Are you tired of feeling stuck in a cycle of financial stress? Do you dream of having the freedom to pursue your passions, travel the world, or simply enjoy a comfortable retirement? If so, you’re not alone. Many people struggle to manage their finances effectively, leaving them feeling overwhelmed and unsure of how to achieve financial stability. But it doesn’t have to be this way. By adopting proven personal finance tips and strategies, you can unlock financial freedom and build a secure financial future for yourself and your loved ones.

This article will equip you with actionable advice on how to save more money, manage your expenses wisely, and invest for the future. From budgeting basics to smart saving techniques and strategic investment strategies, we will cover all the essential aspects of achieving financial independence. Get ready to take control of your finances and embrace the rewarding journey towards financial freedom!

Assessing Your Current Financial Situation

Before you can start planning for your financial future, you need to understand where you stand today. This means taking a comprehensive look at your current financial situation. This includes your income, expenses, assets, and debts.

To get a clear picture of your finances, you can use a budgeting tool, a spreadsheet, or even just a pen and paper. The key is to be honest and thorough. Don’t be afraid to include every penny you spend, even if it seems small.

Income

Your income is the money you earn from your job, investments, or other sources. Be sure to include any regular payments you receive, such as child support or alimony.

Expenses

Your expenses are the money you spend on things like housing, food, transportation, utilities, and entertainment. You can categorize your expenses into fixed expenses, which stay the same each month, and variable expenses, which can fluctuate.

Assets

Your assets are anything you own that has value. This includes things like your house, car, investments, and savings account. It’s important to assess the current market value of your assets.

Debts

Your debts are any money you owe to others, such as loans, credit card balances, and student loans. It’s important to track the interest rate and minimum payment for each debt.

Net Worth

Once you’ve gathered all this information, you can calculate your net worth, which is the difference between your assets and liabilities. A positive net worth means you have more assets than debts, while a negative net worth means you have more debts than assets.

Assessing your current financial situation can be daunting, but it’s an essential first step in achieving your financial goals. By understanding where you stand today, you can start making informed decisions about your money and work towards a brighter financial future.

Setting Realistic Savings Goals

Saving money can be a daunting task, especially if you’re starting from scratch. But it doesn’t have to be overwhelming. The key is to set realistic savings goals that you can actually achieve.

Here are some tips for setting realistic savings goals:

- Start small. Don’t try to save a huge amount of money right away. Begin with a small goal that you can comfortably reach. For example, you could aim to save $50 per week or $200 per month.

- Consider your income and expenses. It’s important to be realistic about how much money you can afford to save each month. Create a budget that tracks your income and expenses so you can identify areas where you can cut back.

- Set a timeline. Having a timeline in mind can help you stay motivated. For example, you might set a goal to save $1,000 in six months.

- Make it automatic. Set up automatic transfers from your checking account to your savings account. This way, you’ll be saving money without even thinking about it.

- Reward yourself. When you reach a savings goal, celebrate your accomplishment! This will help you stay motivated to continue saving.

Remember, saving money is a journey, not a destination. Be patient with yourself and don’t get discouraged if you don’t reach your goals immediately. The important thing is to start saving and to make it a habit.

Creating a Practical Budget You Can Stick To

Managing your finances can feel overwhelming, but it doesn’t have to be. Creating a practical budget that you can stick to is essential for financial stability and achieving your financial goals. Here’s a step-by-step guide to help you build a budget that works for you:

1. Track Your Spending

The first step to creating a budget is understanding where your money is going. For a month, meticulously track every dollar you spend. You can use a budgeting app, a spreadsheet, or even a simple notebook. Be sure to categorize your expenses, such as housing, food, transportation, entertainment, and so on. This will give you a clear picture of your spending habits and help you identify areas where you can cut back.

2. Determine Your Income

Next, determine your total monthly income. This includes your salary, any side income, and regular payments like child support or alimony. It’s crucial to be accurate and include all sources of income. This will form the basis of your budgeting plan.

3. Set Financial Goals

Before you start allocating your income, it’s essential to define your financial goals. Do you want to save for a down payment on a house, pay off debt, or invest for retirement? Having clear goals will motivate you and help you prioritize your spending.

4. Create a Spending Plan

Now it’s time to create a spending plan based on your income and expenses. Allocate your income to different categories, such as:

- Needs: Essentials like housing, food, utilities, transportation, and healthcare.

- Wants: Non-essential items like entertainment, dining out, and shopping.

- Savings: Allocate a specific amount for your financial goals, such as retirement, emergency fund, or a down payment.

- Debt Repayment: Set aside money for paying off loans and credit card balances.

Ensure your spending plan doesn’t exceed your income. You can use the 50/30/20 rule as a starting point: 50% for needs, 30% for wants, and 20% for savings and debt repayment.

5. Review and Adjust Regularly

Don’t consider your budget set in stone. Review it monthly and make adjustments as needed. Your income or expenses may fluctuate, and your financial goals may evolve. Regularly reviewing your budget ensures it remains relevant and effective.

6. Be Realistic and Flexible

Creating a budget is a personal journey, and what works for one person may not work for another. Don’t be afraid to experiment and find what works best for you. Remember, it’s about creating a sustainable plan that fits your lifestyle and financial priorities.

7. Utilize Budgeting Tools

Numerous budgeting tools are available, from simple spreadsheets to sophisticated apps. These tools can help you track your expenses, set budgets, and visualize your financial progress. Explore different options and choose one that suits your preferences and tech skills.

8. Seek Professional Advice

If you’re struggling to create a budget or manage your finances, don’t hesitate to seek professional advice. A financial advisor can provide personalized guidance and support to help you achieve your financial goals.

Creating a practical budget is crucial for financial well-being. It empowers you to take control of your money, achieve your financial goals, and build a secure future. By following these steps, you can create a budget that fits your lifestyle and helps you make informed financial decisions.

Identifying and Eliminating Unnecessary Expenses

In today’s economy, it’s more important than ever to be mindful of your finances. While some expenses are unavoidable, others can be cut back or eliminated entirely. By identifying and eliminating unnecessary expenses, you can free up more money to save, invest, or spend on things that truly matter.

1. Track Your Spending

The first step to eliminating unnecessary expenses is to understand where your money is going. For a month or two, track every dollar you spend. This can be done manually using a notebook or spreadsheet, or using a budgeting app. Once you have a clear picture of your spending habits, you can start identifying areas where you can cut back.

2. Review Subscriptions and Memberships

We often sign up for subscriptions and memberships without realizing how much they cost. Take a look at your bank statements and credit card bills and identify any recurring charges you can eliminate. Are you paying for streaming services you don’t use? Do you have gym memberships you’re not taking advantage of? Canceling these unnecessary subscriptions can save you hundreds of dollars per year.

3. Analyze Your Bills

Take some time to review your utility bills, phone bills, and insurance premiums. Are you paying for services you don’t need? Could you save money by switching to a different provider or plan? Even small savings can add up over time.

4. Shop Around for Better Deals

Once you’ve identified areas where you can cut back, start shopping around for better deals. You might be surprised how much you can save by comparing prices and negotiating with vendors. This applies to everything from groceries and gas to insurance and car payments.

5. Embrace the “No Spend” Challenge

Take a break from spending for a day, week, or even a month. This can help you realize how much money you spend on non-essentials and make it easier to identify areas where you can cut back. There are several “no-spend” challenges online that you can join to find support and accountability.

6. Cook More Meals at Home

Eating out can be expensive. Cooking more meals at home can help you save money and eat healthier. This doesn’t mean you can’t enjoy the occasional restaurant meal. But by reducing the frequency, you can significantly reduce your food expenses.

7. Be Mindful of Impulse Purchases

We all make impulse purchases from time to time. But these small purchases can add up quickly. Before you buy something, ask yourself: Do I really need this? Can I wait? Is there a cheaper alternative? By being more mindful of your spending habits, you can avoid many unnecessary purchases.

8. Set Financial Goals

Having clear financial goals can help you stay motivated and on track with your spending. Whether you’re saving for a down payment on a house, retirement, or a vacation, having a goal in mind can make it easier to say no to unnecessary expenses.

9. Automate Your Savings

Setting up automatic transfers from your checking account to your savings account can help you save money without even thinking about it. You can set up these transfers to happen weekly, bi-weekly, or monthly, depending on your income and savings goals.

10. Reward Yourself

It’s important to reward yourself for your efforts, but make sure these rewards are within your budget. Instead of splurging on a fancy dinner, treat yourself to a movie night at home or a day trip to a local park. By being mindful of your spending and eliminating unnecessary expenses, you can take control of your finances and achieve your financial goals.

Negotiating Bills and Finding Better Deals

In today’s economy, it’s more important than ever to be mindful of your spending and find ways to save money. One area where many people overspend is on their monthly bills. However, with a little effort, you can often negotiate better deals and save a significant amount of money each year. Here are some tips on how to negotiate your bills and find better deals:

1. Be Prepared to Switch Providers

One of the most effective ways to negotiate a better deal is to be willing to switch providers. When you tell your current provider that you’re considering switching, they’re more likely to offer you a discount to keep your business. Research other providers in your area and get quotes for similar services. This will give you leverage when negotiating with your current provider.

2. Know Your Current Rates

Before you start negotiating, it’s important to know exactly what you’re currently paying. Gather all of your bills and make a list of your monthly expenses. This will help you identify areas where you can potentially save money.

3. Be Polite and Persistent

When you contact your provider to negotiate a better deal, be polite and respectful. Explain that you’re a loyal customer and that you’re looking for a better rate. If they initially refuse, don’t give up. Be persistent and explain why you’re considering switching providers.

4. Consider Bundling Services

Many providers offer discounts for bundling services. If you’re currently using multiple providers for different services, such as internet, phone, and cable, consider bundling them together. This can often save you money on your monthly bills.

5. Use Online Tools and Comparison Websites

There are several online tools and comparison websites that can help you find better deals on your bills. These websites allow you to compare prices from different providers and often have special offers and promotions.

6. Don’t Be Afraid to Ask for More

Once you’ve negotiated a better deal, don’t be afraid to ask for more. For example, if you’re able to negotiate a lower monthly rate, you might also ask for a free upgrade or additional features. The worst they can say is no.

7. Regularly Review Your Bills

It’s a good idea to review your bills regularly to make sure you’re still getting the best deals. If you notice any changes in your rates, contact your provider to see if they can offer you a better deal.

By following these tips, you can negotiate your bills and find better deals that can save you a significant amount of money each year. Remember to be prepared, polite, and persistent, and don’t be afraid to switch providers if you’re not satisfied with your current rates. With a little effort, you can take control of your finances and make sure you’re getting the best value for your money.

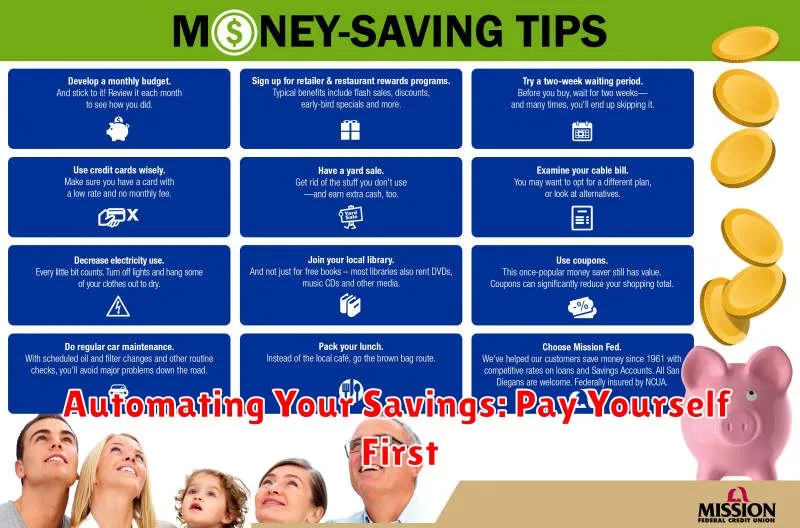

Automating Your Savings: Pay Yourself First

Saving money can be a challenging endeavor, especially when life throws unexpected expenses your way. However, adopting a “pay yourself first” approach can significantly simplify the process and ensure your financial goals are met.

The concept of paying yourself first revolves around setting aside a predetermined amount of money for savings before any other expenses are paid. It’s like treating your future self as a priority bill payer. Here’s why this strategy is so effective:

1. Makes Saving Automatic and Effortless

Instead of relying on willpower and remembering to manually transfer funds, automating your savings ensures a consistent and effortless approach. With automatic transfers, you’ll never have to worry about forgetting or procrastinating.

2. Prevents Overspending

By paying yourself first, you’re essentially limiting the amount of money available for discretionary spending. This helps prevent impulsive purchases and ensures that your financial goals remain on track.

3. Builds a Strong Financial Foundation

Consistent savings, even if they’re small amounts, add up over time. By prioritizing your savings, you’re laying the groundwork for a secure financial future, allowing you to achieve goals like purchasing a home, investing in your education, or retiring comfortably.

How to Implement “Pay Yourself First”

Setting up automatic transfers is a simple yet powerful way to put this strategy into action. Most banks and financial institutions offer this feature, allowing you to schedule regular transfers from your checking account to your savings account.

Here are some tips for implementing “pay yourself first”:

- Determine your savings goals: What are you saving for? A down payment on a house, retirement, or a vacation? Defining your goals will help you determine the amount you need to save each month.

- Set a fixed percentage: Start by saving a small percentage of your income, such as 5% or 10%. As your income increases, you can gradually increase the percentage.

- Automate the transfers: Set up automatic transfers from your checking account to your savings account on a regular basis, such as weekly or bi-weekly.

In conclusion, “pay yourself first” is a simple yet powerful strategy for building a strong financial foundation. By prioritizing your savings, you’ll be well on your way to achieving your financial goals and securing your future.

Exploring Side Hustles for Extra Income

In today’s economic climate, many people are looking for ways to supplement their income. A side hustle can be a great way to earn extra money, gain new skills, and even pursue a passion. But with so many options available, it can be overwhelming to know where to start.

Here are some popular side hustle ideas to consider:

Freelancing

Freelancing is a popular option for those who have skills in writing, editing, graphic design, web development, or other areas. There are many online platforms, such as Upwork and Fiverr, where you can find freelance gigs.

Online Teaching

If you have expertise in a particular subject, you can teach online courses or provide tutoring services. Platforms like Udemy and Coursera offer opportunities to create and sell your own courses.

E-commerce

Starting an online store can be a great way to earn passive income. You can sell physical products, digital products, or services through platforms like Etsy, Amazon, or Shopify.

Blogging/Vlogging

If you enjoy writing or creating videos, you can start a blog or vlog and monetize it through advertising, affiliate marketing, or selling products or services.

Virtual Assistant

Virtual assistants provide administrative, technical, or creative support to clients remotely. This can involve tasks such as scheduling appointments, managing social media, or creating presentations.

Ridesharing/Delivery

If you have a car, you can earn extra money by driving for ridesharing companies like Uber or Lyft or delivering food with services like DoorDash or Grubhub.

Pet Sitting/Dog Walking

If you love animals, you can offer pet sitting or dog walking services in your local area.

Social Media Management

Businesses are increasingly relying on social media to connect with customers. You can offer social media management services to help businesses create and manage their online presence.

These are just a few ideas to get you started. The best side hustle for you will depend on your skills, interests, and available time. Before you commit to a particular side hustle, it’s important to research the market, set realistic expectations, and create a plan for success.

Investing Wisely to Grow Your Savings

In today’s economy, it’s more important than ever to invest your money wisely. With interest rates at historic lows and inflation on the rise, it can be challenging to make your savings grow. But don’t despair! There are many ways to invest your money and build a strong financial future. Whether you’re a seasoned investor or just starting, this article will provide you with valuable insights and practical tips to help you make informed investment decisions.

One of the most important things to consider when investing is your risk tolerance. How much risk are you comfortable taking? This will determine the types of investments that are appropriate for you. If you’re risk-averse, you might prefer to invest in low-risk investments like bonds or government securities. On the other hand, if you’re comfortable with more risk, you might consider investing in stocks or real estate.

Another important factor is your investment goals. What are you saving for? Are you planning for retirement, a down payment on a house, or your child’s education? Your goals will help you determine your investment timeline and how much money you need to save. For example, if you’re saving for retirement, you might need to invest in a more diversified portfolio with a longer time horizon.

Once you have a clear understanding of your risk tolerance and investment goals, you can start exploring different investment options. Here are a few popular choices:

Stocks

Stocks represent ownership in a company. When you buy stock, you’re essentially buying a piece of the company. Stocks can be a risky investment, but they also have the potential for high returns. If you believe in the long-term potential of a company, investing in its stock can be a good way to grow your savings.

Bonds

Bonds are loans that you make to a company or government. When you buy a bond, you’re lending money to the borrower in exchange for regular interest payments and the return of your principal at maturity. Bonds are generally considered less risky than stocks, but they also offer lower returns.

Mutual Funds

Mutual funds are a type of investment that pools money from many investors and invests it in a diversified portfolio of stocks, bonds, or other assets. Mutual funds offer diversification and professional management, making them a popular choice for individual investors.

Exchange-Traded Funds (ETFs)

ETFs are similar to mutual funds, but they trade on stock exchanges like individual stocks. ETFs are generally more tax-efficient than mutual funds, and they offer lower fees.

Investing your money wisely can help you reach your financial goals and build a secure future. By understanding your risk tolerance, setting realistic goals, and exploring different investment options, you can make informed decisions that will help you grow your savings over time.

Building an Emergency Fund for Unexpected Events

Life is full of uncertainties, and unexpected events can happen at any time. From medical emergencies to job loss, these situations can quickly drain your finances and leave you feeling overwhelmed. This is why it’s crucial to have an emergency fund in place. An emergency fund is a savings account specifically designed to cover unexpected expenses. It acts as a safety net, providing financial stability during times of crisis.

The importance of having an emergency fund cannot be overstated. It offers peace of mind knowing that you have a financial cushion to rely on when unexpected events arise. Without it, you might be forced to resort to high-interest loans or deplete your long-term savings, jeopardizing your financial future.

Benefits of an Emergency Fund:

- Financial Stability: Provides a safety net during unexpected events, preventing financial distress.

- Reduced Stress: Offers peace of mind knowing you have resources to handle unforeseen expenses.

- Avoids Debt: Prevents the need to borrow money at high interest rates.

- Protection from Job Loss: Provides financial support during unemployment.

- Improved Credit Score: Helps maintain a good credit score by avoiding unnecessary debt.

How Much Should You Save?

The ideal amount for an emergency fund varies depending on individual circumstances. However, a common recommendation is to have 3-6 months of living expenses saved. This means covering your essential expenses like rent, utilities, groceries, and transportation for that period.

Building Your Emergency Fund:

Building an emergency fund takes time and discipline. Here are some tips to get started:

- Set a Realistic Goal: Determine a specific amount you want to save and set a timeframe.

- Automate Your Savings: Set up automatic transfers from your checking account to your emergency fund.

- Track Your Progress: Regularly monitor your savings and celebrate milestones.

- Reduce Unnecessary Expenses: Identify areas where you can cut back on spending.

- Find Additional Income: Consider side hustles or freelance work to boost your savings.

Reviewing and Adjusting Your Budget Regularly

A budget is a financial plan that outlines how you will manage your income and expenses. It’s a crucial tool for achieving your financial goals, whether you’re saving for a down payment on a house, paying off debt, or simply trying to live within your means. However, a budget is not a set-it-and-forget-it plan. Life is dynamic, and your financial situation can change frequently. That’s why it’s essential to review and adjust your budget regularly.

Why is it important to review and adjust your budget?

- Changes in Income: Your income can fluctuate due to raises, bonuses, job changes, or even unexpected financial windfalls.

- Changes in Expenses: Your expenses can also change, often without you realizing it. For instance, the cost of groceries, gas, and utilities can increase.

- New Financial Goals: As your life changes, your financial goals may evolve as well. You might decide to save for a new car, pay off student loans faster, or start investing.

- Unforeseen Circumstances: Life throws curveballs. You might face unexpected expenses, such as a car repair or a medical bill.

How often should you review your budget?

Ideally, you should review your budget at least once a month. This allows you to stay on top of your spending habits and make adjustments as needed. If you’re dealing with significant financial changes or a new financial goal, you may want to review your budget more frequently.

What should you look for when reviewing your budget?

- Track Your Spending: Make sure you’re accurately tracking all of your income and expenses. This is the foundation of a good budget.

- Identify Areas for Improvement: Look for areas where you can cut back on spending or increase your income.

- Adjust Your Savings Goals: Assess if your savings goals are still realistic and achievable.

- Review Your Financial Goals: Check in on your long-term financial goals and make sure they’re still aligned with your current situation.

Tips for Adjusting Your Budget:

- Be Realistic: Don’t make drastic changes to your budget that you won’t be able to stick to. Start with small, achievable adjustments.

- Seek Professional Advice: If you’re struggling to manage your finances, consider seeking guidance from a financial advisor.

- Be Patient: Budgeting takes time and effort. Be patient with yourself and don’t get discouraged if you don’t see results immediately.

Reviewing and adjusting your budget regularly is crucial for financial success. It empowers you to take control of your money, achieve your financial goals, and navigate life’s uncertainties with confidence.