Navigating the stock market can be daunting, especially in today’s volatile economy. But fear not, intrepid investors! This guide unveils the top stocks poised for success in 2024, helping you navigate the investment landscape with confidence. From burgeoning tech titans to established industry leaders, we’ve meticulously curated a list of promising companies primed for growth and profitability. Whether you’re a seasoned investor or just starting out, this comprehensive guide provides invaluable insights into the most lucrative investment opportunities of the year.

Get ready to discover hidden gems and market-beating returns! Our expert analysis delves into the factors driving these stocks’ success, including industry trends, competitive advantages, and strong fundamentals. We’ll examine their financial performance, growth prospects, and the potential for long-term value creation. By the end of this guide, you’ll be equipped with the knowledge to make informed decisions and build a portfolio that sets you up for financial success in 2024 and beyond.

Understanding Your Investment Goals and Risk Tolerance

Before you start investing, it’s important to understand your investment goals and risk tolerance. This will help you make smart decisions that align with your financial objectives. Without a solid understanding of these two key factors, you risk making choices that don’t serve you well and could lead to disappointment or even losses.

Investment goals are the financial objectives you hope to achieve through investing. They can be short-term, such as saving for a down payment on a house, or long-term, such as retiring comfortably. Here are some common investment goals:

- Retirement savings: This is one of the most common investment goals. Retirement planning should begin as early as possible to take advantage of compound interest.

- Education savings: Saving for your children’s college education is a significant financial goal for many families.

- Down payment on a house: Saving for a down payment on a house is a key step towards homeownership.

- Building an emergency fund: An emergency fund can provide financial security during unexpected events such as job loss, illness, or car repairs.

- Investing for growth: Some investors aim to grow their wealth over time by investing in stocks or other assets with the potential for higher returns.

Your risk tolerance refers to your ability and willingness to handle potential losses in your investments. It’s important to be honest with yourself about your risk tolerance, as it will help you choose investments that are appropriate for your personality and financial situation.

Here are some factors that influence your risk tolerance:

- Time horizon: The longer your time horizon, the more time you have to recover from potential losses. This generally allows you to take on more risk.

- Financial situation: Your income, savings, and debt levels can all affect your risk tolerance. Those with a more stable financial situation may be able to tolerate more risk.

- Personal circumstances: Your age, health, and family obligations can also influence your risk tolerance.

- Investment experience: Investors with more experience may feel more comfortable taking on risk.

- Personality: Some people are naturally risk-averse, while others are more comfortable with risk. It’s important to be aware of your own personality traits when making investment decisions.

Once you understand your investment goals and risk tolerance, you can start to develop an investment strategy. There are many different types of investments available, from stocks and bonds to real estate and precious metals. It is important to choose investments that align with your individual needs and goals.

Analyzing Market Trends and Economic Indicators

In the dynamic world of finance, understanding market trends and economic indicators is crucial for investors, traders, and businesses alike. These insights provide valuable information about the current state of the economy and potential future movements, enabling informed decision-making.

Market Trends refer to the overall direction and patterns observed in financial markets. This includes the performance of various asset classes, such as stocks, bonds, commodities, and currencies. Analyzing market trends involves identifying trends, patterns, and fluctuations to predict future movements and capitalize on opportunities. Techniques like technical analysis and fundamental analysis are employed to interpret market data and make informed decisions.

Economic Indicators are statistical measures that provide information about the health and performance of an economy. They offer valuable insights into various economic aspects, such as inflation, unemployment, GDP growth, and consumer confidence. By monitoring these indicators, investors and businesses can gauge the overall economic climate and its potential impact on financial markets.

Key Economic Indicators include:

- Gross Domestic Product (GDP): Measures the total value of goods and services produced in a country.

- Inflation Rate: Measures the rate at which prices for goods and services increase over time.

- Unemployment Rate: Measures the percentage of the labor force that is unemployed.

- Consumer Price Index (CPI): Measures changes in the prices of a basket of consumer goods and services.

- Interest Rates: The cost of borrowing money.

- Currency Exchange Rates: The value of one currency relative to another.

Understanding market trends and economic indicators is essential for making informed decisions in the financial world. By analyzing these insights, investors can identify potential opportunities, mitigate risks, and make sound investment strategies. This knowledge empowers individuals and businesses to navigate the complex world of finance with greater confidence.

Evaluating Company Performance: Key Financial Ratios to Consider

In the dynamic world of business, understanding a company’s financial health is crucial for making informed decisions, whether you’re an investor, creditor, or even a potential employee. While raw financial statements provide a snapshot of a company’s position, it’s the analysis of key financial ratios that truly illuminates its performance and potential.

Financial ratios act as powerful tools, allowing you to compare a company’s performance over time, against its competitors, or against industry benchmarks. They offer insights into various aspects of a company’s operations, including its profitability, liquidity, solvency, efficiency, and growth prospects.

Profitability Ratios: Gauging the Bottom Line

These ratios reveal how efficiently a company is generating profits from its operations. Some crucial profitability ratios include:

- Gross Profit Margin: Measures the percentage of revenue remaining after deducting the cost of goods sold. A higher margin indicates better control over production costs.

- Operating Profit Margin: Shows the percentage of revenue left after deducting operating expenses. A higher margin suggests efficient operations and cost management.

- Net Profit Margin: Represents the percentage of revenue remaining after all expenses, including taxes and interest, are deducted. It indicates overall profitability.

- Return on Equity (ROE): Measures how effectively a company utilizes shareholder equity to generate profits. A high ROE suggests efficient use of equity.

- Return on Assets (ROA): Indicates how efficiently a company uses its assets to generate profits. A high ROA suggests effective asset management.

Liquidity Ratios: Assessing Short-Term Obligations

Liquidity ratios assess a company’s ability to meet its short-term financial obligations. Key liquidity ratios include:

- Current Ratio: Measures the company’s ability to pay its current liabilities using its current assets. A ratio greater than 1 suggests ample liquidity.

- Quick Ratio (Acid Test): Similar to the current ratio, but excludes inventory from current assets, providing a more conservative measure of liquidity.

- Cash Ratio: Calculates the ratio of cash and cash equivalents to current liabilities, offering the most stringent measure of liquidity.

Solvency Ratios: Assessing Long-Term Financial Health

Solvency ratios determine a company’s ability to meet its long-term financial obligations. Key solvency ratios include:

- Debt-to-Equity Ratio: Shows the proportion of debt financing compared to equity financing. A higher ratio suggests greater reliance on debt, potentially increasing financial risk.

- Times Interest Earned (TIE) Ratio: Measures the company’s ability to cover interest expenses with its earnings before interest and taxes (EBIT). A higher ratio indicates greater financial stability.

- Debt-to-Asset Ratio: Indicates the percentage of a company’s assets financed by debt. A higher ratio suggests higher leverage and potential financial risk.

Efficiency Ratios: Examining Operational Efficiency

Efficiency ratios gauge how efficiently a company uses its resources to generate sales and profits. Key efficiency ratios include:

- Inventory Turnover Ratio: Measures the number of times a company sells its inventory during a specific period. A higher turnover suggests efficient inventory management.

- Days Sales Outstanding (DSO): Calculates the average time it takes a company to collect payments from customers. A shorter DSO indicates efficient credit management.

- Asset Turnover Ratio: Measures the efficiency of a company’s asset utilization in generating sales. A higher ratio suggests better asset utilization.

Growth Ratios: Identifying Expansion and Sustainability

Growth ratios provide insights into a company’s growth trajectory and sustainability. Key growth ratios include:

- Sales Growth Rate: Measures the percentage change in a company’s revenue over time. A consistent growth rate suggests healthy business expansion.

- Earnings Per Share (EPS) Growth Rate: Indicates the percentage change in a company’s earnings per share over time. A strong growth rate suggests increasing profitability.

- Book Value Per Share Growth Rate: Measures the percentage change in a company’s book value per share over time. A growing book value indicates shareholder value creation.

Using Financial Ratios Effectively

Financial ratios are powerful tools, but they are most effective when used in conjunction with other financial information and industry context. Consider these tips for maximizing their value:

- Compare ratios over time: Analyze trends in ratios to identify potential areas of improvement or risk.

- Benchmark against competitors: Compare ratios to those of similar companies to gauge relative performance.

- Consider industry averages: Compare ratios to industry benchmarks to understand a company’s position within its sector.

- Analyze ratios in context: Don’t rely on single ratios alone. Consider the interplay of different ratios and underlying business factors.

By understanding and utilizing these key financial ratios, you can gain a more comprehensive understanding of a company’s performance, its strengths and weaknesses, and its potential for future success.

The Role of Sector Rotation in Portfolio Diversification

In the ever-evolving landscape of financial markets, investors constantly seek strategies to enhance portfolio performance and mitigate risks. One such strategy that has gained significant attention is sector rotation. Sector rotation involves strategically shifting investments between different industry sectors based on economic conditions, market trends, and other relevant factors.

The fundamental premise behind sector rotation is that various industries perform differently throughout the economic cycle. During periods of economic expansion, sectors like technology, consumer discretionary, and financials tend to outperform, while sectors like utilities and staples may lag. Conversely, during economic downturns, defensive sectors such as healthcare, utilities, and consumer staples may offer greater stability.

By strategically rotating investments between sectors, investors aim to capitalize on the relative outperformance of different industries at different points in the economic cycle. This approach can potentially enhance returns while reducing portfolio volatility. For example, during periods of economic uncertainty, investors might rotate out of growth-oriented sectors and into more defensive ones, aiming to preserve capital and minimize downside risk.

While sector rotation can be a valuable tool in portfolio diversification, it is essential to approach it with caution. Several factors can influence the success of this strategy, including:

Factors Influencing Sector Rotation

- Economic Conditions: The overall health of the economy plays a significant role in sector performance.

- Interest Rates: Rising interest rates can negatively impact sectors like technology and financials, while lower rates may favor sectors like utilities and real estate.

- Industry Trends: Technological advancements, regulatory changes, and consumer preferences can influence the performance of specific sectors.

- Market Sentiment: Investor sentiment and expectations can drive sector movements, sometimes leading to overreactions.

Sector rotation is not without its challenges. Identifying the optimal timing for sector shifts can be difficult, and market timing errors can negatively impact portfolio performance. Additionally, sector rotation requires a deep understanding of industry dynamics, economic indicators, and market trends.

It’s important to note that sector rotation is not a guarantee of success. Market conditions are constantly changing, and what works in one economic cycle may not work in another. Therefore, investors should carefully consider their investment objectives, risk tolerance, and time horizon before implementing any sector rotation strategy.

Emerging Industries and Disruptive Technologies Shaping the Future

The world is in a constant state of flux, driven by the rapid evolution of technology and the emergence of new industries. These transformative forces are reshaping our lives, economies, and the very fabric of society. From artificial intelligence (AI) to the metaverse, these emerging trends are poised to redefine the future.

Artificial Intelligence (AI) is rapidly transforming industries, from healthcare and finance to transportation and manufacturing. AI-powered systems are revolutionizing tasks like diagnostics, fraud detection, and autonomous driving. As AI continues to evolve, it is expected to create new jobs, increase productivity, and enhance our lives in countless ways.

The Metaverse, a collective term for immersive digital experiences that blend virtual and augmented reality, is another emerging trend with the potential to revolutionize how we work, play, and interact. From virtual concerts and conferences to online gaming and shopping experiences, the metaverse promises to offer a new level of engagement and immersion.

Blockchain technology, the foundation of cryptocurrencies like Bitcoin, is transforming industries by enabling secure and transparent transactions. Blockchain’s decentralized nature is creating new opportunities in finance, supply chain management, and other sectors. As blockchain technology matures, it is expected to play an increasingly significant role in shaping the future economy.

Sustainable technologies are becoming increasingly vital as the world confronts the climate crisis. Renewable energy sources, energy-efficient technologies, and carbon capture technologies are all playing a crucial role in mitigating climate change. As these technologies advance, they are expected to create new jobs, drive innovation, and help us build a more sustainable future.

Biotechnology and genetic engineering are pushing the boundaries of medicine and agriculture. CRISPR technology, for example, allows scientists to edit genes with unprecedented precision, opening up new possibilities for treating diseases and developing new therapies. Advancements in biotechnology are also revolutionizing agriculture, leading to more resilient crops and sustainable farming practices.

These emerging industries and disruptive technologies are reshaping the world at an unprecedented pace. It is essential to stay informed about these trends, adapt to the changing landscape, and leverage these advancements to create a more prosperous and sustainable future for all.

Top Stocks in Technology: Riding the Wave of Innovation

The technology sector continues to be a powerhouse of growth and innovation, attracting investors seeking to capitalize on its transformative potential. As we navigate the ever-evolving landscape, identifying the top stocks in technology becomes paramount. These companies are at the forefront of groundbreaking advancements, shaping industries and driving economic progress.

1. Apple (AAPL): The Tech Titan

Apple, a household name synonymous with innovation, has consistently delivered impressive returns. Its strong brand loyalty, expansive ecosystem, and diversified product portfolio, from iPhones and Macs to wearables and services, continue to fuel its growth. As Apple expands its reach into new markets, its stock remains a compelling investment opportunity.

2. Microsoft (MSFT): Cloud Computing Powerhouse

Microsoft has transformed itself into a dominant force in the cloud computing space. Its Azure platform, offering a wide range of services from storage and computing to artificial intelligence, powers businesses globally. Microsoft’s strong cash flow and consistent dividend payouts make it an attractive investment for both growth and income-seeking investors.

3. Amazon (AMZN): E-commerce Giant and Beyond

Amazon, the undisputed king of e-commerce, has become a behemoth in retail, cloud computing (AWS), and entertainment. Its extensive network, vast customer base, and aggressive expansion into new markets position it for continued growth. Despite its size, Amazon remains an innovative force, pushing boundaries in various sectors.

4. Alphabet (GOOGL): The Search and AI Leader

Alphabet, the parent company of Google, dominates the search and advertising landscape. Its search engine, YouTube, and other platforms generate vast revenue streams. Furthermore, Alphabet is making significant strides in artificial intelligence, self-driving cars, and other cutting-edge technologies, positioning it for future growth.

5. Tesla (TSLA): Electric Vehicle Revolution

Tesla has emerged as a leader in the electric vehicle revolution, disrupting the traditional automotive industry. Its innovative technology, sleek designs, and growing production capacity have fueled its rapid growth. While Tesla faces competition, its commitment to sustainability and technological advancement makes it a stock worth considering.

Investing in technology stocks can be both rewarding and volatile. It’s essential to conduct thorough research, understand the risks, and develop a well-defined investment strategy. By carefully selecting companies at the forefront of innovation, investors can potentially ride the wave of technological advancement and reap substantial returns.

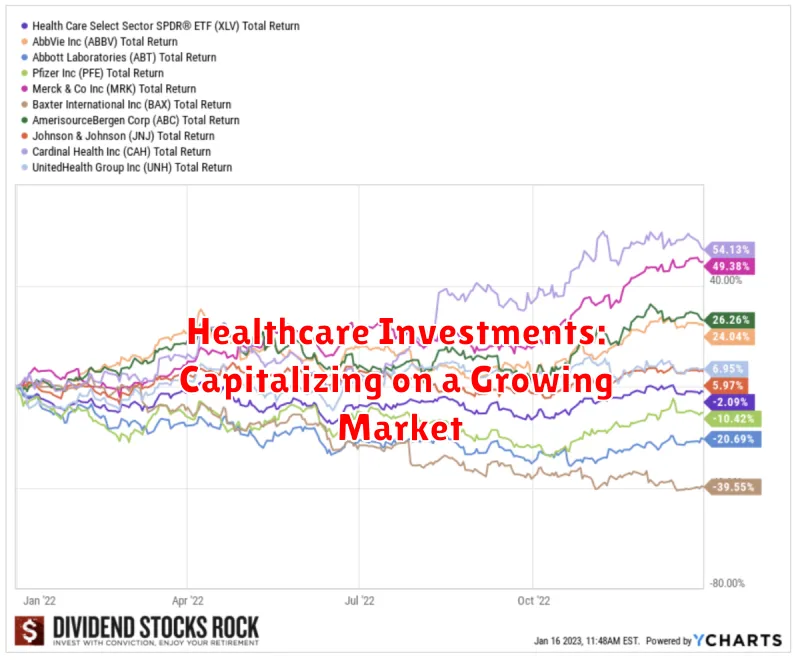

Healthcare Investments: Capitalizing on a Growing Market

The healthcare industry is a vast and ever-evolving landscape, consistently presenting both challenges and opportunities. As the global population ages and demands for quality care escalate, the healthcare market presents a compelling arena for investors. This article will delve into the key drivers of growth within the healthcare sector, spotlighting the most promising investment avenues and providing insights to navigate this dynamic landscape.

Understanding the Healthcare Market

The healthcare market is a complex ecosystem encompassing numerous subsectors, each with its own unique dynamics. Key areas of focus include:

- Pharmaceuticals: Developing and distributing drugs to address a wide range of health concerns, from chronic diseases to rare conditions.

- Biotechnology: Leveraging advancements in biology and genetics to create innovative therapies and diagnostic tools.

- Medical Devices: Designing and manufacturing medical equipment ranging from imaging systems to implantable devices.

- Healthcare Services: Providing a spectrum of medical services, including hospitals, clinics, and home healthcare.

- Healthcare IT: Developing software and technology solutions to enhance efficiency and improve patient care.

Key Drivers of Growth

Several factors are propelling the healthcare market forward, creating a favorable environment for investment:

- Aging Population: Globally, the population is aging, resulting in increased demand for healthcare services, particularly for chronic disease management.

- Rising Healthcare Expenditure: As people live longer and require more medical attention, healthcare spending continues to rise across the world.

- Technological Advancements: Breakthroughs in areas like genomics, artificial intelligence, and telemedicine are revolutionizing healthcare delivery and treatment options.

- Focus on Prevention and Wellness: A growing emphasis on preventive care and wellness programs is driving investment in healthcare technologies and services aimed at maintaining good health.

Investing in Healthcare

Several avenues exist for investors to capitalize on the growth potential of the healthcare sector:

- Publicly Traded Stocks: Investing in healthcare companies listed on stock exchanges provides exposure to a diverse range of businesses.

- Mutual Funds and ETFs: These funds diversify investment portfolios by pooling money from multiple investors to buy a basket of healthcare stocks.

- Venture Capital: Funding early-stage healthcare companies with high growth potential, typically through specialized venture capital firms.

- Real Estate Investment Trusts (REITs): Investing in healthcare real estate, such as hospitals, clinics, and medical office buildings.

Challenges and Considerations

While the healthcare market offers significant growth opportunities, investors should be aware of potential challenges:

- Regulatory Landscape: Navigating the complex regulatory environment governing healthcare can be challenging for investors.

- Competition: The healthcare industry is highly competitive, with numerous players vying for market share.

- Cost Containment: Healthcare costs are a major concern for governments and payers, leading to pressure on pricing and reimbursement.

- Innovation Risk: Investing in healthcare technologies and therapies involves inherent risk, as not all innovations succeed.

Conclusion

The healthcare market is a dynamic and promising sector, offering diverse investment opportunities. Understanding the key growth drivers, exploring various investment avenues, and considering potential challenges are essential for navigating this evolving landscape. By carefully assessing investment options and adopting a long-term perspective, investors can capitalize on the growth potential of the healthcare sector and contribute to advancing the field of medicine.

Sustainable Investing: Profiting from Responsible Businesses

Sustainable investing, also known as responsible investing or impact investing, has gained significant traction in recent years. This approach goes beyond traditional financial considerations, incorporating environmental, social, and governance (ESG) factors into investment decisions. By aligning investments with ethical values and long-term sustainability, investors aim to generate both financial returns and positive societal impact.

The Rise of ESG Factors

ESG factors encompass a wide range of criteria that reflect a company’s environmental performance, social responsibility, and corporate governance practices. Environmental factors include a company’s carbon footprint, water usage, and waste management practices. Social considerations encompass labor rights, human rights, and community engagement. Governance focuses on factors such as board composition, executive compensation, and anti-corruption policies.

Benefits of Sustainable Investing

Sustainable investing offers numerous benefits for both individual and institutional investors:

- Positive Impact: By investing in companies that prioritize sustainability, investors contribute to positive social and environmental change.

- Long-Term Value: Companies with strong ESG practices often exhibit greater financial stability and long-term value creation.

- Risk Mitigation: Incorporating ESG factors into investment analysis can help identify companies with potential sustainability risks, reducing portfolio exposure.

- Improved Reputation: Sustainable investors often attract a more positive reputation, aligning with growing consumer and stakeholder demand for responsible business practices.

Types of Sustainable Investments

Sustainable investing encompasses a variety of approaches:

- ESG Integration: Incorporating ESG factors into traditional investment analysis and decision-making processes.

- Impact Investing: Investing with the explicit goal of generating positive social and environmental impact alongside financial returns.

- Exclusionary Screening: Avoiding investments in companies involved in activities considered harmful, such as fossil fuels, tobacco, or weapons manufacturing.

- Positive Screening: Investing in companies that demonstrate strong ESG performance and contribute to positive societal outcomes.

Investing in a Sustainable Future

Sustainable investing is more than just a trend; it’s a fundamental shift towards a more ethical and responsible approach to investing. By aligning financial goals with positive societal impact, investors can contribute to a more sustainable and equitable future while generating competitive returns.

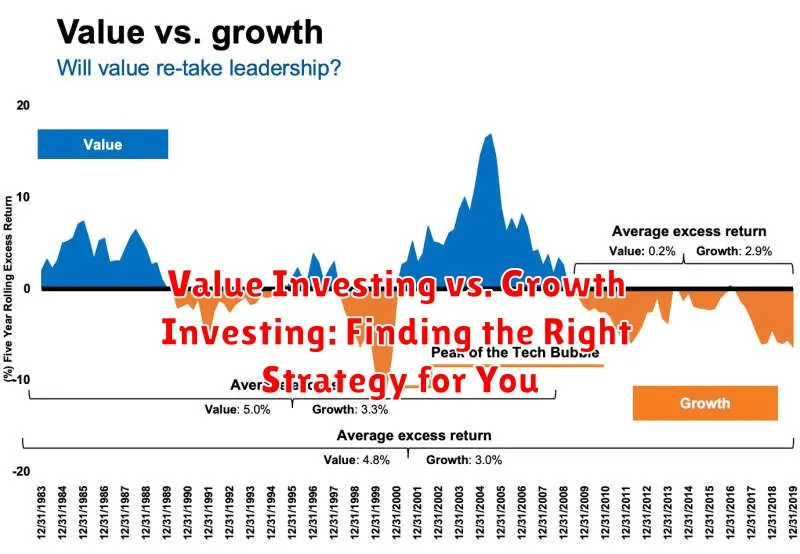

Value Investing vs. Growth Investing: Finding the Right Strategy for You

In the world of finance, there are two main approaches to investing: value investing and growth investing. Both strategies have their own set of merits and drawbacks, and choosing the right one for you depends on your individual financial goals, risk tolerance, and investment horizon.

What is Value Investing?

Value investing, as the name suggests, focuses on identifying and purchasing undervalued stocks. Value investors look for companies that are trading below their intrinsic value, often due to temporary market sentiment or overlooked fundamentals. They believe that the market will eventually recognize the true worth of these companies, leading to price appreciation. This strategy often involves looking at financial ratios like the price-to-earnings ratio (P/E) and price-to-book ratio (P/B) to identify undervalued stocks.

What is Growth Investing?

Growth investing, on the other hand, prioritizes investing in companies with high growth potential. These companies are typically expected to have above-average earnings growth rates and are often operating in rapidly expanding industries. Growth investors are willing to pay a premium for these companies, expecting their future growth to justify the higher price. They tend to focus on factors like revenue growth, market share, and innovation potential.

Key Differences Between Value and Growth Investing

Here’s a table highlighting the key differences between value and growth investing:

| Factor | Value Investing | Growth Investing |

|---|---|---|

| Focus | Undervalued stocks | High-growth companies |

| Investment Criteria | Financial ratios, dividend yield, low debt-to-equity ratio | Revenue growth, market share, innovation |

| Risk Tolerance | Lower | Higher |

| Investment Horizon | Longer-term | Shorter-term |

Which Strategy is Right for You?

The best strategy for you depends on your individual circumstances. Here are some factors to consider:

- Risk Tolerance: Value investing is generally considered less risky than growth investing, as undervalued stocks tend to be more stable. If you’re risk-averse, value investing may be a better fit.

- Investment Horizon: Value investing often involves holding stocks for the long term, as it takes time for the market to recognize the true value of undervalued companies. Growth investing, on the other hand, may require a shorter investment horizon, as high-growth companies can experience rapid changes in valuation.

- Financial Goals: If your goal is to generate steady income and capital appreciation over the long term, value investing may be a good choice. If you’re looking for rapid growth potential, growth investing may be more suitable.

Ultimately, the decision of whether to pursue value or growth investing is a personal one. It’s important to carefully consider your own financial goals, risk tolerance, and investment horizon before making a decision.

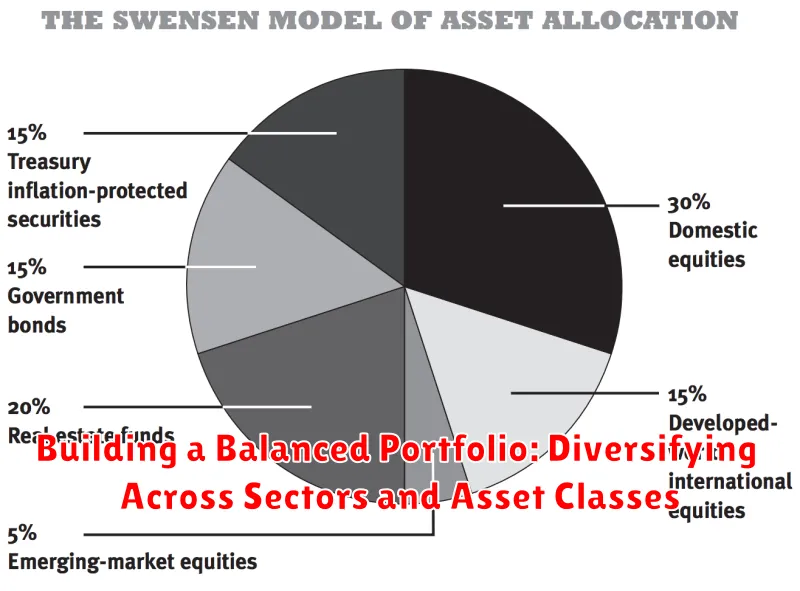

Building a Balanced Portfolio: Diversifying Across Sectors and Asset Classes

In the realm of investing, a well-structured portfolio is the bedrock of financial success. It’s not just about chasing high returns; it’s about mitigating risk and ensuring long-term growth. A key principle in building a robust portfolio is diversification – spreading your investments across various sectors and asset classes. This strategy helps to reduce the impact of any single investment’s underperformance and enhances the overall resilience of your portfolio.

Diversification by Sector

Investing in different sectors of the economy provides exposure to various industries and their respective growth potential. For instance, allocating a portion of your portfolio to technology, healthcare, consumer staples, and energy can create a balanced mix. Each sector has its own cyclical nature and growth drivers, allowing you to capitalize on different economic trends.

Diversification by Asset Class

Beyond sectors, diversifying across asset classes is crucial. Stocks, bonds, real estate, and commodities offer different risk-return profiles and respond differently to market fluctuations. Stocks are generally considered riskier but have the potential for higher returns, while bonds are considered safer but offer lower returns. Real estate can provide diversification and potential for appreciation, while commodities like gold can act as a hedge against inflation.

Benefits of Diversification

- Reduced Risk: Diversification lowers the overall risk of your portfolio by reducing the impact of any single investment’s underperformance.

- Enhanced Returns: By investing in different sectors and asset classes, you can capture a wider range of market opportunities and potentially increase your overall returns.

- Stability During Market Volatility: A diversified portfolio can help to mitigate the effects of market fluctuations, providing greater stability during volatile periods.

- Long-Term Growth: Over the long term, diversification allows you to capitalize on different economic cycles and growth drivers, contributing to sustainable portfolio growth.

Tips for Building a Diversified Portfolio

- Define Your Risk Tolerance: Determine your comfort level with risk and investment volatility before making any decisions.

- Set Clear Investment Goals: Establish specific financial goals, such as retirement planning or buying a home, to guide your portfolio allocation.

- Conduct Thorough Research: Before investing in any sector or asset class, conduct thorough research to understand its historical performance, current trends, and potential risks.

- Seek Professional Advice: Consider consulting a financial advisor to get personalized guidance on building a diversified portfolio that meets your specific needs and goals.

Building a balanced portfolio is an ongoing process that requires careful planning, diversification, and regular monitoring. By diversifying across sectors and asset classes, you can enhance your portfolio’s resilience, mitigate risk, and potentially achieve your financial goals.