The world of cryptocurrency is a dynamic and ever-evolving landscape, offering both immense potential and significant risk. As an investor looking to navigate this digital asset market, having the right tools is essential to make informed decisions and maximize your chances of success. Whether you’re a seasoned trader or just starting your journey, the right cryptocurrency investment tools can empower you to research, analyze, and manage your portfolio with confidence.

From cryptocurrency exchanges and wallets to trading platforms and portfolio trackers, a variety of tools are available to assist you in your cryptocurrency investment journey. This article will explore the essential tools you need to understand the intricacies of the market, make well-informed investment decisions, and navigate the complexities of the digital asset space.

Understanding the Cryptocurrency Market

The cryptocurrency market has exploded in popularity in recent years, with Bitcoin, Ethereum, and other digital currencies capturing the attention of investors and the general public alike. But what exactly is cryptocurrency, and how does it work? This article will provide a comprehensive guide to understanding the basics of the cryptocurrency market.

At its core, cryptocurrency is a form of digital currency that uses cryptography for security and operates independently of central banks. Unlike traditional fiat currencies, like the US dollar or the Euro, cryptocurrencies are decentralized, meaning they are not subject to government control. This decentralized nature is one of the key features that attracts many users to cryptocurrencies.

Cryptocurrencies are often built on a technology called blockchain. A blockchain is a distributed, public ledger that records every transaction made in the cryptocurrency. This ledger is constantly updated and shared across a network of computers, ensuring transparency and security.

The market for cryptocurrencies is volatile and constantly changing. The value of a particular cryptocurrency can fluctuate significantly over short periods, influenced by factors like market sentiment, news events, and regulatory developments. This volatility can be both exciting and risky for investors.

There are a variety of ways to engage with the cryptocurrency market. Some individuals choose to invest in cryptocurrencies directly through exchanges, while others participate in mining, the process of verifying transactions and adding them to the blockchain. There are also decentralized finance (DeFi) platforms that offer various services, such as lending and borrowing cryptocurrencies.

It is important to remember that the cryptocurrency market is still relatively new and evolving. While it offers exciting opportunities for investors, it also comes with risks. Before investing in any cryptocurrency, it is crucial to conduct thorough research, understand the risks involved, and only invest an amount you can afford to lose.

As the cryptocurrency market continues to grow and evolve, it is essential to stay informed about the latest trends, technologies, and regulations. Understanding the basics of the cryptocurrency market is the first step toward navigating this dynamic and potentially lucrative world.

Essential Cryptocurrency Investment Tools for Beginners

Investing in cryptocurrency can be a daunting prospect for beginners. With a rapidly evolving landscape and a wide range of tools and platforms available, it’s easy to feel overwhelmed. However, by equipping yourself with the right tools, you can navigate the world of crypto with confidence and make informed decisions.

1. Cryptocurrency Exchanges

Cryptocurrency exchanges are essential for buying, selling, and trading cryptocurrencies. They act as marketplaces where users can connect and exchange digital assets. Popular exchanges include:

- Binance: One of the largest and most comprehensive exchanges, offering a wide selection of cryptocurrencies and trading pairs.

- Coinbase: A user-friendly platform known for its simplicity and regulatory compliance.

- Kraken: A reputable exchange with advanced trading features and excellent security measures.

2. Cryptocurrency Wallets

Cryptocurrency wallets are digital containers that store your private keys, which are essential for accessing and controlling your crypto assets. Different wallets offer varying levels of security and features. Popular wallet options include:

- Ledger Nano S: A hardware wallet that provides offline storage for your private keys, offering maximum security.

- MetaMask: A popular browser extension wallet that allows you to interact with decentralized applications (DApps).

- Coinbase Wallet: A mobile wallet that offers a user-friendly interface and supports a wide range of cryptocurrencies.

3. Charting and Analysis Tools

Charting and analysis tools are crucial for understanding price trends and making informed trading decisions. They provide a visual representation of historical data, enabling you to identify patterns and potential opportunities. Popular options include:

- TradingView: A powerful charting platform with advanced indicators and analysis tools.

- CoinMarketCap: A comprehensive website that tracks cryptocurrency prices, market capitalization, and other key metrics.

- Coinglass: A platform that offers real-time data and analysis on various cryptocurrencies.

4. News and Information Resources

Staying up-to-date with the latest news and developments in the cryptocurrency world is essential. There are numerous websites and publications that provide insights and analysis:

- CoinDesk: A leading source for cryptocurrency news, analysis, and insights.

- Cointelegraph: A comprehensive website covering all aspects of the crypto space.

- Decrypt: A publication focused on the intersection of technology, finance, and cryptocurrency.

5. Educational Resources

Investing in cryptocurrency requires a solid understanding of the underlying technology and market dynamics. Various educational resources can help you develop your knowledge and skills:

- Cryptocurrency Courses: Platforms like Coursera and Udemy offer courses on cryptocurrency basics, trading, and blockchain technology.

- YouTube Channels: Numerous YouTube channels provide educational content on cryptocurrency investing and the blockchain space.

- Community Forums: Online forums and communities offer a platform for discussion, learning, and networking with other cryptocurrency enthusiasts.

By utilizing these essential tools, beginners can gain the necessary knowledge and resources to navigate the world of cryptocurrency with confidence. Remember to conduct thorough research, diversify your investments, and always prioritize security.

Technical Analysis Tools for Crypto Trading

Technical analysis is a vital tool for any crypto trader, as it helps to identify trends, predict price movements, and make informed trading decisions. The use of technical analysis tools can help traders identify trading opportunities, manage risk, and increase their chances of success. While there are many different technical analysis tools available, here are some of the most popular and effective ones.

Moving Averages

Moving averages are one of the most basic yet powerful technical analysis tools. They smooth out price fluctuations and help identify trends. There are two main types of moving averages: simple moving averages (SMA) and exponential moving averages (EMA). SMAs calculate the average price over a specific period, while EMAs give more weight to recent prices. Traders often use moving averages to confirm trends, identify support and resistance levels, and generate buy and sell signals.

Relative Strength Index (RSI)

The RSI is a momentum indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the market. It is displayed as an oscillator, which moves between 0 and 100. A reading above 70 generally indicates that the market is overbought, while a reading below 30 suggests that the market is oversold. Traders use RSI to confirm trends, identify potential reversals, and manage risk.

MACD (Moving Average Convergence Divergence)

The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of prices. It consists of two lines: a MACD line and a signal line. When the MACD line crosses above the signal line, it indicates a bullish signal, and when it crosses below the signal line, it suggests a bearish signal. Traders use the MACD to identify trend changes, confirm buy and sell signals, and manage risk.

Bollinger Bands

Bollinger Bands are a volatility indicator that uses a moving average and standard deviations to create an envelope around the price. The width of the bands represents the volatility of the market. When prices are close to the upper band, it indicates high volatility and a potential for a price reversal. Conversely, when prices are close to the lower band, it suggests low volatility and a potential for a price increase. Traders use Bollinger Bands to identify overbought and oversold conditions, set stop-loss orders, and manage risk.

Fibonacci Retracement

Fibonacci Retracement is a technical analysis tool that uses Fibonacci numbers to identify support and resistance levels. It is based on the idea that prices often retrace a certain percentage of their previous move before continuing in the original direction. Traders use Fibonacci Retracement to identify potential entry and exit points, set stop-loss orders, and manage risk.

Candlestick Patterns

Candlestick patterns are visual representations of price movements over a specific period. Each candlestick represents the open, high, low, and close prices of a particular asset. Different candlestick patterns can indicate bullish or bearish signals, depending on their formation and interpretation. Traders use candlestick patterns to identify potential trends, confirm buy and sell signals, and manage risk.

Technical Analysis Platforms

There are numerous technical analysis platforms available, both free and paid, that offer various tools and features to support trading decisions. Some popular platforms include TradingView, MetaTrader 4 (MT4), and NinjaTrader. These platforms allow traders to access real-time market data, chart prices, use indicators, and execute trades.

It is important to note that technical analysis is not an exact science and should be used in conjunction with other factors, such as fundamental analysis and risk management. While technical analysis tools can be powerful for predicting price movements, they are not foolproof. Therefore, it is crucial for traders to continuously learn and adapt their strategies to the ever-changing cryptocurrency market.

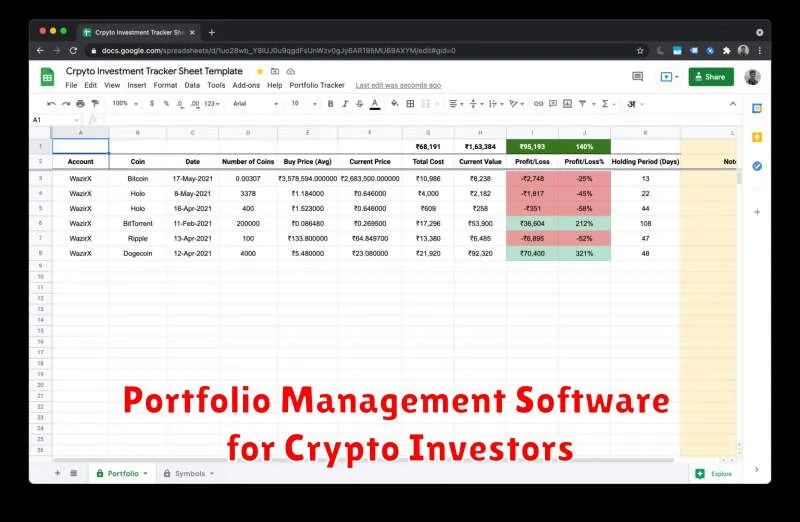

Portfolio Management Software for Crypto Investors

The crypto market is constantly evolving, with new coins and tokens being launched daily. This makes it challenging for investors to keep track of their portfolio and make informed investment decisions. This is where portfolio management software comes in. Portfolio management software for crypto investors helps you track your investments, monitor market trends, and make better decisions.

Key Features of Portfolio Management Software

Portfolio management software for crypto investors offers a range of features that can be beneficial to your investment strategy. These features include:

- Portfolio Tracking: Track all your crypto holdings in one place, including your buy and sell history, current value, and profit/loss.

- Real-Time Data: Get up-to-date price information on your crypto assets, market trends, and news.

- Market Analysis: Use charts, graphs, and other tools to analyze market trends and identify potential investment opportunities.

- Trading Alerts: Set price alerts for your crypto assets and receive notifications when a price target is reached.

- Tax Reporting: Track your capital gains and losses for tax reporting purposes.

- Integration with Exchanges: Connect your software to your crypto exchange accounts for seamless data synchronization.

Benefits of Using Portfolio Management Software

There are numerous benefits to using portfolio management software for crypto investors:

- Improved Decision-Making: By having a clear picture of your portfolio performance and market trends, you can make more informed investment decisions.

- Enhanced Risk Management: Portfolio management software can help you monitor your risk exposure and make adjustments as needed.

- Increased Efficiency: Automate tasks like portfolio tracking, market analysis, and tax reporting, freeing up your time to focus on other aspects of your investment strategy.

- Improved Organization: Keep all your crypto-related information in one place, making it easy to access and manage.

Types of Portfolio Management Software

There are two main types of portfolio management software:

- Web-Based Software: Access your portfolio and features through a web browser on any device.

- Desktop Software: Download and install the software on your computer for offline access.

Choosing the Right Portfolio Management Software

When choosing portfolio management software, consider the following factors:

- Features: Choose software that offers the features you need, such as portfolio tracking, real-time data, market analysis, and tax reporting.

- Ease of Use: Look for software that is easy to navigate and use, even if you are new to crypto investing.

- Security: Ensure the software uses strong security measures to protect your sensitive data.

- Price: Portfolio management software can be free or paid. Choose a software that fits your budget and meets your needs.

- Customer Support: Choose a software that offers reliable customer support in case you encounter any issues.

Conclusion

Portfolio management software is an essential tool for any serious crypto investor. By leveraging the features and benefits of this software, you can improve your decision-making, enhance your risk management, and increase your efficiency. Choose the right portfolio management software for your needs and start managing your crypto investments with greater confidence.

Cryptocurrency News Aggregators: Staying Informed

In the fast-paced world of cryptocurrency, staying informed is crucial. With new developments, price fluctuations, and regulatory changes happening constantly, it can be overwhelming to keep up with everything. This is where cryptocurrency news aggregators come in, providing a centralized platform to access the latest news, insights, and analysis from various sources.

These aggregators act as your one-stop shop for all things crypto. They curate and organize news articles, blog posts, social media updates, and other relevant content from reputable news outlets, industry experts, and cryptocurrency communities. By consolidating information from multiple sources, aggregators save you time and effort by eliminating the need to manually search for updates.

Benefits of Using Cryptocurrency News Aggregators

There are numerous benefits to using cryptocurrency news aggregators, including:

- Convenience: Accessing all the latest crypto news from a single platform saves you time and effort.

- Comprehensive Coverage: Aggregators provide a wide range of content, ensuring you don’t miss any important developments.

- Personalized Experience: Many aggregators offer customization options, allowing you to filter content based on your interests and preferences.

- Increased Awareness: Staying informed about the latest crypto news helps you make more informed investment decisions.

- Community Insights: Some aggregators include forums or comment sections where you can engage with other crypto enthusiasts.

Popular Cryptocurrency News Aggregators

There are numerous cryptocurrency news aggregators available, each with its own unique features and strengths. Some popular options include:

- CoinDesk: A leading source for cryptocurrency news and analysis.

- Cointelegraph: Another reputable platform covering blockchain technology and crypto markets.

- CryptoSlate: Offers a comprehensive range of news, analysis, and opinion pieces.

- CryptoNews: Provides updates on various cryptocurrencies, blockchain projects, and industry trends.

- The Block: A prominent source for institutional-grade crypto news and data.

Before choosing a news aggregator, consider factors like the quality of content, the sources they use, and the user interface.

Security Measures for Your Crypto Investments

Investing in cryptocurrencies can be a lucrative endeavor, but it’s essential to prioritize security to protect your hard-earned assets. The decentralized nature of crypto makes it susceptible to various threats, such as hacking, scams, and theft. To safeguard your investments, implementing robust security measures is paramount.

1. Use a Secure Wallet

A crypto wallet is essential for storing your digital assets. Choose a wallet that prioritizes security features and offers multi-factor authentication (MFA). Hardware wallets, which store your private keys offline, provide the highest level of security. Software wallets, while convenient, are more vulnerable to hacking.

2. Enable Two-Factor Authentication (2FA)

2FA adds an extra layer of protection by requiring a second verification step, typically a code sent to your phone or email. This makes it significantly harder for unauthorized individuals to access your account, even if they obtain your password.

3. Create Strong Passwords

Use strong, unique passwords for all your crypto accounts. Avoid using personal information or easily guessable phrases. Consider using a password manager to generate and store complex passwords securely.

4. Be Wary of Phishing Scams

Phishing scams are common in the crypto world. Be cautious of suspicious emails, messages, or websites claiming to be from legitimate companies or individuals. Never click on links or download attachments from unknown sources.

5. Stay Updated on Security Best Practices

The crypto landscape is constantly evolving, with new threats emerging regularly. Stay informed about the latest security best practices and updates. Follow reputable crypto news sources and security experts to stay ahead of potential risks.

6. Diversify Your Investments

Don’t put all your eggs in one basket. Diversifying your portfolio across different cryptocurrencies can help reduce risk and minimize potential losses.

7. Be Cautious of High-Yield Investment Schemes

Promises of unrealistically high returns should be treated with skepticism. Legitimate crypto investments don’t typically offer such exorbitant gains. Research thoroughly before investing in any project, and be wary of scams.

8. Back Up Your Wallet

Create backups of your wallet’s seed phrase, private keys, or recovery phrases. Store these backups securely in a safe place, separate from your primary wallet. This will allow you to recover your assets if you lose access to your wallet.

9. Use a VPN

A VPN (Virtual Private Network) can enhance your privacy and security by encrypting your internet traffic. This is especially important when accessing crypto exchanges or wallets from public Wi-Fi networks.

10. Be Vigilant and Stay Informed

Maintaining vigilance and staying informed about potential threats is crucial for protecting your crypto investments. Always be on the lookout for suspicious activity and report any security breaches to the relevant authorities or platform providers.

By following these security measures, you can significantly reduce the risks associated with crypto investing. Remember, protecting your assets is your responsibility. Be proactive, stay informed, and take the necessary steps to safeguard your investments in the ever-evolving world of cryptocurrencies.

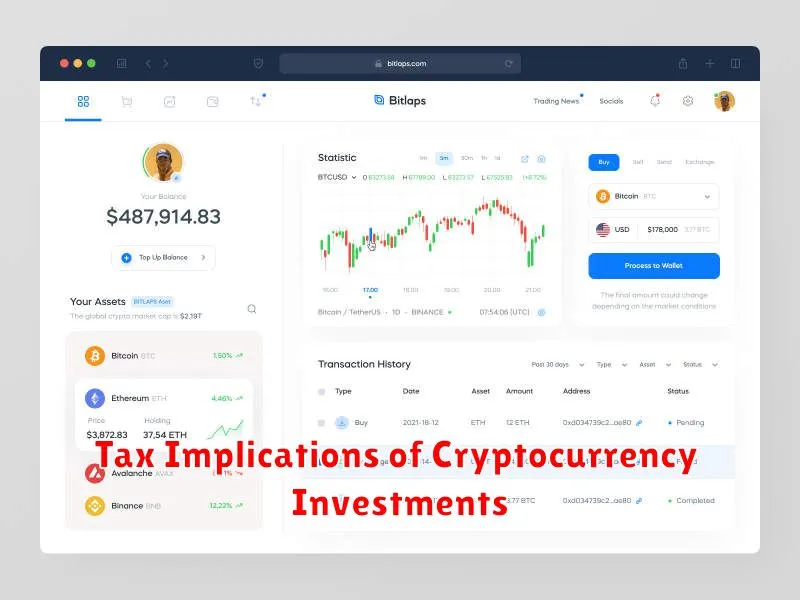

Tax Implications of Cryptocurrency Investments

The world of cryptocurrency is rapidly evolving, and with it, the tax implications of investing in cryptocurrencies are becoming increasingly complex. As a result, it’s crucial for investors to understand the tax treatment of cryptocurrencies, especially if they’re planning to hold, trade, or use their digital assets.

This article will shed light on the key tax aspects of cryptocurrency investments, covering topics such as capital gains tax, income tax, gift tax, and inheritance tax. Understanding these implications will help you navigate the world of crypto investments with greater clarity and avoid potential tax liabilities.

Capital Gains Tax

The most common tax implication associated with cryptocurrency investments is capital gains tax. This tax applies when you sell or exchange your cryptocurrencies for a profit. The profit, or capital gain, is subject to taxation at your ordinary income tax rate, which can vary depending on your income level.

For instance, if you bought Bitcoin for $10,000 and sold it for $20,000, you would have a $10,000 capital gain. This gain would be subject to capital gains tax at your ordinary income tax rate. Keep in mind that short-term capital gains, held for less than a year, are taxed at a higher rate than long-term capital gains held for longer than a year.

Income Tax

Cryptocurrency can also generate income, which is subject to income tax. This income can arise from several sources, including:

- Mining: If you mine cryptocurrencies, the value of the mined coins is considered income and is taxable.

- Staking: Earning rewards through staking, a process of validating transactions on a blockchain, is also considered taxable income.

- Airdrops: Receiving free cryptocurrencies through airdrops, which are often given as rewards or incentives, is typically treated as taxable income.

Gift Tax

Giving cryptocurrencies as gifts can trigger gift tax. The IRS considers cryptocurrencies to be property, similar to stocks or real estate. The annual gift tax exclusion in 2023 is $17,000 per person, meaning you can gift up to $17,000 worth of cryptocurrencies to someone without having to pay gift tax. However, if you gift more than this amount, you may be subject to gift tax.

Inheritance Tax

Upon your death, your cryptocurrency holdings become part of your estate and are subject to estate tax. This tax is applied to the value of your estate above a certain threshold, currently $12.92 million in 2023. If your estate exceeds this threshold, your heirs may be required to pay estate tax on the value of your cryptocurrency holdings.

Important Considerations

Here are some important considerations to keep in mind when it comes to the tax implications of cryptocurrency investments:

- Record-keeping: Maintaining accurate records of all your cryptocurrency transactions, including purchases, sales, exchanges, and any other relevant activities, is essential for tax purposes.

- Tax reporting: You must report your cryptocurrency gains and losses on your tax return. This includes reporting any income generated from mining, staking, or airdrops.

- Professional advice: Due to the complexity of cryptocurrency tax regulations, it’s advisable to seek guidance from a tax professional familiar with cryptocurrencies. They can help you determine your tax liabilities and navigate the reporting process.

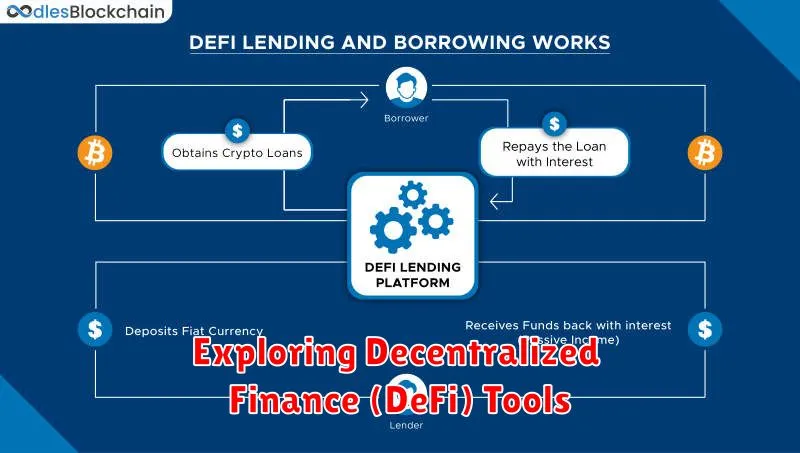

Exploring Decentralized Finance (DeFi) Tools

Decentralized Finance (DeFi) has emerged as a revolutionary force in the financial world, offering innovative tools and services that challenge traditional financial institutions. DeFi leverages blockchain technology to create a decentralized, transparent, and accessible financial system. This article explores the key tools and concepts within the DeFi ecosystem.

What is DeFi?

In essence, DeFi empowers individuals to take control of their finances by eliminating intermediaries and allowing direct interaction with financial services. It achieves this through smart contracts, automated programs that execute financial transactions on the blockchain without the need for third-party involvement.

Key DeFi Tools

The DeFi landscape is populated with a diverse range of tools, each addressing specific financial needs. Some of the prominent DeFi tools include:

1. Decentralized Exchanges (DEXs)

DEXs offer a platform for trading cryptocurrencies without relying on centralized exchanges. They enable peer-to-peer transactions, providing greater control and privacy to users. Popular examples include Uniswap and SushiSwap.

2. Lending and Borrowing Platforms

DeFi lending platforms allow users to lend and borrow cryptocurrencies, earning interest on their assets or accessing liquidity for various purposes. Platforms like Aave and Compound facilitate this process through smart contracts.

3. Stablecoins

Stablecoins are cryptocurrencies designed to maintain a stable value, typically pegged to fiat currencies like the US dollar. They play a crucial role in DeFi by mitigating volatility inherent in crypto markets. Examples include Tether (USDT) and USD Coin (USDC).

4. Yield Aggregators

Yield aggregators automate the process of finding the best interest rates across multiple lending platforms. They optimize returns by constantly searching for the most profitable lending opportunities.

5. Decentralized Insurance

DeFi insurance platforms offer protection against smart contract vulnerabilities and other risks. They enable users to pool their assets to create a shared risk pool, providing coverage against potential losses.

Benefits of DeFi

DeFi offers numerous advantages over traditional finance, including:

- Transparency and Auditability: All transactions and operations on the blockchain are publicly auditable, fostering transparency and trust.

- Accessibility: DeFi services are accessible to anyone with an internet connection, regardless of their location or financial background.

- Openness and Interoperability: DeFi protocols are open-source and interoperable, allowing for the development of new applications and integrations.

- Security: Blockchain technology provides a secure and immutable ledger, minimizing the risk of fraud and manipulation.

Challenges of DeFi

While DeFi presents a promising future, it also faces challenges:

- Volatility: The inherent volatility of cryptocurrency markets can pose risks to DeFi investments.

- Complexity: DeFi protocols can be complex and require technical knowledge to navigate.

- Regulation: The lack of clear regulatory frameworks for DeFi can create uncertainty and challenges for investors.

The Role of Fundamental Analysis in Crypto Investing

In the dynamic and volatile world of cryptocurrencies, investors are constantly seeking strategies to navigate the market effectively. While technical analysis focuses on price patterns and trading signals, fundamental analysis delves deeper into the underlying factors that influence the value of crypto assets. This approach provides valuable insights into the long-term prospects of projects and helps investors make informed decisions.

Understanding Fundamental Analysis in Crypto

Fundamental analysis in crypto involves examining the intrinsic value of a cryptocurrency by analyzing its technology, team, community, market adoption, and economic factors. It aims to identify projects with strong fundamentals and growth potential.

Key Factors to Consider:

- Technology: Evaluating the underlying technology, such as the blockchain platform, consensus mechanism, and smart contracts, is crucial. A robust and innovative technology can drive adoption and value creation.

- Team: The team behind the project, including their experience, expertise, and vision, plays a significant role. Strong leadership and a well-rounded team are essential for project success.

- Community: A vibrant and engaged community is a positive indicator. Active participation, development contributions, and community support foster growth and adoption.

- Market Adoption: The number of users, merchants, and developers utilizing the cryptocurrency is a key measure of its value. Widespread adoption indicates real-world utility and demand.

- Economic Factors: Analyzing the cryptocurrency’s supply, demand, and economic model is important. Factors like inflation, deflation, and tokenomics can impact its value.

Benefits of Fundamental Analysis:

- Identifies Long-Term Value: By focusing on fundamental factors, investors can identify projects with strong potential for long-term growth.

- Reduces Risk: Thorough analysis helps investors avoid investing in projects with weak fundamentals or questionable intentions.

- Informed Decision-Making: Fundamental analysis provides a comprehensive understanding of the project, enabling investors to make more informed decisions.

Conclusion:

Fundamental analysis is an essential tool for crypto investors seeking to make informed and strategic decisions. By evaluating the underlying factors that drive value, investors can identify projects with solid fundamentals and growth potential, reducing risk and maximizing their returns.

Risk Management Strategies for Cryptocurrency Investors

The cryptocurrency market is known for its volatility, and investors need to be prepared for potential risks. While the potential for high returns is enticing, it’s crucial to implement effective risk management strategies to protect your investments. Here are some essential tips to help you navigate the turbulent world of crypto:

1. Understand the Risks

Before investing in any cryptocurrency, it’s essential to thoroughly research the underlying technology, the project’s team, and the market’s current conditions. Understanding the potential risks involved is crucial to making informed investment decisions. Some key risks to consider include:

- Market Volatility: Cryptocurrency prices can fluctuate dramatically in short periods, potentially leading to significant losses.

- Regulatory Uncertainty: Governments around the world are still developing regulations for the cryptocurrency industry, creating uncertainty for investors.

- Security Risks: Cryptocurrency exchanges and wallets are vulnerable to hacking and theft, posing risks to investors’ funds.

- Scams and Fraud: The cryptocurrency market is prone to scams and fraudulent activities, making it essential to be vigilant.

2. Diversify Your Portfolio

Just like in traditional finance, diversification is key to managing risk in the cryptocurrency market. Spreading your investments across various cryptocurrencies can help mitigate losses if one asset underperforms. However, it’s important to select projects with different use cases and potential growth opportunities.

3. Set Realistic Investment Goals

Don’t invest more than you can afford to lose. Set realistic investment goals and stick to them. Avoid chasing quick profits or investing based on hype or speculation.

4. Use Stop-Loss Orders

A stop-loss order is a pre-set instruction that automatically sells your cryptocurrency at a specific price if the market price drops below a certain threshold. This can help limit potential losses if the market takes a sudden downturn.

5. Store Cryptocurrencies Securely

Store your cryptocurrency in a secure wallet, preferably a hardware wallet, to minimize the risk of theft. Be cautious about storing cryptocurrencies on exchanges, as they are more vulnerable to hacking.

6. Stay Informed and Adapt

The cryptocurrency market is constantly evolving. Staying informed about industry news, regulatory updates, and market trends is crucial for making informed investment decisions. Be prepared to adapt your investment strategy as needed based on changing market conditions.

7. Seek Professional Advice

If you’re unsure about cryptocurrency investing, consider seeking advice from a qualified financial advisor. A professional can help you assess your risk tolerance, develop a suitable investment strategy, and manage your portfolio effectively.