Diving into the world of cryptocurrency can feel overwhelming, especially for beginners. The constant fluctuations, complex jargon, and high initial investment requirements can be daunting. But what if we told you that you don’t need a fortune to start investing in this revolutionary asset class? With small steps and a strategic approach, you can begin your cryptocurrency journey with just a few dollars. This guide will walk you through the fundamentals of cryptocurrency investing for beginners, focusing on strategies for small investments, minimizing risk, and maximizing your potential returns.

Forget the myth that you need thousands to get started. The beauty of cryptocurrency is its accessibility. Whether you’re looking to diversify your portfolio, explore the potential of blockchain technology, or simply learn about this exciting new world, this beginner’s guide will empower you to take control of your financial future. Let’s break down the barriers and show you how to make big returns with small investments in cryptocurrency.

Debunking the Myth of Large Investments

The financial world often paints a picture where success is directly linked to the size of your investments. The bigger the number you throw at the market, the greater the returns, right? Wrong. While it’s true that larger sums can potentially generate higher absolute returns, this narrative overlooks a crucial element: risk.

The truth is, investing is not a game of throwing money at the market and hoping for the best. It’s about understanding your financial goals, your risk tolerance, and making calculated decisions.

The Reality of Small Investments

Contrary to popular belief, small investments can be just as effective, if not more so, than large ones in the long run. Here’s why:

- Consistent Savings: Small, regular investments allow you to cultivate a habit of saving and investing, building a solid foundation for your financial future. This consistent approach is more powerful than sporadic large investments.

- Power of Compounding: Even small amounts invested consistently can grow significantly over time due to the magic of compounding. The interest earned on your investment also earns interest, creating a snowball effect that multiplies your returns.

- Reduced Risk: Spreading your investments across different assets and time periods reduces your exposure to market volatility. Small investments allow you to diversify your portfolio, minimizing the impact of any single investment performing poorly.

The Importance of Strategy

Instead of focusing on the size of your initial investment, prioritize a well-defined investment strategy. This includes:

- Setting Clear Goals: Determine your financial goals, such as buying a house, retiring early, or paying for your children’s education. This will help you choose the appropriate investment vehicles and timeframe.

- Understanding Risk Tolerance: Be realistic about your comfort level with risk. Your investment strategy should align with your risk tolerance, ensuring you don’t make impulsive decisions driven by fear or greed.

- Diversifying Your Portfolio: Don’t put all your eggs in one basket. Invest in a mix of assets, such as stocks, bonds, real estate, and commodities, to spread your risk and potentially enhance returns.

The Bottom Line

Don’t let the myth of large investments discourage you from taking the first step toward building your financial future. Even small, consistent investments can lead to significant growth over time. Remember, it’s not about the size of your investment, but about the strategy and discipline behind it.

Benefits of Starting Small in Cryptocurrency

The world of cryptocurrency is rapidly evolving and can be a daunting space to navigate. For newcomers, it can seem overwhelming, particularly with the constant fluctuations in prices and the complex technical jargon. However, starting small in cryptocurrency can provide numerous benefits, both financially and in terms of knowledge acquisition.

Minimizing Financial Risk

One of the primary advantages of starting small is minimizing financial risk. The cryptocurrency market is volatile, and prices can fluctuate significantly within a short period. By investing small amounts, you can reduce the potential for significant losses. This allows you to experiment, learn, and gradually increase your investment as you gain confidence and understanding.

Learning the Ropes

Starting small provides an excellent opportunity to learn the basics of cryptocurrency. You can explore different platforms, understand the concepts of wallets, exchanges, and trading strategies. You can also research and experiment with different cryptocurrencies to identify those that align with your investment goals. This hands-on learning experience can be invaluable as you navigate the complexities of the cryptocurrency world.

Developing a Strong Foundation

By starting with small investments, you can gradually build a strong foundation in cryptocurrency. You can develop a disciplined approach to investing, learn to manage your risk, and understand the importance of diversification. This foundation will serve you well as you increase your investments and venture into more advanced strategies.

Building Confidence

As you gain experience and see positive results from your small investments, you will naturally build confidence in your abilities. This confidence is essential for navigating the volatile world of cryptocurrency, allowing you to make more informed decisions and take calculated risks.

Avoiding Emotional Decisions

Starting small helps you avoid making emotional decisions based on market hype or fear. When your investment is small, you are less likely to panic sell or buy impulsively. This disciplined approach allows you to remain objective and make rational decisions based on your research and understanding.

Setting Realistic Investment Goals

Investing can be a daunting task, but it’s an essential part of building a secure financial future. The key to successful investing lies in setting realistic goals. Without clear goals, it’s easy to get lost in the noise of the market and make impulsive decisions that can jeopardize your investment strategy.

The first step to setting realistic goals is to understand your financial situation. Consider your income, expenses, debts, and existing savings. This will help you determine how much you can afford to invest and for how long. It’s important to be honest with yourself about your financial constraints and not overextend yourself.

Next, define your investment objectives. What are you hoping to achieve with your investments? Are you saving for retirement, a down payment on a house, or your child’s education? Understanding your goals will help you choose the right investments and track your progress.

It’s also crucial to consider your risk tolerance. Some investors are comfortable with high-risk investments that have the potential for high returns, while others prefer low-risk investments with stable returns. Your risk tolerance should align with your investment goals and time horizon. If you’re investing for the long term, you might be willing to take on more risk, but if you need the money in the short term, you’ll likely prefer safer investments.

Once you have a clear understanding of your financial situation, investment objectives, and risk tolerance, you can start setting specific, measurable, achievable, relevant, and time-bound (SMART) goals. For example, instead of saying, “I want to invest in the stock market,” you could say, “I want to invest $100 per month in a diversified stock portfolio for the next 5 years.”

Remember, consistency is key to successful investing. Don’t expect to get rich quick or make unrealistic gains. Stick to your goals, stay disciplined, and review your investment strategy periodically to ensure it remains aligned with your objectives. By setting realistic goals and following a consistent investment plan, you can build a strong foundation for your financial future.

Choosing the Right Cryptocurrency Exchange

The world of cryptocurrency is constantly evolving, and with it, the landscape of cryptocurrency exchanges. Choosing the right exchange is crucial for both beginners and seasoned traders, as it can significantly impact your trading experience and potentially your financial well-being. With numerous exchanges available, each with its own unique features and offerings, it can be overwhelming to navigate this complex market. This guide will provide you with essential factors to consider when choosing the right cryptocurrency exchange for your needs.

Security

Security should be your top priority when selecting an exchange. Look for exchanges that prioritize the safety of your funds and personal information. Consider these factors:

- Two-factor authentication (2FA): Ensure the exchange offers 2FA to enhance account security.

- Cold storage: A reputable exchange will store a significant portion of its users’ assets offline in cold storage to minimize the risk of hacking.

- Security audits: Look for exchanges that have undergone independent security audits to validate their security measures.

- Insurance: Some exchanges offer insurance policies to protect users’ assets in case of security breaches.

Fees

Cryptocurrency exchanges typically charge fees for various services, including trading, deposits, and withdrawals. Compare fees across different exchanges to find one that offers competitive rates. Consider these fee types:

- Trading fees: These fees are usually charged as a percentage of the trade value. Some exchanges offer tiered fee structures based on trading volume.

- Deposit fees: Some exchanges may charge fees for depositing funds, especially for certain payment methods.

- Withdrawal fees: Withdrawal fees are common and can vary depending on the cryptocurrency and withdrawal method.

Supported Cryptocurrencies

Before choosing an exchange, ensure it supports the cryptocurrencies you intend to trade. Different exchanges offer varying ranges of cryptocurrencies, so select one that aligns with your trading needs. Consider the following:

- Popular cryptocurrencies: Ensure the exchange supports widely traded cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC).

- Emerging cryptocurrencies: If you are interested in trading less established cryptocurrencies, check if the exchange lists them.

- Altcoins: Some exchanges specialize in offering a wide selection of altcoins, which are cryptocurrencies other than Bitcoin.

User Interface (UI) and User Experience (UX)

A user-friendly interface and experience are essential for seamless trading. Look for an exchange with a clean, intuitive UI and UX that is easy to navigate. Consider these factors:

- Ease of navigation: The exchange should be easy to navigate, allowing you to find information and execute trades quickly.

- Order types: Check if the exchange offers various order types, such as market orders, limit orders, and stop-loss orders, to suit your trading strategies.

- Mobile app: Some exchanges offer mobile apps, which allow you to trade on the go.

Customer Support

Reliable customer support is crucial, especially for resolving issues or seeking assistance. Look for exchanges with responsive customer support channels, such as email, live chat, or phone. Consider these factors:

- Response time: Evaluate the exchange’s response time to customer queries.

- Availability: Determine the availability of customer support channels, including their operating hours.

- Help resources: Look for comprehensive help resources, such as FAQs, tutorials, and blog posts, to assist you in navigating the platform.

Regulation and Compliance

Consider the regulatory environment and compliance of the exchange. Choosing a regulated exchange can provide an added layer of security and assurance. Consider these factors:

- Legal jurisdiction: Check the legal jurisdiction of the exchange and its compliance with relevant regulations.

- KYC/AML procedures: Reputable exchanges typically require Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures to comply with regulations.

- Transparency: Look for an exchange that is transparent about its operations and financial activities.

Reputation and Community

Research the reputation and community of the exchange. Consider reading reviews from other users and evaluating the exchange’s overall reputation. Consider these factors:

- Online reviews: Read reviews on reputable websites and forums to gather insights from other users.

- Social media presence: Check the exchange’s social media presence and engagement with the community.

- Community forums: Participate in community forums and discussions to gain valuable insights from experienced traders.

Conclusion

Choosing the right cryptocurrency exchange is a critical decision. By considering the factors outlined above, you can make an informed choice that aligns with your trading needs and preferences. Remember to prioritize security, fees, supported cryptocurrencies, user interface, customer support, regulation, and reputation.

Exploring Micro-Investing Platforms

In today’s world, it’s easier than ever to invest, even if you don’t have a lot of money. Micro-investing platforms allow you to invest small amounts of money, often as little as $1 or $5, in a variety of assets, including stocks, ETFs, and mutual funds. This makes investing accessible to everyone, regardless of their income level or financial experience.

One of the biggest advantages of micro-investing platforms is that they make investing automatic. You can set up recurring investments, such as weekly or monthly contributions, and the platform will automatically invest your money for you. This takes the hassle out of investing and helps you build a portfolio over time, even if you don’t have a lot of time to manage your investments.

Another advantage of micro-investing platforms is that they are often user-friendly. Many platforms have simple interfaces that are easy to navigate, even for beginners. They also offer educational resources and tools to help you learn about investing and make informed decisions.

Types of Micro-Investing Platforms

There are several types of micro-investing platforms available, each with its own unique features and benefits. Here are a few of the most popular types:

- Robo-advisors: These platforms use algorithms to create and manage your investment portfolio based on your financial goals and risk tolerance. They typically offer a diversified portfolio of ETFs or mutual funds, making them a good option for beginners. Examples include Betterment, Wealthfront, and Acorns.

- Fractional share platforms: These platforms allow you to invest in fractional shares of stocks, meaning you can buy a portion of a share instead of having to buy the entire share. This makes it possible to invest in expensive stocks even if you don’t have a lot of money. Examples include Robinhood and Stash.

- Micro-investment apps: These apps offer a variety of investing options, including stocks, ETFs, and mutual funds. They often have gamified features that make investing more fun and engaging. Examples include Acorns, Stash, and M1 Finance.

Things to Consider When Choosing a Platform

When choosing a micro-investing platform, it’s important to consider the following factors:

- Fees: Micro-investing platforms typically charge fees, so it’s important to compare the fees of different platforms before choosing one. Some platforms charge a flat monthly fee, while others charge a percentage of your assets under management.

- Investment options: Make sure the platform offers the investment options that you’re looking for. Some platforms specialize in stocks, while others offer a wider range of assets, such as ETFs, mutual funds, and even cryptocurrency.

- User experience: Choose a platform with a user-friendly interface that is easy to navigate. You should also be able to access customer support if you have any questions or concerns.

- Security: Make sure the platform you choose has strong security measures in place to protect your personal information and financial data.

Conclusion:

Micro-investing platforms can be a great way to start investing, even if you don’t have a lot of money. They offer a variety of benefits, including automation, user-friendliness, and affordability. However, it’s important to compare different platforms before choosing one to ensure that you find a platform that meets your needs and goals.

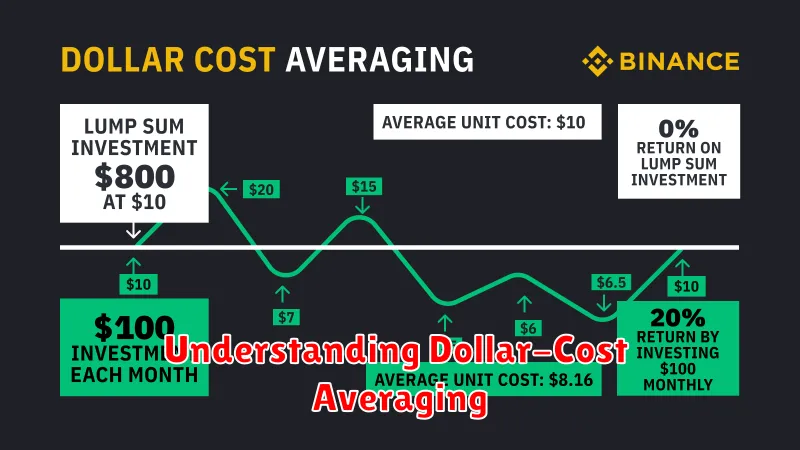

Understanding Dollar-Cost Averaging

Dollar-cost averaging (DCA) is an investment strategy where you invest a fixed amount of money in a particular asset, such as stocks or mutual funds, at regular intervals, regardless of the asset’s price. This strategy aims to reduce the impact of market volatility on your investment returns. By buying more units when prices are low and fewer units when prices are high, you smooth out the average purchase price of your investment over time.

DCA is particularly beneficial for long-term investors who are uncertain about the market’s direction. It helps to mitigate the risk of buying high and selling low, a common mistake among investors.

How Dollar-Cost Averaging Works

Imagine you decide to invest $100 per month in a particular stock. Let’s say the stock price fluctuates over the following months:

- Month 1: $10

- Month 2: $15

- Month 3: $5

- Month 4: $20

Using DCA, you would buy 10 shares in month 1, 6.67 shares in month 2, 20 shares in month 3, and 5 shares in month 4. Your average purchase price would be $11.25 per share, even though the stock price has varied significantly over the period.

Benefits of Dollar-Cost Averaging

Dollar-cost averaging offers several advantages:

- Reduces the impact of market volatility: DCA helps to average out the highs and lows of the market, minimizing the risk of buying at peak prices.

- Disciplined investment strategy: DCA encourages regular investing, promoting a consistent approach to wealth building.

- Reduces emotional decision-making: By automating investments, DCA removes the temptation to time the market, which often leads to poor decisions.

- Suitable for long-term investors: DCA is best suited for investors with a long investment horizon, as it allows time for market fluctuations to average out.

Drawbacks of Dollar-Cost Averaging

While DCA has its benefits, it also has some drawbacks:

- Potential for lower returns: If the market consistently trends upwards, DCA might result in lower returns compared to investing a lump sum at the beginning.

- Opportunity cost: By investing gradually, you might miss out on potential gains during periods of rapid market growth.

Dollar-Cost Averaging vs. Lump-Sum Investing

The choice between DCA and lump-sum investing depends on your individual circumstances and investment goals.

- DCA is ideal for investors who are risk-averse, have limited capital, and prefer a disciplined investment strategy. It’s a good option for long-term goals, such as retirement saving.

- Lump-sum investing is suitable for investors who are comfortable with market volatility and have a substantial amount of capital to invest. It can be advantageous during periods of market growth.

Conclusion

Dollar-cost averaging is a valuable investment strategy, particularly for those who are new to investing or prefer a less volatile approach. It helps to reduce the impact of market fluctuations and promotes disciplined investing. While DCA may not always offer the highest returns, it can provide peace of mind and help you build wealth over the long term.

Fractional Shares: Investing in Fractions of Cryptocurrency

The world of cryptocurrency has opened up a whole new realm of investment opportunities, with Bitcoin and Ethereum leading the way. However, the high prices of these digital assets can be a deterrent for many investors, especially those with limited capital. This is where fractional shares come into play, offering a way to invest in a piece of these crypto giants without having to purchase the entire coin.

Fractional shares allow you to own a portion of a cryptocurrency, even if you can’t afford to buy the whole unit. This is similar to owning a fractional share of a company’s stock. With fractional shares, you can invest in a diversified portfolio of cryptocurrencies without needing to commit a large sum of money.

Here are some key advantages of fractional shares:

- Accessibility: Fractional shares make investing in cryptocurrency more accessible to a wider range of investors, including those with limited capital.

- Affordability: You can invest in cryptocurrencies without having to spend thousands of dollars on a single coin.

- Diversification: Fractional shares enable you to diversify your portfolio by investing in multiple cryptocurrencies without breaking the bank.

- Flexibility: You can easily adjust your investment by buying or selling fractional shares as needed.

However, it’s essential to understand the potential risks associated with fractional shares:

- Volatility: Cryptocurrency prices are highly volatile, and the value of your fractional shares can fluctuate significantly.

- Liquidity: Fractional shares may not be as liquid as whole coins, making it more challenging to sell them quickly.

- Platform Dependence: The availability and features of fractional shares depend on the specific cryptocurrency exchange or platform you use.

Overall, fractional shares provide an exciting opportunity for investors to participate in the cryptocurrency market without significant upfront investment. However, it’s crucial to understand the risks involved and carefully research the platform before investing.

Staking and Yield Farming Opportunities

In the rapidly evolving landscape of decentralized finance (DeFi), staking and yield farming have emerged as prominent strategies for generating passive income and maximizing returns on cryptocurrency holdings. This article delves into the intricacies of these concepts, exploring their underlying mechanisms, potential benefits, and associated risks.

Staking: A Foundation for Passive Income

Staking is a process by which cryptocurrency holders actively participate in the security and validation of a blockchain network. By locking up their coins in a designated wallet or exchange, stakers contribute to the network’s consensus mechanism, often through Proof-of-Stake (PoS) protocols. In return for their contribution, stakers receive rewards in the form of newly minted coins or transaction fees.

Benefits of Staking:

- Passive income: Stakers earn rewards simply by holding their coins, eliminating the need for active trading or investment strategies.

- Network security: Staking incentivizes users to participate in the network’s security, ensuring its stability and reliability.

- Governance rights: In some cases, stakers may receive voting rights on network upgrades or proposals, allowing them to influence the project’s future direction.

Risks Associated with Staking:

- Loss of liquidity: Staked coins are locked for a predetermined period, limiting access to immediate funds.

- Smart contract vulnerabilities: Security breaches in the staking platform can lead to loss of funds.

- Market volatility: The value of staked coins can fluctuate, potentially impacting the rewards earned.

Yield Farming: Amplifying Returns

Yield farming takes the concept of staking a step further, enabling users to earn higher returns by lending their crypto assets to decentralized applications (dApps) or protocols. These platforms typically offer attractive interest rates or rewards in exchange for providing liquidity to their ecosystem.

Yield Farming Strategies:

- Liquidity provision: Users deposit equal amounts of two cryptocurrencies into a liquidity pool, providing trading pairs for other users. In return, they earn fees from trades and a share of the pool’s rewards.

- Flash lending: Borrowers can access large amounts of crypto assets for a short period, paying a small fee for the privilege. This strategy enables sophisticated yield farming opportunities.

- Token farming: Platforms offer incentives for holding or using their native tokens, rewarding users with additional tokens or other benefits.

Risks of Yield Farming:

- Impermanent loss: When the price of one asset in a liquidity pool fluctuates significantly compared to the other, users may experience a loss on their initial investment.

- Rug pulls: Malicious developers can abscond with funds from a liquidity pool, leaving users with nothing.

- High volatility: Yield farming strategies often involve high-risk assets, leading to potentially large swings in value.

Balancing Risk and Reward

Staking and yield farming present compelling opportunities to generate passive income and enhance cryptocurrency portfolios. However, it’s crucial to understand the inherent risks involved. Thorough research, diversification of assets, and a cautious approach are essential to mitigate potential losses. By carefully evaluating project legitimacy, understanding the mechanics of various protocols, and staying informed about market conditions, investors can navigate the DeFi landscape and maximize their returns while minimizing risk.

Managing Risks with Small Investments

Investing can be a daunting task, especially for those just starting out. The prospect of losing money can be frightening, and it’s easy to feel overwhelmed by the complexities of the market. However, it’s crucial to remember that even small investments can contribute to your financial goals. The key is to manage risk effectively, ensuring that you’re comfortable with the potential ups and downs of the market.

One way to manage risk with small investments is to diversify your portfolio. This means spreading your money across different asset classes, such as stocks, bonds, and real estate. By diversifying, you reduce the impact of any single investment going sour. For example, if you invest in a single stock and the company performs poorly, your entire investment could be at risk. However, if you invest in a diversified portfolio of stocks, bonds, and other assets, the impact of any single investment’s decline is mitigated.

Another important aspect of risk management is to invest in assets you understand. It’s tempting to chase after high-yielding investments, but it’s crucial to stick to what you know. If you’re not comfortable with the risks associated with a particular investment, it’s best to avoid it altogether. Remember, your investment strategy should align with your financial goals, risk tolerance, and investment horizon.

Investing in index funds or exchange-traded funds (ETFs) can be a good way to manage risk for small investors. These funds track a specific market index, such as the S&P 500, providing broad market exposure at a lower cost. This approach allows you to diversify your portfolio without having to buy individual stocks, reducing the risk of picking losers.

It’s also essential to set realistic expectations. Understand that the market goes up and down, and there will be times when your investments lose value. Don’t panic sell during market downturns; instead, consider it an opportunity to buy more of the assets you believe in at a lower price. Remember, your investments are a long-term strategy, and short-term fluctuations are a normal part of the process.

Don’t be afraid to seek professional advice from a financial advisor. They can help you develop a personalized investment plan based on your individual needs and risk tolerance. They can also guide you through the complexities of the market and help you make informed investment decisions.

Managing risk is an integral part of successful investing. By diversifying your portfolio, investing in what you understand, and setting realistic expectations, you can navigate the market with confidence, even with small investments. Remember, every dollar invested, regardless of its size, is a step towards achieving your financial goals.

Importance of Research and Education

Research and education are two essential pillars of human progress. They go hand in hand, driving innovation, shaping societies, and empowering individuals. Research fuels the advancement of knowledge, exploring new frontiers and uncovering hidden truths. It provides the foundation for informed decision-making, and helps us understand the world around us better. Education, on the other hand, plays a crucial role in disseminating this knowledge and nurturing the next generation of thinkers, innovators, and leaders.

Research is a systematic and rigorous process of inquiry that aims to discover new knowledge or validate existing theories. It involves collecting, analyzing, and interpreting data to arrive at conclusions. Research can be conducted in various fields, including science, technology, medicine, humanities, and social sciences. It is essential for addressing complex societal challenges, developing new technologies, improving healthcare, and advancing our understanding of the universe.

Education is the process of acquiring knowledge, skills, values, and beliefs. It encompasses formal learning in schools and universities, as well as informal learning through experiences, interactions, and self-study. Education empowers individuals to become critical thinkers, problem solvers, and active citizens. It helps them develop their potential, navigate the complexities of life, and contribute meaningfully to society.

The relationship between research and education is symbiotic. Research provides the raw materials for education, while education equips individuals with the skills and knowledge necessary to conduct research. The two complement and reinforce each other, creating a virtuous cycle of innovation and progress. For example, research in medicine leads to new treatments and cures, which are then incorporated into medical education, enabling healthcare professionals to provide better care.

In today’s rapidly evolving world, the importance of research and education cannot be overstated. They are crucial for staying ahead of the curve, adapting to change, and building a more just and sustainable future. By investing in research and education, we can foster innovation, empower our citizens, and create a better world for all.

Tracking Your Progress and Making Adjustments

Tracking your progress is an essential part of achieving your goals. It allows you to see how far you’ve come, identify areas where you need to improve, and stay motivated. There are many different ways to track your progress, depending on your goals and preferences. Some common methods include:

- Keeping a journal: This is a simple and effective way to track your progress, especially for goals related to personal development, such as learning new skills or improving your habits. Write down your thoughts, feelings, and experiences related to your goals on a regular basis.

- Using a spreadsheet or a tracking app: This is a more structured approach that can be helpful for goals that involve measurable outcomes, such as losing weight or saving money. Use a spreadsheet or a tracking app to record your progress over time.

- Setting milestones and deadlines: Break your goals down into smaller, more manageable steps. Set specific deadlines for each milestone and track your progress towards them.

- Seeking feedback from others: Get feedback from trusted friends, family members, or mentors on your progress. Their insights can be valuable in identifying areas where you can improve.

Once you’ve tracked your progress, it’s important to use that information to make adjustments to your plan. If you’re not making progress as quickly as you’d like, consider:

- Re-evaluating your goals: Are your goals realistic and achievable? Do you need to adjust them based on your progress?

- Changing your strategies: Are you using the most effective strategies to achieve your goals? Are there other approaches you could try?

- Increasing your effort: Are you putting in enough time and effort to make progress? Can you make adjustments to your schedule or routines to dedicate more time to your goals?

- Seeking support: Are you getting the support you need from others? Can you find a mentor or coach to help you stay motivated and on track?

Tracking your progress and making adjustments is an ongoing process. It’s important to be patient and persistent. Remember that setbacks are inevitable, but don’t let them derail your progress. Learn from your mistakes and keep moving forward.