Feeling overwhelmed by your finances? Leveling up your finances doesn’t have to be a daunting task. With the right knowledge and a little effort, you can gain control over your money and achieve your financial goals. This comprehensive guide provides practical strategies and actionable tips to help you improve your personal finances, from budgeting and saving to investing and debt management. Whether you’re just starting out or looking to take your financial game to the next level, this guide has something for you.

This article will delve into the essential elements of personal finance, providing a roadmap to guide you towards financial stability and success. We’ll explore how to create a budget that works for you, develop effective saving habits, understand different investment options, and navigate the complexities of debt. By implementing the strategies outlined in this guide, you can gain confidence in your financial decisions, build a solid foundation for your future, and unlock the potential for a more secure and prosperous life.

Assess Your Current Financial Situation

Before you can start planning for your financial future, you need to know where you stand today. This means taking a close look at your current financial situation, including your income, expenses, assets, and debts.

To get started, gather all of your financial documents, such as your bank statements, credit card statements, investment statements, and tax returns. Once you have these documents, you can start to create a budget. Your budget should list all of your income and expenses. Make sure to include all of your income, including your salary, investments, and any other sources of income. Also, make sure to include all of your expenses, including your rent or mortgage payment, utilities, groceries, transportation, and entertainment. This will help you to see where your money is going and where you can make cuts. It is also helpful to use an online budget tool such as Mint or Personal Capital.

Next, you need to assess your assets, which are things that you own that have value. This includes your home, car, savings, and investments. You should also assess your debts, which are amounts of money that you owe to others. This includes your mortgage, car loan, credit card debt, and student loan debt. By understanding your assets and debts, you can get a better picture of your overall financial health.

Once you have assessed your income, expenses, assets, and debts, you can start to create a financial plan. This plan should include your goals for the future, such as retirement, saving for a down payment on a home, or paying off debt. It should also include strategies for achieving these goals, such as budgeting, investing, and saving.

It’s also a good idea to speak with a qualified financial advisor to discuss your financial situation and develop a plan for your future.

Set Clear and Achievable Financial Goals

Financial goals are essential for achieving financial stability and security. They provide a roadmap for your financial journey, guiding your decisions and motivating you to stay on track. However, setting effective financial goals requires careful consideration and a clear understanding of your current financial situation and future aspirations.

To set clear and achievable financial goals, it’s crucial to follow a structured approach:

1. Define Your Goals

Start by identifying your financial goals. What do you want to achieve? Do you want to purchase a home, pay off debt, invest for retirement, or save for your children’s education? Once you have a list of goals, prioritize them based on their importance and urgency.

2. Set Specific and Measurable Targets

Make your goals concrete and quantifiable. Instead of saying “I want to save money,” specify “I want to save $10,000 in the next year.” This clarity helps you track progress and stay motivated.

3. Set Realistic Timeframes

Assign realistic deadlines to your goals. While ambitious targets can be inspiring, they can also be discouraging if they feel unattainable. Break down large goals into smaller, more manageable milestones with achievable timelines.

4. Consider Your Current Financial Situation

Before setting financial goals, assess your current financial standing. Analyze your income, expenses, and debt levels. This will help you determine how much you can realistically save or invest towards your goals.

5. Review and Adjust Regularly

Life is dynamic, and your financial circumstances can change. Regularly review your goals and adjust them as needed. If you experience a change in income, unexpected expenses, or a shift in your priorities, make the necessary adjustments to keep your goals aligned with your current situation.

6. Seek Professional Guidance

If you find it challenging to set and achieve financial goals independently, consider seeking professional financial advice. A qualified financial advisor can provide personalized guidance, create a customized financial plan, and help you stay on track.

By setting clear and achievable financial goals, you can take control of your finances and create a brighter financial future.

Create a Realistic Budget and Stick to It

Creating a budget can seem daunting, but it’s a crucial step in managing your finances effectively. A well-crafted budget allows you to track your income and expenses, make informed financial decisions, and achieve your financial goals. Here’s a comprehensive guide to help you create a realistic budget and stick to it.

1. Track Your Income and Expenses

Before you can create a budget, you need to understand where your money is coming from and where it’s going. Keep track of your income from all sources, such as your salary, investments, and side hustles. Additionally, monitor your expenses for a month or two to identify your spending habits. You can use a spreadsheet, a budgeting app, or a simple notebook to record your transactions.

2. Categorize Your Expenses

Once you have a list of your expenses, categorize them to gain valuable insights into your spending patterns. Common expense categories include:

- Housing: Rent or mortgage payments, utilities, property taxes, and homeowners’ insurance.

- Food: Groceries, dining out, and takeout.

- Transportation: Car payments, gas, insurance, public transportation, and parking.

- Healthcare: Health insurance premiums, doctor’s visits, prescriptions, and dental care.

- Personal Care: Clothing, toiletries, haircuts, and personal grooming.

- Entertainment: Movies, concerts, travel, hobbies, and subscriptions.

- Education: Tuition, books, and school supplies.

- Savings and Debt Repayment: Contributions to retirement accounts, emergency funds, and loan payments.

3. Set Financial Goals

Having clear financial goals provides motivation and direction for your budgeting efforts. Consider what you want to achieve financially, such as:

- Saving for a down payment on a home

- Paying off debt

- Funding your children’s education

- Retiring comfortably

- Taking a dream vacation

4. Allocate Your Income

Based on your income and expenses, allocate your money to different categories. Start with your essential expenses, such as housing, food, and healthcare. Then, allocate funds to your savings goals and debt repayment. Finally, allow for discretionary spending on entertainment and other non-essential items.

5. Create a Realistic Budget

Your budget should be realistic and achievable. Don’t try to cut expenses too drastically, as this may lead to frustration and difficulty sticking to your plan. Instead, focus on making small, gradual changes to your spending habits.

6. Monitor Your Progress Regularly

Regularly review your budget to track your progress and make adjustments as needed. Consider reviewing your budget monthly or quarterly. This allows you to identify any areas where you’re overspending or undersaving and make necessary changes to stay on track.

7. Use Budgeting Tools

There are numerous budgeting tools available to help you create, monitor, and manage your budget. These tools can automate expense tracking, provide financial insights, and set reminders for upcoming bills. Explore options like budgeting apps, spreadsheets, and online budgeting services to find the tool that best suits your needs.

8. Seek Professional Advice

If you find it challenging to create or stick to a budget, consider seeking professional financial advice from a certified financial planner. A financial planner can provide personalized guidance, create a customized budget, and help you develop a plan to achieve your financial goals.

9. Make It a Habit

Consistency is key when it comes to budgeting. Make budgeting a regular habit, just like brushing your teeth or checking your emails. By incorporating budgeting into your daily routine, you’ll be more likely to stick to your plan and achieve your financial goals.

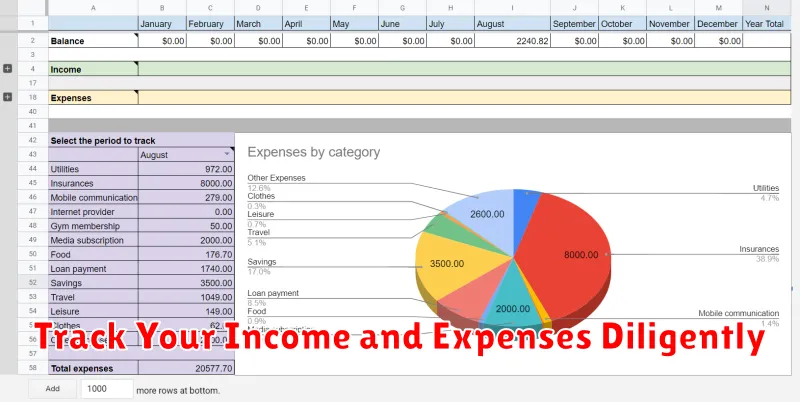

Track Your Income and Expenses Diligently

In today’s economic climate, it’s more important than ever to keep a close eye on your finances. Tracking your income and expenses diligently can help you stay on top of your budget, identify areas where you can save money, and avoid financial stress.

There are several different methods you can use to track your income and expenses. Some people prefer to use a simple spreadsheet, while others may opt for a dedicated budgeting app. No matter which method you choose, the key is to be consistent and accurate in your tracking.

Benefits of Tracking Your Income and Expenses

- Gain a clear picture of your financial situation: Tracking your income and expenses can help you understand where your money is going and identify areas where you may be overspending.

- Make informed financial decisions: By knowing your income and expenses, you can make more informed decisions about how to spend your money and allocate your resources.

- Reach your financial goals faster: If you’re saving for a specific goal, tracking your income and expenses can help you stay on track and reach your goal faster.

- Reduce financial stress: Knowing where your money is going and having a plan for your finances can help reduce financial stress and anxiety.

Tips for Tracking Your Income and Expenses

Here are some tips for making the most of your income and expense tracking:

- Choose a method that works for you: There are many different methods for tracking income and expenses. Experiment with different methods until you find one that you enjoy using and that fits your lifestyle.

- Be consistent: The key to successful income and expense tracking is consistency. Make a habit of recording your transactions regularly.

- Track everything: It’s important to track all of your income and expenses, no matter how small. Even small transactions can add up over time.

- Categorize your expenses: Categorizing your expenses can help you identify areas where you may be overspending. This can help you make more informed decisions about where to cut back.

- Review your finances regularly: It’s a good idea to review your income and expense tracking data on a regular basis, such as monthly or quarterly. This will help you stay on top of your finances and make necessary adjustments.

Tracking your income and expenses is a valuable habit that can have a significant positive impact on your financial well-being. By taking the time to track your finances, you can gain control of your money, make informed decisions, and achieve your financial goals.

Build an Emergency Fund for Unexpected Events

Life is full of surprises, and not all of them are pleasant. A job loss, a medical emergency, or a car breakdown can happen at any time, leaving you scrambling to make ends meet. That’s why it’s crucial to have an emergency fund, a stash of money set aside for unexpected expenses.

An emergency fund acts as a safety net, preventing you from falling into debt or resorting to drastic measures when life throws you a curveball. The goal is to accumulate enough money to cover your essential expenses for 3-6 months. This cushion will give you time to get back on your feet financially without having to make difficult decisions.

How Much Should You Save?

A good starting point is to aim for three to six months’ worth of living expenses. This amount should cover your rent or mortgage, utilities, food, transportation, and other essential bills. However, you can tailor this figure based on your individual circumstances. If you have a stable income and a low risk tolerance, you might aim for a smaller emergency fund. But if you have a volatile income or a high risk tolerance, you might want to build a larger fund.

Tips for Building an Emergency Fund

- Set a Budget: Track your spending and identify areas where you can cut back. Even small savings add up over time.

- Automate Savings: Set up automatic transfers from your checking account to your savings account each month. This makes saving consistent and effortless.

- Use the “50/30/20” Rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. This rule can help you prioritize saving.

- Look for Extra Income: Explore side hustles or part-time jobs to supplement your income and accelerate your savings progress.

Manage and Reduce Debt Effectively

Debt can be a major source of stress and financial strain. It can impact your ability to save for the future, reach your financial goals, and enjoy financial peace of mind. But don’t despair! There are effective ways to manage and reduce your debt and take control of your financial situation.

1. Understand Your Debt

The first step is to understand the type and amount of debt you have. Make a list of all your outstanding debts, including the balance, interest rate, and minimum payment. This will give you a clear picture of your debt situation and help you prioritize your repayment strategy.

2. Create a Budget

A budget is essential for managing debt. Track your income and expenses to identify areas where you can cut back or reduce spending. This will free up more money to put towards debt repayment.

3. Prioritize Debt Repayment

Once you have a clear picture of your debt, prioritize repayment based on the interest rate. Focus on paying down the debts with the highest interest rates first, as this will save you the most money in the long run. Consider using the avalanche method, where you focus on the debt with the highest interest rate, or the snowball method, where you focus on the debt with the smallest balance. Both methods are effective, and the best option for you will depend on your individual financial situation.

4. Explore Debt Consolidation

Debt consolidation can help simplify your debt repayment process and potentially lower your monthly payments. This involves combining multiple debts into one loan with a lower interest rate. However, make sure to carefully research and compare offers before choosing a consolidation loan.

5. Negotiate with Creditors

If you are struggling to make payments, consider negotiating with your creditors. They may be willing to reduce your interest rate, lower your monthly payments, or offer a temporary hardship program. Be polite and persistent, and be prepared to explain your financial situation.

6. Avoid Taking on New Debt

While you are working on reducing your debt, it’s crucial to avoid taking on new debt. Resist the temptation to make unnecessary purchases or use credit cards for everyday expenses. This will only add to your financial burden.

7. Seek Professional Help

If you are overwhelmed by debt and unable to manage it on your own, don’t hesitate to seek professional help. A credit counselor or financial advisor can provide guidance and support in developing a debt management plan. They can also help you negotiate with creditors and explore debt relief options.

Managing and reducing debt can be a challenging process, but it is achievable with a strategic plan and commitment. By following these steps, you can take control of your finances and achieve financial freedom.

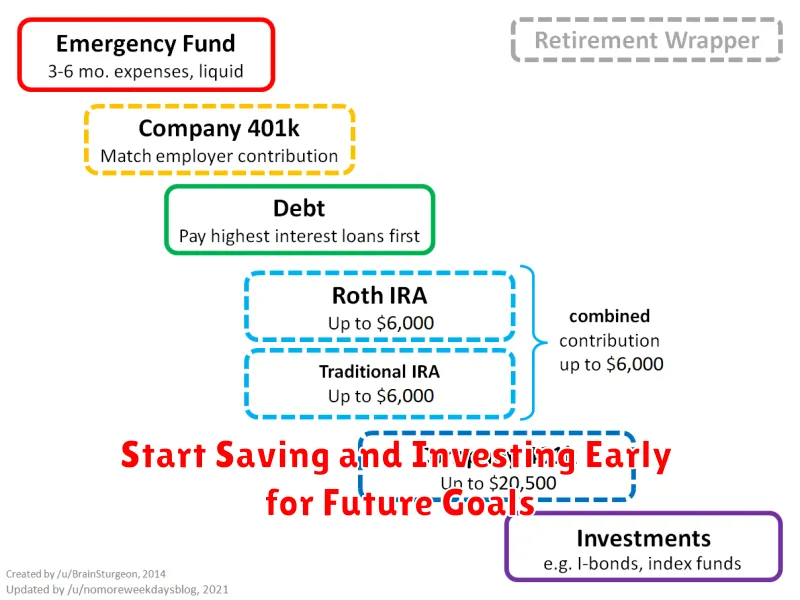

Start Saving and Investing Early for Future Goals

Saving and investing early is crucial for achieving your financial goals, whether it’s buying a home, retiring comfortably, or funding your children’s education. The earlier you start, the more time your money has to grow through the power of compounding.

Compounding is the snowball effect of earning interest on your initial investment, and then earning interest on that interest. Over time, this can significantly boost your returns. For example, if you invest $1,000 at a 7% annual return, after 30 years, your investment will have grown to over $7,612.

Here are some key reasons why it’s essential to start saving and investing early:

Benefits of Early Saving and Investing

- Time is your ally: The longer your money has to grow, the more substantial your returns will be.

- Power of compounding: As explained above, the magic of compounding can work wonders for your investments.

- Lower risk tolerance: Younger investors typically have a higher risk tolerance, allowing them to invest in growth-oriented assets that may have a higher potential for returns.

- Reduced financial stress: Saving and investing early can help you feel more secure about your financial future, reducing stress and anxiety.

- More flexibility: Starting early gives you more flexibility to adjust your investment strategy and goals as your life changes.

Getting Started

If you’re just starting your saving and investing journey, here are a few steps to take:

- Set financial goals: Determine what you want to achieve with your savings and investments, such as buying a house, retiring comfortably, or funding your children’s education.

- Create a budget: Track your income and expenses to identify areas where you can save more.

- Start small: Even if you can only save a small amount each month, it’s better than nothing. Every dollar saved and invested counts.

- Consider an emergency fund: Before investing, it’s wise to build up an emergency fund that can cover 3-6 months of living expenses.

- Choose investment options: Research different investment options, such as stocks, bonds, mutual funds, and ETFs, to find those that align with your risk tolerance and goals.

- Seek professional advice: If you’re unsure about where to start, consult with a financial advisor who can provide personalized guidance.

Remember, saving and investing is a marathon, not a sprint. It’s a journey that requires consistency, discipline, and patience. The sooner you start, the better equipped you’ll be to achieve your financial goals and build a secure future for yourself and your loved ones.

Review and Adjust Your Financial Plan Regularly

A financial plan is a roadmap for your financial future. It outlines your goals, how you plan to achieve them, and how you will manage your money along the way. A good financial plan is essential for achieving your financial goals, but it’s not a set-it-and-forget-it document. To ensure that your financial plan is still on track, it’s crucial to review and adjust it regularly.

There are several reasons why you should make reviewing your financial plan a regular habit:

- Life changes

Life is full of unexpected changes, such as getting married, having children, changing jobs, or experiencing a health crisis. These life events can have a significant impact on your financial situation, so it’s important to adjust your plan accordingly. For instance, if you’re expecting a child, you’ll need to factor in the costs of childcare, diapers, and other baby-related expenses.

- Market fluctuations

The stock market and other investments are constantly fluctuating. What may have been a sound investment strategy a year ago may not be as effective today. You need to monitor your investments and make adjustments as needed to ensure that your portfolio is still aligned with your risk tolerance and financial goals.

- Changes in your financial goals

Your financial goals may change over time. Maybe you’re no longer interested in buying a house, or you’ve decided to retire earlier than you initially planned. When your goals change, your financial plan needs to be updated to reflect those changes.

- New opportunities

New opportunities may arise that you may not have anticipated when you first created your plan. For example, you might receive a lucrative job offer or inherit some money. These opportunities require you to revisit your financial plan and decide how to best utilize these new resources.

How often you review your financial plan will depend on your individual circumstances. However, at a minimum, you should review your plan annually. You may need to review it more frequently if you experience significant life changes or market volatility.

When you review your financial plan, start by evaluating your progress toward your goals. Are you on track to achieve your goals within the timeframe you set? Are you meeting your savings goals? If you’re not on track, you need to determine why and what adjustments you can make to get back on track.

Reviewing your financial plan is a valuable process. It gives you the opportunity to stay informed about your financial situation, make necessary adjustments, and ensure that you’re on the right path to achieving your financial goals.

Seek Professional Financial Advice When Needed

In today’s complex financial landscape, it can be overwhelming to navigate investment options, retirement planning, and other financial matters. While you can find plenty of information online and through self-help resources, there are times when seeking professional financial advice is essential.

Here are some key instances when you should consider consulting a financial advisor:

1. Significant Life Events

Major life changes often bring about financial implications that require expert guidance. These events include:

- Marriage or Divorce: Financial planning for a new household or navigating asset division requires professional assistance.

- Birth of a Child: Planning for college expenses, childcare, and future financial needs for your child can be overwhelming without expert advice.

- Job Loss or Career Change: Navigating unemployment benefits, managing finances during a transition, and planning for a new career path can benefit from professional input.

- Inheritance or Windfall: Managing a sudden influx of money requires careful planning to avoid making impulsive decisions.

- Retirement: Developing a retirement plan, understanding your retirement income sources, and managing your investments are crucial aspects of planning for your golden years.

2. Complex Financial Situations

If you are dealing with intricate financial matters, seeking professional help is crucial. These situations include:

- High-Net-Worth Individuals: Managing significant assets, complex investment portfolios, and estate planning require the expertise of a financial advisor.

- Business Ownership: Financial planning for a business, including tax strategies, investment decisions, and succession planning, is critical.

- Debt Management: If you are struggling with debt, a financial advisor can help you develop a budget, negotiate with creditors, and create a plan for debt consolidation or repayment.

- Tax Planning: Optimizing your tax situation and making informed decisions regarding tax deductions and credits can save you money in the long run.

3. Lack of Financial Knowledge or Expertise

If you don’t feel confident in your understanding of financial concepts or managing your finances effectively, seeking professional advice can provide valuable insights and guidance.

A financial advisor can help you:

- Set Financial Goals: Defining your short-term and long-term financial objectives will help you prioritize your financial decisions.

- Develop a Budget: Creating a realistic budget can help you track your income and expenses, identify areas for savings, and achieve your financial goals.

- Choose Investments: A financial advisor can guide you in selecting investment options that align with your risk tolerance, time horizon, and financial objectives.

- Review Your Financial Plan: Regularly reviewing your financial plan with an advisor ensures that it remains relevant and effective as your circumstances change.

Finding the Right Advisor

When choosing a financial advisor, it’s important to consider their qualifications, experience, and approach. Look for advisors with the following credentials:

- Certified Financial Planner (CFP): A CFP is a highly respected designation requiring extensive training and experience in financial planning.

- Chartered Financial Analyst (CFA): A CFA is a designation for professionals with expertise in investment analysis and portfolio management.

- Registered Investment Advisor (RIA): RIAs are required to act in the best interests of their clients and must adhere to specific ethical standards.

It’s also essential to have a clear understanding of the fees associated with their services. Discuss their fee structure, potential conflicts of interest, and their approach to financial planning before engaging their services.

Explore Additional Income Streams to Boost Savings

Saving money is a crucial part of achieving financial stability and security. While a regular job provides a steady income, it may not be enough to meet all your financial goals. Exploring additional income streams can significantly boost your savings and help you reach your financial aspirations faster.

Part-time work is a great way to earn extra money without committing to a full-time job. There are numerous part-time opportunities available in various industries, such as retail, customer service, or administrative work. You can also consider online platforms like Upwork or Fiverr to find freelance gigs in writing, editing, or graphic design.

Freelancing has become increasingly popular in recent years. If you have a skill or expertise, you can offer your services online to businesses and individuals. Some popular freelance platforms include Upwork, Fiverr, and Guru. You can set your own rates and work hours, making it a flexible and lucrative option.

Renting out a spare room or your entire property can be a great way to generate passive income. Websites like Airbnb and VRBO connect homeowners with travelers looking for short-term accommodations. If you have a spare room, you can easily rent it out and earn a significant amount of income.

Investing in real estate can be a lucrative way to boost your savings. You can purchase rental properties and earn passive income from rent. However, investing in real estate requires significant capital and knowledge. It’s crucial to research thoroughly before making any investment decisions.

Starting a side hustle can be a fulfilling way to earn extra income. If you have a passion or interest, you can turn it into a business. For example, if you enjoy baking, you can start a home-based bakery business. Or, if you are creative, you can sell your artwork online.

Investing in the stock market can be a powerful way to grow your savings over time. However, it’s essential to understand the risks involved and invest wisely. You can start with a small amount and gradually increase your investment as you gain experience.

Selling used items can be a great way to declutter your home and earn some extra cash. You can sell your unwanted items online through platforms like eBay or Craigslist or at local consignment shops.

Exploring additional income streams is a smart move for anyone looking to boost their savings. By choosing the right option for you and putting in the effort, you can achieve your financial goals and build a brighter future.