Navigating the stock market can be daunting, especially for beginners. With the rise of mobile technology, however, accessing and managing your investments has become more accessible than ever. The abundance of stock market apps available provides investors with a plethora of options to track their portfolios, research stocks, and even execute trades from the convenience of their smartphones. But with so many choices, how do you determine the best stock market app for your specific needs? This comprehensive guide will explore the top apps available in 2023, highlighting their features, pros, and cons to help you make an informed decision.

Whether you’re a seasoned investor looking for advanced charting tools or a novice just starting your investment journey, this guide will equip you with the knowledge to select the most suitable stock trading app for your investment strategy. We’ll delve into key aspects like user interface, research capabilities, trading fees, and other features to ensure you find an app that empowers you to navigate the stock market with confidence.

Understanding Your Investment Needs

Investing is a crucial aspect of financial planning, allowing you to grow your wealth and achieve your financial goals. However, before embarking on your investment journey, it is essential to understand your investment needs.

Your investment needs are determined by a range of factors, including your financial goals, risk tolerance, time horizon, and financial circumstances. By understanding these factors, you can make informed investment decisions that align with your individual requirements.

Financial Goals

Your financial goals provide the foundation for your investment strategy. What are you aiming to achieve with your investments? Some common goals include:

- Retirement planning

- Saving for a down payment on a home

- Funding your children’s education

- Building an emergency fund

The specific goals you have will shape your investment choices. For example, if you’re saving for retirement, you’ll likely have a longer time horizon and can afford to take on more risk compared to someone saving for a down payment on a home.

Risk Tolerance

Risk tolerance refers to your ability and willingness to accept potential losses in exchange for the possibility of higher returns. Your risk tolerance is influenced by factors such as your age, financial situation, and investment experience.

A high risk tolerance means you’re comfortable with the potential for significant losses in the short term, but you also have the potential to earn higher returns over the long term. Conversely, a low risk tolerance means you’re more averse to losses and prefer investments with lower but more consistent returns.

Time Horizon

The time horizon refers to the length of time you plan to invest your money. Your time horizon is a crucial factor in determining your investment strategy because it influences the level of risk you can afford to take.

A longer time horizon allows you to ride out market fluctuations, giving you the opportunity to earn higher returns over the long term. Conversely, a shorter time horizon requires a more conservative approach, as you may not have enough time to recover from significant losses.

Financial Circumstances

Your financial circumstances, such as your income, expenses, and debt levels, will also influence your investment needs. It’s important to consider your overall financial picture when making investment decisions.

For example, if you have a high level of debt, you may want to focus on paying it down before investing.

Conclusion

By understanding your investment needs, you can develop a personalized investment strategy that aligns with your goals, risk tolerance, and financial circumstances. Consulting with a financial advisor can provide you with expert guidance and support in creating a comprehensive investment plan.

Key Features to Look for in a Stock Market App

In today’s digital age, the stock market is more accessible than ever before. With numerous apps available, choosing the right one can be overwhelming. To make an informed decision, it’s crucial to identify the key features that align with your investment needs and preferences.

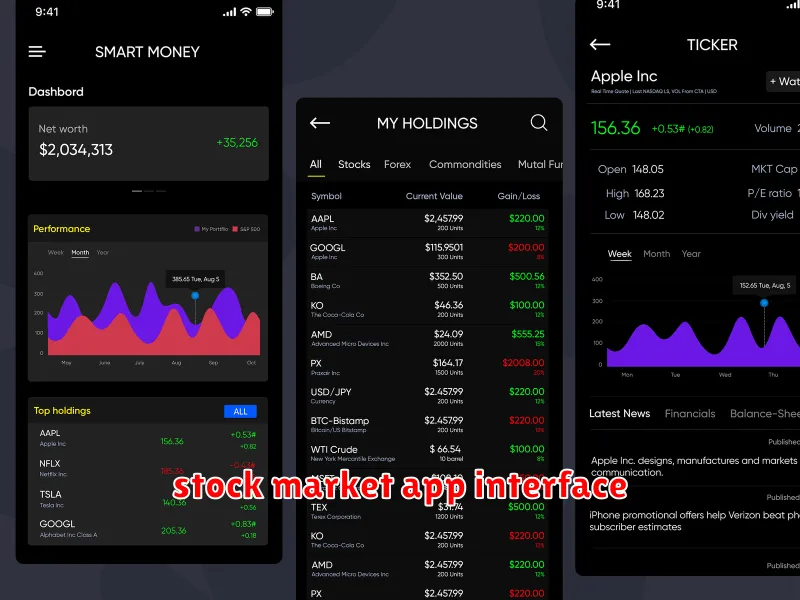

One essential feature is real-time data. This ensures that you have access to the latest stock prices and market information, enabling you to make timely trading decisions. Look for apps that offer real-time quotes, charts, and news updates.

Another important feature is order execution. The app should allow you to place orders quickly and efficiently, with various order types available, such as market orders, limit orders, and stop-loss orders. Additionally, consider the app’s trading fees, as these can significantly impact your profits.

Research and analysis tools are vital for making informed investment decisions. Look for apps that provide access to company fundamentals, analyst ratings, financial news, and charting tools. These resources can help you understand the underlying value of a company and make informed decisions.

Portfolio tracking is a crucial feature for monitoring your investments. The app should allow you to view your entire portfolio, track performance, and see your gains or losses. Some apps even offer automated portfolio rebalancing features to ensure your asset allocation remains aligned with your investment goals.

Security and reliability are paramount when choosing a stock market app. The app should have robust security measures, such as encryption and two-factor authentication, to protect your sensitive data. Look for apps that have a proven track record of reliability and uptime.

User interface (UI) and user experience (UX) play a significant role in the overall experience. Choose an app with a clean, intuitive interface that is easy to navigate and understand. A user-friendly design can enhance your trading experience and make it more enjoyable.

Beyond these core features, consider other factors like customer support, educational resources, and mobile compatibility. A responsive customer support team can address any questions or concerns you may have, while educational resources can help you learn more about investing. Mobile compatibility ensures that you can access your account and trade from anywhere.

Top-Rated Stock Market Apps for Beginners

Investing in the stock market can be a daunting task, especially for beginners. With so many options available, it can be difficult to know where to start. Fortunately, there are several user-friendly apps designed specifically for new investors, providing a platform to learn the ropes and manage your investments. Here are some of the top-rated stock market apps for beginners:

1. Robinhood

Robinhood is known for its intuitive interface and commission-free trades. Its user-friendly design makes it easy for beginners to navigate and understand. The app offers a variety of investment options, including stocks, ETFs, options, and cryptocurrency. It also provides educational resources and personalized insights to help you make informed decisions.

2. Stash

Stash is another popular choice for beginners, particularly those looking for a more hands-off approach. It allows you to invest in fractional shares of stocks and ETFs, making it accessible even with a small investment amount. The app also features a “round-up” feature that automatically invests your spare change. Stash provides personalized learning content and investment recommendations based on your financial goals.

3. Acorns

Similar to Stash, Acorns uses a “round-up” feature to invest your spare change. It automatically rounds up your purchases to the nearest dollar and invests the difference. Acorns offers a variety of investment portfolios based on your risk tolerance and investment goals. The app is ideal for those who want to start investing passively and build their wealth over time.

4. M1 Finance

M1 Finance provides a unique approach to investing by allowing you to create customizable “pies,” which represent your investment portfolio. Each slice of the pie represents a different asset class, such as stocks, bonds, or real estate. You can adjust the size of each slice based on your investment strategy. M1 Finance offers fractional shares, automated investing, and a user-friendly interface.

5. Public

Public stands out with its social investing features. You can follow other investors and see what they are buying and selling. The app also provides educational content and insights from experts. Public offers a variety of investment options, including stocks, ETFs, and fractional shares. Its community-driven approach makes it a fun and engaging platform for beginners.

When choosing a stock market app, consider your investment goals, risk tolerance, and preferred investment style. Each app offers unique features and benefits, so it’s important to research and compare options before making a decision. Start small, learn the basics, and invest with confidence.

Advanced Trading Platforms for Experienced Investors

Navigating the complex world of financial markets demands sophisticated tools and platforms that empower investors to make informed decisions. Advanced trading platforms, specifically designed for seasoned investors, offer a comprehensive suite of features and functionalities to unlock their full potential. These platforms cater to the needs of traders seeking advanced technical analysis, real-time market data, and customizable trading experiences.

One of the key features of advanced trading platforms is their extensive technical analysis capabilities. They provide a wide array of indicators, charts, and tools that enable traders to identify trends, patterns, and potential trading opportunities. From moving averages and Bollinger Bands to MACD and RSI, these platforms offer a comprehensive arsenal of technical analysis instruments.

Another crucial aspect of these platforms is their real-time market data. Access to up-to-the-minute price quotes, news feeds, and economic indicators is paramount for informed trading decisions. Advanced trading platforms provide real-time data feeds from multiple sources, ensuring traders stay ahead of the curve and capitalize on market movements as they occur.

Customization is another defining characteristic of advanced trading platforms. They allow traders to personalize their trading experience by configuring their dashboards, charts, and alerts. This level of customization enables traders to tailor their platform to their specific trading style and preferences, creating an environment that optimizes their workflow.

Advanced trading platforms also often offer order types beyond the standard market and limit orders. These specialized orders provide traders with greater control and flexibility, allowing them to execute trades based on specific price levels, time frames, or other criteria. This empowers traders to manage their risk and maximize their potential returns.

Furthermore, advanced trading platforms often integrate with third-party tools and services, such as charting platforms, news aggregators, and portfolio management software. This integration enables traders to seamlessly connect their trading platform with their existing workflows, enhancing their overall trading experience.

For experienced investors seeking to take their trading to the next level, advanced trading platforms provide an indispensable toolset. Their comprehensive functionalities, from advanced technical analysis and real-time market data to customizable interfaces and order types, empower traders to make informed decisions, execute trades with precision, and achieve their investment goals.

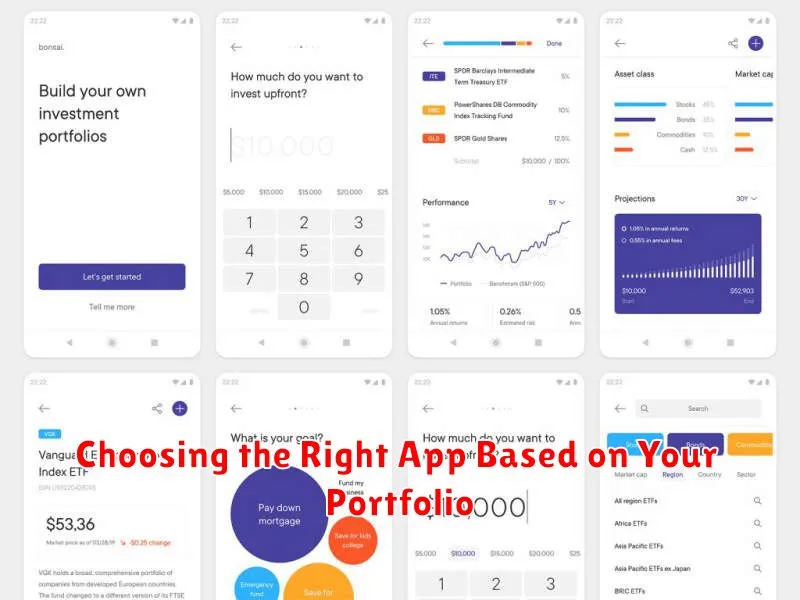

Choosing the Right App Based on Your Portfolio

In the world of freelancing and creative professions, a strong online presence is paramount. Your portfolio website serves as your digital calling card, showcasing your skills, experience, and unique style to potential clients. But with a plethora of portfolio apps available, choosing the right one can feel overwhelming. Fear not! This guide will help you navigate the landscape and select the perfect platform to showcase your best work.

First and foremost, consider your target audience. Who are you trying to attract? Are you a graphic designer seeking to connect with marketing agencies, or a photographer hoping to land clients for weddings and portraits? Understanding your audience will help you choose an app that aligns with their expectations and preferences.

Next, evaluate your portfolio needs. Do you require a simple platform to showcase your work, or do you need advanced features like e-commerce integration, blog functionality, or client management tools? Assess the complexity of your portfolio and choose an app that offers the necessary features without being overly complicated.

User-friendliness is another crucial factor. Some apps are designed for beginners, offering intuitive interfaces and drag-and-drop functionality. Others are more sophisticated, requiring technical expertise. Select an app that matches your comfort level and allows you to easily manage your content.

Customization is also essential. You want to ensure that your portfolio reflects your brand identity and resonates with your target audience. Look for apps that offer customizable templates, color schemes, and font options, allowing you to create a truly unique online presence.

Finally, consider pricing. Some portfolio apps offer free plans, while others require a paid subscription. Determine your budget and choose an app that provides the necessary features at a price point you can afford.

By carefully considering these factors, you can confidently choose the right app to showcase your portfolio and attract your dream clients.

Tips for Using Stock Market Apps Safely

Stock market apps are becoming increasingly popular, offering investors a convenient way to buy and sell stocks. However, it’s crucial to use these apps safely and responsibly. Here are some tips for protecting yourself and your investments when using stock market apps.

1. Choose Reputable Apps: Select apps from well-established and regulated brokers. Check reviews and ratings to ensure the app has a good track record and is secure.

2. Understand Security Measures: Look for apps that employ strong security features like two-factor authentication and encryption. This will help protect your account and financial information.

3. Be Wary of Scams: Beware of suspicious offers or unsolicited advice from unknown sources. Legitimate brokers will not reach out to you with investment recommendations unless you’ve initiated contact.

4. Limit Account Access: Grant access to your stock market app only on trusted devices. Avoid using public Wi-Fi for financial transactions.

5. Be Mindful of Trading Fees: Compare the fees charged by different apps. Some apps offer commission-free trading, while others charge per transaction. Understand the fee structure before making any trades.

6. Start Small: Begin with a small investment amount to test the app and your trading strategies. Avoid investing more than you can afford to lose.

7. Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversify your investments across different sectors and asset classes to reduce risk.

8. Don’t Chase Returns: Avoid making impulsive trades based on hype or short-term market fluctuations. Stick to your investment strategy and long-term goals.

9. Keep Records: Maintain records of all your trades, including dates, amounts, and brokerages. This will help you track your performance and identify any potential issues.

10. Seek Professional Advice: If you’re unsure about your investments or have any questions, consult with a qualified financial advisor.

Staying Updated on Market Trends and News

In today’s rapidly evolving business landscape, staying informed about market trends and news is crucial for success. A deep understanding of market dynamics, including consumer behavior, competitor actions, and technological advancements, enables businesses to make informed decisions, capitalize on opportunities, and mitigate risks.

Here are some effective strategies for staying updated on market trends and news:

1. Leverage Industry Publications and Websites

Numerous industry publications and websites provide valuable insights and analysis on market trends and news. Subscribe to newsletters, follow industry experts on social media, and regularly visit websites dedicated to your specific sector. This will keep you abreast of the latest developments, emerging technologies, and industry-specific challenges.

2. Attend Industry Events and Conferences

Industry events and conferences offer a unique opportunity to connect with peers, network with thought leaders, and gain firsthand insights into market trends. These events often feature keynote speakers, panel discussions, and workshops that provide valuable information and perspectives. Actively participate in discussions, ask questions, and connect with industry experts to expand your knowledge base.

3. Utilize Social Media Platforms

Social media platforms have become an important source of market intelligence. Follow industry influencers, thought leaders, and relevant companies on platforms such as Twitter, LinkedIn, and Facebook. Participate in industry-specific groups and forums to engage in discussions, share insights, and stay informed about current trends.

4. Monitor Competitor Activity

Keep a close eye on your competitors’ activities, including their product launches, marketing campaigns, and strategic initiatives. Analyze their website, social media presence, and news articles to gain insights into their strategies, target markets, and competitive advantages. Understanding your competitors’ moves will help you anticipate market shifts and develop effective counterstrategies.

5. Conduct Market Research

Formal market research provides in-depth insights into consumer preferences, market size, and competitive landscapes. Conducting surveys, focus groups, and data analysis can offer valuable data to support decision-making and strategic planning. Invest in market research tools and resources to access comprehensive and reliable data.

Staying updated on market trends and news is an ongoing process that requires consistent effort and a willingness to adapt. By implementing these strategies, businesses can gain a competitive edge, identify opportunities, and navigate the dynamic market landscape with confidence.

The Importance of Research and Due Diligence

In today’s fast-paced world, it’s easy to make decisions without conducting thorough research and due diligence. However, taking the time to gather information and assess potential risks is crucial for making informed decisions that can have a positive impact on your personal and professional life.

Research is the process of systematically gathering information about a topic or subject. It involves identifying relevant sources, analyzing the information, and drawing conclusions. Due diligence, on the other hand, is the process of investigating a potential investment or business opportunity to determine its feasibility and potential risks.

There are many benefits to conducting research and due diligence. It helps you to:

- Make informed decisions: By gathering information and assessing potential risks, you can make more informed decisions that are less likely to lead to negative consequences.

- Avoid costly mistakes: Thorough research and due diligence can help you to identify potential problems early on, which can save you time, money, and resources in the long run.

- Increase your chances of success: By carefully considering all aspects of a decision, you can increase your chances of achieving your goals.

- Build credibility: Conducting research and due diligence demonstrates your commitment to making sound decisions and shows that you are a responsible and reliable individual or organization.

There are many different methods of conducting research and due diligence. Some common approaches include:

- Online research: The internet provides access to a wealth of information, including articles, reports, databases, and more.

- Library research: Libraries offer a wide range of resources, including books, journals, and other materials.

- Interviews: Talking to experts in the field can provide valuable insights and perspectives.

- Site visits: Visiting a potential investment or business location can help you to gain a better understanding of the environment and operations.

The amount of research and due diligence required will vary depending on the situation. For example, a small personal investment may not require as much research as a major business acquisition. However, it is always important to take the time to gather sufficient information to make informed decisions.

Research and due diligence are essential tools for success in both personal and professional life. By taking the time to conduct thorough research and assess potential risks, you can make more informed decisions that can lead to positive outcomes.