Navigating the world of cryptocurrency can feel like stepping into a wild, uncharted territory. With so many different coins and tokens vying for attention, it’s easy to get overwhelmed and make impulsive decisions. But just like any investment, a well-rounded approach is key to achieving success. This is where diversification comes in. A diversified portfolio of cryptocurrency investments acts as a safety net, helping you weather market fluctuations and maximize your potential for long-term gains.

This beginner’s guide is designed to equip you with the knowledge and tools you need to unlock a balanced portfolio. We’ll delve into the essential concepts of cryptocurrency diversification, exploring different asset classes, risk management strategies, and practical steps you can take to build a portfolio that aligns with your individual financial goals. Whether you’re a seasoned investor or just dipping your toes into the crypto waters, understanding the principles of diversification can be a game-changer in your journey towards achieving financial freedom.

Understanding Cryptocurrency Diversification

In the dynamic world of cryptocurrency, diversification is a crucial strategy for mitigating risk and maximizing potential returns. Just like a well-balanced investment portfolio in traditional markets, diversifying your cryptocurrency holdings across different assets can help reduce the impact of market volatility and increase the chances of long-term success.

Why Diversify?

Cryptocurrency markets are notoriously volatile, with prices fluctuating significantly even within short periods. Holding a single cryptocurrency can expose you to substantial risk if that asset’s value declines. Diversification helps you spread this risk across a range of assets, lowering the overall impact on your portfolio.

Key Diversification Strategies:

- Asset Classes: Invest in a mix of cryptocurrencies representing different asset classes. For example, consider including Bitcoin (a store of value), Ethereum (a platform for decentralized applications), and stablecoins (cryptocurrencies pegged to fiat currencies) in your portfolio.

- Market Capitalization: Diversify across cryptocurrencies with varying market capitalizations. Large-cap coins like Bitcoin and Ethereum tend to be more stable, while smaller-cap coins offer higher potential for growth.

- Sector Focus: Explore cryptocurrencies focused on specific sectors, such as DeFi (decentralized finance), NFTs (non-fungible tokens), and metaverse projects. This can provide exposure to emerging trends and innovations.

- Time Horizon: Consider your investment time horizon. If you’re a long-term investor, you can tolerate more risk and allocate more to potentially higher-growth coins. Short-term investors may prefer a more conservative approach with larger-cap, more stable assets.

Benefits of Diversification:

- Reduced Risk: By spreading your investment across multiple cryptocurrencies, you lower your exposure to any single asset’s performance fluctuations. This helps to reduce the potential for significant losses.

- Potential for Higher Returns: Investing in a range of cryptocurrencies can expose you to different growth opportunities. As different sectors and projects within the cryptocurrency ecosystem evolve, your diversified portfolio could benefit from these advancements.

- Enhanced Portfolio Resilience: A well-diversified portfolio can be more resilient in the face of market downturns. While some assets may experience losses, others may perform well, helping to offset potential losses.

Conclusion:

Cryptocurrency diversification is a critical aspect of responsible investing in the digital asset space. By spreading your investment across a range of assets, you can mitigate risk, enhance potential returns, and build a more resilient portfolio in the long term. Remember to conduct thorough research, consider your risk tolerance, and seek professional advice if needed before making any investment decisions.

Why Diversification Matters in Crypto

The crypto market is known for its volatility, with prices fluctuating significantly in short periods. This volatility creates both opportunities and risks for investors. One of the key strategies for mitigating risk and maximizing potential returns is diversification. Diversification in crypto involves investing in a variety of different cryptocurrencies, each with its own unique characteristics and potential for growth.

Think of it like this: imagine you’re building a portfolio of investments. You wouldn’t just put all your money in one stock, right? The same principle applies to crypto. By investing in a range of different assets, you’re spreading your risk across various sectors, technologies, and market caps. This helps to reduce the impact of any single asset’s performance on your overall portfolio.

Benefits of Diversification

- Risk Mitigation: Diversification reduces the overall risk of your portfolio by spreading your investment across different assets. If one asset performs poorly, the others may offset its losses.

- Potential for Higher Returns: By investing in a variety of assets with different growth potentials, you increase the chances of capturing higher overall returns. Some assets may outperform others, leading to a more balanced and potentially higher-yielding portfolio.

- Improved Portfolio Stability: A diversified portfolio is less susceptible to market fluctuations. When one asset experiences a downturn, others may perform better, helping to stabilize the overall value of your portfolio.

- Reduced Emotional Impact: Diversification can help investors make more rational decisions by reducing the emotional impact of market volatility. Instead of panicking when one asset dips, you can focus on the overall performance of your diversified portfolio.

How to Diversify Your Crypto Portfolio

There are several ways to diversify your crypto portfolio, each with its own considerations. Here are some common strategies:

- By Market Cap: Invest in cryptocurrencies with varying market capitalizations. Consider investing in large-cap coins like Bitcoin and Ethereum for stability and smaller-cap coins for potential growth.

- By Sector: Explore different sectors within the crypto industry, such as DeFi, NFTs, or Web3. Investing in projects across different sectors can provide exposure to a wider range of innovations and opportunities.

- By Use Case: Diversify by investing in cryptocurrencies with different use cases, such as payments, smart contracts, or privacy. This approach allows you to participate in the growth of various aspects of the crypto ecosystem.

- By Technology: Consider investing in projects with different underlying technologies, such as proof-of-work, proof-of-stake, or layer-2 scaling solutions. Each technology brings its own advantages and disadvantages, and diversifying across them can provide a more balanced portfolio.

Remember:

Diversification is a crucial element of any investment strategy, especially in the volatile world of cryptocurrency. While it’s important to research and understand the projects you invest in, diversification helps to mitigate risk and maximize potential returns. As the crypto market continues to evolve, maintaining a well-diversified portfolio will be key to navigating the ever-changing landscape.

Exploring Different Cryptocurrency Categories

The world of cryptocurrencies is constantly evolving, with new projects and innovations emerging regularly. Navigating this vast landscape can be overwhelming, especially for newcomers. One way to make sense of it all is by understanding the different categories of cryptocurrencies. Each category possesses unique features, use cases, and underlying technology, contributing to the diverse and dynamic ecosystem.

Here are some of the prominent categories of cryptocurrencies:

1. Stablecoins

Stablecoins are designed to maintain a stable value, typically pegged to a fiat currency like the US dollar. This stability is achieved through various mechanisms, such as holding reserves of fiat currency or other assets. Stablecoins aim to minimize price volatility, making them suitable for everyday transactions and as a store of value. Some popular examples include Tether (USDT), USD Coin (USDC), and Binance USD (BUSD).

2. Utility Tokens

Utility tokens are primarily used to access or utilize specific services or platforms. They are often integrated into decentralized applications (dApps) and function as a means of payment within the ecosystem. Utility tokens can be used for tasks such as paying for gas fees, accessing premium features, or participating in governance. Examples include BAT (Basic Attention Token), MANA (Decentraland), and CHZ (Chiliz).

3. Security Tokens

Security tokens are digital assets that represent ownership or investment rights in a real-world asset, such as real estate, equity, or debt. They offer a more efficient and transparent way to invest in traditional assets. Security tokens are typically regulated by securities laws, ensuring investor protection and compliance. Examples include tZERO and Polymath.

4. Meme Coins

Meme coins are cryptocurrencies that often gain popularity based on internet memes and online communities. They are typically highly volatile and speculative, with value fluctuations driven by hype and social media trends. Meme coins like Dogecoin (DOGE) and Shiba Inu (SHIB) have become popular among retail investors and have achieved significant market capitalizations.

5. Layer-1 Blockchains

Layer-1 blockchains refer to the foundational blockchain networks that provide the core infrastructure for decentralized applications and cryptocurrency transactions. These blockchains, such as Bitcoin (BTC), Ethereum (ETH), and Solana (SOL), are responsible for consensus mechanisms, transaction processing, and network security. Layer-1 blockchains often serve as the foundation for other cryptocurrencies and applications.

6. Layer-2 Solutions

Layer-2 solutions are built on top of existing layer-1 blockchains to improve their scalability and efficiency. They provide faster transaction speeds, lower gas fees, and increased throughput. Layer-2 solutions aim to address the scalability challenges faced by layer-1 blockchains, making them more suitable for mass adoption. Examples include Polygon (MATIC), Arbitrum, and Optimism.

7. Non-Fungible Tokens (NFTs)

Non-fungible tokens (NFTs) are unique and indivisible digital assets that represent ownership of a specific item, such as digital art, music, or virtual collectibles. NFTs are stored on blockchains, ensuring authenticity and provenance. NFTs have gained significant popularity as a way to tokenize digital assets and create new avenues for creators and collectors.

Assessing Risk Tolerance and Investment Goals

Before you start investing, it’s crucial to understand your risk tolerance and investment goals. These two factors will help you make informed decisions about where to invest your money and how much risk you’re willing to take. Risk tolerance refers to your capacity to withstand fluctuations in the value of your investments. Investment goals are your financial objectives, such as saving for retirement, buying a house, or funding your children’s education.

Understanding Your Risk Tolerance

Your risk tolerance is influenced by several factors, including your age, financial situation, and investment experience. Younger investors with a longer time horizon can generally afford to take on more risk, as they have time to recover from any potential losses. Older investors with a shorter time horizon typically prefer lower-risk investments to preserve their capital. Investors with a strong financial foundation might be more comfortable taking on more risk, while those with limited financial resources may opt for lower-risk investments.

Here are some questions to help you assess your risk tolerance:

- How would you feel if your investment lost 10% of its value in a short period?

- Are you comfortable with the possibility of losing some money to achieve potentially higher returns?

- How long are you willing to hold your investments?

Defining Your Investment Goals

Once you understand your risk tolerance, you can start defining your investment goals. These goals should be specific, measurable, achievable, relevant, and time-bound (SMART). For example, instead of saying “I want to save for retirement,” you should say “I want to save $1 million by the time I turn 65.”

Here are some common investment goals:

- Retirement planning: Saving enough money to support yourself during retirement.

- Homeownership: Saving for a down payment on a house.

- Education savings: Saving for your children’s or grandchildren’s education.

- Emergency fund: Building a safety net for unexpected expenses.

- Wealth accumulation: Growing your wealth over time.

Putting It All Together

Your risk tolerance and investment goals should work together to create a coherent investment strategy. If you have a high risk tolerance and a long-term goal, you might choose to invest in a diversified portfolio of stocks and other growth-oriented investments. If you have a low risk tolerance and a short-term goal, you might prefer to invest in bonds or other conservative investments.

It’s important to regularly review your investment strategy and make adjustments as your risk tolerance and investment goals change over time. This will help you stay on track and achieve your financial objectives.

Strategies for Effective Cryptocurrency Diversification

Cryptocurrency diversification is a crucial strategy for mitigating risk and maximizing returns in the volatile crypto market. By spreading your investment across a variety of cryptocurrencies, you can reduce your exposure to the fluctuations of any single asset. This article will explore effective strategies for diversifying your cryptocurrency portfolio, emphasizing the importance of thorough research, market analysis, and a well-defined investment plan.

1. Diversify by Asset Class

The crypto market encompasses various asset classes, each with its unique characteristics and potential for growth. Diversifying across these classes can help mitigate risk and capture different market trends.

- Bitcoin (BTC): Often considered the gold standard of cryptocurrencies, Bitcoin is known for its robust network and limited supply.

- Ethereum (ETH): Ethereum is a leading platform for decentralized applications (DApps) and smart contracts, offering diverse investment opportunities.

- Stablecoins: These cryptocurrencies are designed to maintain a stable value, typically pegged to a fiat currency like the US dollar. They can provide stability and liquidity in your portfolio.

- Layer-1 Blockchains: Emerging blockchains, such as Solana, Avalanche, and Polkadot, are developing innovative solutions to address scalability and efficiency issues.

- DeFi (Decentralized Finance) Tokens: These tokens represent ownership or access to decentralized financial services, offering potential for growth in the rapidly evolving DeFi space.

- NFTs (Non-Fungible Tokens): NFTs are unique digital assets that represent ownership of digital or physical items, presenting opportunities for collectible and artistic investments.

2. Consider Market Capitalization

Market capitalization (market cap) represents the total value of a cryptocurrency’s circulating supply. Diversifying by market cap can help you balance exposure to established, large-cap coins with potential upside from smaller-cap projects.

- Large-Cap: Cryptocurrencies with high market capitalization often have established ecosystems and strong community support.

- Mid-Cap: These coins may offer greater growth potential than large-cap coins but come with higher risk.

- Small-Cap: Cryptocurrencies with low market capitalization are often considered highly speculative, offering the potential for significant returns but also carrying high risk.

3. Allocate Based on Risk Tolerance

Your risk tolerance plays a vital role in determining your diversification strategy. High-risk tolerance investors may allocate a larger portion of their portfolio to speculative projects, while risk-averse investors may prefer a more conservative approach with established, low-volatility assets.

4. Rebalance Regularly

Cryptocurrency prices fluctuate constantly. It’s crucial to rebalance your portfolio regularly to maintain your desired asset allocation. This involves adjusting your holdings to ensure that your investment strategy remains on track.

5. Invest for the Long Term

Cryptocurrency markets are known for their volatility. It’s important to remember that investing in cryptocurrencies is a long-term strategy. Avoid making impulsive decisions based on short-term price movements, and focus on building a diverse and well-balanced portfolio.

Choosing the Right Exchange for Diversified Holdings

When constructing a diversified portfolio, investors often encounter the crucial question: “Which exchange should I utilize?” The answer lies in understanding the nuances of different exchanges and their impact on your investment strategy. This article will delve into the factors to consider when choosing the right exchange, empowering you to make informed decisions about your diversified holdings.

Exchange Types: A Landscape Overview

Exchanges serve as marketplaces where buyers and sellers converge to trade securities. There are two primary categories:

- Stock Exchanges: These facilitate the buying and selling of stocks, representing ownership in publicly traded companies. Examples include the New York Stock Exchange (NYSE) and Nasdaq.

- Futures Exchanges: These offer trading in futures contracts, agreements to buy or sell an asset at a predetermined price and date. Examples include the Chicago Mercantile Exchange (CME) and the Intercontinental Exchange (ICE).

Factors to Consider: Tailoring the Exchange to Your Needs

The selection of the most suitable exchange hinges on several crucial factors:

1. Asset Class: Aligning the Exchange with Your Investments

The type of assets you intend to trade dictates the appropriate exchange. For stocks, consider the NYSE or Nasdaq, renowned for their size and liquidity. For futures contracts, explore exchanges like CME or ICE, specializing in specific asset classes like commodities or interest rates.

2. Liquidity: Ensuring Smooth Trading Experience

Liquidity refers to the ease of buying or selling an asset without significantly impacting its price. Exchanges with high liquidity offer seamless trading, making them ideal for actively managed portfolios. The NYSE and Nasdaq are known for their deep liquidity, while smaller regional exchanges may exhibit lower liquidity.

3. Trading Fees: Minimizing Costs to Enhance Returns

Trading fees are charges associated with buying or selling assets on an exchange. These fees can vary across exchanges, influencing the overall cost of your trades. Compare fees structures to identify exchanges that align with your budget and trading frequency.

4. Regulatory Framework: Enforcing Trust and Transparency

A robust regulatory framework fosters investor confidence and protects against fraudulent activities. Choose exchanges with a strong regulatory reputation to ensure transparency and fairness in trading practices.

Key Considerations for Diversified Portfolios

For diversified portfolios, it’s advantageous to consider exchanges that offer a broad range of assets. The NYSE and Nasdaq provide access to a wide array of stocks, while exchanges like CME and ICE offer contracts on various commodities and financial instruments. This diversification can enhance risk management and potentially improve returns over time.

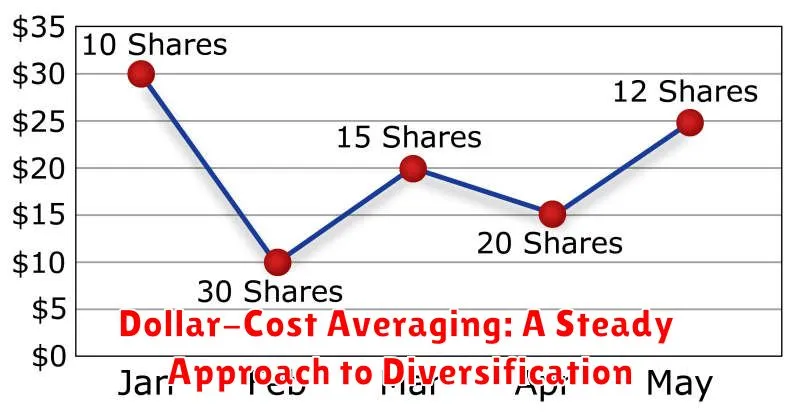

Dollar-Cost Averaging: A Steady Approach to Diversification

Dollar-cost averaging (DCA) is a popular investment strategy that involves investing a fixed amount of money at regular intervals, regardless of the market’s current price. This approach aims to reduce the impact of market volatility by spreading out your investment over time, lessening the risk of buying high and selling low.

How Dollar-Cost Averaging Works

Imagine you decide to invest $100 per month in a particular stock. If the stock price is high one month, you’ll buy fewer shares. When the price is low, you’ll buy more shares. This strategy, over time, averages out the cost of your investment, reducing the influence of market fluctuations.

Benefits of Dollar-Cost Averaging

Dollar-cost averaging offers several key advantages for investors:

- Reduces emotional investment decisions: DCA takes emotion out of investing by automating your contributions. It eliminates the temptation to panic sell during market downturns or chase returns during rallies.

- Disciplined investment approach: By investing consistently, you develop a disciplined investment habit, contributing regularly even when the market is volatile.

- Minimizes risk of market timing: Trying to time the market is notoriously difficult, even for experienced investors. DCA removes the pressure to predict market movements, allowing you to invest regardless of market conditions.

- Potential for higher returns: While not guaranteed, studies have shown that DCA can lead to higher returns over the long term compared to lump-sum investing, especially when market volatility is high.

Considerations for Dollar-Cost Averaging

While DCA offers significant benefits, it’s important to consider some key factors:

- Time horizon: DCA is best suited for long-term investments. It’s a strategy that needs time to average out market fluctuations and may not be ideal for short-term trading.

- Market timing: While DCA aims to minimize risk, it doesn’t eliminate it entirely. It’s possible to miss out on potential gains during strong bull markets.

- Fees: Repeated investments can incur transaction fees, which can impact your overall returns. Choose investment platforms with low fees or consider investing in low-cost index funds.

Conclusion

Dollar-cost averaging is a proven strategy for investors seeking a disciplined and diversified approach to investing. By investing regularly, regardless of market conditions, DCA helps to minimize risk and potentially maximize returns over the long term. However, it’s essential to consider your investment goals, time horizon, and risk tolerance before implementing this strategy.

Portfolio Rebalancing: Maintaining Your Crypto Balance

In the dynamic world of cryptocurrency, where prices fluctuate wildly, maintaining a balanced portfolio is crucial for long-term success. Portfolio rebalancing is the process of adjusting your asset allocation to ensure it aligns with your investment goals and risk tolerance. It involves buying or selling assets to restore the desired proportions within your portfolio.

Why is portfolio rebalancing important?

As the value of different cryptocurrencies changes, your initial asset allocation can become skewed, leading to unintended exposure or under-allocation. Rebalancing helps address this by:

- Maintaining your desired risk level: Rebalancing prevents you from becoming overly exposed to volatile assets or missing out on potential gains in undervalued ones.

- Optimizing your portfolio’s performance: By selling high-performing assets and buying underperforming ones, you can potentially improve your overall returns.

- Disciplined investing: Rebalancing encourages a disciplined approach, reducing emotional decision-making and promoting a long-term perspective.

How to Rebalance Your Crypto Portfolio:

The process of rebalancing is relatively straightforward. It involves the following steps:

- Determine your target asset allocation: Define the percentage you want to allocate to each cryptocurrency in your portfolio based on your risk tolerance and investment goals.

- Monitor your portfolio regularly: Keep track of your portfolio’s performance and identify any significant deviations from your target allocation.

- Rebalance your portfolio: If your portfolio has drifted too far from your target, buy or sell assets to restore the desired proportions.

- Rebalance periodically: The frequency of rebalancing depends on your individual needs and market volatility. A common approach is to rebalance quarterly or semi-annually.

Strategies for Portfolio Rebalancing:

There are different rebalancing strategies you can choose from, including:

- Constant Proportion Portfolio Insurance (CPPI): This strategy involves adjusting your portfolio’s risk level based on market conditions. It uses a fixed percentage of your portfolio’s value to invest in risky assets, while the remaining portion is allocated to less volatile assets.

- Time-based rebalancing: This approach involves rebalancing your portfolio at fixed intervals, such as quarterly or annually. It can help ensure that your portfolio remains aligned with your goals over time.

- Threshold rebalancing: This strategy involves rebalancing only when your portfolio deviates from your target allocation by a certain threshold. It can help minimize trading costs and transaction fees.

Conclusion:

Portfolio rebalancing is an essential practice for any cryptocurrency investor. It helps maintain a balanced portfolio, control risk, and optimize returns. By understanding the principles of rebalancing and implementing a suitable strategy, you can increase your chances of long-term success in the dynamic world of cryptocurrencies.

The Importance of Research and Due Diligence

In today’s fast-paced world, it’s easy to get caught up in the excitement of new opportunities and make decisions without doing the necessary research. However, research and due diligence are crucial for making informed decisions, especially when it comes to investments, business ventures, or any significant life choices.

Research involves gathering information about a particular topic, product, or service. It can involve reading articles, reports, and reviews; conducting interviews; and analyzing data. Due diligence is a more in-depth process that goes beyond simply gathering information. It involves verifying the information you’ve gathered, assessing risks and potential problems, and making a well-informed judgment.

Here are some of the key benefits of conducting thorough research and due diligence:

- Reduces Risk: By understanding the potential risks and downsides of a particular decision, you can make more informed choices and minimize your chances of making a costly mistake.

- Improves Decision-Making: The information you gather through research can help you identify potential opportunities and challenges, allowing you to make more strategic and effective decisions.

- Boosts Confidence: Knowing that you’ve done your homework and have a solid understanding of the situation can boost your confidence and make you feel more secure in your decisions.

- Saves Time and Money: While research and due diligence take time and effort, they can save you time and money in the long run by preventing costly mistakes and helping you avoid pitfalls.

- Builds a Reputation: Demonstrating a commitment to research and due diligence can build a reputation for being thorough, reliable, and trustworthy.

Whether you’re starting a new business, investing in a new product, or simply making a major life decision, taking the time to conduct research and due diligence is essential for making informed and successful decisions.

Security Measures for Your Diversified Portfolio

A diversified portfolio is a crucial aspect of achieving long-term financial goals. It involves spreading your investments across various asset classes, such as stocks, bonds, real estate, and commodities. While diversification helps mitigate risk, it’s equally important to implement robust security measures to protect your assets from potential threats.

Here are some key security measures to consider for your diversified portfolio:

1. Strong Passwords and Two-Factor Authentication

Your online accounts, including brokerage platforms and financial institutions, are vulnerable to unauthorized access. Use strong passwords that are unique for each account, combining uppercase and lowercase letters, numbers, and symbols. Two-factor authentication (2FA) adds an extra layer of security by requiring a second verification step, typically through a code sent to your phone or email. 2FA significantly reduces the risk of unauthorized logins.

2. Secure Your Devices

Your devices, including smartphones, laptops, and tablets, hold sensitive financial information. Install antivirus software to protect against malware and viruses. Keep your operating system and software updated to patch security vulnerabilities. Use a password manager to securely store and manage your passwords. Enable device encryption to protect your data if your device is lost or stolen.

3. Be Vigilant Against Phishing Scams

Phishing scams are designed to trick you into revealing your personal and financial information. Be wary of emails, texts, or phone calls that ask for your login credentials, bank details, or other sensitive information. Never click on links in suspicious emails or text messages. Verify the legitimacy of any request by contacting the organization directly through their official website or phone number.

4. Monitor Your Accounts Regularly

Regularly review your account statements for any suspicious activity. Check your credit report for any unauthorized accounts or inquiries. Set up alerts for unusual activity on your accounts, such as large withdrawals or changes in your contact information. Promptly report any suspicious activity to the relevant financial institution or service provider.

5. Invest with Reputable Institutions

Choose financial institutions and brokerage firms with a strong track record of security and regulatory compliance. Research their security measures and ensure they have appropriate safeguards in place to protect your investments. Avoid dealing with unknown or unregulated entities that may pose a higher risk of fraud or theft.

6. Keep Your Information Updated

Ensure your contact information, including your address, phone number, and email address, is up-to-date with all your financial institutions and brokerage firms. This ensures you receive important notifications and communications regarding your accounts. Regularly review your account settings and make necessary updates as needed.

7. Understand Investment Risks

Diversification alone cannot eliminate all risks. It’s crucial to understand the risks associated with each asset class in your portfolio. Conduct thorough research before investing in any asset class, and seek professional advice from a qualified financial advisor. This will help you make informed decisions and manage your risk effectively.

Staying Informed About Market Trends

In the dynamic and ever-evolving world of business, staying informed about market trends is crucial for success. Market trends, which refer to the patterns and changes in consumer behavior, technology, and competition, can significantly impact a company’s performance and profitability. By understanding and adapting to these trends, businesses can capitalize on opportunities, mitigate risks, and maintain a competitive edge.

Market research plays a pivotal role in staying informed about trends. This involves gathering and analyzing data from various sources, including customer surveys, industry reports, competitor analysis, and social media monitoring. By understanding the insights derived from market research, companies can gain valuable knowledge about emerging consumer needs, preferences, and purchasing patterns.

Industry publications are another vital source of information on market trends. These publications, ranging from trade magazines to research reports, provide in-depth analyses of specific industries and sectors. By subscribing to relevant publications and staying abreast of industry news, companies can gain insights into technological advancements, regulatory changes, and competitive landscapes.

Attending industry conferences and events offers an excellent opportunity to network with peers, listen to expert presentations, and discover emerging trends. These events often feature keynote speakers, panel discussions, and workshops that provide valuable perspectives on the latest developments in the industry.

Social media monitoring is becoming increasingly important for staying informed about market trends. By analyzing social media conversations, companies can gauge consumer sentiment, identify emerging trends, and understand how their brand is perceived in the market.

Competitor analysis is essential for understanding the strategies and tactics of competitors. By analyzing competitor products, marketing campaigns, and pricing strategies, companies can identify areas of strength and weakness and develop effective countermeasures.

Staying informed about market trends is an ongoing process that requires vigilance and proactive engagement. By leveraging various resources and tools, businesses can gain a comprehensive understanding of market dynamics and make informed decisions to achieve sustained growth and success.