Are you feeling overwhelmed by your finances? Do you find yourself constantly struggling to make ends meet? You’re not alone! Many people find personal finance to be a daunting topic. But it doesn’t have to be. With the right strategies and a little effort, you can take control of your money and achieve your financial goals. This step-by-step guide will provide you with the essential knowledge and tools you need to manage your finances effectively, regardless of your experience level.

Whether you’re just starting out on your financial journey or looking to improve your existing habits, this article will guide you through key concepts like budgeting, saving, and investing. We’ll break down these often intimidating topics into manageable steps, making personal finance accessible and understandable. By the end of this guide, you’ll have a solid foundation to make informed financial decisions, build a secure future, and finally gain peace of mind when it comes to your money.

Understanding Your Financial Situation

Having a clear understanding of your financial situation is crucial for making informed decisions about your money. It allows you to track your income and expenses, identify areas where you can save, and set realistic financial goals. Here’s a step-by-step guide to help you gain a comprehensive view of your finances:

1. Track Your Income

Start by documenting all your sources of income, including your salary, wages, investments, and any other regular payments you receive. Be sure to factor in any deductions or taxes that are taken out of your income.

2. Monitor Your Expenses

Keep track of every dollar you spend. This can be done through budgeting apps, spreadsheets, or simply by keeping receipts and manually recording your expenses. Categorize your spending into different areas such as housing, food, transportation, and entertainment.

3. Analyze Your Spending Habits

Once you have a comprehensive record of your income and expenses, analyze your spending patterns. Identify any areas where you are spending more than you need to. Are you eating out too often? Do you have unnecessary subscriptions? This analysis will help you identify potential areas for savings.

4. Evaluate Your Assets and Liabilities

Your assets are items of value that you own, such as your home, car, savings, and investments. Your liabilities are debts you owe, such as loans, credit card balances, and mortgages. Knowing your assets and liabilities will help you understand your net worth and your overall financial health.

5. Create a Budget

A budget is a financial plan that outlines how you will spend your money. It helps you track your income and expenses, allocate money to your priorities, and achieve your financial goals. There are various budgeting methods available, so choose one that suits your needs and preferences.

6. Set Financial Goals

Once you have a good understanding of your financial situation, it’s time to set some goals. These could include saving for a down payment on a house, paying off debt, investing for retirement, or simply building an emergency fund. Having goals will motivate you and provide direction for your financial journey.

7. Review Your Finances Regularly

It’s essential to review your finances regularly, at least once a month or quarterly. This will help you stay on track with your budget, adjust as needed, and ensure that you are making progress towards your financial goals.

Understanding your financial situation is an ongoing process. As your income, expenses, and priorities change over time, you’ll need to adjust your approach. By consistently tracking your finances, analyzing your spending, and setting realistic goals, you can take control of your money and work towards a brighter financial future.

Creating a Realistic Budget That Works for You

Are you tired of feeling like you’re constantly struggling to make ends meet? Do you dream of having more financial freedom but don’t know where to start? Creating a realistic budget can be the key to achieving your financial goals. It may sound daunting, but it doesn’t have to be a stressful experience. This guide will walk you through the steps of creating a budget that works for you, helping you take control of your finances and gain peace of mind.

The first step is to track your spending. This can be done using a spreadsheet, a budgeting app, or even just a notebook. For a month, meticulously record every dollar you spend. Don’t forget to include everything, from groceries and rent to entertainment and coffee. This step is crucial because it gives you a clear picture of where your money is going.

Once you have a good understanding of your spending habits, you can start to categorize your expenses. This will help you see where you can cut back and where you’re spending the most. Common categories include housing, transportation, food, utilities, entertainment, and personal care.

Now it’s time to create your budget. This involves allocating your income to different categories based on your priorities and needs. Start with your essential expenses, such as housing, utilities, and groceries. Then, allocate funds for your debt payments, savings goals, and discretionary spending.

Remember, a realistic budget is one that you can stick to. Don’t be afraid to adjust your budget as needed. Life is unpredictable, and your financial situation may change over time. You may need to make adjustments to your spending habits or income to keep your budget on track.

Creating a budget is a journey, not a destination. It takes time and effort to establish healthy financial habits. Don’t get discouraged if you don’t see results overnight. With persistence and a positive mindset, you can achieve your financial goals and gain control over your finances.

Building an Emergency Fund: A Safety Net for Unexpected Expenses

Life is full of surprises, and not all of them are pleasant. Unexpected expenses can pop up at the most inconvenient times, throwing your finances off balance. Car repairs, medical bills, job loss – these are just a few examples of events that can drain your savings and leave you scrambling. This is where an emergency fund comes in.

An emergency fund is a safety net that provides financial cushion during unexpected events. It’s a dedicated pool of money that you can access quickly to cover expenses without resorting to high-interest debt. Building an emergency fund is a crucial step towards financial stability and peace of mind.

Why is an Emergency Fund So Important?

Having an emergency fund offers numerous benefits:

- Reduces stress and anxiety: Knowing you have a financial cushion for unexpected events can significantly reduce stress and anxiety about money.

- Protects your savings: An emergency fund prevents you from dipping into your long-term savings for unexpected expenses, allowing your investments to grow.

- Avoids high-interest debt: By having an emergency fund, you can avoid taking out high-interest loans or credit cards to cover unexpected expenses.

- Provides financial flexibility: An emergency fund gives you the flexibility to seize opportunities or make unplanned purchases without worrying about financial strain.

How Much Should You Save?

The recommended amount for an emergency fund is 3-6 months’ worth of essential living expenses. This includes rent/mortgage, utilities, groceries, transportation, and any other recurring bills.

It’s essential to assess your individual circumstances and determine the appropriate amount for your emergency fund. If you have a stable income and few dependents, 3 months’ worth of expenses may suffice. However, if you have a volatile income or are a single parent, you may want to aim for 6 months or even more.

Tips for Building an Emergency Fund

Building an emergency fund can seem daunting, but it’s achievable with consistent effort and a well-planned approach. Here are some tips to get you started:

- Set a realistic goal: Start with a small amount, such as $500 or $1,000, and gradually increase it over time. Don’t try to save everything at once, as it can be overwhelming and unsustainable.

- Automate your savings: Set up automatic transfers from your checking account to your savings account on a regular basis. This ensures that you save consistently without having to manually transfer funds.

- Cut unnecessary expenses: Identify areas where you can cut back on spending, such as subscriptions, dining out, or entertainment. Even small savings can add up over time.

- Take advantage of windfalls: When you receive a bonus, tax refund, or unexpected gift, allocate a portion of it to your emergency fund.

- Track your progress: Monitor your savings progress regularly to stay motivated and ensure you’re on track to meet your goals.

Building an emergency fund is an essential step towards financial security. It provides a safety net during unexpected life events, protecting your savings and preventing you from falling into debt. By following these tips and making consistent efforts, you can establish a strong emergency fund that gives you peace of mind and financial stability.

Managing Debt Effectively: Tips and Strategies

Debt is a prevalent issue in today’s society, and effectively managing it is crucial for financial well-being. Whether it’s credit card debt, student loans, or personal loans, carrying a significant amount of debt can be stressful and limit your financial freedom. This article will explore effective tips and strategies to help you manage your debt responsibly and achieve financial stability.

1. Understand Your Debt Situation

The first step towards managing debt is to understand your current situation. Make a list of all your outstanding debts, including the principal amount, interest rate, minimum payment, and due date. This will give you a clear picture of how much debt you have and the associated costs. You can use a spreadsheet, budgeting app, or debt tracker to organize this information.

2. Create a Budget

A budget is essential for managing debt. It helps you track your income and expenses, identify areas where you can cut back, and allocate funds towards debt repayment. Start by listing all your income sources and expenses. Then, categorize your expenses and prioritize those related to your debt. By sticking to your budget, you can free up more money to pay down your debt faster.

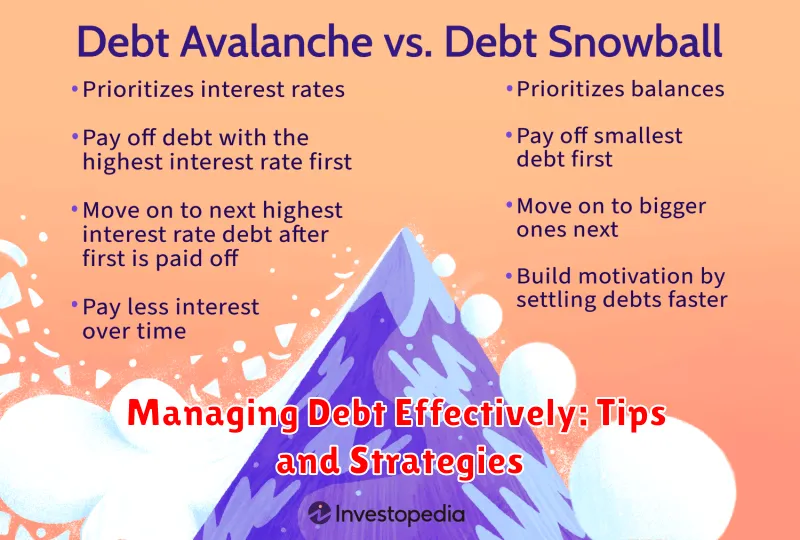

3. Prioritize Debt Repayment

Once you understand your debt situation and have a budget in place, it’s time to prioritize debt repayment. There are several methods to consider, such as the snowball method or the avalanche method. The snowball method focuses on paying off the smallest debt first, while the avalanche method targets the debt with the highest interest rate first. Choose the method that best suits your financial goals and personality.

4. Consider Debt Consolidation

Debt consolidation involves combining multiple debts into a single loan with a lower interest rate. This can be a helpful strategy if you have high-interest debt, but it’s important to carefully consider the terms of the consolidation loan. Make sure the new interest rate is lower than your existing debt rates, and that the loan term doesn’t extend your repayment period significantly.

5. Negotiate with Creditors

If you’re struggling to make your debt payments, don’t hesitate to contact your creditors. They may be willing to work with you by reducing your interest rate, extending your repayment term, or offering a temporary forbearance. Be upfront about your financial situation and explain your need for assistance. Many creditors are willing to negotiate to avoid losing a customer.

6. Avoid Taking on New Debt

While you’re working on paying off your existing debt, it’s crucial to avoid taking on new debt. Resist the temptation to use credit cards for everyday purchases or borrow money for unnecessary items. Focus on living within your means and saving money for future goals.

7. Seek Professional Help

If you’re overwhelmed by debt and struggling to manage it on your own, consider seeking professional help. A financial advisor or credit counselor can provide guidance and support. They can help you create a realistic debt repayment plan, negotiate with creditors, and develop strategies for long-term financial stability.

Saving for the Future: Retirement, Education, and More

Saving money is a crucial part of achieving financial security and achieving your goals. Whether it’s preparing for retirement, funding your children’s education, or simply building an emergency fund, having a solid savings plan can bring peace of mind and ensure you have the resources you need when you need them.

One of the most common reasons people save is for retirement. Retirement planning is essential, as it ensures you have enough income to maintain your standard of living after you stop working. The earlier you start saving, the more time your money has to grow through compounding.

Another important reason to save is for education. Tuition costs are on the rise, and saving for your children’s education can help reduce the burden of student loans. There are several educational savings plans available, such as 529 plans, which offer tax benefits.

Having an emergency fund is vital. Life is unpredictable, and unexpected expenses can arise. An emergency fund can help you cover costs associated with job loss, medical emergencies, or car repairs.

Saving for major purchases, such as a house or a car, is also important. By saving up for these purchases, you can avoid taking on significant debt.

To make saving easier, consider automating your savings. Set up regular transfers from your checking account to your savings account. This will ensure that you are saving consistently without having to think about it. You can also take advantage of employer-sponsored retirement plans, such as 401(k)s, which often include employer matching contributions, increasing your savings power.

Saving is a journey, not a destination. Don’t be discouraged if you can’t save as much as you would like to start. Start small and gradually increase your savings as your income grows.

The Basics of Investing: Getting Started

Investing can seem daunting, especially for beginners. The world of stocks, bonds, and mutual funds might feel like a foreign language. However, investing is essential for achieving financial goals, from buying a home to securing a comfortable retirement. This guide will break down the basics of investing, making it accessible to everyone.

Why Invest?

Investing is the process of putting money into assets with the expectation of generating a return. It’s not just about making money; it’s about growing your wealth over time. Here are some key reasons to invest:

- Beat Inflation: Inflation erodes the purchasing power of your money. Investing helps your money grow faster than inflation, preserving its value.

- Achieve Financial Goals: Whether it’s buying a house, funding your child’s education, or retiring comfortably, investing provides the potential to reach your financial goals.

- Build Long-Term Wealth: Consistent investing over the long term can help you build a substantial nest egg for the future.

Understanding Risk and Return

Investing always involves some level of risk. The higher the potential return, the higher the risk. Understanding the relationship between risk and return is crucial:

- High-Risk Investments: Investments like stocks can offer the potential for high returns but also come with the possibility of significant losses.

- Low-Risk Investments: Investments like bonds or savings accounts generally offer lower returns but are considered less risky.

The key is to find an investment strategy that aligns with your risk tolerance and financial goals.

Types of Investments

The investment world offers a wide variety of options. Here are some common types:

- Stocks: Represent ownership in a company. Stocks can appreciate in value and pay dividends.

- Bonds: Loans you make to a company or government. Bonds pay regular interest payments and return the principal at maturity.

- Mutual Funds: Pooled investments that allow you to diversify across a range of stocks or bonds.

- Exchange-Traded Funds (ETFs): Similar to mutual funds, but traded on stock exchanges like individual stocks. ETFs offer diversification and can be a good option for long-term investing.

- Real Estate: Investing in physical property can offer potential for appreciation and rental income.

Getting Started

Ready to start investing? Here are some steps to take:

- Determine Your Financial Goals: Define what you want to achieve with your investments (e.g., retirement savings, down payment on a house).

- Assess Your Risk Tolerance: How much risk are you comfortable taking? This will help you choose the right investments.

- Open an Investment Account: Choose an online brokerage or traditional financial advisor.

- Start Small: You don’t need a lot of money to start investing. Begin with a small amount and gradually increase your contributions over time.

- Diversify: Don’t put all your eggs in one basket. Spread your investments across different asset classes (stocks, bonds, real estate).

- Be Patient: Investing is a long-term game. Don’t expect to get rich quickly. Be patient and consistent with your investments.

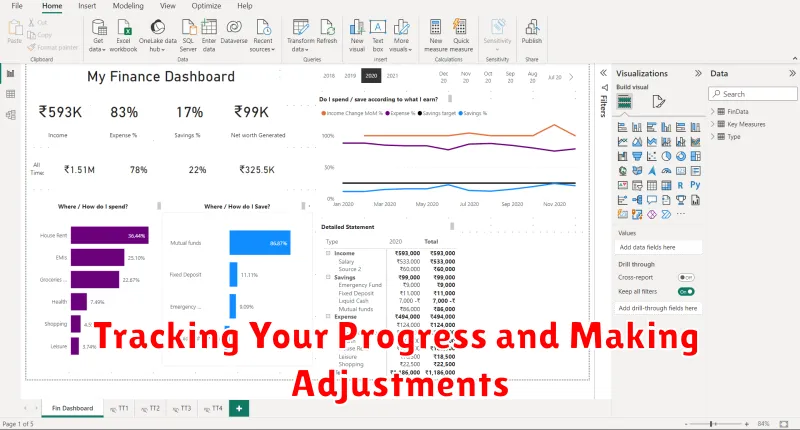

Tracking Your Progress and Making Adjustments

It’s crucial to keep track of your progress as you work toward your objectives. This enables you to see how far you’ve come, identify areas where you need to improve, and stay motivated. There are many different ways to track your progress, so find a method that works best for you.

A journal is a fantastic tool for keeping track of your development. You may write down your accomplishments, difficulties, and lessons learned in a journal. You can use this information to spot patterns, identify areas for development, and celebrate your successes.

Another technique is to utilize a spreadsheet or a project management tool. You can use these tools to monitor your progress toward specific goals and deadlines. You can monitor your progress toward your objectives using the visual representation these tools provide, and you can make necessary modifications along the way.

Regularly reviewing your progress is essential to ensure you’re on track. Schedule time to reflect on your progress and make necessary adjustments. This could be a weekly, bi-weekly, or monthly review depending on your goals and timeline.

When reviewing your progress, consider the following:

- What have you accomplished? Celebrate your successes, no matter how small.

- What challenges have you faced? Analyze why you encountered these challenges and what you can do differently next time.

- What adjustments need to be made? Based on your progress and challenges, determine if you need to adjust your goals, strategies, or timeline.

Adjusting your plan as needed is an important part of the process. Don’t be afraid to change course if something isn’t working. Flexibility and adaptability are key to achieving your goals.