Are you looking for a way to diversify your portfolio and build long-term wealth? If so, then real estate investing might be the perfect opportunity for you. Real estate has historically been a reliable asset class, offering consistent returns and the potential for significant capital appreciation. However, navigating the world of real estate investment can seem daunting, especially if you’re a beginner. This guide will demystify the process and provide you with a roadmap to get started in real estate investing.

Whether you’re interested in buying rental properties, flipping houses, or investing in REITs, this comprehensive guide will cover the essential steps, from understanding the different types of real estate investments to navigating the financing process and finding the right property. We’ll also discuss crucial factors to consider, such as market analysis, property management, and tax implications. By the end of this guide, you’ll have a solid foundation to embark on your real estate investment journey with confidence.

Understanding the Basics of Real Estate Investment

Real estate investment can be a lucrative venture, offering the potential for substantial returns and long-term wealth building. However, it’s crucial to approach it with a solid understanding of the fundamentals. This guide will delve into the basics of real estate investing, covering key concepts and considerations to get you started.

Types of Real Estate Investments

The world of real estate investing encompasses various avenues. Some common types include:

- Residential Properties: Single-family homes, townhouses, and condominiums are popular choices for individual investors seeking rental income or appreciation.

- Commercial Real Estate: Office buildings, retail spaces, and industrial properties cater to businesses and offer potentially higher returns.

- Land: Investing in raw land can be a long-term strategy, hoping for future development or appreciation.

- Real Estate Investment Trusts (REITs): These publicly traded companies invest in and own various real estate assets, providing investors with a diversified portfolio.

Key Considerations for Real Estate Investment

Before diving into real estate investing, it’s essential to assess your financial situation, risk tolerance, and investment goals. Key factors to consider include:

- Capital: Real estate investments require significant upfront capital for down payments, closing costs, and ongoing expenses.

- Investment Horizon: Real estate investments typically have a longer holding period compared to stocks or bonds, so consider your time frame for returns.

- Location: Choosing a desirable location with strong rental demand and potential for appreciation is crucial for success.

- Market Research: Thoroughly research the local real estate market, including current trends, inventory, and potential risks.

- Financing: Explore different financing options, such as mortgages or private loans, to secure funds for your investment.

Benefits of Real Estate Investing

Real estate investing offers a range of benefits, including:

- Potential for High Returns: Real estate has historically provided strong returns, exceeding inflation and offering the potential for substantial appreciation.

- Rental Income: Income-producing properties can generate a steady stream of passive income.

- Tax Advantages: Certain real estate investments offer tax benefits, such as deductions for depreciation and mortgage interest.

- Tangible Asset: Real estate is a tangible asset that provides a sense of security and stability compared to investments in stocks or bonds.

- Hedge Against Inflation: Real estate values tend to rise with inflation, acting as a hedge against economic uncertainty.

Risks of Real Estate Investing

While real estate offers numerous advantages, it’s crucial to be aware of the associated risks:

- Market Volatility: Real estate markets are susceptible to fluctuations, potentially leading to price drops or difficulty selling.

- Liquidity Risk: Real estate can be less liquid than other assets, making it challenging to quickly convert into cash.

- Property Management Challenges: Managing rental properties can be time-consuming and demanding, requiring expertise in tenant relations, repairs, and maintenance.

- Vacancy Risk: Empty properties can result in lost rental income and financial strain.

- Economic Downturn: Economic downturns can negatively impact rental demand and property values, affecting investment returns.

Conclusion:

Real estate investing presents a unique opportunity to build wealth and generate passive income. By understanding the fundamentals, considering key factors, and carefully assessing risks, investors can navigate this market and potentially achieve their financial goals. Remember, real estate investing is a long-term strategy that requires patience, research, and a sound financial plan.

Exploring Different Types of Real Estate Investments

Real estate investment offers a diverse range of opportunities, catering to various risk appetites and financial goals. From traditional properties to niche markets, understanding the different types of real estate investments is crucial for making informed decisions.

Residential Real Estate

Residential real estate encompasses single-family homes, townhouses, condominiums, and multi-family dwellings. It’s a popular investment choice due to its relatively low barrier to entry and potential for rental income. Investors can opt for:

- Buy-and-hold strategy: Purchasing properties with the intent to hold them for long-term appreciation and rental income.

- Flipping: Purchasing properties, renovating them, and reselling them for a profit within a shorter timeframe.

Commercial Real Estate

Commercial real estate includes properties used for business purposes, such as office buildings, retail spaces, industrial facilities, and hotels. This segment typically involves larger investments and offers potential for substantial returns. Some common commercial real estate investments include:

- Office buildings: Providing workspace for businesses.

- Retail spaces: Hosting shops, restaurants, and other commercial establishments.

- Industrial facilities: Supporting manufacturing, warehousing, and distribution operations.

Industrial Real Estate

Industrial real estate encompasses properties used for manufacturing, warehousing, and distribution. This segment is often influenced by factors like location, access to transportation, and infrastructure. Industrial real estate investments can range from small warehouses to large manufacturing plants.

Land Investment

Land investment involves purchasing undeveloped land with the potential for future development or appreciation. This type of investment can be speculative, as its value is often tied to zoning changes, infrastructure development, and market demand. Land investments can include:

- Raw land: Undeveloped land without any improvements.

- Development land: Land with potential for future development, such as residential or commercial projects.

REITs (Real Estate Investment Trusts)

REITs are publicly traded companies that own and operate income-producing real estate assets. They offer investors an opportunity to participate in the real estate market through the stock market. REITs can specialize in various property types, including residential, commercial, and industrial.

Setting Your Investment Goals and Budget

Investing is a crucial step towards achieving your financial goals, whether it’s buying a house, retiring comfortably, or simply building a safety net. But before you start investing, it’s important to set clear goals and establish a budget that works for you. This will help you stay focused and avoid impulsive decisions.

Defining Your Investment Goals

Start by identifying your financial goals. What are you hoping to achieve with your investments? Do you want to buy a house in five years, retire in twenty years, or simply save for emergencies? Once you have a clear idea of your goals, you can start to develop a plan to reach them.

Setting Realistic Timeframes

It’s important to set realistic timeframes for your investment goals. If you’re saving for retirement in twenty years, you have more time to take on higher-risk investments. But if you’re saving for a down payment on a house in five years, you’ll need to consider investments with lower risk profiles.

Determining Your Investment Budget

Once you know your goals and timeframes, you need to figure out how much you can afford to invest. This will involve analyzing your current income and expenses, and creating a budget that allows for regular contributions to your investment account.

Prioritizing Your Investments

It’s also important to prioritize your investments. Are there any specific goals that are more urgent than others? For example, if you’re saving for a down payment on a house, you may want to prioritize that goal over saving for retirement.

Reviewing Your Goals and Budget Regularly

Your financial situation may change over time, so it’s important to review your investment goals and budget regularly. You may need to adjust your goals, your investment strategy, or your contribution amount based on changes in your income, expenses, or risk tolerance.

Getting Professional Advice

If you’re unsure about how to set your investment goals and budget, it’s a good idea to seek professional advice from a financial advisor. They can help you create a personalized plan that aligns with your unique financial circumstances and goals.

Researching Potential Markets and Properties

Before you start your real estate investment journey, you must understand the market you’re getting into. This requires in-depth research on potential markets and properties. Knowing your market is crucial to making profitable and informed decisions.

Start by identifying your investment goals and objectives. This could include rental income, capital appreciation, or a combination of both. Once you know what you want to achieve, you can start narrowing down your search to areas that fit your criteria.

Market Analysis

Analyzing the market involves understanding the local economic conditions, demographics, and real estate trends. Here are some essential factors to consider:

- Job Market: A strong job market indicates a healthy economy and a higher demand for housing.

- Population Growth: Growing populations mean increasing demand for housing, potentially driving up prices.

- Local Amenities: Look for areas with desirable amenities, such as schools, parks, and shopping centers, as these can influence property values.

- Infrastructure: Good infrastructure, like transportation systems and utilities, can improve the quality of life and attract residents.

- Property Values: Research historical property price trends and current market valuations to understand the potential for growth and appreciation.

Property Research

Once you’ve identified a promising market, it’s time to start researching specific properties. Here are some key aspects to consider:

- Property Type: Determine the type of property that aligns with your investment goals, such as single-family homes, multi-family units, or commercial buildings.

- Location: Choose a location that’s desirable and meets your criteria based on market analysis.

- Condition: Evaluate the property’s condition to estimate potential renovation costs and future expenses.

- Rental Potential: If you’re planning to rent the property, research average rental rates and vacancy rates in the area.

- Property Taxes and Insurance: Understand the cost of owning the property, including taxes and insurance premiums.

Utilize Resources

Several resources can help you with your research:

- Real Estate Websites: Sites like Zillow, Redfin, and Realtor.com offer detailed property listings, market data, and insights.

- Local Real Estate Agents: Connect with local agents to gain access to their expertise, MLS listings, and market knowledge.

- Government Data: Explore data from sources like the U.S. Census Bureau and the Bureau of Labor Statistics to understand demographics, economic trends, and more.

Finding and Vetting Real Estate Agents and Professionals

Buying or selling a home is a major financial and emotional undertaking. It’s essential to have a real estate agent or professional who is knowledgeable, experienced, and trustworthy to guide you through the process. This article will help you find the right person for the job, understand the different types of real estate professionals, and know what questions to ask before you make your choice.

Types of Real Estate Professionals

While the term “real estate agent” is often used broadly, there are several different types of professionals in the industry. Here are some of the most common:

- Real Estate Agent: A licensed individual who represents buyers and sellers in real estate transactions. They can assist with finding properties, negotiating offers, and handling the paperwork.

- Real Estate Broker: A licensed professional who can manage a real estate brokerage and oversee agents. They can also represent buyers and sellers directly.

- Real Estate Appraiser: A licensed professional who evaluates the market value of a property.

- Home Inspector: A professional who conducts thorough inspections of properties to identify any potential issues or defects.

Finding the Right Real Estate Agent

When choosing a real estate agent, it’s important to consider these factors:

- Experience: Look for an agent who has a proven track record in your local market and specializes in the type of property you’re interested in.

- Knowledge: The agent should be knowledgeable about the current market conditions, comparable properties, and the legal aspects of real estate transactions.

- Communication Skills: A good agent will communicate clearly, promptly, and effectively throughout the process.

- Availability: Make sure the agent is available to answer your questions, show you properties, and represent your interests.

- References: Ask for references from previous clients to get their feedback on the agent’s performance.

- Personal Connection: Choose someone you feel comfortable working with and trust to advocate for your needs.

Vetting the Real Estate Agent

Once you’ve identified a few potential agents, it’s crucial to interview them and ask the following questions:

- How long have you been a real estate agent?

- What is your experience in my local market?

- What is your strategy for selling/buying a home?

- How many homes have you sold/bought in the last year?

- What is your commission structure?

- Do you have any experience with [specific type of property]?

- Can you provide me with references from previous clients?

Be sure to pay attention to the agent’s communication style, responsiveness, and overall demeanor. Trust your gut feeling and choose an agent who you feel confident and comfortable working with. Remember, selecting the right real estate agent is an important step in navigating the complex world of buying or selling a home. It’s an investment in your peace of mind and your financial success.

Financing Your Real Estate Investment

Investing in real estate can be a lucrative venture, but it often requires significant upfront capital. Fortunately, various financing options are available to help you secure the funds necessary to purchase your desired property. This article will explore the different types of real estate financing, their pros and cons, and provide insights to help you make informed decisions.

Traditional Mortgages

A traditional mortgage is a loan secured by your property. It’s the most common type of financing for real estate investments. These mortgages typically involve a fixed or adjustable interest rate and a set repayment period.

Pros

- Lower interest rates compared to other loan options.

- Predictable monthly payments.

- Longer repayment terms, offering more flexibility.

Cons

- Requires a substantial down payment, usually 20% of the property value.

- Strict credit score requirements and income verification.

- Loan approval process can be lengthy and complex.

Private Loans

Private loans, also known as hard money loans, are provided by private lenders, such as individuals or investment firms. They are often used for fix-and-flip projects or properties with limited financing options from traditional institutions.

Pros

- Faster approval process than traditional mortgages.

- May offer financing for properties with lower credit scores or limited income.

- Can be customized to fit your specific needs.

Cons

- Higher interest rates than traditional mortgages.

- Shorter repayment terms, resulting in larger monthly payments.

- Potentially higher fees and penalties.

Seller Financing

Seller financing occurs when the property seller agrees to provide a loan to the buyer, typically in situations where the buyer lacks traditional financing. This can be advantageous for both parties.

Pros

- May offer more flexibility on terms compared to traditional mortgages.

- Can be an option for buyers with lower credit scores.

- Allows sellers to receive regular payments and retain some control over the property.

Cons

- Potentially higher interest rates than traditional mortgages.

- Repayment terms may be shorter, requiring larger monthly payments.

- Can be more complex to navigate and require legal counsel.

Home Equity Loans and Lines of Credit (HELOCs)

Home equity loans and HELOCs are secured by the equity you have built in your primary residence. They allow you to borrow against your home’s value.

Pros

- Lower interest rates than unsecured loans.

- Can be used for various purposes, including real estate investments.

Cons

- Putting your primary residence at risk if you default on the loan.

- May have stricter credit score requirements.

Choosing the Right Financing

The best type of real estate financing depends on your specific needs and circumstances. Consider factors like your credit score, income, property type, and investment strategy. It’s wise to consult with a financial advisor or mortgage broker who can help you assess your options and guide you toward the most appropriate financing solution.

Negotiating and Closing the Deal

Negotiating and closing a deal are critical parts of any business transaction. Whether you’re a seasoned entrepreneur or a newbie, having a solid understanding of the process can make all the difference in securing favorable terms and achieving your desired outcomes.

Preparation is Key

Before you even step into the negotiation room, it’s crucial to do your homework. This involves:

- Thoroughly understanding the market: Research industry trends, competitor pricing, and market demand to establish a fair baseline for your negotiations.

- Defining your goals and priorities: Clearly identify your non-negotiables and areas where you’re willing to be flexible. This will provide a framework for your negotiation strategy.

- Preparing your arguments: Anticipate counterarguments and develop compelling responses that support your position. Be prepared to present data, research, and examples to justify your requests.

- Assessing the other party’s needs: Understanding their motivations and priorities will help you identify potential areas for collaboration and compromise.

Negotiation Strategies

Once you’re at the negotiation table, remember to:

- Be assertive but respectful: Stand firm in your position while maintaining a professional and courteous demeanor.

- Practice active listening: Carefully listen to the other party’s concerns and understand their perspective. This fosters trust and helps you identify potential solutions.

- Be willing to compromise: Negotiations are rarely a win-lose scenario. Find common ground and be flexible to reach a mutually beneficial agreement.

- Utilize negotiation tactics: Explore various techniques like anchoring, bracketing, and concessions to leverage your position and steer the negotiation in your favor.

Closing the Deal

When you reach a point of agreement, ensure you:

- Summarize key terms: Recap the agreed-upon conditions to avoid any misunderstandings or misinterpretations.

- Document the terms in writing: Create a formal agreement that clearly outlines the responsibilities, deadlines, and other essential details.

- Get everything in writing: Don’t rely on verbal promises or handshakes. Have all agreements documented and signed by both parties.

- Establish clear communication channels: Create a system for ongoing communication to address any questions or concerns that may arise after the deal is closed.

Key Takeaways

Negotiating and closing deals effectively requires preparation, strategic thinking, and strong communication skills. By understanding the process, mastering key strategies, and staying focused on your objectives, you can increase your chances of achieving successful and mutually beneficial outcomes.

Managing Your Real Estate Investment Property

Owning a real estate investment property can be a lucrative venture. However, it requires careful planning and management to ensure profitability. Managing your property effectively involves various aspects, from tenant screening to maintenance and financial planning. This guide will provide you with comprehensive information on how to manage your real estate investment property successfully.

Tenant Screening

Finding reliable tenants is crucial to a smooth and profitable investment. Thorough tenant screening helps minimize risks and ensures a positive tenant-landlord relationship. Conduct background checks, credit checks, and verify employment history. Consider asking for references from previous landlords and inquire about their rental history.

Lease Agreements

A comprehensive lease agreement is essential to protect your interests and outline the terms of the tenancy. A well-drafted lease should include details about rent, security deposits, late fees, pet policies, tenant responsibilities, and termination clauses. Consult with a legal professional to ensure your lease agreement complies with local laws and regulations.

Maintenance and Repairs

Maintaining your property in good condition is vital for tenant satisfaction and asset preservation. Establish a routine maintenance schedule for regular inspections and repairs. Respond promptly to tenant requests for repairs to prevent minor issues from escalating into major problems. Consider setting aside funds in a dedicated maintenance account to cover unexpected expenses.

Financial Management

Accurate financial planning is crucial for maximizing your investment return. Track all income and expenses related to your property. This includes rent, utilities, insurance, property taxes, and maintenance costs. Monitor your cash flow and adjust your rental rates as necessary to ensure a healthy profit margin. Consider using accounting software or hiring a property manager to streamline your financial management process.

Marketing and Advertising

Finding tenants requires effective marketing and advertising strategies. Utilize online platforms like Craigslist and Zillow to list your property. Consider professional photography and virtual tours to enhance your listings. Network with local real estate agents and property management companies to expand your reach and attract potential tenants.

Legal Compliance

Stay informed about local laws and regulations governing landlords and tenants. Ensure your property meets all safety and building codes. Comply with fair housing laws and avoid discriminatory practices when screening tenants. Seek legal advice when necessary to understand your rights and responsibilities as a landlord.

Long-Term Strategies for Success

In today’s fast-paced world, it’s easy to get caught up in the immediate and lose sight of the bigger picture. But true success is often the result of long-term planning and consistent effort. Whether you’re pursuing personal goals or professional aspirations, adopting a strategic mindset is crucial for achieving lasting fulfillment.

One of the most fundamental strategies for success is to set clear goals. Without a clear vision of what you want to achieve, it’s difficult to stay motivated and make progress. Goals should be specific, measurable, achievable, relevant, and time-bound (SMART). This framework provides a structured approach to defining your objectives and tracking your progress.

Another essential element of long-term success is continuous learning. The world is constantly evolving, and staying ahead of the curve requires a commitment to ongoing education and development. This can involve reading books, attending workshops, taking online courses, or simply engaging in meaningful conversations with experts in your field. The more you learn, the more equipped you’ll be to navigate challenges and seize opportunities.

Alongside learning, building strong relationships is vital. Surround yourself with people who support your goals, challenge your thinking, and inspire you to grow. This network can provide invaluable advice, mentorship, and collaboration opportunities. Cultivating meaningful connections can also foster a sense of community and belonging, which are essential for well-being and success.

Finally, remember that success is a journey, not a destination. There will be setbacks and obstacles along the way. But by embracing a growth mindset, you can view challenges as opportunities for learning and improvement. Don’t be afraid to experiment, take risks, and learn from your mistakes. It’s through these experiences that you’ll discover your strengths and develop the resilience needed to overcome adversity.

Common Mistakes to Avoid as a Beginner Investor

Investing can be a daunting prospect, especially for beginners. The world of finance can seem complex and overwhelming, with countless options and strategies to choose from. However, making informed decisions and avoiding common pitfalls is crucial to achieving your financial goals. Here are some common mistakes to avoid as a beginner investor:

1. Investing Without a Plan

A lack of planning can lead to impulsive and misguided investment decisions. Before investing, it is essential to define your investment goals, risk tolerance, and time horizon. Having a clear plan will help you stay focused and make informed decisions.

2. Ignoring Your Risk Tolerance

Every investor has a different level of risk tolerance. It’s vital to understand your own risk tolerance and choose investments that align with it. If you are risk-averse, you may prefer low-risk investments such as bonds or fixed deposits. If you are comfortable with risk, you may consider investing in stocks or other higher-risk assets.

3. Chasing Returns

Don’t fall prey to the lure of high returns. While it is tempting to invest in assets that promise high profits, it’s important to remember that high returns often come with high risks. Be wary of investments that seem too good to be true, and always conduct thorough research before investing.

4. Investing Emotionally

It’s easy to get caught up in the excitement or fear of the market. However, making investment decisions based on emotions is often detrimental to your portfolio. Stick to your plan and avoid making hasty decisions based on short-term market fluctuations.

5. Not Diversifying Your Portfolio

Diversification is crucial to manage risk. By investing in a variety of asset classes, you reduce the impact of poor performance in any single asset. Diversifying your portfolio can include investing in different industries, sectors, and geographies.

6. Trading Too Frequently

Excessive trading can eat into your profits through transaction costs and capital gains taxes. If you are a beginner investor, it’s generally best to adopt a long-term investment approach and avoid frequent trading.

7. Not Seeking Professional Advice

If you are unsure about investment strategies, don’t hesitate to seek professional advice from a financial advisor. They can provide personalized guidance based on your individual circumstances and help you create a suitable investment plan.

8. Failing to Monitor Your Investments

Once you’ve invested, it’s crucial to monitor your investments regularly and make adjustments as needed. This includes reviewing your portfolio performance, rebalancing your assets, and staying informed about market developments.

9. Not Considering Taxes

Taxes can have a significant impact on your investment returns. Be aware of the tax implications of your investments and consider strategies to minimize your tax burden.

10. Not Staying Informed

The investment landscape is constantly evolving. Staying informed about market trends, economic developments, and industry news is essential for making sound investment decisions.

By avoiding these common mistakes, you can set yourself up for success in the world of investing. Remember, patience, discipline, and a long-term perspective are key to building a strong and profitable investment portfolio.

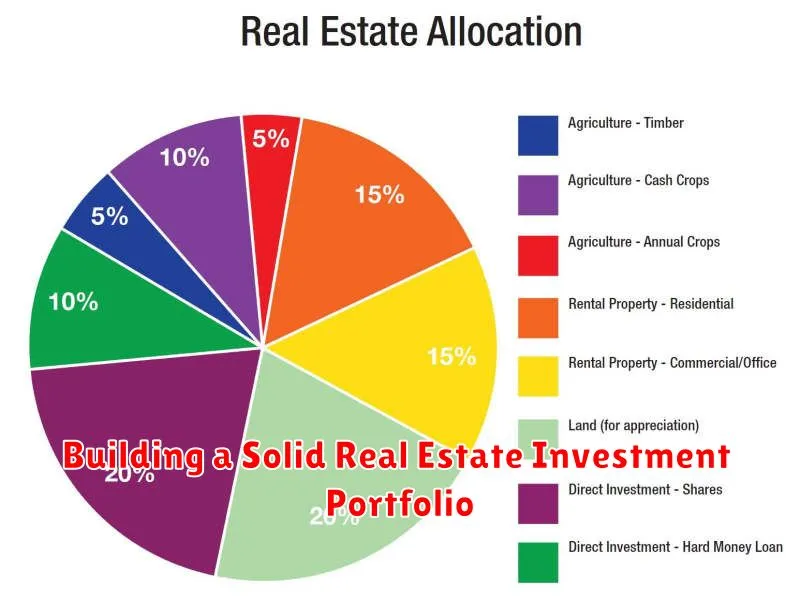

Building a Solid Real Estate Investment Portfolio

Real estate investing can be a rewarding venture, offering potential for passive income, long-term appreciation, and tax advantages. However, building a solid real estate investment portfolio requires careful planning, research, and a strategic approach. Here’s a comprehensive guide to help you navigate the process:

1. Define Your Investment Goals and Strategy

Before diving into the market, it’s crucial to define your investment goals and align them with a suitable strategy. Consider your financial situation, risk tolerance, and time horizon. Are you looking for short-term flips, long-term rentals, or a mix of both?

2. Conduct Thorough Market Research

Understanding the local real estate market is essential for making informed decisions. Research factors like property values, rental rates, vacancy rates, and future development plans. Analyze demographics, economic trends, and local regulations to identify areas with strong potential for appreciation and rental income.

3. Secure Funding and Financing

Real estate investments often require significant capital. Determine how much you can invest upfront and explore different financing options. This may include traditional mortgages, private loans, or hard money lenders. Consider your credit score, debt-to-income ratio, and loan terms when evaluating financing choices.

4. Choose the Right Properties

Selecting the right properties is crucial for building a successful portfolio. Factors to consider include location, condition, and potential for appreciation and rental income. Consider properties with desirable features like proximity to amenities, schools, and transportation, and focus on areas with growing demand.

5. Due Diligence is Key

Before making any investment, conduct thorough due diligence to assess the property’s condition, value, and potential risks. Hire qualified professionals such as home inspectors, appraisers, and real estate attorneys to evaluate the property and ensure you have all the necessary information to make an informed decision.

6. Manage Your Properties Effectively

Managing your properties effectively is essential for maximizing returns. This includes tasks like finding and screening tenants, collecting rent, handling maintenance requests, and staying compliant with local regulations. Consider hiring a property management company if you don’t have the time or expertise to manage the properties yourself.

7. Diversify Your Portfolio

Diversification is key to mitigating risk in real estate investing. Don’t put all your eggs in one basket. Consider investing in different property types, locations, and rental strategies. This can help to balance out potential losses and protect your overall investment.

8. Stay Informed and Adapt

The real estate market is dynamic. Staying informed about market trends, economic conditions, and regulatory changes is crucial for making sound investment decisions. Be flexible and adaptable to changing market conditions, and be prepared to adjust your strategy as needed.