Are you tired of living paycheck to paycheck, feeling stressed about your finances, and dreaming of a secure financial future? You’re not alone. Many people struggle with managing their money effectively, leaving them feeling overwhelmed and uncertain about their financial well-being. But it doesn’t have to be this way! This comprehensive guide, Master Your Money: A Practical Guide to Effective Personal Finance Management, will equip you with the knowledge and tools you need to take control of your finances and achieve your financial goals.

From understanding your spending habits and setting realistic budgets to investing wisely and planning for retirement, this guide will cover all the essential aspects of personal finance management. Whether you’re just starting out or looking to refine your existing financial strategies, this practical guide will provide you with the actionable steps and strategies to build a solid financial foundation and unlock your financial potential.

Understanding Your Financial Situation

Having a solid understanding of your financial situation is crucial for achieving your financial goals. It involves assessing your income, expenses, assets, and debts to gain a clear picture of your current financial standing. By understanding your financial situation, you can identify areas for improvement and make informed decisions about your money.

Assess Your Income

Start by carefully reviewing your income sources. This includes your salary, wages, investment income, and any other regular income streams. Make a list of all your income sources and their amounts. It’s also helpful to consider any potential changes in your income, such as salary increases or bonuses, in the near future.

Track Your Expenses

Tracking your expenses is equally important. Keep track of all your spending, from groceries and utilities to entertainment and subscriptions. Use a budgeting app, spreadsheet, or a simple notebook to record your expenses. Categorize your expenses to identify areas where you might be overspending.

Evaluate Your Assets

Assets are anything you own that has value. This includes your home, car, investments, savings, and any other valuables. Assess the value of your assets to understand your overall wealth. Remember that the value of assets can fluctuate, so it’s essential to regularly re-evaluate them.

Analyze Your Debts

Debts are any financial obligations you owe to others. This includes loans, credit card debt, and other outstanding payments. List your debts and their balances, interest rates, and minimum payments. Knowing your debt obligations is essential for managing your finances effectively.

Develop a Budget

Once you have a clear understanding of your income, expenses, assets, and debts, you can develop a budget. A budget helps you allocate your income to cover your expenses and save for your financial goals. Create a realistic budget that aligns with your lifestyle and financial priorities.

Seek Professional Advice

If you’re struggling to understand your financial situation or need guidance on managing your finances, consider seeking professional advice. A financial advisor can provide personalized recommendations and support based on your unique circumstances.

Review Regularly

Financial situations can change over time, so it’s essential to review your financial picture regularly. Make adjustments to your budget, income sources, or spending habits as needed. Regularly reviewing your financial situation helps you stay on track and achieve your financial goals.

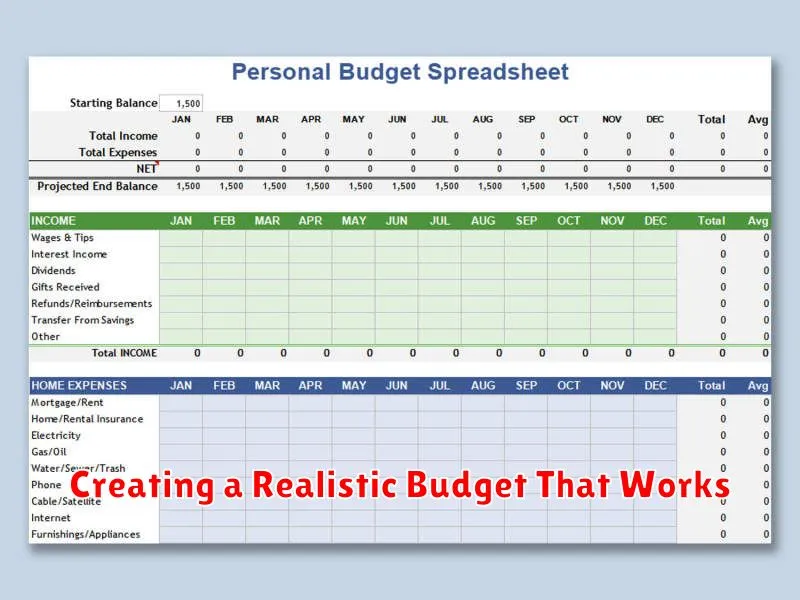

Creating a Realistic Budget That Works

Creating a budget is essential for anyone who wants to take control of their finances. It helps you track your income and expenses, identify areas where you can save money, and achieve your financial goals. However, many people struggle to create a budget that they can stick to. This is often because their budgets are unrealistic and unsustainable.

To create a realistic budget that works, you need to start by understanding your current spending habits. This means tracking your income and expenses for a few months. You can use a budgeting app, spreadsheet, or even a notebook to do this. Once you have a good understanding of where your money is going, you can start to make adjustments.

One of the most important aspects of creating a realistic budget is being honest with yourself about your spending. Many people underestimate their expenses or overestimate their income. This can lead to a budget that is too tight and unsustainable. It is important to be realistic and include all of your expenses, even the small ones, such as coffee or snacks. Don’t forget to factor in unexpected expenses, such as car repairs or medical bills.

Another important step is to prioritize your spending. What is most important to you? What are you willing to cut back on? Once you have prioritized your spending, you can allocate your money accordingly. For example, if you are trying to save for a down payment on a house, you may want to prioritize your housing costs and cut back on other expenses, such as dining out or entertainment.

It’s also important to make your budget flexible. Life happens, and unexpected expenses can arise. Be prepared to adjust your budget as needed. You may need to cut back on certain expenses temporarily, or you may need to increase your income. The key is to be flexible and adapt to your circumstances.

Creating a realistic budget takes time and effort. But it is a worthwhile investment in your financial future. By following these tips, you can create a budget that works for you and helps you achieve your financial goals.

Building an Emergency Fund

An emergency fund is a crucial part of personal finance. It’s a safety net that can help you weather unexpected financial storms, such as job loss, medical emergencies, or car repairs.

Building an emergency fund can seem daunting, but it’s a worthwhile goal. Here’s a step-by-step guide to help you get started:

1. Determine Your Needs

The amount you need in your emergency fund will depend on your individual circumstances, such as your income, expenses, and dependents. A good starting point is to aim for 3-6 months’ worth of living expenses. This should cover your essential costs, including rent, utilities, groceries, and transportation.

2. Set a Savings Goal

Once you know how much you need, set a specific savings goal. Break it down into smaller, more achievable targets. For example, instead of aiming for $10,000, set a goal of saving $1,000 per month for 10 months.

3. Track Your Progress

Monitor your progress regularly to stay motivated. Use a spreadsheet, budgeting app, or a simple notebook to keep track of your savings. Celebrating milestones along the way can help you stay on track.

4. Automate Your Savings

Set up automatic transfers from your checking account to your savings account. This takes the guesswork out of saving and helps you stay consistent.

5. Find Extra Money

Look for ways to cut back on unnecessary expenses or find extra income. This could include things like:

- Negotiating lower bills

- Canceling subscriptions you don’t use

- Selling unused items

- Taking on a side hustle

6. Be Patient and Persistent

Building an emergency fund takes time and effort. Don’t get discouraged if you don’t see results immediately. Be patient and consistent, and you’ll eventually reach your goal.

Managing Debt Wisely

Debt can be a heavy burden to carry. It can weigh on your mind, affect your sleep, and even damage your relationships. But managing debt wisely is possible, and it can lead to a brighter financial future. Here are some tips to help you get started:

1. Understand your debt: The first step to managing debt is to understand what you owe and to whom. This includes the amount of each debt, the interest rate, and the minimum payment due. You can use a budgeting app or spreadsheet to track your debt and see where your money is going.

2. Prioritize your debts: Once you understand your debt, you can start to prioritize it. Focus on paying down the debts with the highest interest rates first. This will save you money in the long run. You can use a debt snowball or debt avalanche method for this.

3. Create a budget: Creating a budget is essential for managing debt. It will help you see where your money is going and make sure you have enough money to cover your essential expenses. You can also use a budgeting app or spreadsheet to track your spending. You can find free resources and calculators to help with this process.

4. Increase your income: Increasing your income is another important step in managing debt. This can be done by getting a raise, taking on a side hustle, or selling something you no longer need. This extra money can be used to make extra payments on your debt. Remember, every little bit helps.

5. Negotiate with your creditors: If you are struggling to make your debt payments, consider talking to your creditors. They may be willing to work with you to lower your interest rate or reduce your monthly payment. If you are considering consolidating your debt, make sure you understand the terms of the new loan and the potential risks.

6. Get help: Managing debt can be overwhelming, but you don’t have to do it alone. There are many resources available to help you, including credit counseling agencies, non-profit organizations, and financial advisors. These professionals can provide you with personalized advice and support.

Managing debt effectively is a journey that requires discipline, effort, and patience. By following these tips, you can make progress in reducing your debt, gaining control over your finances, and building a more secure future.

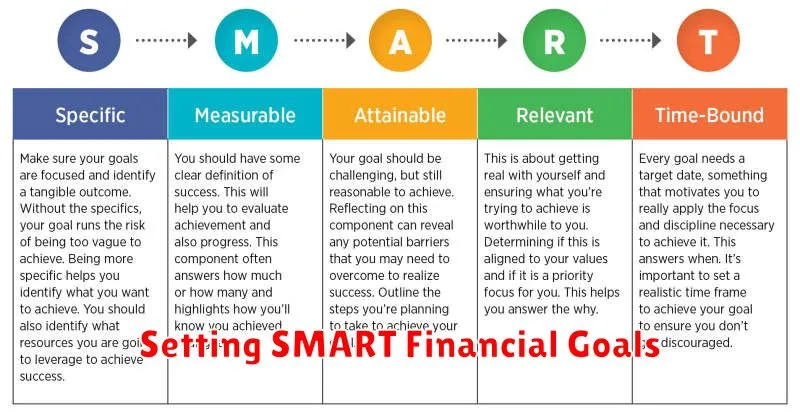

Setting SMART Financial Goals

Setting financial goals is an essential part of achieving financial success. However, simply stating that you want to “save more money” or “pay off debt” isn’t enough. You need to set specific, measurable, achievable, relevant, and time-bound (SMART) goals to guide your financial journey.

Here’s a breakdown of how to set SMART financial goals:

Specific

Instead of saying “I want to save money,” specify how much you want to save and what you plan to use it for. For example, “I want to save $10,000 for a down payment on a house.”

Measurable

Make sure your goals are quantifiable. You can track your progress and know when you’ve achieved your goal. Instead of saying “I want to pay down debt,” say “I want to reduce my credit card debt by $5,000 this year.”

Achievable

Set realistic goals that you can actually reach. Don’t set yourself up for failure by aiming too high. For example, if you only have a few hundred dollars in your savings account, aiming to save $100,000 in the next year might be too ambitious.

Relevant

Ensure your goals align with your overall financial objectives and values. Don’t set goals that don’t matter to you or that won’t contribute to your overall financial well-being. For example, if you’re not interested in investing in the stock market, don’t set a goal to grow your investments by 10%.

Time-Bound

Attach a deadline to your goals to create a sense of urgency. For example, “I want to pay off my student loans within 5 years.”

Benefits of Setting SMART Financial Goals

- Increased Motivation: Specific, measurable goals provide a clear roadmap and encourage you to take action.

- Enhanced Focus: SMART goals help you prioritize and focus your efforts on what matters most.

- Improved Tracking: Measurable goals allow you to track your progress and celebrate your successes.

- Greater Accountability: Setting deadlines and making your goals public can increase accountability.

- Financial Success: By setting and achieving SMART financial goals, you’re taking control of your finances and moving closer to financial independence.

Setting SMART financial goals is a powerful tool for achieving your financial aspirations. By following these steps, you can create a clear plan, stay motivated, and track your progress toward financial success.

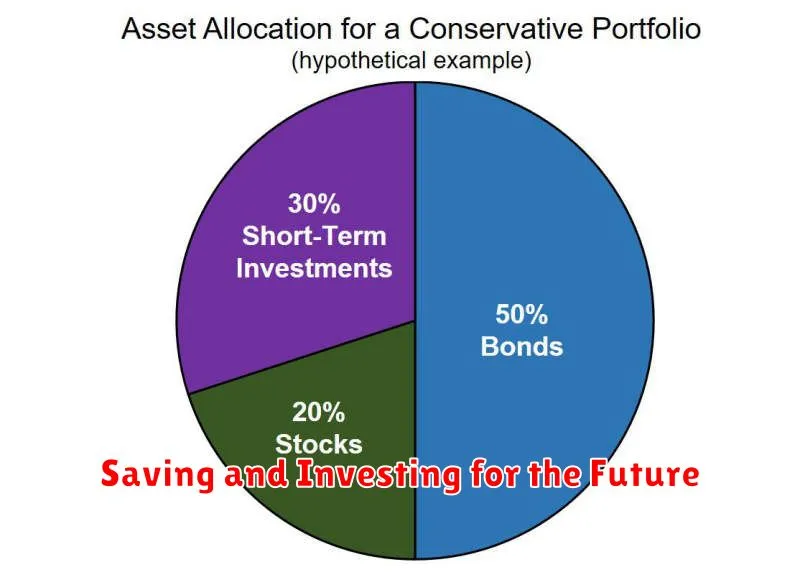

Saving and Investing for the Future

Saving and investing are essential for a secure financial future. They allow you to build wealth, achieve your financial goals, and prepare for unexpected events. While saving involves setting aside money for future use, investing involves using that saved money to potentially grow it over time. By understanding the differences between saving and investing, and the various strategies available, you can make informed decisions that will benefit your long-term financial well-being.

Saving: Building a Financial Foundation

Saving is the foundation of financial security. It involves setting aside a portion of your income regularly, creating a financial cushion for unexpected expenses or future goals. There are several types of savings accounts, each offering different benefits:

- High-Yield Savings Accounts (HYSA): Offer higher interest rates than traditional savings accounts, allowing your money to grow faster.

- Money Market Accounts (MMA): Offer slightly higher interest rates than HYSAs and often allow limited check-writing privileges.

- Certificates of Deposit (CDs): Offer fixed interest rates for a set period, typically ranging from a few months to several years.

The key to successful saving is consistency. Set a budget, identify areas where you can cut back on spending, and automate regular contributions to your savings account.

Investing: Growing Your Wealth

Investing goes beyond simply setting aside money; it involves using that money to potentially generate returns. Investing can be a powerful tool for wealth building, but it also comes with risks. There are various investment options, each with its own level of risk and potential return:

- Stocks: Represent ownership in a company. Stock prices can fluctuate based on market conditions and company performance.

- Bonds: Represent loans to companies or governments. Bonds typically offer lower returns than stocks but are considered less risky.

- Mutual Funds and Exchange-Traded Funds (ETFs): Diversified portfolios of stocks or bonds managed by professionals.

- Real Estate: Investing in property, which can generate rental income and appreciate in value over time.

Choosing the right investments depends on your individual financial goals, risk tolerance, and time horizon. It’s essential to conduct thorough research and consult with a financial advisor before making any investment decisions.

Protecting Your Assets with Insurance

Insurance is an essential tool for safeguarding your assets and protecting yourself from financial ruin in the event of unforeseen circumstances. By transferring risk to an insurance company, you can gain peace of mind knowing that you are financially protected against potential losses.

There are various types of insurance available, each designed to cover specific risks. Property insurance protects your home, belongings, and other real estate from damage caused by fire, theft, natural disasters, and other perils. Liability insurance safeguards you from financial responsibility if you are found legally liable for causing harm to others or their property.

Health insurance is crucial for covering the costs of medical expenses, including doctor visits, hospital stays, and prescription drugs. Life insurance provides financial support to your loved ones in the event of your untimely death. Auto insurance is required by law in most jurisdictions and covers damages to your vehicle and others involved in an accident.

When choosing insurance, it is important to carefully consider your individual needs and circumstances. Factors such as your age, location, and assets will influence the types of insurance you require and the coverage amounts you should obtain. It is also crucial to compare quotes from different insurance providers to find the most competitive rates.

By investing in comprehensive insurance coverage, you can create a financial safety net that protects your assets, your loved ones, and your peace of mind. It is a wise decision to prioritize insurance as a vital component of your financial planning and risk management strategies.

Planning for Retirement

Retirement is a significant milestone in life, marking a transition from a career to a new chapter filled with possibilities. It’s a time to pursue passions, travel, and enjoy the fruits of your labor. However, achieving a comfortable and fulfilling retirement requires careful planning and preparation. With proper planning, you can ensure a smooth transition and a financially secure future.

One of the first steps is to determine your retirement goals. What do you envision your life being like after you retire? Do you want to travel extensively, relocate to a new location, or simply relax and enjoy your hobbies? Once you have a clear picture of your aspirations, you can start planning how to achieve them.

Next, it’s crucial to assess your financial situation. Determine your current savings, expected income, and estimated expenses in retirement. This will give you a realistic picture of your financial position and help you identify any potential gaps. Consider factors such as healthcare costs, housing expenses, and potential inflation.

Once you have a good understanding of your financial needs, you can start developing a retirement savings plan. This plan should outline your savings goals, investment strategies, and time horizon. There are various retirement savings vehicles available, including 401(k)s, IRAs, and Roth IRAs. Each option has its own advantages and disadvantages, so it’s important to choose the one that best suits your individual circumstances.

It’s also essential to consider your health and well-being in retirement. Maintaining a healthy lifestyle is crucial for enjoying your golden years. Consider factors such as your physical and mental health, access to healthcare, and potential long-term care needs.

Retirement planning is an ongoing process, and it’s important to review and adjust your plan periodically. Life is full of unexpected twists and turns, so it’s essential to stay flexible and adapt your plan to changing circumstances. You may need to reassess your goals, update your savings strategy, or consider alternative options as you approach retirement.

Reviewing and Adjusting Your Plan Regularly

In the dynamic landscape of business, achieving success hinges on adaptability and the ability to pivot based on evolving circumstances. Regularly reviewing and adjusting your plan is not just a good practice, it’s a necessity. This process ensures that your strategy aligns with your current realities, maximizes your chances of achieving your goals, and safeguards your business from unforeseen challenges.

The frequency of your plan reviews should be tailored to the pace of change within your industry and the specific nature of your business. For rapidly evolving sectors, more frequent reviews may be required, perhaps even on a monthly basis. For more established sectors, quarterly reviews might suffice.

Here are some key areas to focus on during your plan review:

- Progress Tracking: Assess how well you’re meeting your milestones and objectives. Identify areas where you’re ahead of schedule and areas where you’re lagging. This provides valuable insights into your plan’s effectiveness and allows you to course-correct if needed.

- Market Trends: Analyze emerging trends and competitor activities. Are there new opportunities arising or threats you need to address? Adapt your plan to capitalize on new opportunities or mitigate potential risks.

- Resource Allocation: Evaluate your resource allocation. Are you utilizing your resources efficiently? Do you need to adjust your allocation to support strategic priorities or respond to changing conditions?

- Performance Metrics: Review your key performance indicators (KPIs). Are you seeing improvements in your desired metrics? If not, what adjustments need to be made to your plan to improve performance?

- Feedback Collection: Gather feedback from your team, stakeholders, and customers. What are their insights and suggestions? Their perspectives can provide valuable input for refining your plan.

Adjusting your plan based on the review process is essential for keeping your business on track. Don’t be afraid to make changes. Flexibility is key to success in today’s business environment.

Remember, a static plan is a recipe for stagnation. By embracing the iterative process of review and adjustment, you can ensure that your plan remains a dynamic tool that drives you toward achieving your goals.