The world of cryptocurrency is rapidly expanding, presenting both exciting opportunities and potential risks. If you’re a beginner looking to dip your toes into the crypto market, it’s crucial to navigate the frontier with a strategic approach. This guide will equip you with essential investment tips that can help you make informed decisions and protect your assets.

From understanding the basics of blockchain technology to identifying reliable exchanges and diversifying your portfolio, we’ll cover the key aspects of navigating the crypto landscape. Whether you’re seeking long-term growth or short-term profits, our insights can help you achieve your crypto investment goals.

Understanding the Basics of Cryptocurrency

In today’s digital age, it is impossible to ignore the rise of cryptocurrency. This new form of digital currency has taken the world by storm, capturing the attention of investors, businesses, and individuals alike. While the concept may seem complex at first, understanding the basics is crucial for anyone who wants to navigate the world of crypto. In this article, we will delve into the fundamentals of cryptocurrency, exploring its key features, benefits, and potential risks.

At its core, cryptocurrency is a digital asset designed to work as a medium of exchange. Unlike traditional fiat currencies, which are controlled by central banks, cryptocurrencies operate on a decentralized network, meaning they are not subject to government regulation or control. This decentralization is made possible through the use of cryptography, a complex system of mathematical algorithms that secure transactions and prevent counterfeiting.

One of the most well-known cryptocurrencies is Bitcoin, which was created in 2008 by an anonymous individual or group known as Satoshi Nakamoto. Bitcoin’s success has paved the way for the development of thousands of other cryptocurrencies, collectively known as altcoins. Each cryptocurrency has its unique characteristics and functionalities, catering to specific needs and applications.

The technology underpinning cryptocurrency is known as blockchain. A blockchain is a distributed, public ledger that records all transactions in a secure and transparent manner. Each block in the chain contains a timestamp, transaction details, and a cryptographic hash of the previous block. This interconnected structure ensures the integrity of the data and prevents tampering or fraud.

Cryptocurrencies offer a range of benefits, including:

- Decentralization: No single entity controls the network, making it resistant to censorship and government interference.

- Transparency: All transactions are recorded on the public blockchain, ensuring transparency and accountability.

- Security: Cryptographic algorithms protect transactions from unauthorized access and manipulation.

- Accessibility: Cryptocurrency can be accessed by anyone with an internet connection, regardless of location.

- Faster and cheaper transactions: Transactions can be processed quickly and at a lower cost compared to traditional financial systems.

However, it’s important to acknowledge that cryptocurrency also presents potential risks:

- Volatility: Cryptocurrency prices can fluctuate significantly, leading to potential losses for investors.

- Security risks: Cryptocurrency wallets can be hacked or stolen, resulting in the loss of funds.

- Lack of regulation: The decentralized nature of cryptocurrency makes it difficult to regulate and can expose users to fraud or scams.

- Environmental concerns: The energy consumption associated with mining some cryptocurrencies has raised environmental concerns.

As cryptocurrency continues to evolve, it is essential to stay informed and understand the potential benefits and risks involved. By gaining a solid understanding of the fundamentals, individuals can make informed decisions about whether or not to invest in this innovative technology.

Choosing the Right Cryptocurrency Exchange

In the rapidly evolving world of cryptocurrency, selecting the right exchange platform is crucial for any investor. With a plethora of options available, navigating this landscape can be overwhelming. This guide will provide a comprehensive overview of factors to consider when choosing the right cryptocurrency exchange for your needs.

Security

Security is paramount when dealing with digital assets. Look for exchanges that prioritize user security with robust measures such as:

- Two-factor authentication (2FA): This adds an extra layer of security by requiring a code from your phone or email in addition to your password.

- Cold storage: A significant portion of the exchange’s cryptocurrency holdings should be stored offline in cold wallets, making them less susceptible to hacking.

- Regular security audits: Reputable exchanges undergo regular security audits by independent third parties to ensure the integrity of their systems.

Fees

Fees can significantly impact your profits, so it’s essential to compare the fee structures of different exchanges. Consider:

- Trading fees: These are charged on every trade you make, typically expressed as a percentage of the transaction amount.

- Withdrawal fees: These are charged when you withdraw your cryptocurrency from the exchange to your personal wallet.

- Deposit fees: Some exchanges may charge fees for depositing funds, especially through certain methods.

Coin Selection

Ensure the exchange offers the cryptocurrencies you are interested in trading. Consider the following:

- Popular coins: The exchange should support major cryptocurrencies like Bitcoin, Ethereum, and Litecoin.

- Altcoins: If you are interested in alternative coins, check if the exchange offers a wide selection of altcoins.

- New listings: Some exchanges prioritize listing new and upcoming cryptocurrencies, providing opportunities for early investment.

User Interface and Experience

A user-friendly interface can significantly enhance your trading experience. Look for an exchange that is:

- Intuitive: The platform should be easy to navigate and understand, even for beginners.

- Mobile-friendly: A mobile app allows you to trade on the go and stay updated on market movements.

- Responsive customer support: Reliable customer support is essential to address any questions or issues you may encounter.

Regulations and Compliance

Consider the regulatory environment of the exchange. Choose a platform that operates in compliance with local laws and regulations, ensuring a safer and more secure trading environment.

Conclusion

Choosing the right cryptocurrency exchange involves careful consideration of several factors, including security, fees, coin selection, user experience, and regulatory compliance. By taking the time to research and compare different platforms, you can find an exchange that meets your specific needs and empowers you to confidently navigate the world of cryptocurrency.

The Importance of Research and Due Diligence

In today’s fast-paced world, it’s easy to get caught up in the excitement of new opportunities and make decisions without proper research and due diligence. However, this can lead to costly mistakes and missed opportunities.

Research and due diligence are essential for informed decision-making and ensuring that you’re making the best choices for your business or personal life.

Research is the process of gathering information and analyzing it to understand a particular topic or situation. This can involve reading articles, conducting surveys, interviewing experts, and collecting data from various sources.

Due diligence is a more thorough process that involves conducting a comprehensive investigation into a specific opportunity or investment. This can include reviewing financial statements, conducting background checks, and assessing legal and regulatory risks.

Benefits of Research and Due Diligence

There are numerous benefits to conducting thorough research and due diligence before making decisions. These include:

- Reduced risk: By understanding the potential risks and challenges involved, you can make more informed decisions that minimize your exposure to negative outcomes.

- Improved decision-making: Research and due diligence provide you with the information you need to make sound and informed decisions.

- Increased confidence: When you’ve done your homework, you’ll feel more confident in your decisions and be less likely to second-guess yourself.

- Enhanced reputation: A reputation for being thorough and diligent can help you build trust and credibility with clients, partners, and stakeholders.

Tips for Effective Research and Due Diligence

Here are some tips for conducting effective research and due diligence:

- Define your goals and objectives: What are you trying to achieve with your research? What questions are you trying to answer?

- Identify your sources: Where will you find the information you need? Who are the experts in this field?

- Be objective and unbiased: Don’t let your personal biases or preconceived notions influence your research.

- Verify your information: Don’t rely on just one source of information. Cross-check your findings with multiple sources to ensure accuracy.

- Document your findings: Keep detailed records of your research process and findings for future reference.

Starting Small and Diversifying Your Portfolio

Investing can be a daunting task, especially for beginners. The idea of putting your hard-earned money into the market can be scary, and it’s easy to feel overwhelmed by all the different options available. But the truth is, you don’t need a lot of money to start investing. In fact, you can start small and gradually build your portfolio over time.

One of the best ways to get started is to invest in a mutual fund or exchange-traded fund (ETF). These funds allow you to diversify your portfolio by investing in a basket of stocks or bonds. This means you’re not putting all your eggs in one basket, which can help to reduce your risk.

You can also start by investing in individual stocks, but it’s important to do your research and only invest in companies you understand and believe in. You can use resources like Morningstar or Yahoo Finance to research companies and find out their financial performance.

Another important aspect of investing is diversification. Don’t just invest in one type of asset, like stocks. Spread your money across different asset classes, such as bonds, real estate, and commodities. This will help to reduce your risk and potentially increase your returns over time.

Remember, investing is a marathon, not a sprint. Don’t expect to get rich quick. Be patient and focus on building a solid portfolio that can grow over the long term. The key is to start small, diversify, and stay consistent with your investing plan.

Setting Realistic Investment Goals

Investing can be a daunting task, especially for beginners. With so many different options available, it can be overwhelming to know where to start and how to set realistic goals. It’s crucial to understand your financial situation, investment horizon, and risk tolerance before setting any goals. Here are some key steps to setting realistic investment goals that align with your financial aspirations and provide a solid foundation for your investment journey.

1. Define Your Financial Goals

Start by clearly defining your financial objectives. What are you saving for? Do you want to buy a home, retire comfortably, or save for your children’s education? Be specific and quantify your goals. For example, instead of saying “I want to retire early,” say “I want to retire at age 55 with a nest egg of $2 million.” Having specific goals will help you stay motivated and track your progress.

2. Determine Your Investment Horizon

Your investment horizon is the length of time you plan to invest your money. This is an important factor to consider because it influences your risk tolerance. If you have a long investment horizon, you can afford to take on more risk, as you have more time to recover from any potential losses. Conversely, if you have a short investment horizon, you may want to invest in less risky assets. For example, if you’re saving for retirement in 30 years, you can potentially invest in stocks, which have historically provided higher returns than bonds. However, if you’re saving for a down payment on a house in five years, you may want to invest in bonds or other less risky assets.

3. Assess Your Risk Tolerance

Your risk tolerance is your ability to withstand fluctuations in the value of your investments. If you are risk-averse, you may prefer to invest in lower-risk assets like bonds or money market accounts. On the other hand, if you are comfortable with risk, you may be willing to invest in stocks or other higher-risk assets that have the potential for higher returns. Understanding your risk tolerance is crucial for making investment decisions that align with your comfort level.

4. Consider Your Current Financial Situation

Before setting investment goals, it’s essential to assess your current financial situation. This includes your income, expenses, debts, and savings. This information will help you determine how much money you can realistically allocate to investing. If you have high debt levels, it may be advisable to focus on debt repayment before investing. However, if you have a good handle on your finances, you can start setting realistic investment goals based on your current income and savings rate.

5. Research and Plan Your Investment Strategy

Once you have defined your goals, determined your investment horizon, and assessed your risk tolerance, you need to develop an investment strategy. This involves researching different investment options, such as stocks, bonds, mutual funds, ETFs, and real estate. You can consult with a financial advisor or do your own research online. Based on your goals, risk tolerance, and investment horizon, you can choose a portfolio of investments that aligns with your needs.

6. Monitor and Adjust Your Goals Regularly

It’s important to regularly monitor your investment progress and adjust your goals as needed. Life circumstances can change, such as a job loss, a change in family size, or an unexpected expense. You may need to adjust your investment goals to reflect these changes. It’s also important to re-evaluate your risk tolerance and investment strategy periodically to ensure it still aligns with your current situation.

7. Be Patient and Stay Disciplined

Investing is a long-term game. Don’t expect to get rich quick. Be patient and stay disciplined with your investment strategy. There will be market ups and downs, but over time, if you invest wisely, you should see positive returns. Avoid making emotional investment decisions and stick to your long-term goals.

Setting realistic investment goals is an essential step towards achieving your financial aspirations. By following these steps, you can create a solid foundation for your investment journey and work towards a more secure financial future. Remember to be patient, stay disciplined, and consult with a financial advisor if you need help developing an investment strategy. With a well-defined plan, you can confidently pursue your investment goals and reach your financial objectives.

Securing Your Cryptocurrency Investments: Wallets and Security Best Practices

In the dynamic world of cryptocurrency, security is paramount. With the rise of digital assets, safeguarding your investments is crucial to protect your hard-earned funds. This guide delves into the essential aspects of securing your cryptocurrency, focusing on wallets and best security practices.

Cryptocurrency wallets are digital containers that store your private keys, granting you access to your cryptocurrency holdings. Understanding the different types of wallets and their security features is vital.

Types of Cryptocurrency Wallets

The cryptocurrency wallet landscape offers a diverse range of options, each catering to specific needs and security preferences. Here’s a breakdown of the most common types:

1. Hot Wallets

Hot wallets are connected to the internet and provide quick and easy access to your cryptocurrency. Examples include:

- Web wallets: Accessed through a web browser, offering convenience but potentially exposing you to vulnerabilities if the website is compromised.

- Mobile wallets: Accessible on your smartphone or tablet, offering portability but requiring robust mobile security measures.

- Desktop wallets: Software installed on your computer, providing greater control but susceptible to malware and phishing attacks.

2. Cold Wallets

Cold wallets are offline devices that store your private keys securely, making them highly resistant to hacking attempts. Examples include:

- Hardware wallets: Physical devices like Ledger Nano S and Trezor, offering the highest level of security but requiring careful handling.

- Paper wallets: Printed pieces of paper containing your private keys, offering offline storage but prone to damage or loss.

Security Best Practices for Cryptocurrency Investments

While choosing the right wallet type is essential, it’s equally critical to adopt comprehensive security practices to protect your cryptocurrency:

1. Strong Passwords and Two-Factor Authentication (2FA)

Use complex and unique passwords for all your cryptocurrency accounts and wallets. Enable 2FA, which adds an extra layer of security by requiring a code from your phone or email in addition to your password.

2. Secure Storage and Backup

Store your private keys and backup information securely. For hardware wallets, keep the device in a safe location. For paper wallets, store them in a fireproof and waterproof container. Regularly back up your wallets to prevent data loss.

3. Beware of Phishing Scams

Be wary of phishing emails, websites, and messages that try to trick you into revealing your private keys or login credentials. Verify the authenticity of any communication before clicking on links or providing personal information.

4. Regular Security Audits

Periodically review your security settings and ensure that all your devices and accounts are protected with the latest security updates and patches.

5. Limit Access to Your Wallet

Avoid sharing your private keys with anyone, including family or friends. Be cautious when accessing your wallet from public computers or Wi-Fi networks.

Choosing the Right Wallet for You

The best wallet for you depends on your specific needs and risk tolerance. Consider the following factors:

- Frequency of Use: If you frequently trade cryptocurrency, a hot wallet might be suitable. For long-term storage, a cold wallet offers greater security.

- Security Needs: The level of security you require depends on the value of your cryptocurrency holdings. Hardware wallets offer the highest level of security, while web wallets are more vulnerable to hacking.

- Ease of Use: Mobile wallets offer convenience, while hardware wallets might require a steeper learning curve.

By understanding the different types of wallets and implementing strong security practices, you can significantly reduce the risk of losing your cryptocurrency investments. Stay vigilant, stay informed, and protect your digital assets.

The Role of Risk Management in Crypto Trading

The cryptocurrency market is known for its high volatility and potential for both significant gains and losses. This volatility is what attracts many investors to the space, but it also makes it crucial to implement a sound risk management strategy. Risk management in crypto trading is not just about limiting losses, it’s about maximizing your chances of long-term success.

Why Risk Management Matters

Here’s why risk management is critical for crypto traders:

- Preserving Capital: The most important aspect of risk management is protecting your investment. By setting limits and using stop-loss orders, you can prevent significant losses if the market moves against you.

- Emotional Control: Cryptocurrency markets can be highly emotional, leading to impulsive decisions. Risk management helps you stick to your trading plan and avoid making rash decisions based on fear or greed.

- Sustainable Trading: A well-defined risk management plan allows you to trade consistently over the long term. You can avoid blowing up your account and continue to learn and grow as a trader.

- Profit Optimization: By managing your risk effectively, you can allocate your capital more strategically, potentially leading to higher returns.

Key Risk Management Strategies

Here are some key strategies for managing risk in crypto trading:

- Define Your Risk Tolerance: Before you start trading, understand your risk tolerance. How much are you comfortable losing? This will help you determine the size of your positions.

- Set Stop-Loss Orders: Stop-loss orders automatically close your position when a certain price point is reached, limiting potential losses.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversifying across different cryptocurrencies can help to reduce overall portfolio risk.

- Dollar-Cost Averaging: This strategy involves investing a fixed amount of money at regular intervals, regardless of the market price. This helps to average out your cost basis over time.

- Position Sizing: Don’t risk more than a small percentage of your capital on any single trade. A common rule of thumb is to risk no more than 1-2% of your portfolio per trade.

Tools and Resources

There are various tools and resources available to help you implement risk management strategies:

- Trading Platforms: Most reputable crypto trading platforms offer features like stop-loss orders, take-profit orders, and position sizing tools.

- Risk Management Calculators: Several online calculators can help you determine appropriate position sizes based on your risk tolerance and account balance.

- Educational Resources: Numerous websites and blogs provide comprehensive guides on risk management in crypto trading.

Conclusion

Risk management is an essential component of successful crypto trading. By implementing sound strategies and utilizing available tools, you can protect your capital, trade with confidence, and increase your chances of long-term profitability in this dynamic market.

Staying Informed: Keeping Up with Market Trends and News

In today’s fast-paced world, staying informed about market trends and news is crucial for both individuals and businesses. The ability to adapt to changing circumstances and make informed decisions is essential for success. This article will explore the importance of staying informed and provide practical tips to help you stay ahead of the curve.

Why Staying Informed Matters

Staying informed offers numerous benefits:

- Improved Decision Making: Understanding market trends and news allows you to make more informed decisions about investments, career choices, and business strategies.

- Enhanced Competitiveness: By staying ahead of the competition, you can identify opportunities and adapt to changing market dynamics.

- Increased Efficiency: Knowledge about market trends can help you optimize your resources and operations to achieve better results.

- Personal Growth: Staying informed keeps you engaged and helps you develop a broader perspective on the world.

Effective Strategies for Staying Informed

Here are some effective strategies for staying informed:

- Subscribe to Reputable News Sources: Follow reliable news outlets and industry-specific publications.

- Utilize Social Media Strategically: Follow industry leaders and experts on platforms like Twitter and LinkedIn.

- Attend Industry Events: Conferences, webinars, and workshops provide valuable insights and networking opportunities.

- Leverage Data and Analytics: Utilize market research reports and data analysis tools to gain deeper understanding.

- Stay Curious and Ask Questions: Don’t be afraid to seek out information and ask questions to broaden your knowledge.

By staying informed about market trends and news, you can make better decisions, enhance your competitiveness, and achieve your goals. It’s an ongoing process that requires dedication and a proactive approach. Remember to critically evaluate information and develop your own informed opinions.

Common Cryptocurrency Scams and How to Avoid Them

The world of cryptocurrency is exciting, but it also attracts scammers. There are numerous ways that people try to defraud cryptocurrency investors, so it’s vital to be aware of the most common scams and how to protect yourself.

1. Phishing Scams

Phishing is a common tactic used by scammers. This involves sending fake emails, text messages, or social media messages that appear to be from legitimate companies or individuals, often crypto exchanges or wallets. The messages try to trick you into revealing your login credentials, private keys, or other sensitive information.

Tips to avoid phishing scams:

- Never click on links in suspicious emails or messages.

- Always verify the sender’s identity and authenticity before clicking on links or providing any information.

- Be wary of offers that seem too good to be true, especially if they involve high returns or guarantees.

2. Fake Cryptocurrency Exchanges and Wallets

Scammers often create fake websites that mimic legitimate cryptocurrency exchanges or wallets. They may even offer attractive bonuses or promotions to lure unsuspecting victims.

Tips to avoid fake exchanges and wallets:

- Always research and verify the legitimacy of any exchange or wallet before using it.

- Look for trusted reviews and feedback from other users.

- Check for security certifications and data encryption measures.

3. Pump and Dump Schemes

Pump-and-dump schemes involve artificially inflating the price of a cryptocurrency by spreading false information or hype. Scammers buy large quantities of the token at a low price and then spread rumors to create a surge in demand. Once the price has risen, they dump their holdings, causing the price to crash and leaving other investors with significant losses.

Tips to avoid pump-and-dump schemes:

- Be skeptical of sudden price spikes, especially without any legitimate news or announcements.

- Conduct thorough research on any cryptocurrency before investing.

- Don’t follow hype or rumors blindly.

4. Social Media Scams

Scammers use social media platforms to target cryptocurrency investors with fake giveaways, contests, and investment opportunities. They may create fake profiles, impersonate legitimate influencers, or use deceptive marketing tactics.

Tips to avoid social media scams:

- Be cautious of offers that promise unrealistic returns or guarantees.

- Verify the identity and legitimacy of any social media account or website before interacting.

- Never send cryptocurrency to unknown addresses or participate in schemes that seem too good to be true.

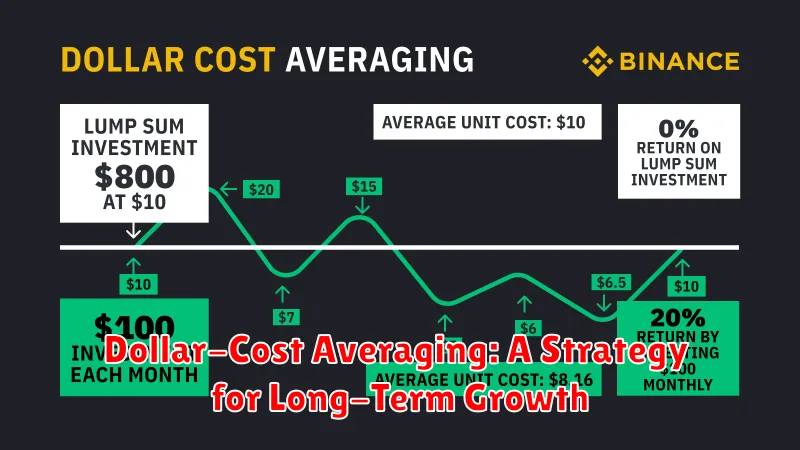

Dollar-Cost Averaging: A Strategy for Long-Term Growth

Investing can be a daunting task, especially for beginners. The market’s volatility can make it seem like an unpredictable gamble, leaving many investors hesitant to take the plunge. However, there are strategies designed to help mitigate risk and enhance returns over the long haul. One such strategy is dollar-cost averaging.

Dollar-cost averaging (DCA) is a technique that involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. Instead of investing a lump sum all at once, you gradually allocate your funds over time. This approach aims to reduce the impact of market volatility and potentially lower your average purchase price.

How Does Dollar-Cost Averaging Work?

Imagine you decide to invest $1,000 in a particular stock. You can choose to invest the entire amount at once or spread it out over several months. With DCA, you might invest $200 per month for five months. Here’s how it benefits you:

- Averaging Out Price Fluctuations: When you invest a fixed amount regularly, you buy more shares when prices are low and fewer shares when prices are high. This effectively lowers your average purchase price over time.

- Reducing Emotional Decisions: Market swings can trigger impulsive reactions, often leading to buying high and selling low. DCA helps you detach from short-term fluctuations and stick to a disciplined investment plan.

- Long-Term Growth: By consistently investing, you benefit from compounding growth over time. Even small, regular investments can accumulate significant value over the long term.

Is Dollar-Cost Averaging Right for You?

Dollar-cost averaging isn’t a one-size-fits-all approach. It’s best suited for:

- Long-Term Investors: DCA is most effective for investors who plan to stay invested for several years or even decades.

- Risk-Averse Individuals: If you’re uncomfortable with the possibility of significant market losses, DCA can provide a sense of security.

- Those with Regular Income: DCA works best when you have a consistent source of funds to invest regularly.

It’s important to note that DCA isn’t a guaranteed path to riches. It can’t eliminate market risk entirely, and there’s no guarantee that your investments will always appreciate in value. However, as a long-term investment strategy, DCA can help you navigate market volatility and potentially increase your chances of achieving your financial goals.

The Future of Cryptocurrency: Trends to Watch Out For

The cryptocurrency market has experienced explosive growth in recent years, attracting investors and enthusiasts alike. While its future remains uncertain, several trends are shaping the landscape and offering valuable insights into what we can expect.

One of the most significant trends is the increasing adoption of institutional investment. Traditionally, cryptocurrencies were seen as a risky investment, but major financial institutions are now entering the space, bringing with them substantial capital and legitimacy. This institutional influx is expected to drive further growth and stability within the market.

Another key trend is the rise of decentralized finance (DeFi). DeFi applications allow users to access financial services, such as lending, borrowing, and trading, without relying on traditional intermediaries. These applications are built on blockchain technology, offering greater transparency, security, and accessibility. The DeFi movement is expected to transform the financial landscape, challenging the established order and providing new opportunities for individuals and businesses.

Furthermore, the development of central bank digital currencies (CBDCs) is gaining momentum. Several countries around the world are exploring the possibility of issuing their own digital currencies, potentially impacting the future of traditional fiat currencies and cryptocurrencies. The adoption of CBDCs could significantly change the way we manage money and interact with financial systems.

Regulation is another crucial aspect shaping the future of cryptocurrency. As the industry matures, governments and regulatory bodies are actively working to establish clear frameworks and guidelines. While regulation can bring greater stability and consumer protection, it also poses challenges to the decentralized nature of cryptocurrencies. Finding the right balance between regulation and innovation will be essential for the long-term success of the industry.

In addition to these trends, the ongoing development of new technologies, such as artificial intelligence (AI) and Internet of Things (IoT), is expected to have a profound impact on cryptocurrency. AI can enhance trading strategies and improve the efficiency of blockchain networks, while IoT devices can be integrated with cryptocurrency systems to facilitate secure and seamless transactions. These advancements are likely to further accelerate the growth and adoption of cryptocurrencies.

The future of cryptocurrency is undoubtedly exciting and full of possibilities. While the road ahead may be uncertain, the trends discussed above provide a glimpse into the transformative potential of this evolving technology. It’s essential to stay informed and adapt to the changing landscape to navigate the opportunities and challenges presented by the cryptocurrency revolution.