Are you tired of living paycheck to paycheck, dreaming of financial freedom? Do you want to build lasting wealth and achieve your financial goals? It’s time to take control of your finances and cultivate healthy financial habits. <Cultivating Financial Success: Personal Finance Habits for Building Lasting Wealth> will guide you through the essential steps to building a strong financial foundation and achieving your financial dreams.

This article delves into the key personal finance habits that will help you master your finances and secure a prosperous future. Learn about the power of budgeting, the importance of saving and investing, the benefits of paying off debt, and the strategies for maximizing your income. Whether you’re just starting your financial journey or looking to enhance your existing habits, this article provides valuable insights and practical advice to help you reach financial success.

Understanding Your Financial Goals

Financial goals are the targets you set for your financial future. They can be short-term, like saving for a vacation, or long-term, like retiring comfortably. Having clear financial goals is essential for staying motivated and making informed financial decisions.

There are many different types of financial goals, but some common ones include:

- Saving for retirement: This is arguably the most important financial goal for most people. Retirement planning involves saving enough money to maintain your desired lifestyle after you stop working.

- Saving for a down payment on a house: This is a significant financial goal for many people. Saving for a down payment requires discipline and planning.

- Paying off debt: Reducing or eliminating debt, such as credit card debt or student loans, can free up cash flow and improve your credit score.

- Saving for emergencies: It’s crucial to have an emergency fund to cover unexpected expenses like medical bills or job loss.

- Saving for your children’s education: Planning for your children’s education can involve saving for college or other educational expenses.

- Investing for wealth building: Investing can help you grow your money over time and reach your financial goals faster.

Once you have identified your financial goals, you need to create a plan to achieve them. This plan should include:

- Setting specific, measurable, achievable, relevant, and time-bound (SMART) goals: SMART goals are clear, concise, and actionable.

- Creating a budget: A budget helps you track your income and expenses so you can see where your money is going and make adjustments as needed.

- Saving regularly: Regular saving is crucial for reaching your financial goals. Consider automating your savings to make it easier.

- Investing wisely: Investing your savings can help you grow your money over time. Consider investing in a diversified portfolio of assets, such as stocks, bonds, and real estate.

- Reviewing and adjusting your plan: Your financial goals and circumstances may change over time, so it’s important to review your plan regularly and make adjustments as needed.

Understanding your financial goals is the first step toward achieving financial success. By setting clear goals and creating a plan to reach them, you can take control of your financial future.

Building a Realistic Budget That Works

Creating a budget can feel overwhelming, but it’s an essential step towards financial stability and achieving your goals. A realistic budget is not about deprivation, but about mindful spending and prioritizing what truly matters to you. Here’s a guide to help you build a budget that works for your unique needs.

1. Track Your Spending

Before you can budget, you need to understand where your money is going. Track your spending for at least a month, using a spreadsheet, budgeting app, or even a notebook. Be thorough and include everything, from groceries to entertainment.

2. Know Your Income

Calculate your net income (income after taxes and deductions). This is the amount you have available to spend each month. Don’t forget to factor in any regular income from side gigs or investments.

3. Prioritize Essential Expenses

Start with your fixed expenses, such as rent/mortgage, utilities, transportation, and loan payments. These are typically non-negotiable, so ensure you have enough to cover them.

4. Allocate for Variable Expenses

Next, allocate funds for variable expenses, which are more flexible. This includes things like groceries, dining out, entertainment, and clothing. Consider how much you typically spend in these areas and adjust accordingly.

5. Plan for Savings and Debt Repayment

Allocate a portion of your income to savings and debt repayment. Set specific goals for both, such as an emergency fund or paying off high-interest credit cards. Having a clear plan will keep you motivated.

6. Don’t Be Afraid to Adjust

Your budget is a living document. It should be reviewed and adjusted regularly to reflect changes in your income, expenses, or goals. Be flexible and make adjustments as needed.

7. Be Realistic and Kind to Yourself

Budgeting should not be a source of stress. Start with small, achievable goals and gradually work towards bigger ones. Remember, it’s a marathon, not a sprint. Celebrate your progress, even small victories, and don’t be afraid to ask for help if you need it.

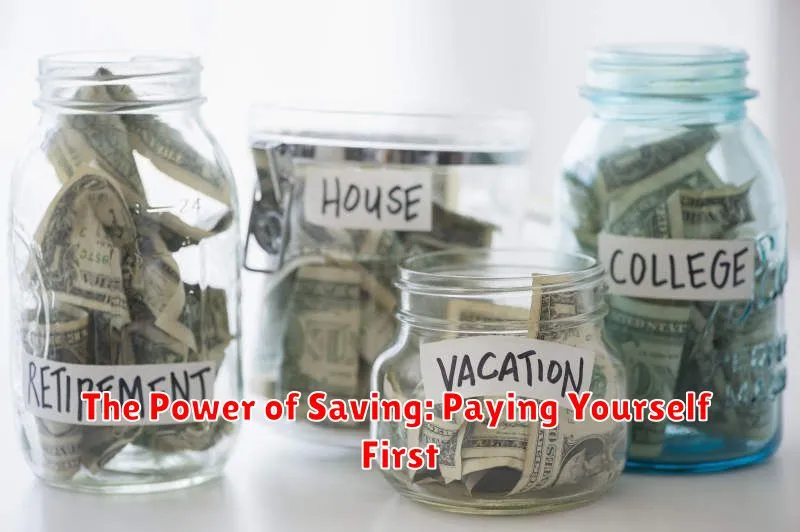

The Power of Saving: Paying Yourself First

In the whirlwind of daily expenses, it’s easy to forget about saving for the future. But prioritizing your financial well-being is crucial for achieving long-term goals, whether it’s buying a home, retiring comfortably, or simply having a financial safety net. The key to building a solid financial foundation is to adopt the “pay yourself first” philosophy. This means setting aside a portion of your income for savings before paying any other bills.

Imagine your paycheck as a pie. Instead of allocating slices to various expenses, you prioritize a slice for yourself first. This could be a set percentage of your income, a specific dollar amount, or even a small contribution to your savings account. The key is to make saving a non-negotiable part of your budget.

The benefits of paying yourself first are manifold:

- Financial Security: Building an emergency fund helps you weather unexpected financial storms like job loss, medical emergencies, or car repairs.

- Reaching Your Goals: Whether it’s buying a home, funding your children’s education, or securing a comfortable retirement, savings are the fuel that propels you towards your aspirations.

- Peace of Mind: Knowing that you have a financial cushion can reduce stress and anxiety, allowing you to focus on other aspects of your life.

- Compounding Interest: The magic of compound interest works wonders for your savings. By saving early and consistently, your money grows exponentially over time.

Getting started with paying yourself first might seem daunting, but it’s simpler than you think. Here are some practical tips:

- Automate your savings: Set up automatic transfers from your checking account to your savings account on a regular basis. This ensures that you don’t forget to save and removes the temptation to spend the money.

- Start small: Don’t be discouraged if you can only save a small amount initially. Every little bit counts, and as your income increases, you can gradually increase your savings contributions.

- Track your progress: Monitor your savings growth and celebrate your achievements. Seeing how your savings accumulate can provide motivation and encourage you to continue on your path.

Paying yourself first is not just about money; it’s about prioritizing your financial future and taking control of your financial well-being. By making saving a habit, you’re investing in a more secure and fulfilling life.

Managing Debt Effectively

Debt is a common financial burden that many individuals and families face. It can stem from various sources, including student loans, mortgages, credit cards, and personal loans. While debt can be a necessary tool for achieving financial goals, it’s crucial to manage it effectively to avoid overwhelming your finances and jeopardizing your financial well-being.

Effective debt management involves a combination of strategies, including:

1. Creating a Budget

The first step towards managing debt effectively is to create a detailed budget. This involves tracking your income and expenses to understand where your money is going. A budget will help you identify areas where you can cut back on spending and free up more cash flow for debt repayment.

2. Prioritizing Debt Repayment

Once you have a budget, it’s important to prioritize your debt repayment. This involves focusing on the debts with the highest interest rates first, as these can accrue interest more quickly and cost you more in the long run. Consider using strategies like the snowball method or the avalanche method to systematically tackle your debts.

3. Negotiating with Creditors

If you’re struggling to make payments on your debts, don’t hesitate to reach out to your creditors. They may be willing to work with you to create a payment plan that fits your budget. You can negotiate for a lower interest rate, a temporary forbearance, or a reduced monthly payment amount.

4. Consolidating Debt

Debt consolidation involves combining multiple debts into a single loan with a lower interest rate. This can help simplify your payments and save you money on interest. However, it’s important to shop around for the best consolidation options and ensure that the new loan terms are favorable.

5. Seeking Professional Help

If you’re overwhelmed by debt and struggling to manage it on your own, don’t be afraid to seek professional help. Credit counseling agencies can provide guidance and support in developing a debt management plan. They can also negotiate with creditors on your behalf and help you explore options like bankruptcy if necessary.

Managing debt effectively requires discipline, planning, and a commitment to improving your financial situation. By following these strategies, you can gain control of your finances and work towards a debt-free future.

Investing Wisely for Long-Term Growth

Investing is an essential part of building wealth and securing your financial future. Whether you’re a seasoned investor or just starting, making wise investment decisions can have a significant impact on your financial well-being.

To achieve long-term growth, it’s crucial to have a well-defined investment strategy that aligns with your financial goals, risk tolerance, and time horizon.

Here are some key principles to consider when investing for the long term:

1. Define Your Financial Goals

Before making any investment decisions, it’s essential to define your financial goals. What are you saving for? Are you aiming for retirement, a down payment on a house, your child’s education, or something else? Having a clear understanding of your goals will help you choose appropriate investments.

2. Determine Your Risk Tolerance

Every investment carries a certain level of risk, and your risk tolerance is how comfortable you are with the potential for losses. If you’re a risk-averse investor, you’ll likely prefer investments with lower risk and potential returns, such as bonds or money market accounts. On the other hand, if you’re willing to take on more risk, you might consider investing in stocks or real estate, which have the potential for higher returns but also carry a greater risk of losses.

3. Diversify Your Portfolio

Diversification is a crucial principle of investing. Don’t put all your eggs in one basket. Instead, spread your investments across different asset classes, such as stocks, bonds, real estate, and commodities. This reduces the overall risk of your portfolio by mitigating the impact of any single investment performing poorly.

4. Invest for the Long Term

The stock market goes up and down in the short term, but over the long term, it has historically delivered positive returns. Avoid trying to time the market or panicking during market downturns. If you’re investing for retirement, for example, you have decades to ride out market fluctuations.

5. Stay Informed and Rebalance Regularly

The investment landscape is constantly changing, so it’s important to stay informed about market trends and economic conditions. Regularly review your portfolio and make adjustments as needed to maintain your desired asset allocation and risk level.

6. Consider Professional Advice

For complex investment decisions, it’s always a good idea to seek advice from a qualified financial advisor. A financial advisor can help you develop a personalized investment plan, manage your portfolio, and answer your questions.

Investing wisely for long-term growth requires patience, discipline, and a well-defined strategy. By following these principles, you can increase your chances of achieving your financial goals and building a secure financial future.

Protecting Your Assets with Insurance

In the unpredictable world we live in, safeguarding your assets is paramount. Whether it’s your home, car, or valuable possessions, unexpected events can happen, leaving you vulnerable to significant financial losses. This is where insurance comes in, acting as a crucial safety net to protect your hard-earned assets and provide peace of mind.

Insurance works by transferring the risk of financial loss from you to an insurance company. You pay a premium, which is a regular payment, in exchange for the insurance company agreeing to cover your losses if a covered event occurs. These events can range from natural disasters like fires and floods to accidents, theft, and even medical emergencies.

Types of Insurance

There are numerous types of insurance available to cater to different needs and assets. Some common types include:

- Home insurance: Protects your home and belongings from damage or loss due to various perils like fire, theft, and natural disasters.

- Auto insurance: Covers damages to your vehicle and liability for injuries or property damage you cause to others in an accident.

- Health insurance: Provides financial protection against the costs of medical expenses, including hospitalization, surgeries, and prescriptions.

- Life insurance: Provides financial security to your loved ones in the event of your death, covering expenses such as funeral costs, mortgage payments, and other financial obligations.

Benefits of Insurance

Insurance offers a plethora of benefits, making it an essential part of a well-rounded financial plan. Some key benefits include:

- Financial protection: Insurance acts as a safety net, shielding you from the financial burden of unexpected events.

- Peace of mind: Knowing that your assets are insured provides peace of mind and reduces stress during difficult times.

- Legal compliance: In some cases, insurance is required by law, such as auto insurance for driving a vehicle.

- Risk management: Insurance helps you manage risks effectively, ensuring you can recover from setbacks and continue pursuing your financial goals.

Choosing the Right Insurance

Selecting the appropriate insurance policy is crucial. Consider the following factors:

- Your assets: Identify the assets you need to protect, such as your home, car, and valuables.

- Your needs: Determine your specific coverage requirements based on your individual circumstances.

- Your budget: Compare insurance premiums from different providers to find a policy that fits your budget.

- Coverage details: Carefully review the policy documents to understand the coverage provided, exclusions, and limitations.

By investing in appropriate insurance, you can protect your assets, safeguard your financial well-being, and enjoy greater peace of mind in the face of life’s uncertainties.

Planning for Retirement Early

Retirement is a significant milestone in everyone’s life, and it’s never too early to start planning for it. Whether you’re just starting your career or are well into your working years, taking proactive steps to secure your financial future can significantly improve your quality of life in your golden years. Early planning offers numerous advantages, including:

Financial Security

One of the primary benefits of early retirement planning is financial security. By starting early, you have ample time to accumulate a substantial nest egg. Compound interest works wonders over time, allowing your investments to grow exponentially. The earlier you begin, the more time your money has to work for you.

Reduced Stress

Knowing that you’re financially prepared for retirement can significantly reduce stress levels. Many people worry about their financial future, especially as they age. However, by planning ahead, you can eliminate these concerns and enjoy your retirement years without financial burdens.

Flexibility and Options

Early retirement planning offers flexibility in terms of your retirement goals. You can explore different retirement options, such as retiring early, working part-time, or pursuing your passions. Having a solid financial foundation gives you the freedom to choose how you want to spend your retirement years.

Time to Adjust

As you approach retirement, you have time to adjust your lifestyle and spending habits. Early planning allows you to identify areas where you can cut back and prioritize your expenses. This can help you live comfortably on your retirement income.

Professional Guidance

Seeking advice from a financial advisor early on can provide valuable insights and guidance. An advisor can help you create a personalized retirement plan based on your financial situation, risk tolerance, and goals. Their expertise can ensure you’re on the right track to a secure retirement.

Strategies for Early Retirement Planning

There are numerous strategies you can implement to plan for retirement early. Here are a few key ones:

Start Saving Early and Often

The earlier you start saving, the more time your money has to grow. Even small contributions can add up significantly over time. Consider maximizing contributions to retirement accounts like 401(k)s or IRAs.

Invest Wisely

Choosing the right investments is crucial for building wealth. Diversify your portfolio across different asset classes, such as stocks, bonds, and real estate, to mitigate risk and maximize returns.

Track Your Expenses

Understanding your spending habits is essential for developing a realistic budget. Identify areas where you can cut back and prioritize saving for retirement.

Consider Your Income Needs

Estimate your future income needs in retirement, considering factors like healthcare costs, housing, and leisure activities. This will help you determine how much you need to save.

Conclusion

Planning for retirement early is a smart decision that can significantly enhance your financial security and overall well-being. By taking proactive steps, you can create a comfortable and fulfilling retirement that you deserve.

Reviewing and Adjusting Your Plan Regularly

A well-crafted plan is essential for achieving your goals, but it’s not a set-in-stone document. The world is constantly changing, and your circumstances and priorities may evolve over time. To ensure your plan remains relevant and effective, it’s crucial to review and adjust it regularly. This proactive approach allows you to stay on track, make necessary course corrections, and maximize your chances of success.

Here are some key aspects to consider when reviewing and adjusting your plan:

1. Assess Your Progress

Start by evaluating your progress against your goals. Are you on track, or have you fallen behind? Analyzing your accomplishments and identifying areas where you’ve made strides can boost your motivation and reinforce your commitment to the plan. On the other hand, recognizing areas where you’ve lagged can highlight opportunities for improvement.

2. Re-evaluate Your Goals

Your goals may have changed since you first created your plan. Perhaps your priorities have shifted, or new opportunities have arisen. Take this opportunity to reassess your goals, ensuring they still align with your current aspirations and values. If your goals have evolved, modify your plan to reflect these changes.

3. Identify Obstacles and Challenges

Every journey has its obstacles. Review your plan and identify any unforeseen challenges you’ve encountered. Consider whether these obstacles are temporary or long-term and assess your ability to overcome them. You may need to adjust your strategies or seek additional resources to navigate these hurdles.

4. Explore New Opportunities

The world is full of possibilities. As you review your plan, consider whether any new opportunities have emerged that could enhance your progress toward your goals. Be open to exploring new avenues and adjusting your plan to leverage these opportunities.

5. Seek Feedback from Others

Don’t be afraid to seek feedback from trusted friends, mentors, or colleagues. They can provide valuable insights and perspectives that may help you identify areas for improvement or uncover blind spots in your plan. Their objective opinions can help you refine your approach and optimize your strategy.

6. Don’t Be Afraid to Experiment

Your plan is a living document, and it’s okay to experiment and make changes along the way. Be willing to try new approaches, adjust your strategies, and embrace a mindset of continuous learning. This adaptability will allow you to remain agile and respond effectively to evolving circumstances.

7. Track Your Changes

As you make adjustments to your plan, it’s essential to document these changes. This tracking will provide a valuable historical record of your progress, allowing you to analyze the effectiveness of your modifications and identify patterns in your decision-making. This data can be invaluable for future planning and optimization.

Regularly reviewing and adjusting your plan is an ongoing process. It’s not a one-time event, but rather an iterative cycle that allows you to stay on track, adapt to change, and ultimately achieve your goals. By embracing this approach, you can unlock your full potential and create a roadmap for success.

Seeking Professional Financial Advice

In today’s complex financial world, seeking professional financial advice can be invaluable. Whether you’re navigating retirement planning, investing, or simply looking to improve your financial well-being, a financial advisor can provide expert guidance and support. But with so many advisors out there, how do you find the right one for you?

Understanding Your Needs

Before embarking on your search, it’s essential to understand your individual financial situation and goals. What are your financial priorities? Are you saving for a down payment on a home, planning for your child’s education, or preparing for retirement? Once you have a clear picture of your needs, you can begin to identify the type of advisor who can best assist you.

Types of Financial Advisors

There are various types of financial advisors, each with their own specialties and qualifications. Here are a few common types:

- Certified Financial Planner (CFP®): CFPs are required to meet rigorous education and experience requirements, as well as pass a comprehensive exam. They specialize in providing comprehensive financial planning advice, encompassing investment management, insurance, retirement planning, and more.

- Registered Investment Advisor (RIA): RIAs are fiduciaries, meaning they are legally obligated to act in their clients’ best interests. They offer a wide range of investment services, including portfolio management and asset allocation.

- Broker-Dealer: Broker-dealers are licensed to buy and sell securities on behalf of their clients. They may offer investment advice, but their primary focus is on facilitating transactions.

Finding the Right Advisor

Once you’ve determined the type of advisor you need, here are some tips for finding the right one:

- Network with your connections: Ask friends, family, and colleagues for recommendations. They may have firsthand experience with advisors they trust.

- Use online resources: Websites such as the Certified Financial Planner Board of Standards (CFP Board) and the Financial Industry Regulatory Authority (FINRA) provide directories of advisors.

- Check credentials: Verify that the advisor you’re considering has the necessary licenses and certifications.

- Schedule a consultation: Most advisors offer a free initial consultation to discuss your needs and determine if they are a good fit for you.

- Ask the right questions: Inquire about the advisor’s experience, fees, investment philosophy, and how they communicate with clients.

Building a Lasting Relationship

Finding the right financial advisor is only the first step. Building a strong, lasting relationship requires open communication, trust, and a commitment to working together towards your financial goals. Regular check-ins and honest discussions about your progress are essential for keeping your plan on track.