Are you intrigued by the world of cryptocurrency but unsure where to start? Trading in the volatile realm of crypto can be both exciting and daunting, but with the right knowledge and strategies, you can navigate this market successfully. This beginner’s guide to cryptocurrency trading will equip you with the essential information to make informed decisions and maximize your potential for success.

Whether you’re a seasoned investor or just stepping into the crypto space, understanding the fundamentals is key. We’ll break down crucial concepts like cryptocurrency exchanges, trading strategies, and risk management. By the end of this guide, you’ll have a solid foundation for making your first cryptocurrency trades with confidence. So, buckle up and get ready to unlock the world of crypto trading.

Understanding the Basics of Cryptocurrency

In the world of finance, cryptocurrency has become a popular topic of discussion. While it may seem like a complex concept, the underlying principles are actually quite simple. Cryptocurrency is a digital form of currency that utilizes cryptography for security and transaction verification. These digital currencies are decentralized, meaning they are not controlled by any central bank or government. Instead, they operate on a decentralized network of computers called a blockchain.

The blockchain is a distributed ledger that records all transactions in a transparent and immutable way. Each block in the chain contains a set of transactions, and once a block is added to the chain, it cannot be altered or deleted. This immutability makes cryptocurrencies incredibly secure and resistant to fraud.

One of the most well-known cryptocurrencies is Bitcoin, often referred to as the first cryptocurrency. It was created by an anonymous individual or group known as Satoshi Nakamoto. Bitcoin’s value is determined by supply and demand, and it can be exchanged for other currencies, goods, and services.

There are numerous other cryptocurrencies available, each with its own unique features and applications. Some examples include Ethereum, which enables smart contracts and decentralized applications, and Litecoin, which focuses on fast and efficient transactions.

Cryptocurrencies have the potential to revolutionize the financial industry, offering advantages such as lower transaction fees, increased transparency, and financial inclusion. However, it’s important to note that the cryptocurrency market is still relatively new and can be volatile. Before investing in cryptocurrencies, it’s crucial to understand the risks involved and conduct thorough research.

Choosing the Right Exchange for You

The world of cryptocurrency is vast and complex. With so many different exchanges available, choosing the right one for your needs can be a daunting task. However, it’s crucial to choose a platform that is secure, reliable, and offers the features you need. This article will guide you through the essential factors to consider when selecting a cryptocurrency exchange.

Security

Security should be your top priority when choosing an exchange. Look for platforms with robust security measures such as:

- Two-factor authentication (2FA): This adds an extra layer of security by requiring you to enter a code from your phone or email in addition to your password.

- Cold storage: This refers to storing a significant portion of the exchange’s cryptocurrency offline, making it less vulnerable to hackers.

- Encryption: Ensuring that all your data is encrypted during transmission and at rest is essential.

Fees

Exchanges charge various fees, including trading fees, deposit fees, withdrawal fees, and inactivity fees. It’s important to understand these fees before choosing an exchange. Some platforms offer tiered fee structures based on your trading volume, while others offer flat fees. Compare fee structures from different exchanges to find the most cost-effective option for you.

Supported Cryptocurrencies

Consider the cryptocurrencies you plan to trade and ensure the exchange supports them. Different platforms offer different selections of cryptocurrencies. Some exchanges specialize in specific cryptocurrencies, while others offer a broader range. Choose an exchange that supports the cryptocurrencies you’re interested in.

User Interface and User Experience

The user interface (UI) and user experience (UX) of an exchange play a significant role in your overall trading experience. Look for platforms with a clean and intuitive UI that is easy to navigate. A user-friendly platform makes it easier to place orders, monitor your portfolio, and manage your funds.

Customer Support

Reliable customer support is essential in case you encounter any issues or have questions. Choose an exchange with responsive and knowledgeable customer support channels, such as live chat, email, or phone. A good exchange will have comprehensive FAQs, help guides, and tutorials available as well.

Regulation and Compliance

Ensure the exchange you choose is regulated and compliant with relevant financial laws and regulations. This adds an extra layer of security and protects your funds. Look for exchanges that are licensed and registered in reputable jurisdictions.

Additional Features

Consider other features that might be important to you, such as:

- Margin trading: This allows you to borrow funds to increase your trading power, but it comes with higher risk.

- Staking: Some exchanges offer staking features, allowing you to earn rewards by holding specific cryptocurrencies.

- Educational resources: Some exchanges offer educational resources to help you learn more about cryptocurrency trading.

Choosing the right cryptocurrency exchange is essential for a successful and safe trading experience. Carefully consider the factors outlined above to find the best platform for your individual needs and preferences.

Developing a Solid Trading Strategy

In the world of trading, it is crucial to have a solid trading strategy to guide your decisions. A well-defined strategy acts as your roadmap, helping you navigate the volatile markets and make informed choices.

A trading strategy should be based on your individual risk tolerance, investment goals, and trading style. It should clearly outline your entry and exit points, risk management techniques, and profit targets. Here are some essential steps involved in developing a robust trading strategy:

1. Define Your Trading Goals

Before diving into the intricacies of trading, it’s important to define your goals. Are you looking for short-term profits, long-term growth, or a combination of both? Do you prefer to trade frequently or hold investments for a longer period? Clearly defining your goals will help you choose the right trading strategy and assets.

2. Determine Your Risk Tolerance

Every investment carries a certain level of risk, and it’s essential to understand your risk tolerance. How much potential loss are you willing to accept? Are you comfortable with high volatility or prefer more conservative investments? Determining your risk tolerance will help you select appropriate trading instruments and manage your positions effectively.

3. Analyze the Markets

A thorough market analysis is crucial for making informed trading decisions. You need to understand the current trends, economic indicators, and market sentiment. Analyzing technical charts, studying fundamental data, and staying updated on news events can provide valuable insights into potential trading opportunities.

4. Choose Your Trading Style

Different trading styles cater to different personalities and preferences. You can choose from various strategies like scalping, day trading, swing trading, or investing. Each style involves different timeframes, risk levels, and trading approaches. Select a style that aligns with your goals, risk tolerance, and time commitment.

5. Develop Entry and Exit Points

Your trading strategy should clearly define your entry and exit points. When will you enter a trade? What signals will you use? And when will you exit a trade? These criteria should be based on your chosen indicators, technical analysis, and risk management principles. It’s important to have a plan in place to avoid emotional trading decisions.

6. Implement Risk Management Techniques

Risk management is paramount in trading. You need to protect your capital and minimize potential losses. Implement strategies like stop-loss orders, position sizing, and diversification. Always trade within your risk tolerance and avoid over-leveraging your positions.

7. Backtest and Optimize Your Strategy

Once you have developed a trading strategy, it’s essential to backtest it using historical data. This will help you evaluate its performance and identify potential weaknesses. Backtesting allows you to refine your strategy and optimize its effectiveness.

8. Monitor and Adapt Your Strategy

Market conditions are constantly evolving, so your trading strategy needs to be adaptable. Continuously monitor the performance of your strategy and make adjustments as needed. Stay informed about market changes, economic events, and evolving trends to maintain the effectiveness of your strategy.

Developing a solid trading strategy is a continuous process that requires ongoing research, analysis, and adaptation. By following these steps, you can create a framework that helps you make informed decisions and navigate the complexities of the trading world.

Types of Cryptocurrency Trading Strategies

The cryptocurrency market is volatile and dynamic, presenting a range of opportunities for traders. To navigate this market effectively, it’s crucial to understand the various trading strategies available. These strategies, when used correctly, can help you maximize your potential profits while minimizing your risks.

Scalping

Scalping is a short-term trading strategy that aims to profit from small price fluctuations. Scalpers open and close trades rapidly, often within seconds or minutes. They typically use high leverage to amplify their gains, but this also increases their risk.

Advantages:

- High profit potential in volatile markets.

- Suitable for traders with fast reaction times.

Disadvantages:

- High risk due to rapid price movements.

- Requires constant monitoring and a quick trading style.

Day Trading

Day trading involves holding positions for a shorter period, usually within a single trading day. Day traders aim to capitalize on intraday price swings, often using technical analysis to identify trading opportunities.

Advantages:

- More flexibility compared to long-term strategies.

- Suitable for traders who prefer a more active trading style.

Disadvantages:

- Requires constant monitoring and market analysis.

- Can be stressful due to the fast-paced nature.

Swing Trading

Swing trading involves holding positions for a longer period, typically from a few days to a few weeks. Swing traders aim to capture larger price swings, using technical and fundamental analysis to identify trends and potential breakout points.

Advantages:

- Lower risk compared to scalping or day trading.

- Allows for more flexibility in trading schedules.

Disadvantages:

- Potentially lower profit potential compared to short-term strategies.

- Requires more time and patience to identify trading opportunities.

Trend Trading

Trend trading focuses on identifying and riding long-term trends in the market. Trend traders use technical analysis, news events, and other factors to determine the direction of a trend and place trades accordingly.

Advantages:

- Higher potential for profits over extended periods.

- Less need for constant monitoring, allowing for a more passive trading approach.

Disadvantages:

- Longer time horizon, requiring patience and discipline.

- Can be challenging to identify true trends amidst market volatility.

Arbitrage

Arbitrage is a strategy that exploits price discrepancies between different exchanges or markets. Arbitrageurs simultaneously buy and sell the same cryptocurrency on different exchanges, taking advantage of price differences to profit.

Advantages:

- High potential for risk-free profits.

- Can be automated for efficiency.

Disadvantages:

- Price discrepancies are often fleeting and challenging to find.

- Requires specialized software and technical knowledge.

Copy Trading

Copy trading allows you to automatically mirror the trades of experienced cryptocurrency traders. Platforms like eToro and ZuluTrade facilitate this process, allowing you to follow successful traders’ strategies without manual intervention.

Advantages:

- Access to the expertise of professional traders.

- Reduced need for technical analysis and market research.

Disadvantages:

- Dependent on the performance of the copied trader.

- May not be suitable for traders seeking full control over their trades.

Conclusion

Each cryptocurrency trading strategy has its own set of advantages and disadvantages. Choosing the right strategy depends on your individual risk tolerance, trading style, and financial goals. It’s important to conduct thorough research, practice with a demo account, and develop a well-defined trading plan before you start trading cryptocurrency in a live environment.

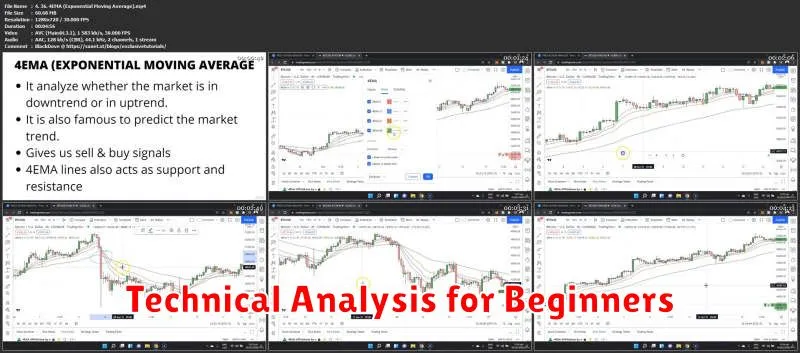

Technical Analysis for Beginners

Technical analysis is a method of forecasting the future price movements of an asset by studying past price and trading volume data. It is often used by traders to identify potential buying and selling opportunities. Technical analysis can be applied to any asset class, including stocks, bonds, commodities, and currencies.

There are many different technical indicators and tools that can be used in technical analysis. Some of the most popular indicators include:

- Moving averages: These are lines that show the average price of an asset over a certain period of time. Moving averages can be used to identify trends, support and resistance levels, and potential buy and sell signals.

- Relative strength index (RSI): This indicator measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset.

- MACD: The Moving Average Convergence Divergence (MACD) indicator shows the relationship between two moving averages of prices. It is used to identify trend changes in the price of an asset.

- Bollinger Bands: Bollinger Bands are a statistical measure of the volatility of a security or market.

Technical analysis is not a foolproof method for predicting the future. However, it can be a useful tool for traders to help them make informed trading decisions. If you are new to technical analysis, it is important to start by learning the basics and then gradually increase your understanding. There are many resources available online and in libraries that can help you learn more about technical analysis.

Fundamental Analysis for Cryptocurrency

Fundamental analysis is a method of evaluating the intrinsic value of an asset. It involves examining the underlying factors that affect the asset’s value, such as its financial statements, management team, industry outlook, and competitive landscape. In the context of cryptocurrency, fundamental analysis can be used to determine the long-term viability and potential growth of a particular cryptocurrency project.

There are several key factors to consider when conducting fundamental analysis for cryptocurrency projects. These include:

- Technology: The underlying technology of the cryptocurrency project is crucial. Factors to consider include the security, scalability, and efficiency of the blockchain. For example, a project with a strong, secure blockchain that can handle a high volume of transactions is likely to be more valuable than a project with a weak or inefficient blockchain.

- Team: The team behind the cryptocurrency project is important. This includes the founders, developers, advisors, and other key personnel. A team with a strong track record of success in the technology industry is likely to be more successful in building a valuable cryptocurrency project.

- Community: The community surrounding the cryptocurrency project is also important. A large and active community can help to drive adoption and growth. Factors to consider include the size of the community, the level of engagement, and the quality of the discussions.

- Use Cases: The real-world applications of the cryptocurrency are important. A project with clear and compelling use cases is likely to be more valuable than a project with limited or unclear use cases.

- Tokenomics: The tokenomics of the cryptocurrency project refer to how the tokens are issued, distributed, and used. Factors to consider include the total supply of tokens, the token distribution, and the token utility. A well-designed tokenomics model can help to ensure the long-term sustainability of the project.

- Competition: The competitive landscape of the cryptocurrency industry is constantly evolving. It is important to consider the competition when evaluating a cryptocurrency project. Factors to consider include the number of competitors, the market share of each competitor, and the competitive advantages of the project.

Fundamental analysis can be a valuable tool for investors looking to identify promising cryptocurrency projects. By carefully considering the factors outlined above, investors can make more informed investment decisions and potentially achieve higher returns. However, it is important to note that fundamental analysis is not a foolproof method and that there is always inherent risk involved in investing in cryptocurrencies.

Risk Management and Protecting Your Investments

Investing can be a rewarding experience, but it also comes with inherent risks. The potential for losses is always present, and it’s crucial to have a sound risk management strategy in place to safeguard your investments. Risk management involves identifying, assessing, and mitigating potential threats to your portfolio.

Understanding Different Types of Risk

There are various types of risks that investors face. Some common ones include:

- Market risk: This refers to the overall fluctuations in the market, such as economic downturns or geopolitical events.

- Interest rate risk: Changes in interest rates can impact the value of fixed-income investments, such as bonds.

- Inflation risk: Rising inflation can erode the purchasing power of your investments.

- Credit risk: This risk applies to debt investments, where the issuer may default on their payments.

- Liquidity risk: This refers to the difficulty in selling an investment quickly and at a fair price.

Risk Management Strategies

Here are some effective risk management strategies you can implement:

- Diversification: Spreading your investments across different asset classes, industries, and geographic locations can reduce your exposure to any single risk.

- Asset allocation: Determining the optimal proportion of your portfolio to allocate to different asset classes, based on your risk tolerance and investment goals.

- Rebalancing: Regularly adjusting your portfolio to maintain your desired asset allocation and mitigate any imbalances.

- Risk assessment: Regularly assessing your investments and identifying potential threats, such as changes in market conditions or company performance.

- Stop-loss orders: Setting predetermined limits to sell an investment if its price drops below a certain threshold, limiting potential losses.

Importance of Professional Advice

While it’s essential to understand risk management principles, seeking professional advice from a qualified financial advisor can be highly beneficial. They can provide personalized guidance based on your individual circumstances and help you develop a robust risk management strategy.

Conclusion

Risk management is an integral part of successful investing. By understanding the various types of risks, implementing effective strategies, and seeking professional advice, you can protect your investments and increase your chances of achieving your financial goals.

Common Mistakes to Avoid in Crypto Trading

Crypto trading can be a lucrative endeavor, but it’s also risky. Many new traders make common mistakes that can lead to losses. Avoiding these mistakes is crucial to becoming a successful trader. Here are some of the most common mistakes to avoid:

1. Trading Without a Plan

One of the biggest mistakes beginners make is trading without a plan. You need to have a clear strategy for entering and exiting trades, managing your risk, and setting your profit targets. Without a plan, you’re likely to make impulsive decisions that can cost you money.

2. Not Doing Your Research

Before you invest in any cryptocurrency, it’s important to do your research and understand the project behind it. Consider factors such as the team, the technology, the market cap, and the overall market sentiment. Failing to do your research can lead to investing in projects that are not viable or have questionable management.

3. Ignoring Risk Management

Risk management is critical in crypto trading. You should never invest more than you can afford to lose. It’s also important to set stop-loss orders to limit your potential losses on individual trades. Ignoring risk management can lead to catastrophic losses.

4. Chasing Pumps

Pump-and-dump schemes are common in the crypto market. These involve artificially inflating the price of a cryptocurrency to attract buyers, and then dumping the coin to drive the price down. Chasing pumps can lead to significant losses, as the price is likely to crash quickly.

5. Holding onto Losing Trades

Another common mistake is holding onto losing trades in the hope that the price will rebound. This is known as “averaging down,” and it can lead to further losses. It’s important to cut your losses and move on if a trade isn’t working out. Remember, sometimes the best move is to walk away.

6. FOMO (Fear of Missing Out)

Fear of missing out (FOMO) can lead to impulsive trading decisions. If you see a cryptocurrency rallying, it’s easy to get caught up in the hype and buy in at the top. This can lead to losses as the price inevitably corrects.

7. Overtrading

Overtrading is a common mistake that can lead to significant losses. If you’re constantly buying and selling cryptocurrencies, you’re likely to increase your trading fees and make more impulsive decisions. It’s important to be patient and only trade when there are clear opportunities.

8. Not Diversifying

Diversifying your portfolio is important in any investment, but it’s especially crucial in the volatile crypto market. Don’t put all your eggs in one basket. Instead, invest in a variety of cryptocurrencies across different sectors. This will help to mitigate your risk.

9. Not Keeping Up with the Market

The crypto market is constantly evolving. New projects are emerging, regulations are changing, and market sentiment is constantly shifting. To be a successful trader, you need to stay informed about the latest news and developments. Follow reputable news sources and use tools like charting software to track price trends.

10. Ignoring Your Emotions

It’s essential to trade with a clear head and not let your emotions get in the way of making sound decisions. Fear and greed can lead to irrational behavior that can cost you money. Avoid making decisions when you’re feeling stressed, anxious, or excited.

By avoiding these common mistakes, you’ll be well on your way to becoming a more successful crypto trader. Remember, patience, discipline, and a solid trading plan are key to success.

Tips for Successful Cryptocurrency Trading

The cryptocurrency market is a volatile and fast-paced environment, making it crucial for traders to have a solid strategy and understanding of the market dynamics. To navigate the intricacies of this exciting world, it’s essential to equip yourself with knowledge and follow proven tips that can enhance your chances of success. This guide will delve into key strategies for navigating the cryptocurrency trading landscape.

1. Start with a Solid Foundation: Education and Research

Before you dive into the world of cryptocurrency trading, it’s imperative to have a strong foundation.

Start by understanding the basics of blockchain technology, how cryptocurrencies work, and different types of crypto assets.

Explore reputable resources like white papers, online articles, and educational videos to gain a comprehensive understanding. Familiarize yourself with key terminology, market trends, and potential risks associated with trading.

2. Choose the Right Exchange and Wallet

Selecting a reliable cryptocurrency exchange and secure wallet is crucial for your trading journey.

Research exchanges based on factors like fees, security measures, available cryptocurrencies, and user interface.

Consider using cold storage wallets for long-term holdings, which offer enhanced security compared to hot wallets. Ensure the chosen exchange and wallet are reputable and have robust security protocols in place.

3. Develop a Trading Strategy

A well-defined trading strategy is your roadmap to success.

Determine your trading goals, risk tolerance, and investment horizon.

Explore different trading strategies like day trading, swing trading, or long-term investing, and choose the one that aligns with your goals and risk profile. Consider implementing technical analysis tools and fundamental research to identify trading opportunities and make informed decisions.

4. Manage Your Risks Wisely

Risk management is paramount in cryptocurrency trading.

Set stop-loss orders to limit potential losses on your trades.

Diversify your portfolio across different cryptocurrencies to mitigate the impact of fluctuations in any single asset. Never invest more than you can afford to lose and maintain a healthy balance between risk and reward.

5. Embrace Continuous Learning

The cryptocurrency market is constantly evolving, so continuous learning is essential.

Stay updated on market trends, news, and emerging technologies that could impact your trading decisions.

Attend webinars, read industry blogs, and engage in online communities to expand your knowledge base and stay ahead of the curve.

6. Be Patient and Disciplined

Cryptocurrency trading requires patience and discipline.

Avoid impulsive decisions and stick to your trading plan.

Don’t chase profits or panic sell during market volatility. Stay calm, analyze the situation, and make rational decisions based on your strategy. Remember, patience and discipline are key to long-term success in this dynamic market.

7. Consider Tax Implications

Cryptocurrency transactions are often subject to capital gains taxes.

Research the tax regulations in your jurisdiction and consult with a tax professional to ensure compliance.

Properly track your trades and transactions to accurately report your income and capital gains for tax purposes.

8. Stay Informed About Regulations

The regulatory landscape for cryptocurrencies is constantly changing.

Keep yourself updated on the latest regulations and guidelines that could impact your trading activities.

Ensure you are trading in compliance with the rules and regulations of your region.

Staying Informed About Market Trends

In today’s dynamic business environment, staying ahead of the curve is crucial for success. One of the most critical aspects of this is staying informed about market trends. Understanding what consumers want, how competitors are evolving, and the overall direction of the industry can provide valuable insights that inform strategic decision-making.

But with a constant barrage of information from various sources, it can be overwhelming to sift through and identify truly valuable trends. That’s where a structured approach to market trend analysis comes into play. Here are some key steps to ensure you’re staying informed:

1. Define Your Scope

Start by clearly defining the scope of your market trend analysis. What industry, product, or service are you focusing on? What geographical area are you interested in? Having clear boundaries will help you narrow down your research and ensure you’re collecting relevant data.

2. Identify Reliable Sources

There are numerous sources of market information, both primary and secondary. Primary sources include customer surveys, focus groups, and interviews, while secondary sources encompass industry reports, market research databases, trade publications, and online news articles. It’s essential to choose reliable and credible sources to ensure the accuracy of your information.

3. Monitor Key Metrics

Once you have identified key sources, track relevant metrics that indicate changes in market dynamics. This could include:

- Sales figures

- Customer demographics

- Competitive activity

- Technological advancements

- Consumer sentiment

4. Analyze and Interpret Data

After gathering data, analyze it to identify emerging patterns and trends. This could involve statistical analysis, qualitative insights, or expert opinion. Look for:

- Growth areas: Which segments are expanding?

- Declining areas: Which segments are shrinking?

- Emerging technologies: What new technologies are impacting the market?

- Consumer preferences: How are consumer preferences changing?

- Competitive threats: What are competitors doing?

5. Develop Actionable Strategies

The final step is to use the insights gleaned from market trend analysis to inform your business strategy. This might involve product development, marketing campaigns, pricing adjustments, or operational improvements. By acting proactively based on market trends, you can position yourself for success in the long run.