the investor can purchase a $1 million property. If the property value increases by 10%, their initial $200,000 investment would yield a return of $100,000, representing a 50% return on investment (ROI). Without leverage, their $100,000 investment would have yielded a 10% return.

However, leverage is a double-edged sword. While it can amplify returns, it can also amplify losses. If the property value decreases, the investor may lose more than their initial investment. For instance, in the previous example, if the property value drops by 10%, the investor could lose $100,000, wiping out their entire investment. This highlights the importance of careful due diligence and a thorough understanding of the market before employing leverage.

The key to using leverage successfully lies in a well-defined strategy, risk management, and a solid understanding of the market. Investors must assess their financial capabilities, consider their risk tolerance, and ensure they have a solid exit strategy.

Here are some key benefits of leveraging in real estate investing:

- Amplified Returns: Leverage allows investors to control assets worth more than their initial capital, potentially generating higher returns on their investment.

- Greater Purchasing Power: Leverage provides investors with the ability to acquire larger or more expensive properties, opening up opportunities in higher-value markets.

- Tax Advantages: Interest payments on mortgage loans are often deductible, reducing taxable income and potentially lowering overall tax liabilities.

- Inflation Hedging: Real estate investments, particularly those with leverage, can act as a hedge against inflation. As property values rise with inflation, the debt remains fixed, protecting the investor from erosion of their investment value.

Leverage can be a powerful tool in real estate investing, enabling investors to achieve significant financial growth. However, it is essential to approach leverage with a comprehensive strategy, responsible risk management, and a thorough understanding of the market.

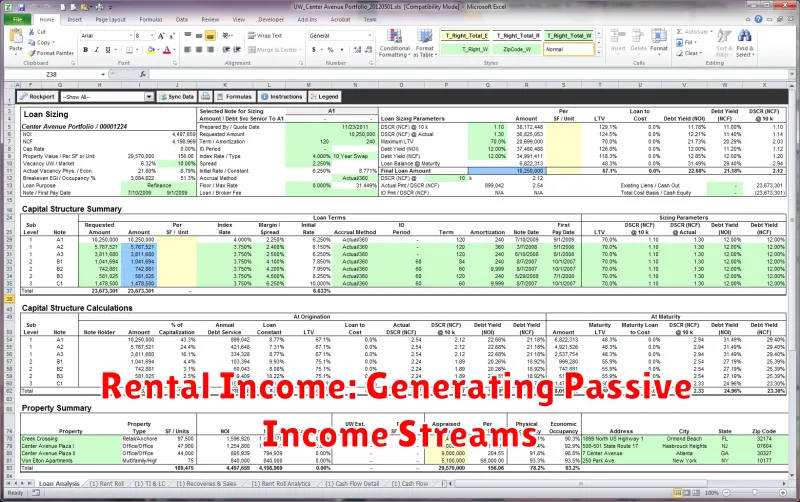

Rental Income: Generating Passive Income Streams

In the realm of finance, the pursuit of passive income has become increasingly popular. One of the most time-tested and reliable methods for generating such income is through rental properties. Rental income, as the name suggests, is the money earned from renting out a property, whether it be a residential dwelling, commercial space, or even a parking spot.

The allure of rental income lies in its potential for passive cash flow. Once a property is acquired and tenants are secured, the rental process becomes largely automated, allowing landlords to collect income with minimal effort. This passive income stream can provide financial security, supplement existing earnings, or even serve as a primary source of revenue.

There are numerous benefits associated with generating income from rental properties. Financial Stability: Rental income provides a consistent and predictable source of revenue, helping to stabilize personal finances and reduce dependence on a single income stream. Asset Appreciation: Over time, real estate values tend to appreciate, increasing the value of the rental property and potentially leading to substantial capital gains. Tax Advantages: Rental property ownership offers various tax benefits, including deductions for mortgage interest, property taxes, and expenses related to maintenance and repairs.

However, it’s crucial to acknowledge that rental income is not without its challenges. Maintenance and Repairs: Unexpected repairs and maintenance issues can arise, requiring financial resources and potentially disrupting tenants’ enjoyment of the property. Tenant Management: Screening tenants, handling lease agreements, and addressing tenant concerns can be time-consuming and demanding. Market Fluctuations: Rental rates and occupancy levels can be affected by economic factors, leading to fluctuations in income.

Despite these challenges, generating rental income can be a rewarding endeavor for those willing to invest the time and effort. By carefully selecting properties, managing tenants effectively, and planning for unforeseen circumstances, investors can build a sustainable and profitable passive income stream.

Property Flipping: A Fast-Paced Path to Profits

Property flipping is a popular investment strategy that involves purchasing properties, making necessary improvements, and then reselling them for a profit. It’s a fast-paced and exciting way to make money in real estate, but it requires significant capital, a keen eye for deals, and a good understanding of the market. If you’re considering property flipping, here’s a breakdown of the process and some key things to keep in mind.

The Basics of Property Flipping

The core principle of property flipping is simple: buy low, fix up, and sell high. Here’s a typical process:

- Finding the Deal: The first step is to identify undervalued properties with potential for improvement. This could include foreclosures, fixer-uppers, or properties in up-and-coming neighborhoods.

- Negotiating the Purchase: Once you’ve found a suitable property, you’ll need to negotiate a price that allows for repairs and still leaves room for profit.

- Renovating the Property: This is where your skills and resources come into play. You’ll need to assess the necessary repairs, obtain permits if needed, and manage the renovation process efficiently.

- Marketing and Selling: Once the renovations are complete, it’s time to market and sell the property. You can use traditional methods like listing with a real estate agent or explore online platforms for wider reach.

Pros and Cons of Property Flipping

Pros:

- Potential for High Profits: Property flipping can generate significant returns on investment if done right.

- Fast Turnaround Time: Compared to traditional real estate investing, flipping often involves shorter holding periods, allowing for faster profits.

- Flexibility and Control: You have control over the renovation process and can customize the property to appeal to a wider range of buyers.

Cons:

- High Risk: Property flipping involves significant financial risk, and unexpected expenses or market fluctuations can eat into your profits.

- Time Commitment: Property flipping requires a substantial time commitment for sourcing deals, managing renovations, and marketing the property.

- Expertise Needed: Success in property flipping requires a good understanding of real estate, construction, and marketing.

Key Considerations for Property Flipping

- Market Research: Thoroughly research the local market to identify areas with high demand and potential for appreciation.

- Financing: Secure reliable financing for the purchase and renovation costs. Consider hard money lenders or private investors.

- Renovation Budget: Create a detailed renovation budget, factoring in labor, materials, permits, and contingencies.

- Contractor Selection: Choose experienced and reputable contractors who can deliver quality work on time and within budget.

- Exit Strategy: Have a clear plan for selling the property, including pricing, marketing, and potential buyer targets.

Tips for Successful Property Flipping

- Network with Professionals: Connect with real estate agents, contractors, and other professionals in the industry for valuable insights and potential deals.

- Learn from Experienced Flippers: Seek guidance from experienced property flippers to learn from their successes and mistakes.

- Stay Updated on Market Trends: Continuously monitor market trends and adjust your strategy accordingly to capitalize on opportunities.

- Manage Risks: Understand the risks involved in property flipping and implement strategies to mitigate them.

Property flipping can be a lucrative path to real estate profits, but it’s not without its challenges. By understanding the process, weighing the pros and cons, and approaching it with careful planning, you can increase your chances of success. Always remember that the key to success in property flipping lies in identifying undervalued properties, executing efficient renovations, and understanding the market dynamics that drive demand and value.

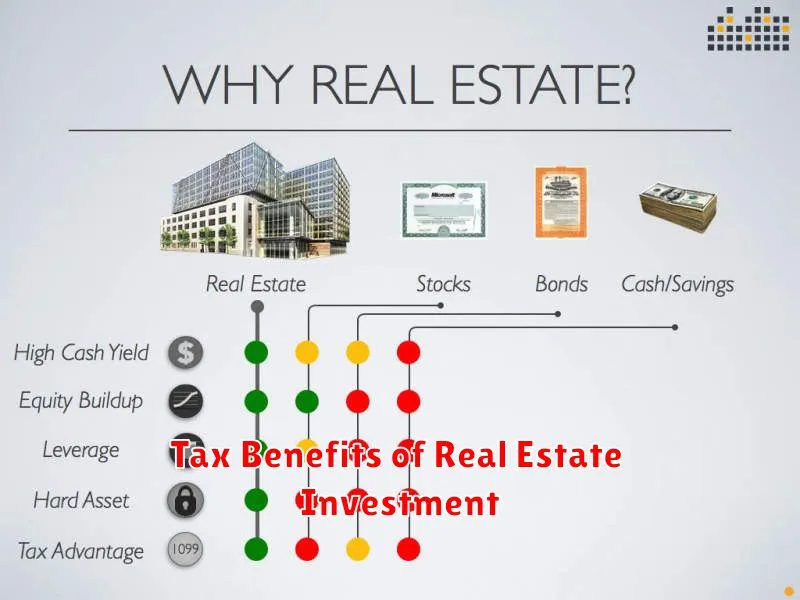

Tax Benefits of Real Estate Investment

Real estate investing can be a great way to build wealth and achieve financial goals. However, many investors are unaware of the significant tax benefits that can be realized through this type of investment. Understanding these tax benefits is crucial to maximizing your returns and making informed decisions.

Depreciation Deduction

One of the most significant tax benefits available to real estate investors is the depreciation deduction. Depreciation is the gradual decline in the value of an asset over time due to wear and tear. The Internal Revenue Service (IRS) allows investors to deduct a portion of the cost of their rental property each year, which can significantly reduce their taxable income.

Mortgage Interest Deduction

Another valuable tax benefit for real estate investors is the mortgage interest deduction. This allows homeowners and landlords to deduct the interest paid on their mortgage loans from their taxable income. This deduction can be substantial, especially in the early years of a mortgage when the interest portion of your payments is higher.

Property Taxes

Property taxes are another deductible expense for real estate investors. These taxes are levied by local governments and are based on the assessed value of your property. You can deduct property taxes from your taxable income, further reducing your tax liability.

Capital Gains Tax Exclusion

For homeowners, there is a capital gains tax exclusion that allows you to exclude up to $250,000 in profit from the sale of your primary residence ($500,000 for married couples filing jointly). This exclusion can be a valuable tax advantage, especially if you have owned your home for a significant period.

Other Deductions

Besides these major tax benefits, there are various other deductions that real estate investors can claim, including:

- Insurance premiums

- Repairs and maintenance expenses

- Utilities

- Advertising and marketing costs

- Property management fees

Consult with a Tax Professional

It is crucial to remember that tax laws and regulations can be complex, and specific situations may differ. Therefore, it is always advisable to consult with a qualified tax professional for personalized guidance on the tax benefits available to you as a real estate investor.

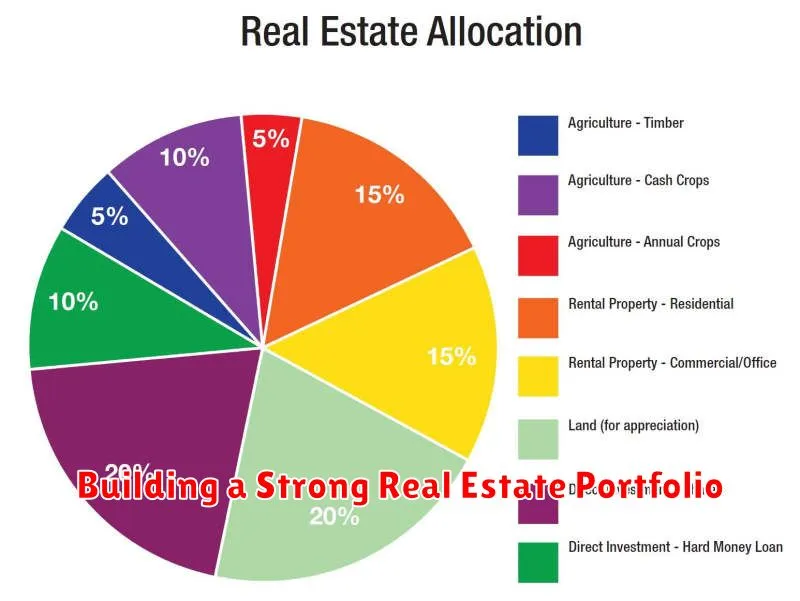

Building a Strong Real Estate Portfolio

Building a strong real estate portfolio is a great way to build wealth and secure your financial future. But it can be overwhelming to know where to start. This article will provide you with some essential tips to help you get started on your journey towards building a successful real estate portfolio.

The first step is to define your goals. What are you hoping to achieve with your real estate investments? Are you looking for long-term capital appreciation, passive income, or both? Once you know your goals, you can start to research different investment strategies. There are many different ways to invest in real estate, such as buying and holding rental properties, flipping properties, or investing in real estate investment trusts (REITs).

It is also crucial to assess your risk tolerance. How much risk are you willing to take on with your investments? Some real estate investments are more risky than others. For example, flipping properties can be very profitable, but it also carries a high risk of losing money. If you are risk-averse, you may want to consider investing in more stable investments, such as rental properties.

Once you have defined your goals, researched different investment strategies, and assessed your risk tolerance, you can start to build your team. A strong team will be essential to your success. This team should include a real estate agent, a mortgage broker, a property manager, and an attorney. Your team can provide you with expert advice and guidance throughout your investment journey.

Another important step is to secure financing. You will need to obtain a mortgage or other forms of financing to purchase your first property. Make sure you understand the different types of loans available and choose one that best suits your needs. It is also essential to manage your finances wisely. You need to ensure you have enough money to cover your mortgage payments, property taxes, insurance, and other expenses. It’s essential to diversify your portfolio. Don’t put all your eggs in one basket. Invest in different types of properties and in different locations to reduce your risk.

Once you have acquired your property, you need to manage it effectively. This includes finding tenants, collecting rent, maintaining the property, and dealing with any issues that may arise. You may want to hire a property manager to help you with these tasks, especially if you are not familiar with managing rental properties.

Building a strong real estate portfolio takes time, effort, and patience. It is a journey, not a destination. But if you follow these tips, you can increase your chances of success and build a portfolio that will help you achieve your financial goals.

Managing Your Real Estate Investments for Long-Term Success

Real estate investing can be a lucrative venture, offering the potential for substantial financial rewards. However, achieving long-term success requires a strategic approach to management. From tenant selection to maintenance, every aspect of managing your real estate investments plays a crucial role in maximizing returns and building a sustainable portfolio.

1. Tenant Selection

The foundation of successful real estate investing lies in selecting reliable tenants. Thoroughly vetting potential tenants through background checks, credit reports, and rental references can help you identify individuals who are financially responsible and respectful of your property.

2. Effective Communication

Open and timely communication with tenants is paramount. Respond promptly to their inquiries, address concerns promptly, and provide clear expectations regarding rent payments, lease terms, and maintenance requests. Building a positive rapport with your tenants can foster a mutually beneficial relationship.

3. Regular Property Maintenance

Regular property maintenance is essential for preserving the value of your investment and ensuring tenant satisfaction. Implement a proactive maintenance schedule that includes routine inspections, addressing repairs promptly, and addressing potential issues before they escalate.

4. Financial Management

Maintaining accurate financial records is crucial for tracking your investments’ profitability and making informed decisions. Track all expenses, income, and mortgage payments. Regularly review your financial performance and identify opportunities for cost optimization or revenue generation.

5. Staying Informed

The real estate market is dynamic, and staying informed about current trends and regulations is essential. Subscribe to industry publications, attend real estate seminars, and network with other investors. This ongoing learning will equip you with the knowledge to navigate the market effectively and make informed decisions.

6. Legal Compliance

Compliance with local, state, and federal laws is paramount. Ensure your rental agreements are up to date, familiarize yourself with tenant rights and responsibilities, and stay informed about changes in legislation that could impact your business.

7. Diversification

Don’t put all your eggs in one basket. Diversifying your real estate investments by investing in different property types, locations, and rental strategies can mitigate risk and enhance long-term returns. Consider exploring options such as residential, commercial, or industrial properties to spread your investments across various market segments.

8. Professional Assistance

Consider enlisting the help of professionals to manage your real estate investments effectively. Property management companies can handle tenant screening, lease administration, maintenance, and financial management, freeing you to focus on other aspects of your business.

By following these strategies, you can effectively manage your real estate investments for long-term success. Remember that consistent effort, proactive management, and a commitment to continuous learning are essential for building a profitable and sustainable real estate portfolio.