Are you looking to grow your wealth and achieve financial freedom? Investing in the stock market can be a powerful tool to reach your financial goals, but it can also seem daunting for beginners. This comprehensive guide will walk you through the fundamentals of stock market investing, from understanding the basics to navigating the world of stocks, bonds, and mutual funds. We’ll cover everything you need to know to get started, including how to choose the right investments, manage risk, and build a diversified portfolio.

No matter your experience level, this guide will equip you with the knowledge and confidence to unlock the market’s potential and make informed investment decisions. We’ll break down complex concepts into easy-to-understand language, providing actionable insights to help you embark on your investment journey.

Understanding Your Financial Goals

Financial goals are the targets you set for your financial future. They can be short-term, such as saving for a vacation, or long-term, such as retiring comfortably. Having clear financial goals is essential for making informed financial decisions and achieving your financial aspirations.

Types of Financial Goals

Financial goals can be categorized into different types, including:

- Short-term goals: These are goals that you plan to achieve within a year or less. Examples include saving for a down payment on a car, paying off credit card debt, or taking a vacation.

- Mid-term goals: These are goals that you plan to achieve within one to five years. Examples include buying a house, starting a business, or saving for your child’s education.

- Long-term goals: These are goals that you plan to achieve in five years or more. Examples include retiring comfortably, leaving an inheritance, or achieving financial independence.

Setting SMART Financial Goals

When setting financial goals, it’s helpful to follow the SMART framework:

- Specific: Your goals should be clear and well-defined. Avoid vague goals like “save more money.”

- Measurable: Your goals should have a quantifiable target. For example, “save $10,000 for a down payment on a house.”

- Achievable: Your goals should be realistic and within your reach. Don’t set goals that are too ambitious and likely to discourage you.

- Relevant: Your goals should align with your values and overall financial objectives.

- Time-bound: Your goals should have a specific deadline. This will help you stay motivated and track your progress.

Benefits of Having Financial Goals

Having clear financial goals offers numerous benefits, including:

- Improved financial planning: Goals provide direction and help you prioritize your spending.

- Increased motivation: Knowing what you’re working towards can be a powerful motivator.

- Reduced financial stress: Having a plan can reduce anxiety about your financial future.

- Better decision-making: Goals help you make informed choices about your money.

- Financial success: By setting and working towards goals, you’re more likely to achieve financial security and independence.

Conclusion

Understanding your financial goals is crucial for making sound financial decisions and achieving your financial aspirations. By setting SMART goals and working towards them consistently, you can build a solid financial foundation and secure your future.

Building a Solid Budget for Investing

Investing is a crucial part of achieving financial security and growing your wealth over time. However, before you start investing, it’s essential to have a solid budget in place. A well-structured budget will ensure you’re financially stable, allowing you to allocate funds for investing without jeopardizing your essential expenses.

Understanding Your Income and Expenses

The first step in creating a budget is to understand your income and expenses. Keep track of all your income sources, including your salary, bonuses, and any other regular income streams.

Track all your expenses, both fixed and variable, over a period of several months. Fixed expenses are recurring costs that stay relatively consistent, such as rent, mortgage payments, utilities, and loan payments. Variable expenses are costs that fluctuate from month to month, such as groceries, entertainment, and transportation.

Categorize and Analyze Your Expenses

Once you have a clear picture of your income and expenses, categorize them to understand where your money is going. You can use budgeting apps or spreadsheets to track your spending and categorize it into categories like housing, food, transportation, healthcare, entertainment, and savings.

Analyzing your expenses allows you to identify areas where you can potentially reduce spending. For example, you might discover that you’re spending more on eating out than you’d like or that your entertainment budget is higher than necessary.

Setting Financial Goals

Before you start investing, it’s crucial to set financial goals. Your financial goals will guide your investment decisions and help you stay motivated. Determine what you want to achieve with your investments, such as buying a house, paying off debt, funding your retirement, or saving for your children’s education.

Once you have defined your goals, you can estimate how much money you’ll need to achieve them and set realistic timelines. This will help you determine how much you should allocate to investing each month.

Creating a Budget for Investing

Once you’ve established your income, expenses, and financial goals, you can create a budget that allows for investing. Start by prioritizing your essential expenses, such as housing, food, and healthcare. Allocate a portion of your remaining income to savings, which you can then use for investing.

When determining how much to allocate to investing, consider your risk tolerance, investment timeframe, and financial goals. It’s wise to start small and gradually increase your investment amount as your income and savings grow.

Review and Adjust Your Budget Regularly

A budget isn’t static; it’s a living document that should be reviewed and adjusted regularly. As your income, expenses, and financial goals change, your budget should adapt accordingly.

Review your budget at least once a quarter or annually. This allows you to track your progress, identify areas for improvement, and make adjustments to ensure your budget is still aligned with your financial goals.

Building a Solid Budget for Investing

Building a solid budget is essential for successful investing. By understanding your income and expenses, setting financial goals, and allocating funds for investing, you can create a plan that supports your financial well-being and helps you achieve your long-term financial aspirations.

Choosing the Right Investment Account (Brokerage, IRA)

Investing is a crucial step towards building wealth and achieving your financial goals. However, with a plethora of investment accounts available, selecting the right one can seem overwhelming. Two popular choices are brokerage accounts and Individual Retirement Accounts (IRAs), each offering unique benefits and considerations.

Brokerage Accounts

Brokerage accounts provide a platform to buy and sell various financial instruments like stocks, bonds, exchange-traded funds (ETFs), and mutual funds. They offer flexibility and control over your investments, allowing you to create a personalized portfolio aligned with your risk tolerance and investment strategy.

Key Features of Brokerage Accounts:

- Wide range of investment options: Access to a diverse selection of securities, including stocks, bonds, ETFs, and mutual funds.

- Flexibility and control: You have the freedom to make investment decisions based on your own research and analysis.

- Trading platforms: Most brokerages offer user-friendly platforms for placing orders and managing your portfolio.

- Research tools and resources: Access to market data, analytical tools, and educational resources to aid in investment decisions.

Individual Retirement Accounts (IRAs)

IRAs are retirement savings accounts designed to encourage individuals to save for their golden years. These accounts offer tax advantages, allowing you to grow your investment earnings tax-deferred or tax-free depending on the type of IRA.

Key Features of IRAs:

- Tax advantages: Traditional IRAs allow tax deductions on contributions, while Roth IRAs offer tax-free withdrawals in retirement.

- Growth potential: Investments within an IRA grow tax-deferred or tax-free, maximizing your returns.

- Retirement planning: IRAs are specifically designed for retirement savings, providing a dedicated vehicle to accumulate funds for your later years.

Choosing the Right Account

The decision between a brokerage account and an IRA hinges on your individual circumstances, financial goals, and tax situation. Here are some factors to consider:

Age and Time Horizon

If you’re younger and have a longer time horizon, a brokerage account might be a better option. It offers more flexibility and control, allowing you to invest in a variety of assets for potential long-term growth.

Retirement Planning

If retirement is on the horizon, an IRA is a compelling choice. Its tax advantages can help you maximize your retirement savings and potentially reduce your tax liability in retirement.

Tax Situation

Consider your current tax bracket and projected tax situation in retirement. Traditional IRAs offer immediate tax deductions, while Roth IRAs provide tax-free withdrawals in retirement.

Investment Goals

Align your investment goals with the account type. If you seek active trading and short-term gains, a brokerage account may be suitable. If you prefer long-term growth with tax benefits, an IRA might be a better fit.

Conclusion

Choosing the right investment account is essential for building a solid financial foundation. Carefully assess your needs, goals, and tax situation to determine whether a brokerage account or an IRA best suits your investment strategy.

Exploring Different Investment Options: Stocks, Bonds, ETFs

Investing is a crucial aspect of building wealth and achieving financial goals. With numerous investment options available, choosing the right ones can be overwhelming. This article delves into three popular investment types: stocks, bonds, and exchange-traded funds (ETFs), providing insights into their characteristics, risks, and potential rewards.

Stocks: Owning a Piece of a Company

Stocks represent ownership in a company. When you purchase a stock, you become a shareholder and have a claim on the company’s assets and profits. Stocks are considered a growth investment, with the potential for higher returns over time, but they also carry higher risk. Stock prices can fluctuate significantly due to factors such as company performance, market sentiment, and economic conditions.

There are two main types of stocks:

- Common stock: Provides voting rights and the right to receive dividends, if declared by the company.

- Preferred stock: Offers fixed dividend payments and priority in receiving assets in case of bankruptcy, but typically has limited voting rights.

Bonds: Lending to Borrowers

Bonds are debt securities that represent loans to borrowers, such as governments or corporations. When you buy a bond, you are essentially lending money to the borrower in exchange for regular interest payments and the return of your principal at maturity. Bonds are generally considered a safer investment than stocks, as they have lower volatility and provide a more predictable stream of income.

The primary types of bonds include:

- Government bonds: Issued by federal, state, or local governments and are generally considered very safe.

- Corporate bonds: Issued by corporations to finance their operations and carry more risk than government bonds.

Exchange-Traded Funds (ETFs): Diversification and Liquidity

ETFs are investment funds that trade on stock exchanges like individual stocks. They typically track a specific index, sector, or commodity, providing investors with a way to diversify their portfolios and gain exposure to a wide range of assets. ETFs offer several advantages, including:

- Diversification: ETFs can hold hundreds of different securities, reducing portfolio risk.

- Liquidity: ETFs can be bought and sold throughout the trading day like stocks, offering greater flexibility.

- Low expense ratios: ETFs typically have lower fees than actively managed mutual funds.

Choosing the Right Investment Options

The best investment options for you will depend on your individual circumstances, financial goals, risk tolerance, and time horizon. Consider the following factors when making investment decisions:

- Your risk tolerance: How much risk are you comfortable taking with your investments?

- Your investment goals: What are you trying to achieve with your investments, such as retirement, a down payment on a house, or education expenses?

- Your time horizon: How long do you plan to keep your investments? Longer time horizons generally allow for greater potential for growth.

- Your financial situation: Your income, expenses, and existing debt obligations all play a role in determining how much you can invest.

It’s essential to conduct thorough research, consult with a financial advisor, and consider your personal circumstances before making any investment decisions. Diversification, a key principle of investing, involves allocating your assets across different asset classes to reduce risk and potentially enhance returns.

Researching Companies and Analyzing Stocks

Before investing in any company, it is crucial to conduct thorough research and analyze its financial performance. This process involves understanding the company’s business model, industry landscape, financial health, and future prospects. By carefully evaluating these factors, investors can make informed decisions and potentially maximize their returns.

One of the first steps in researching a company is to understand its business model. This involves examining the products or services it offers, its target market, its competitive landscape, and its revenue streams. By comprehending the company’s business model, investors can assess its long-term viability and its ability to generate profits.

It is also essential to analyze the company’s industry. Understanding the industry’s growth prospects, regulatory environment, and competitive dynamics can provide valuable insights into the company’s future performance. For example, a company operating in a rapidly growing industry may have more opportunities for expansion and profitability. Conversely, a company in a declining industry may face challenges in maintaining its market share.

Furthermore, investors should carefully examine the company’s financial health. This involves analyzing its financial statements, such as its income statement, balance sheet, and cash flow statement. Key metrics to consider include revenue growth, profitability, debt levels, and cash flow generation. A strong financial foundation is essential for a company’s long-term success.

Finally, it is important to consider the company’s future prospects. This includes evaluating its competitive advantages, growth strategies, and potential risks and opportunities. Investors should consider the company’s management team, its innovation capabilities, and its ability to adapt to changing market conditions.

Once a company has been thoroughly researched, investors can begin to analyze its stock. This involves evaluating its valuation, comparing it to its peers, and considering its market sentiment. By analyzing these factors, investors can determine whether the stock is currently undervalued, overvalued, or fairly valued.

Ultimately, researching companies and analyzing stocks is an essential part of the investment process. By conducting thorough due diligence, investors can make informed decisions and potentially achieve their financial goals.

Start Small and Diversify Your Portfolio

Starting a portfolio can feel daunting, especially when faced with a seemingly endless array of options. The key, however, is to start small and gradually build your portfolio with a diverse range of investments.

Investing a small amount on a regular basis, such as through a robo-advisor or a mutual fund, allows you to start accumulating wealth without overwhelming yourself with complex financial decisions. Diversifying your portfolio across different asset classes, such as stocks, bonds, and real estate, helps mitigate risk and maximize returns over the long term.

Remember, starting small doesn’t mean compromising your long-term goals. As you become more comfortable with the market and your investments grow, you can adjust your portfolio accordingly. By following a disciplined approach and prioritizing diversification, you can build a strong foundation for your financial future.

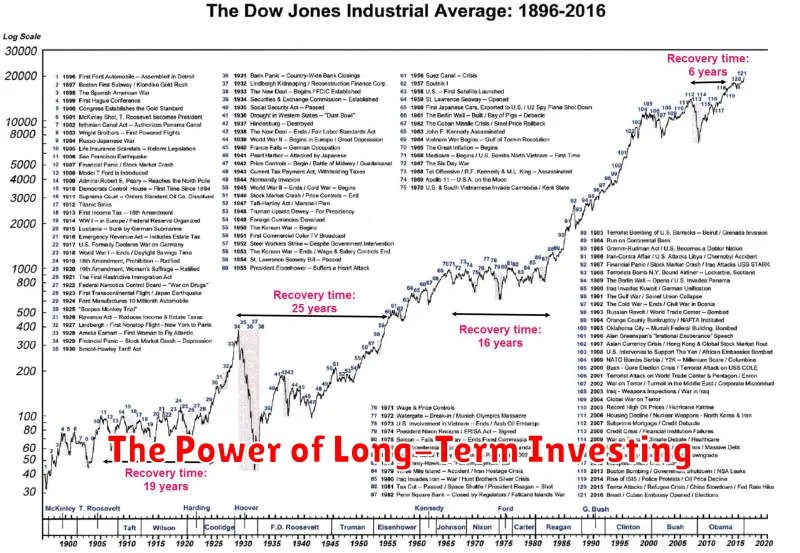

The Power of Long-Term Investing

In the realm of finance, the allure of quick riches often overshadows the enduring power of long-term investing. While the promise of overnight fortunes may be tempting, it’s crucial to recognize that true financial success is often the product of patient and consistent investment strategies.

Long-term investing, as the name suggests, involves holding investments for an extended period, typically years or even decades. This approach allows for the benefits of compounding, a powerful phenomenon that amplifies the growth of your investments over time. As your investments generate returns, those returns are reinvested, further fueling future growth.

Here are some key benefits of long-term investing:

- Reduced Impact of Market Volatility: Long-term investors are less susceptible to short-term fluctuations in the market. Market downturns are inevitable, but over time, the market tends to trend upward. By staying invested, you ride out the dips and benefit from the long-term growth potential.

- Power of Compounding: Compounding is the key to long-term wealth accumulation. It’s the snowball effect of earning returns on your initial investment and then earning returns on those returns. The longer you stay invested, the more potent compounding becomes.

- Disciplined Approach: Long-term investing fosters a disciplined mindset. By committing to a long-term strategy, you’re less likely to make impulsive decisions based on short-term market noise.

- Focus on the Big Picture: Long-term investing encourages a focus on the bigger picture rather than chasing short-term gains. It allows you to invest in companies with strong fundamentals and growth potential, regardless of short-term market fluctuations.

While long-term investing offers numerous advantages, it’s essential to remember that it’s not a passive approach. It requires careful planning, due diligence, and ongoing monitoring. Here are some tips for successful long-term investing:

- Establish Clear Financial Goals: Define your investment objectives, whether it’s retirement planning, buying a home, or funding your child’s education. Having clear goals helps you stay focused and disciplined.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversify your investments across different asset classes, industries, and geographic regions to mitigate risk.

- Invest Regularly: Establish a regular investment schedule, whether it’s monthly, quarterly, or annually. Consistency is key to building wealth over time.

- Seek Professional Advice: Consult with a financial advisor to develop a customized investment plan that aligns with your financial goals, risk tolerance, and time horizon.

- Stay Patient and Disciplined: Long-term investing requires patience and discipline. Avoid making emotional decisions based on market fluctuations. Stick to your investment plan and let your investments grow over time.

Long-term investing is not a get-rich-quick scheme; it’s a journey of building wealth over time. It’s about patience, discipline, and a commitment to your financial future. By embracing the power of long-term investing, you can set yourself on a path to financial security and achieve your long-term financial goals.

Managing Risks and Handling Market Volatility

In the dynamic world of finance, market volatility is an inevitable reality. It refers to the fluctuations in asset prices, such as stocks, bonds, and commodities, over a specific period. These fluctuations can be driven by a multitude of factors, including economic news, political events, and investor sentiment. While volatility can present both opportunities and challenges, managing risks and handling market volatility effectively is crucial for investors of all levels.

Understanding Market Volatility

Market volatility is a measure of how much an asset’s price changes over time. High volatility indicates that the price is fluctuating rapidly and significantly, while low volatility suggests that the price is relatively stable. Understanding the factors that contribute to volatility is essential for making informed investment decisions.

Managing Risks

Managing risks in a volatile market requires a comprehensive approach. Here are some key strategies:

- Diversification: Spreading investments across different asset classes, industries, and geographical regions can help reduce overall portfolio risk.

- Asset Allocation: Determining the optimal mix of assets in a portfolio based on risk tolerance and investment goals is crucial for mitigating volatility.

- Risk Tolerance Assessment: Understanding your own risk tolerance is vital for making investment decisions that align with your financial goals and comfort level.

- Long-Term Perspective: Market volatility is often short-lived. Maintaining a long-term perspective can help navigate short-term fluctuations and focus on achieving long-term financial objectives.

Handling Market Volatility

When faced with market volatility, it’s important to stay calm and avoid impulsive decisions. Here are some strategies for handling volatility:

- Stay Informed: Monitor market trends, economic indicators, and news events that could impact investments.

- Avoid Panic Selling: Selling assets during a downturn can lock in losses. Resist the urge to panic and consider holding investments for the long term.

- Rebalance Portfolio: Periodically review and adjust portfolio allocations to ensure that they remain aligned with investment goals and risk tolerance.

- Seek Professional Advice: Consult with a financial advisor to develop a personalized investment strategy and receive guidance on managing volatility.

Conclusion

Market volatility is an inherent part of the investment landscape. By understanding the factors that contribute to volatility, managing risks effectively, and handling market fluctuations with a calm and rational approach, investors can increase their chances of achieving long-term financial success. Remember that investing involves risks, and it’s essential to make informed decisions based on a thorough understanding of your own financial situation and investment goals.

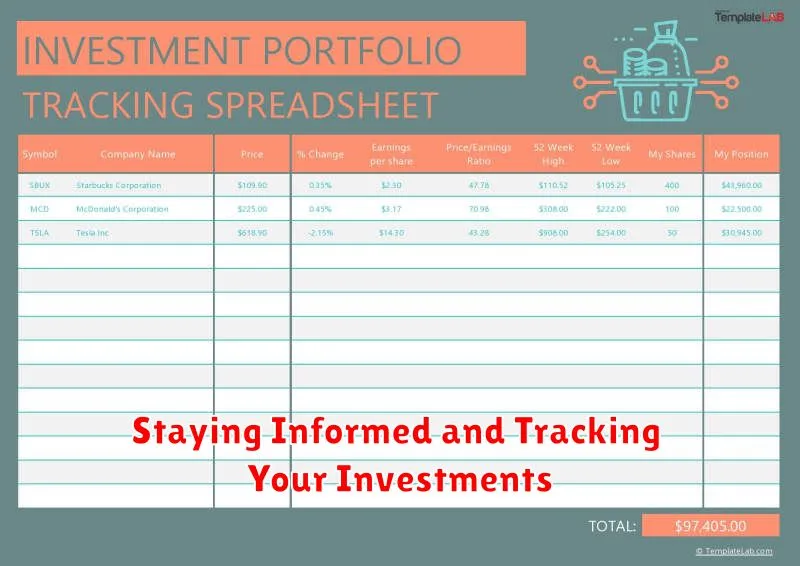

Staying Informed and Tracking Your Investments

In today’s dynamic financial landscape, staying informed and actively tracking your investments is crucial for making sound financial decisions. With a myriad of investment options available, it’s essential to have a comprehensive understanding of your portfolio’s performance and market trends.

Regularly Monitoring Your Portfolio:

One of the key aspects of staying informed is regularly monitoring your portfolio. This involves reviewing your investment holdings, analyzing their performance, and assessing their alignment with your financial goals. By tracking your investments, you can identify areas that require attention, such as underperforming assets or potential opportunities for diversification.

Utilizing Financial Resources:

Fortunately, there are numerous financial resources available to assist investors in staying informed. Online brokerage platforms, financial news websites, and investment research firms provide valuable data, market insights, and analysis tools. These resources can help you stay abreast of economic indicators, industry trends, and company performance, empowering you to make informed decisions.

Staying Updated on Market Trends:

Keeping abreast of market trends is vital for adapting your investment strategy. Factors such as interest rates, inflation, and geopolitical events can significantly impact market sentiment and investment returns. By staying informed about these trends, you can anticipate potential market shifts and adjust your portfolio accordingly.

Seeking Professional Advice:

For complex investment strategies or if you lack the time or expertise to manage your portfolio effectively, seeking professional advice from a financial advisor is highly recommended. A qualified advisor can provide personalized guidance, create a customized investment plan, and monitor your portfolio on your behalf.

Staying Informed: A Continuous Process:

Staying informed about your investments is not a one-time event but an ongoing process. By regularly monitoring your portfolio, utilizing available financial resources, and staying updated on market trends, you can make informed decisions and maximize your investment potential. Remember, knowledge is power in the world of investing.

Seeking Advice from Financial Professionals

In today’s complex and ever-evolving financial landscape, it’s more important than ever to seek professional guidance. Financial advisors, planners, and other experts can provide invaluable insights and support to help you achieve your financial goals.

Whether you’re just starting out, planning for retirement, or managing your investments, a financial professional can assist you in navigating the intricacies of the financial world. They possess the knowledge, experience, and objectivity to develop a personalized strategy tailored to your unique circumstances.

Benefits of Seeking Financial Advice:

- Objective Perspective: Financial professionals can offer an unbiased view of your financial situation, free from emotional biases that can cloud your judgment.

- Expert Knowledge: They stay up-to-date on the latest market trends, regulations, and investment strategies, ensuring you have access to the most relevant information.

- Personalized Plans: Financial advisors can create customized plans that align with your goals, risk tolerance, and time horizon.

- Accountability and Support: They provide ongoing support and guidance, helping you stay on track with your financial goals and make informed decisions.

Choosing the Right Financial Professional:

When selecting a financial advisor, it’s crucial to consider several factors:

- Credentials and Experience: Look for professionals with relevant qualifications and a proven track record.

- Fees and Compensation: Understand how they are compensated to avoid any potential conflicts of interest.

- Communication Style: Choose someone who communicates clearly and effectively, ensuring you understand their advice.

- Values and Philosophy: Find an advisor whose values and investment approach align with your own.

Seeking advice from a qualified financial professional can make a significant difference in your financial well-being. By leveraging their expertise, you can gain clarity, confidence, and a roadmap to achieve your financial aspirations.