Are you ready to unlock the secrets to real estate riches? The real estate market offers a wealth of opportunities for investors of all levels, from seasoned professionals to first-time buyers. Whether you’re looking to build a passive income stream, diversify your portfolio, or simply create generational wealth, real estate investing can be the key to achieving your financial goals. But navigating this complex world can feel overwhelming, with countless strategies and potential pitfalls lurking around every corner.

This comprehensive guide is your roadmap to success in the exciting world of real estate. We’ll dive deep into the most effective real estate investment strategies, providing you with actionable insights and practical tips to maximize your profits. From understanding the fundamentals of property valuation and market analysis to mastering the art of negotiation and property management, we’ll cover everything you need to know to confidently embark on your real estate journey.

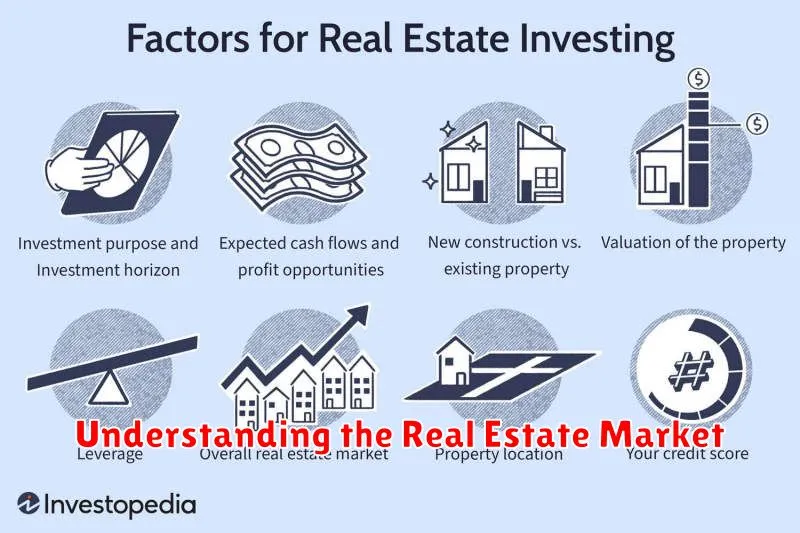

Understanding the Real Estate Market

The real estate market is a complex and ever-changing landscape. It is influenced by a wide range of factors, including economic conditions, demographics, interest rates, and government policies. Understanding these factors can help you make informed decisions about buying, selling, or investing in real estate.

One of the most important factors to consider is the economic climate. A strong economy typically leads to increased demand for housing, which can drive up prices. Conversely, a weak economy can lead to a decline in demand and lower prices. Interest rates also play a significant role. When interest rates are low, it becomes cheaper to borrow money, which can make buying a home more affordable. Conversely, high interest rates can make it more expensive to borrow money, which can discourage homebuyers.

Demographics also have a major impact on the real estate market. Population growth, aging populations, and changing family structures can all influence housing demand. For example, a growing population can lead to increased demand for new homes, while an aging population may create demand for senior housing or assisted living facilities.

Government policies can also have a significant impact on the real estate market. For example, tax breaks for homebuyers can stimulate demand, while zoning regulations can influence the supply of available housing.

In addition to these broad factors, local market conditions can also be important. Factors such as the availability of jobs, schools, and amenities can all influence property values. It’s important to do your research and understand the specific conditions of the market you’re interested in.

Understanding the factors that influence the real estate market is crucial for making informed decisions. By staying informed about economic conditions, demographics, interest rates, and government policies, you can make better decisions about buying, selling, or investing in real estate.

Identifying Profitable Niches: From Rentals to Flipping

In the world of real estate, identifying profitable niches is crucial for success. Whether you’re a seasoned investor or just starting, choosing the right niche can significantly impact your returns and overall profitability.

Here are some popular and potentially lucrative niches in the real estate market:

Rental Properties

The rental market is a reliable source of passive income. You can choose from various types of rental properties, including:

- Single-family homes: These offer greater control and potential for appreciation, but require more maintenance.

- Multi-family properties: These can provide higher rental income, but may involve more complex management.

- Commercial properties: These can generate significant income, but require specialized knowledge and higher capital investment.

Fix-and-Flip Properties

Flipping houses involves purchasing distressed properties, renovating them, and selling them for a profit. Key factors to consider include:

- Location: Choose neighborhoods with strong demand and potential for appreciation.

- Renovation costs: Accurately estimate the cost of repairs and upgrades.

- Market trends: Stay informed about current market conditions and buyer preferences.

Short-Term Rentals

Short-term rentals, such as Airbnb or VRBO listings, have gained immense popularity. Advantages include:

- Higher rental income: Short-term rentals often command higher rates than long-term rentals.

- Flexibility: You can choose your own pricing and availability.

- Unique experiences: Offering unique properties and amenities can attract travelers.

Luxury Real Estate

Investing in luxury properties can be highly profitable, but it requires substantial capital and specialized expertise. Key aspects include:

- High-end markets: Focus on affluent neighborhoods with strong demand for luxury homes.

- Unique features: Look for properties with desirable amenities and features.

- Marketing and networking: Develop relationships with high-net-worth individuals and luxury real estate agents.

Other Niche Opportunities

Beyond the traditional niches, there are several emerging opportunities in real estate, including:

- Tiny homes: These offer affordable housing options and are becoming increasingly popular.

- Off-grid properties: These properties provide self-sufficiency and are attractive to those seeking alternative lifestyles.

- Green buildings: Sustainable and eco-friendly properties are in high demand.

Identifying profitable niches is a crucial step in building a successful real estate investment strategy. By carefully analyzing market trends, understanding your own resources, and choosing the right niche, you can maximize your chances of achieving significant returns.

Financing Your Real Estate Ventures: Loans, Partnerships, and More

Venturing into the world of real estate can be an exciting and lucrative endeavor, but it also often requires significant financial resources. Securing the right financing is crucial for making your real estate dreams a reality. Fortunately, there are various avenues to explore when it comes to funding your projects. Let’s delve into the most common and effective methods for financing your real estate ventures.

Traditional Bank Loans

Traditional bank loans are a tried-and-true method for financing real estate purchases. These loans typically require a substantial down payment (often 20% or more) and involve a lengthy application process. However, they offer competitive interest rates and fixed monthly payments, providing financial predictability.

Private Loans

Private loans, often sourced from individual investors or private lending firms, can be a viable option, especially for projects that may not meet traditional bank lending criteria. These loans often come with higher interest rates and shorter repayment terms, but they can provide much-needed funding when other sources are unavailable.

Hard Money Loans

Hard money loans are short-term loans secured by real estate. They are often used by investors for quick financing during property renovations or flips. While they offer speed and flexibility, hard money loans usually carry high interest rates and fees.

Partnerships

Partnering with other investors can be a strategic way to pool resources and share the financial burden of a real estate venture. This approach allows you to leverage the expertise and capital of others, but it’s essential to establish clear terms and expectations within the partnership agreement.

Seller Financing

In some cases, the seller of a property may be willing to provide financing. This can be an attractive option, especially if you lack the necessary down payment or if the seller wants to facilitate a smooth transaction. Seller financing often involves a lower down payment and longer repayment terms.

Crowdfunding

Crowdfunding platforms have emerged as a popular way to raise capital for real estate projects. This method allows you to tap into a vast network of potential investors who contribute smaller amounts to fund your venture. Platforms like Fundrise and RealtyMogul provide opportunities for both individual and institutional investors to invest in real estate.

Other Options

Beyond these common methods, other financing options exist, such as government-backed loans (FHA, VA), home equity loans, and lines of credit. Researching all available avenues and exploring the best fit for your specific circumstances is crucial.

Choosing the Right Financing

The best financing option depends heavily on your individual circumstances, the nature of your project, and your risk tolerance. Consider factors such as:

- Project type (residential, commercial, land)

- Investment strategy (buy-and-hold, fix-and-flip, development)

- Timeframe (short-term, long-term)

- Credit score

- Debt-to-income ratio

It’s wise to consult with a financial advisor or real estate professional to determine the most appropriate financing strategy. They can help you understand the different options, analyze your financial situation, and navigate the complexities of the real estate financing landscape.

Mastering the Art of Property Valuation

Property valuation, also known as real estate appraisal, is a complex and multifaceted process that involves determining the fair market value of a property. This involves a thorough analysis of various factors, including the property’s physical characteristics, location, market conditions, and recent sales data.

Understanding the nuances of property valuation is crucial for a variety of stakeholders, including:

- Buyers and Sellers: Accurate valuations help buyers make informed decisions about the price they are willing to pay and sellers set realistic asking prices.

- Mortgage Lenders: Lenders rely on property valuations to determine the loan amount they are willing to provide.

- Investors: Investors use valuations to assess the potential profitability of real estate investments.

- Government Agencies: Government agencies use valuations for various purposes, such as property tax assessments and eminent domain proceedings.

The valuation process typically involves the following steps:

- Data Collection: This involves gathering information about the property, including its size, age, condition, and any unique features. Market data, such as recent sales of comparable properties, is also essential.

- Analysis: The collected data is then analyzed to identify trends and patterns in the market and to determine the property’s potential value. This involves considering factors such as location, amenities, and market conditions.

- Valuation Method Selection: There are various valuation methods used, including the sales comparison approach, the cost approach, and the income capitalization approach. The choice of method depends on the type of property and the available data.

- Valuation Report: The final step involves preparing a comprehensive report that documents the valuation process and the final estimated value of the property.

Challenges in Property Valuation

While property valuation involves a systematic approach, there are several challenges that can impact the accuracy of the assessment. These include:

- Market Fluctuations: Real estate markets are constantly changing, making it difficult to predict future value trends.

- Unique Property Characteristics: Every property is unique, and finding comparable properties for comparison can be challenging.

- Subjectivity: Property valuation involves a degree of subjectivity, as different appraisers may have different interpretations of market data.

Importance of Professional Expertise

To ensure accurate and reliable valuations, it is essential to engage the services of qualified and experienced property valuation professionals. These professionals have the knowledge, skills, and tools to conduct thorough assessments and produce accurate valuations.

In conclusion, mastering the art of property valuation requires a deep understanding of market dynamics, property characteristics, and valuation methodologies. By working with qualified professionals and staying abreast of market trends, stakeholders can ensure accurate and reliable valuations that support informed decision-making.

Effective Marketing Strategies for Real Estate Success

In the competitive world of real estate, effective marketing is crucial for attracting potential buyers and sellers, ultimately leading to successful transactions.

Here are some proven marketing strategies that can help you stand out from the crowd and achieve your real estate goals.

1. Establish a Strong Online Presence

In today’s digital age, having a strong online presence is essential for any real estate professional. This involves creating and maintaining a user-friendly website, engaging on social media platforms, and optimizing your online listings.

A well-designed website serves as your digital storefront, showcasing your expertise, testimonials, and available properties. Regularly updating your website with fresh content and engaging visuals will keep visitors interested and coming back for more.

Social media platforms like Facebook, Instagram, and LinkedIn provide valuable opportunities to connect with potential clients, share market insights, and promote your listings. Consistency is key, so post regularly and interact with your followers.

2. Leverage the Power of Email Marketing

Email marketing remains a powerful tool for nurturing leads and building relationships. Create targeted email campaigns that provide valuable information, such as market updates, neighborhood guides, and property spotlights.

When you segment your email lists based on interests and preferences, you can send highly relevant content that resonates with your audience. Personalization is key, so tailor your emails to individual needs and interests.

3. Utilize Virtual Tours and High-Quality Photography

In today’s fast-paced world, potential buyers want to experience properties virtually before making a physical visit. Virtual tours, 3D models, and high-quality photography allow you to showcase properties from every angle, making them more appealing to potential buyers.

Professional photography highlights the best features of a property and creates a lasting impression on viewers. Virtual tours offer an immersive experience, allowing buyers to explore properties from the comfort of their homes.

4. Partner with Local Businesses and Community Events

Building relationships with local businesses and participating in community events can help you expand your network and reach a wider audience. Sponsoring local events, hosting open houses, or partnering with businesses in your area can create opportunities to connect with potential clients and build brand awareness.

Engaging in the community demonstrates your commitment to the area and strengthens your reputation as a trusted real estate professional.

5. Provide Exceptional Customer Service

In the real estate industry, outstanding customer service is paramount. Respond promptly to inquiries, be transparent and communicative throughout the process, and go the extra mile to meet your clients’ needs.

Positive word-of-mouth referrals are essential for long-term success. By consistently exceeding expectations, you build trust and loyalty, leading to repeat business and valuable referrals.

The Legal Side of Real Estate: Contracts, Disclosures, and More

Navigating the real estate market can be exciting, but it’s also essential to understand the legal aspects involved. From contracts to disclosures, numerous legal considerations can impact your transaction. This article will delve into key legal aspects of real estate, providing insights into contracts, disclosures, and other critical factors to ensure a smooth and successful journey.

Contracts: The Foundation of Real Estate Transactions

Real estate transactions are built upon contracts, which serve as legally binding agreements between parties. These contracts outline the terms of the sale or lease, including the purchase price, closing date, and any contingencies. Understanding the language and implications of these contracts is paramount to protecting your interests.

Key Contract Elements

- Purchase Agreement: This document outlines the terms of the sale between the buyer and seller, including the purchase price, closing date, and any contingencies.

- Lease Agreement: This contract details the terms of a rental agreement between the landlord and tenant, covering rent payments, occupancy rights, and responsibilities.

- Mortgage Loan Agreement: When financing a purchase, this agreement establishes the terms of the loan, including interest rate, payment schedule, and repayment terms.

Disclosures: Transparency and Informed Decisions

Real estate transactions involve numerous disclosures, which provide buyers with critical information about the property. These disclosures aim to ensure transparency and allow buyers to make informed decisions. Sellers are typically required to disclose known defects or issues with the property. Failing to disclose material information can have serious legal consequences.

Types of Disclosures

- Property Condition Disclosures: These documents outline any known defects or issues with the property, such as structural problems, environmental hazards, or previous repairs.

- Homeowner Association Disclosures: If the property is part of a homeowners association (HOA), these disclosures provide information about the HOA’s rules, fees, and governing documents.

- Lead-Based Paint Disclosures: If the property was built before 1978, federal law requires sellers to disclose the presence of lead-based paint.

Real Estate Agents and Legal Expertise

Real estate agents are valuable resources during the buying or selling process. They possess knowledge of the market, contracts, and disclosures. While agents are not legal professionals, they can provide guidance and refer you to legal counsel when necessary. It’s essential to have your own legal representation, especially during complex transactions or when dealing with potential issues.

Consult with an Attorney

Seeking legal advice from a real estate attorney is highly recommended, especially for significant transactions. An attorney can review contracts, explain legal implications, and advocate for your interests. Their expertise ensures that you understand your rights and obligations, safeguarding your investment and navigating the legal complexities of real estate.

Building a Strong Real Estate Team: Agents, Attorneys, and Contractors

In the dynamic world of real estate, success hinges on a well-coordinated team of professionals. Building a strong real estate team is essential for navigating the complexities of buying, selling, or investing in properties. This team should consist of key players, each with their specialized expertise, working in harmony to achieve your desired outcomes.

1. Real Estate Agents: Your Navigators in the Market

Real estate agents are your primary point of contact in the market, acting as your trusted guides and negotiators. They possess in-depth knowledge of local market trends, property values, and available listings.

- Listing Agents: Assist sellers in preparing their properties for sale, marketing them effectively, and negotiating with potential buyers.

- Buyer’s Agents: Help buyers identify properties that meet their specific needs, negotiate purchase offers, and guide them through the closing process.

Choosing a reputable and experienced real estate agent is crucial. They should be proficient in communication, negotiation, and market analysis, ensuring a smooth and successful transaction.

2. Real Estate Attorneys: Legal Guardians of Your Transactions

Real estate transactions involve intricate legal aspects, making it imperative to have an experienced real estate attorney on your side. Their expertise in property law, contracts, and title searches safeguards your interests and ensures a legally sound transaction.

- Contract Review: They scrutinize purchase agreements, ensuring all terms are favorable and protect your rights.

- Title Examination: They verify ownership history, liens, and encumbrances to ensure clear title for the property.

- Closing Assistance: They guide you through the closing process, ensuring all legal documents are executed properly.

Engaging an attorney early on in the process allows them to provide valuable legal counsel and prevent potential legal complications down the road.

3. Contractors: Transforming Visions into Reality

If you’re planning renovations, additions, or new construction, a skilled contractor is an indispensable part of your team. Their expertise in construction, design, and project management ensures your vision is brought to life efficiently and within budget.

- Project Planning: They collaborate with you to develop a detailed project plan, including timelines, materials, and budget estimates.

- Construction Expertise: They possess the necessary skills and knowledge to oversee the construction process, ensuring high-quality workmanship.

- Communication and Coordination: They act as a central point of contact, communicating with subcontractors and suppliers to ensure smooth project execution.

Selecting a reputable and experienced contractor is paramount to avoiding delays, cost overruns, and potential construction issues.

Managing Your Real Estate Investments for Long-Term Growth

Investing in real estate can be a lucrative endeavor, offering the potential for substantial returns and passive income. However, maximizing long-term growth requires a proactive and strategic approach to managing your investments. From due diligence during acquisition to ongoing maintenance and tenant management, every aspect of your real estate portfolio plays a vital role in achieving your financial goals.

Due Diligence and Acquisition

The foundation of a successful real estate investment lies in meticulous due diligence during the acquisition phase. Conduct thorough market research to identify properties with strong rental demand and potential for appreciation. Analyze financial statements, inspect the property’s condition, and review local regulations to ensure a sound investment decision. Engaging a reputable real estate agent and a qualified inspector can provide valuable insights and protect you from costly surprises down the line.

Financing and Budgeting

Securing favorable financing is crucial for maximizing your returns. Shop around for competitive mortgage rates and explore different loan options to find the best fit for your needs. Develop a detailed budget that includes all expenses, such as mortgage payments, property taxes, insurance, and maintenance costs. Accurate budgeting allows for informed decision-making and ensures you can comfortably meet your financial obligations.

Maintenance and Repairs

Proactive maintenance is key to preserving your investment’s value and minimizing costly repairs in the future. Establish a regular schedule for inspections and address any issues promptly. Preventive measures, such as routine cleaning, landscaping, and pest control, can help extend the lifespan of your property and prevent major problems. Remember, timely maintenance not only protects your investment but also enhances tenant satisfaction.

Tenant Management

Effective tenant management is essential for generating consistent rental income and maintaining the integrity of your property. Screen potential tenants rigorously, ensuring they have a reliable income and a good rental history. Implement a clear lease agreement outlining tenant responsibilities and rent payment procedures. Being responsive to tenant needs and addressing concerns promptly fosters positive relationships and reduces the likelihood of tenant turnover.

Market Analysis and Adjustments

Regularly monitor market trends to stay informed about rental rates, property values, and demand. Adjust your strategies accordingly to optimize your investment. Consider upgrading or renovating your property to enhance its appeal and command higher rent. Staying current with market dynamics allows you to capitalize on opportunities and minimize potential risks.

Tax Planning and Optimization

Leverage tax benefits associated with real estate investment to maximize your returns. Consult with a tax advisor to explore deductions and credits available to property owners. Implement effective tax planning strategies, such as depreciation, to minimize your tax liability and preserve your cash flow. Understanding tax implications and utilizing available deductions can significantly impact your bottom line.

Diversification and Risk Management

Diversifying your real estate portfolio across different property types, locations, and rental markets can help mitigate risk. Consider investing in both residential and commercial properties to spread your investments and reduce exposure to market fluctuations. Regularly review your portfolio and adjust your allocation based on market trends and your overall financial goals.

Navigating Real Estate Taxes and Deductions

Owning a home is a significant financial commitment, and understanding the complexities of real estate taxes and deductions is crucial for maximizing your financial well-being. This guide will provide a comprehensive overview of real estate taxes, available deductions, and strategies for navigating this intricate landscape.

Understanding Real Estate Taxes

Real estate taxes are levied by local governments and are based on the assessed value of your property. These taxes fund essential services such as schools, fire departments, and infrastructure maintenance. The tax rate varies depending on your location and property type.

Common Real Estate Tax Deductions

The Internal Revenue Service (IRS) allows homeowners to deduct certain expenses related to their property on their federal income taxes. Some common deductions include:

- Property Taxes: This deduction is available for both state and local property taxes, subject to limitations.

- Mortgage Interest: You can deduct the interest paid on your home mortgage up to a certain limit.

- Points: Points are fees paid to obtain a lower interest rate on your mortgage. These can be deducted over the life of the loan.

- Home Improvement Costs: Certain home improvements, such as energy-efficient upgrades, can be deducted as part of the home energy tax credit.

Maximizing Your Deductions

To maximize your tax deductions, consider the following strategies:

- Keep Accurate Records: Maintaining detailed records of your real estate expenses is crucial for claiming deductions accurately.

- Consult a Tax Professional: Seek advice from a qualified tax advisor to ensure you are taking advantage of all applicable deductions.

- Consider Refinancing: Refinancing your mortgage can lower your interest rate and potentially increase your mortgage interest deduction.

- Utilize Home Energy Credits: Explore the home energy tax credit to receive deductions for energy-efficient improvements.