Are you looking to unlock real estate riches and build a strong financial future? Investing in real estate can be a powerful way to grow your wealth and achieve financial freedom. But navigating the world of investment properties can be daunting, especially when it comes to financing. This comprehensive guide will equip you with the knowledge and strategies you need to secure the funding to make your real estate dreams a reality.

From understanding different loan options and credit requirements to navigating the mortgage application process, we’ll break down the essentials of financing investment properties. Whether you’re a seasoned investor or just starting your journey, this guide will provide you with the insights and practical tips to make informed decisions and unlock the potential of real estate investment.

Understanding Your Financial Standing

Knowing where you stand financially is crucial for making informed decisions about your future. Whether you’re aiming to pay off debt, save for retirement, or simply manage your everyday expenses, a clear understanding of your financial standing is essential.

To achieve this, you need to analyze your current financial situation. This involves gathering and reviewing key financial documents such as:

- Bank statements: To understand your income, expenses, and overall cash flow.

- Credit card statements: To assess your credit card debt and interest rates.

- Loan statements: To analyze your outstanding debt and repayment terms.

- Investment statements: To track your investments and their performance.

- Tax returns: To understand your income and tax liabilities.

Once you’ve gathered this information, it’s time to analyze it. Consider the following factors:

Income & Expenses

Income represents the money you earn from various sources, including your salary, investments, or side gigs. Expenses are the money you spend on essential needs, like housing, food, and transportation, as well as discretionary spending, like entertainment and travel.

By analyzing your income and expenses, you can identify areas where you can potentially reduce unnecessary spending or explore ways to increase your income. This could involve creating a budget, tracking your spending, or seeking additional income streams.

Debt

Debt refers to money you owe to others. It can be categorized into different types, such as credit card debt, student loans, or mortgages. Understanding your debt level and interest rates is crucial for making informed decisions about repayment strategies.

High levels of debt can significantly impact your financial standing, limiting your ability to save, invest, or pursue financial goals. Developing a debt management plan can help you prioritize repayment, reduce interest charges, and ultimately achieve financial freedom.

Net Worth

Net worth is a snapshot of your overall financial health. It is calculated by subtracting your total liabilities (what you owe) from your total assets (what you own). Positive net worth indicates financial stability, while negative net worth signifies a debt burden.

Tracking your net worth over time allows you to monitor your financial progress. It helps identify areas for improvement, such as increasing your assets or reducing your debt.

Understanding your financial standing is an ongoing process that requires regular monitoring and adjustments. By staying informed and taking proactive steps, you can make informed decisions and build a solid foundation for your financial future.

Exploring Different Financing Options

Financing plays a crucial role in achieving financial goals, whether it’s purchasing a home, starting a business, or simply managing day-to-day expenses. With a plethora of options available, it’s essential to carefully consider and explore the various financing avenues to find the best fit for your specific needs and circumstances.

Personal Loans: These loans are unsecured, meaning they don’t require collateral. They offer flexibility in terms of loan amount and repayment terms. Personal loans are often used for debt consolidation, home improvement projects, or unexpected expenses.

Credit Cards: Credit cards provide short-term financing with revolving credit. They offer convenience and rewards programs, but high interest rates and potential debt accumulation can be drawbacks.

Mortgages: These loans are specifically designed for purchasing real estate. Mortgages typically have longer repayment terms and lower interest rates compared to personal loans.

Auto Loans: Auto loans are used to finance the purchase of a vehicle. Interest rates and loan terms vary depending on the vehicle’s value, creditworthiness, and lender.

Student Loans: Student loans help individuals finance their education. They offer government-backed options with subsidized interest rates and income-driven repayment plans.

Business Loans: These loans are tailored for businesses seeking funding for expansion, equipment purchases, or working capital. They come in various forms, including term loans, lines of credit, and SBA loans.

Home Equity Loans and Lines of Credit: These loans leverage the equity in your home as collateral. They can be used for various purposes but carry higher interest rates and risks if you default on payments.

Peer-to-Peer Lending: This relatively new option allows individuals to borrow and lend money directly through online platforms. It can offer competitive interest rates and flexible terms.

When exploring financing options, it’s crucial to compare interest rates, loan terms, fees, and other factors. It’s also essential to consider your credit score, debt-to-income ratio, and overall financial situation. Consulting with a financial advisor can provide personalized guidance and help you make informed decisions.

Traditional Mortgages: Pros and Cons

When it comes to buying a home, securing financing is often the biggest hurdle. Traditional mortgages have long been the standard for homeownership, but they are not without their own set of advantages and disadvantages. This blog post will delve into the pros and cons of traditional mortgages to help you make an informed decision about your home financing.

Pros of Traditional Mortgages

Traditional mortgages offer several benefits to borrowers:

- Lower Interest Rates: Traditional mortgages typically have lower interest rates compared to other loan options, such as adjustable-rate mortgages (ARMs). This means you’ll pay less in interest over the life of the loan, saving you money.

- Fixed Interest Rates: With a traditional mortgage, your interest rate remains the same for the entire loan term. This provides financial predictability and stability, as your monthly payments will not fluctuate.

- Long-Term Financing: Traditional mortgages have longer terms, usually 15 or 30 years. This allows you to spread out your payments and make more affordable monthly payments. Additionally, this can help you build equity in your home over time.

- Potential Tax Deductions: Mortgage interest is typically deductible on your federal income taxes, further reducing your overall cost of homeownership.

- Greater Flexibility: Traditional mortgages offer greater flexibility in terms of loan amounts, down payment requirements, and other terms. This allows you to tailor the loan to your specific needs and financial situation.

Cons of Traditional Mortgages

While traditional mortgages offer several advantages, they also have some drawbacks:

- Higher Down Payment Requirements: Traditional mortgages generally require a larger down payment, typically 20% of the purchase price. This can be a significant financial barrier for some borrowers.

- Stricter Qualification Criteria: Lenders have stricter qualification requirements for traditional mortgages, including credit score, debt-to-income ratio, and income verification. This can make it challenging for some borrowers to qualify.

- Closing Costs: Traditional mortgages often come with higher closing costs, which can include appraisal fees, origination fees, and other charges.

- Potential for Refinancing: If interest rates drop significantly after you take out a traditional mortgage, you may want to refinance to secure a lower rate. However, refinancing can involve additional costs and paperwork.

Before deciding on a traditional mortgage, consider your financial situation, homeownership goals, and risk tolerance. Compare different loan options, including ARMs, FHA loans, and VA loans, to determine the best fit for your individual needs.

Hard Money Loans: A Quick Financing Solution

In the world of real estate, securing financing can be a complex and time-consuming process. Traditional lenders often have stringent requirements and lengthy approval times, which can hinder your ability to capitalize on lucrative investment opportunities. This is where hard money loans come in. Hard money loans are short-term financing options that are typically provided by private investors, rather than banks or other institutional lenders.

These loans are known for their speed and flexibility, offering a quick and efficient way to secure the capital needed for various real estate ventures. Here are some of the key benefits of hard money loans:

Faster Approval Times

Unlike traditional loans, hard money loans often have a much faster approval process. Private lenders typically have less stringent requirements and can make decisions more quickly. This allows you to close deals faster and begin your project sooner.

Flexibility in Loan Terms

Hard money lenders are known for their flexibility in loan terms. They are often willing to work with borrowers who may not meet the traditional lending criteria, such as those with less-than-perfect credit scores or who are seeking financing for non-conventional projects. This flexibility makes hard money loans a viable option for a wider range of borrowers.

Access to Capital for Difficult Deals

Hard money loans can be a valuable resource for securing financing for challenging real estate projects. These loans are often used to finance properties that may be considered risky by traditional lenders, such as distressed properties, fixer-uppers, or properties with unconventional financing structures.

Bridge Financing

Hard money loans are frequently used as bridge financing. This means that they can provide temporary capital until a borrower can obtain more permanent financing, such as a conventional mortgage. This can be especially helpful for investors who need to acquire a property quickly or who are planning to renovate a property before securing long-term financing.

Potential for Higher Returns

While hard money loans generally come with higher interest rates than traditional loans, the speed and flexibility they offer can lead to greater potential for returns. By securing financing quickly and closing deals faster, investors can maximize their profits on real estate projects.

Considerations for Hard Money Loans

While hard money loans offer significant benefits, it’s important to be aware of some potential drawbacks:

- Higher Interest Rates: Hard money loans typically have higher interest rates than traditional loans, reflecting the higher risk associated with these loans.

- Shorter Loan Terms: Hard money loans often have shorter loan terms than traditional loans, typically ranging from 6 months to 2 years. This requires borrowers to have a clear exit strategy for repaying the loan within the specified timeframe.

- Origination Fees: Hard money lenders may charge origination fees, which are a percentage of the loan amount, to cover their administrative costs.

- Stricter Collateral Requirements: Hard money lenders typically require borrowers to provide significant collateral, often in the form of the property being financed. This helps to protect the lender’s investment in case of default.

It’s crucial to carefully consider the risks and benefits before deciding whether a hard money loan is the right financing solution for your real estate investment.

Overall, hard money loans offer a valuable financing option for real estate investors who need to secure capital quickly and efficiently. Their speed, flexibility, and ability to bridge financing gaps make them a popular choice for a wide range of projects. By understanding the advantages and disadvantages of hard money loans, investors can make informed decisions about whether this financing option is the right fit for their specific needs.

Private Lenders: Tapping into Network Potential

In the dynamic realm of finance, where access to capital is paramount, the emergence of private lenders has revolutionized the landscape. These individuals or entities, operating outside traditional financial institutions, offer a unique avenue for securing funding, particularly for ventures that may not meet the stringent criteria of banks or other conventional lenders. This article delves into the intricacies of private lending, exploring its advantages, disadvantages, and the crucial role of network potential in accessing this alternative funding source.

Private lenders typically operate on a more personalized basis, often focusing on building relationships with borrowers. This approach allows them to assess projects beyond rigid financial metrics, considering factors such as the borrower’s experience, industry knowledge, and potential for growth. This flexibility makes private lending particularly attractive to startups, small businesses, and individuals pursuing projects that may not resonate with traditional lenders.

Advantages of Private Lending

Private lenders offer several compelling advantages over conventional financing options:

- Speed and Flexibility: Private lenders often have quicker decision-making processes and are more adaptable to unique financing needs.

- Less Stringent Requirements: Private lenders may have lower credit score requirements and may be willing to consider borrowers with unconventional financial backgrounds.

- Personalized Approach: Private lenders engage in a more personalized assessment, considering the overall potential of the project beyond mere financial data.

- Tailored Solutions: Private lenders can tailor loan terms and structures to fit specific project needs, offering flexibility not always found in traditional institutions.

Disadvantages of Private Lending

While private lending offers significant advantages, it is essential to acknowledge potential drawbacks:

- Higher Interest Rates: Private lenders often charge higher interest rates than conventional lenders to offset their higher risk and more personalized approach.

- Limited Funding Capacity: Private lenders typically have smaller funding capacities compared to large financial institutions, limiting the size of loans they can provide.

- Lack of Regulation: The private lending space is less regulated than traditional lending, which can introduce uncertainty and potential risks for borrowers.

- Potential for Fraud: It is essential to conduct due diligence and exercise caution when dealing with private lenders to mitigate the risk of fraudulent activities.

The Power of Network Potential

A critical aspect of accessing private lending is leveraging network potential. Building strong relationships with individuals and organizations within your industry and beyond can open doors to potential private lenders. Actively engaging in industry events, joining relevant professional associations, and utilizing online platforms designed for connecting investors and entrepreneurs can significantly increase your chances of finding suitable private lenders.

Furthermore, cultivating a strong personal brand and demonstrating a compelling investment thesis can attract the attention of private lenders seeking promising opportunities. Engaging in public speaking events, publishing articles, and participating in online forums can help establish your credibility and visibility within your chosen field, making you a more attractive prospect for private investors.

The Power of Partnerships in Real Estate

In the dynamic and competitive world of real estate, forging strategic partnerships can be a game-changer for both individuals and businesses. By collaborating with other professionals in the industry, real estate agents, brokers, developers, and investors can unlock a wealth of opportunities and achieve greater success.

One of the most significant benefits of partnerships is the ability to expand your network. By joining forces with other players in the market, you gain access to their existing client base, contacts, and industry insights. This expanded network can lead to more leads, referrals, and ultimately, more deals. For example, a real estate agent partnering with a mortgage lender can streamline the home buying process for clients, leading to increased satisfaction and repeat business.

Another key advantage of partnerships is shared expertise and resources. By collaborating with professionals who possess complementary skills and knowledge, you can leverage their strengths and overcome your own weaknesses. For instance, a real estate developer partnering with an architect and a construction company can bring together their expertise to create high-quality and desirable projects. This collaboration can lead to more efficient project management, cost savings, and improved outcomes.

Partnerships can also provide access to new markets and opportunities. By working with partners who have a presence in different geographical areas or specialize in different property types, you can tap into new markets and expand your reach. This can be particularly beneficial for real estate agents seeking to broaden their client base or for developers looking to explore new investment opportunities.

Moreover, partnerships can foster innovation and creativity. By bringing together different perspectives and approaches, you can generate new ideas, solutions, and strategies that can benefit both parties. For example, a real estate brokerage partnering with a tech startup can develop innovative marketing and customer relationship management tools, giving them a competitive edge in the market.

In conclusion, the power of partnerships in real estate is undeniable. By strategically collaborating with other professionals, real estate players can unlock a wealth of opportunities, expand their reach, leverage expertise, and achieve greater success. Whether you are a real estate agent, broker, developer, or investor, exploring partnerships can be a key ingredient in achieving your goals in this dynamic industry.

Negotiating Favorable Loan Terms

Securing a loan can be a significant financial undertaking, and it’s crucial to ensure you’re getting the most favorable terms possible. Negotiating with lenders is an essential part of this process, allowing you to potentially save thousands of dollars in interest payments over the life of the loan. This article will guide you through the key aspects of negotiating favorable loan terms, empowering you to achieve the best possible outcome.

1. Know Your Credit Score and History: Lenders assess your creditworthiness based on your credit score and history. Before you even approach a lender, understand your credit score. A higher credit score indicates a lower risk to lenders, potentially leading to lower interest rates. If your credit score is lower, consider strategies to improve it before applying for a loan.

2. Shop Around: Don’t settle for the first loan offer you receive. Shop around and compare loan offers from multiple lenders. This allows you to compare interest rates, fees, and other terms to find the most attractive deal.

3. Understand Loan Terminology: Before you negotiate, familiarize yourself with key loan terminology. This includes:

- Interest Rate: The cost of borrowing money expressed as a percentage. Lower interest rates mean lower overall loan costs.

- Loan Term: The length of time you have to repay the loan. Shorter terms generally result in higher monthly payments but lower overall interest costs.

- Fees: Additional charges associated with the loan, such as origination fees, appraisal fees, and closing costs.

- Prepayment Penalty: A fee charged if you pay off the loan early. Look for loans without prepayment penalties, as this gives you flexibility.

4. Negotiate Interest Rate and Fees:

- Start High: When negotiating, begin by requesting a lower interest rate than you believe you can realistically obtain.

- Be Prepared to Walk Away: If the lender is unwilling to meet your terms, be prepared to walk away and consider other options. Having alternative offers from other lenders strengthens your negotiating position.

- Negotiate Fees: Don’t overlook the fees associated with the loan. Negotiate to reduce or eliminate certain fees, such as origination fees or closing costs.

5. Leverage Your Strengths: Highlight your strengths as a borrower, such as a strong credit history, a stable income, and a substantial down payment. This demonstrates your financial responsibility and makes you a more attractive borrower.

6. Be Persistent and Polite: Negotiating requires persistence and a respectful demeanor. Be persistent in advocating for your desired terms, but maintain a polite and professional tone throughout the process.

7. Get Everything in Writing: Once you reach an agreement, ensure all terms are documented in writing, including the interest rate, loan term, fees, and any other relevant details. This serves as a legally binding contract protecting both you and the lender.

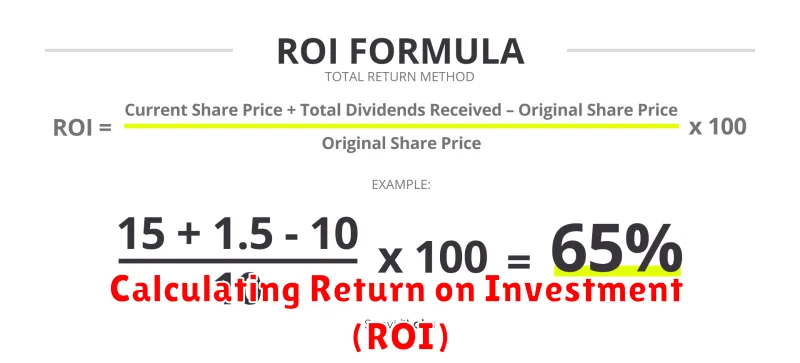

Calculating Return on Investment (ROI)

Return on investment (ROI) is a financial metric that measures the profitability of an investment. It is calculated by dividing the net profit from an investment by the cost of the investment. The result is expressed as a percentage.

For example, if you invest $100 in a stock and the stock increases in value to $120, your net profit is $20. Your ROI would be 20% ($20 / $100 = 0.20, or 20%).

ROI is a useful tool for comparing the profitability of different investments. It can also be used to track the performance of a particular investment over time. However, it is important to note that ROI does not take into account the time value of money.

Formula for Calculating ROI

The formula for calculating ROI is as follows:

ROI = (Net Profit / Cost of Investment) x 100%

Where:

- Net Profit is the profit from the investment after deducting all expenses.

- Cost of Investment is the total cost of the investment, including any initial investment, operating expenses, and any other costs associated with the investment.

Example of Calculating ROI

Let’s say you invest $1,000 in a business venture. After one year, the business generates $1,500 in revenue and incurs $500 in expenses. Your net profit would be $1,000 ($1,500 – $500). Your ROI would be 100% ($1,000 / $1,000 = 1, or 100%).

Benefits of Calculating ROI

There are several benefits to calculating ROI, including:

- It helps you to compare the profitability of different investments.

- It allows you to track the performance of a particular investment over time.

- It can help you to make better investment decisions.

Limitations of ROI

While ROI is a useful metric, it does have some limitations:

- It does not take into account the time value of money.

- It can be misleading if the investment has a long time horizon.

- It does not take into account risk.

Conclusion

ROI is a valuable tool for assessing the profitability of investments. However, it is important to be aware of its limitations and to use it in conjunction with other metrics to make informed investment decisions.

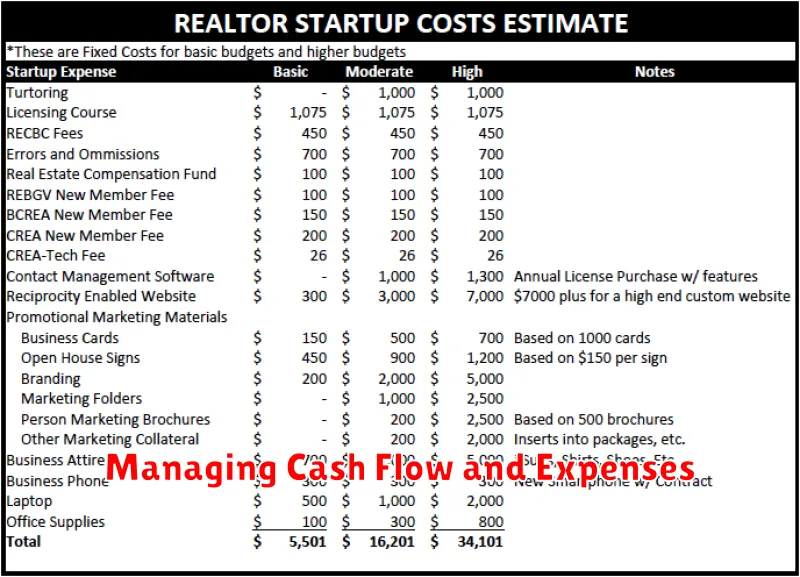

Managing Cash Flow and Expenses

In the realm of business, cash flow is the lifeblood that fuels operations, sustains growth, and ultimately determines a company’s success. It represents the movement of money into and out of a business over a specific period. Efficiently managing cash flow is paramount, as it ensures that a company has sufficient funds to meet its financial obligations, invest in opportunities, and navigate unexpected challenges.

One crucial aspect of cash flow management is expense control. By carefully analyzing and optimizing expenses, businesses can free up valuable resources to invest in areas that drive growth and profitability. This process involves identifying areas of potential savings, negotiating better rates with suppliers, and implementing cost-saving measures without compromising quality or efficiency.

Key Strategies for Managing Cash Flow and Expenses:

- Develop a Budget: A well-structured budget acts as a roadmap, outlining projected income and expenses. It provides a framework for financial planning and helps identify potential areas for improvement.

- Track Cash Flow Regularly: Monitoring cash flow on a consistent basis allows businesses to stay ahead of potential shortfalls and make timely adjustments to their financial strategies.

- Optimize Accounts Receivable: Efficiently managing accounts receivable ensures that payments are received promptly, maximizing cash flow. Strategies like offering discounts for early payments can encourage timely settlements.

- Negotiate Supplier Terms: Securing favorable payment terms with suppliers can extend the cash flow cycle and provide greater flexibility in managing expenses.

- Implement Cost-Saving Measures: Identifying and implementing cost-saving measures, such as automating processes, reducing waste, and negotiating better deals, can significantly improve cash flow and profitability.

- Consider Financing Options: In situations where cash flow is tight, businesses can explore financing options like loans or lines of credit to bridge temporary gaps.

Effective cash flow management is not a one-time event but rather an ongoing process that requires discipline and vigilance. By adopting a proactive approach to expense control and implementing the strategies outlined above, businesses can enhance their financial stability, seize opportunities for growth, and ultimately achieve long-term success.

Building a Strong Investment Strategy

Investing can be a daunting task, especially for beginners. With so many options available, it’s easy to feel overwhelmed and unsure where to start. However, a well-defined investment strategy can help you navigate the complexities of the market and achieve your financial goals.

1. Define Your Financial Goals

Before you start investing, it’s crucial to determine your financial goals. What are you saving for? Do you want to buy a house, retire early, or simply build a nest egg for the future? Clearly defining your objectives will provide a framework for your investment decisions.

2. Assess Your Risk Tolerance

Every investor has a different level of risk tolerance. Some individuals are comfortable with volatile investments, while others prefer stability and security. Understanding your own risk appetite is vital to selecting appropriate investments. If you’re risk-averse, you might consider investments like bonds or real estate. If you’re willing to take on more risk, you might explore stocks or cryptocurrencies.

3. Diversify Your Portfolio

Don’t put all your eggs in one basket. Diversifying your portfolio across different asset classes, such as stocks, bonds, real estate, and commodities, can help mitigate risk. By spreading your investments, you reduce the impact of any single investment’s performance on your overall returns.

4. Choose the Right Investments

Once you’ve considered your goals, risk tolerance, and diversification strategy, it’s time to select specific investments. Do your research and understand the potential risks and rewards associated with each investment option. Consider factors such as historical performance, fees, and liquidity.

5. Monitor and Adjust Regularly

Investing isn’t a one-time decision. It’s an ongoing process that requires regular monitoring and adjustments. Keep track of your investments’ performance and rebalance your portfolio as needed to maintain your desired asset allocation and risk profile. Market conditions change, and your investment strategy should adapt accordingly.

6. Seek Professional Advice

If you’re unsure about how to build an investment strategy or manage your investments, consider seeking advice from a qualified financial advisor. A professional can help you create a personalized plan based on your individual circumstances and goals.