Stepping into the realm of real estate investment can be both exciting and daunting, especially for first-time investors. The allure of building wealth through property ownership is undeniable, but navigating the intricacies of this market can be a minefield. From hidden fees to unforeseen expenses, the real estate jungle is teeming with potential pitfalls that can derail even the most well-intentioned plans. To ensure a smooth and successful journey, it’s crucial to arm yourself with knowledge and avoid common mistakes that can jeopardize your investment.

This guide will delve into the most prevalent pitfalls faced by first-time real estate investors, providing practical insights to navigate the complexities of the market. From understanding the financial nuances to identifying potential risks, we’ll equip you with the tools and strategies to make informed decisions and avoid common traps. So, whether you’re a seasoned professional or just starting your real estate investing journey, join us as we embark on this insightful expedition.

Overpaying for a Property: The Importance of Thorough Research

In the realm of real estate, making a sound investment hinges on meticulous research and a keen understanding of market dynamics. One of the most prevalent pitfalls that can derail a buyer’s financial aspirations is overpaying for a property. This scenario not only diminishes the potential return on investment but can also lead to significant financial strain.

To avoid the trap of overpaying, it’s crucial to undertake thorough research and employ a multifaceted approach. Here’s a comprehensive guide to ensure you make an informed and financially sound decision:

1. Define Your Needs and Budget:

Before embarking on your property search, it’s essential to establish clear criteria for your needs and budget. Determine the type of property you’re seeking, the desired location, and the maximum amount you’re willing to spend. This framework will serve as your guiding principle throughout the process.

2. Conduct a Comprehensive Market Analysis:

Thorough market analysis is the cornerstone of informed real estate investment. This entails researching recent sales data in your target area, analyzing current market trends, and identifying comparable properties that have recently sold. By comparing your potential purchase to similar properties, you can gain valuable insights into the fair market value.

3. Utilize Online Resources:

Numerous online resources can aid in your research endeavors. Websites like Zillow, Redfin, and Realtor.com provide comprehensive data on property listings, recent sales, and market trends. Additionally, websites specializing in real estate market data, such as CoreLogic and Trulia, offer in-depth analysis that can illuminate valuable insights.

4. Engage a Real Estate Professional:

A seasoned real estate agent brings a wealth of experience and local market expertise to the table. They can provide invaluable guidance on negotiation strategies, market trends, and property valuation. Engaging a reputable agent significantly enhances your chances of securing a property at a fair price.

5. Seek Professional Appraisals:

An independent appraisal provides an objective assessment of a property’s value. It’s advisable to obtain an appraisal from a qualified professional before making an offer, as it can validate or challenge the seller’s asking price. This step safeguards you from overpaying due to inflated estimations.

6. Scrutinize the Property’s Condition:

A meticulous inspection of the property’s condition is imperative. This includes checking for structural flaws, potential maintenance issues, and any other red flags that could necessitate costly repairs in the future. A thorough inspection can save you from unexpected financial burdens down the line.

7. Negotiate Strategically:

Armed with the knowledge gained from your research, you can negotiate effectively with the seller. A well-prepared negotiation strategy will ensure you achieve a purchase price that aligns with the fair market value of the property. Don’t be afraid to walk away if the seller is unwilling to compromise.

In conclusion, avoiding the pitfalls of overpaying for a property demands a proactive and methodical approach. By conducting thorough research, leveraging available resources, and engaging with knowledgeable professionals, you can make a sound investment that aligns with your financial goals.

Ignoring a Professional Home Inspection: Hidden Problems Can Be Costly

Purchasing a home is a significant investment, and it’s crucial to make informed decisions throughout the process. One often-overlooked step is a professional home inspection. While it may seem like an added expense, ignoring this crucial step can lead to costly repairs down the line.

A home inspection is a comprehensive evaluation of a property’s condition, conducted by a trained and certified inspector. The inspector will thoroughly examine various aspects of the house, including:

- Structural integrity: Foundation, walls, roof, and framing

- Electrical systems: Wiring, outlets, and appliances

- Plumbing systems: Pipes, fixtures, and drainage

- Heating and cooling systems: HVAC units and ventilation

- Insulation and ventilation: Energy efficiency

- Roofing: Condition and potential leaks

- Appliances: Functionality and safety

The inspection report will provide detailed findings and recommendations, highlighting any potential issues that may require attention. These findings can then be used to negotiate the purchase price or request repairs from the seller. Ignoring these issues could lead to costly surprises after you move in, potentially impacting your budget and enjoyment of your new home.

Here are some of the reasons why ignoring a professional home inspection can be costly:

- Hidden defects: A home inspection can reveal underlying problems that are not visible to the naked eye, such as foundation cracks, water damage, or faulty wiring.

- Major repairs: Neglecting to address these issues could lead to major repairs, potentially requiring significant financial investment.

- Safety hazards: Some problems may pose safety hazards, such as faulty electrical wiring, gas leaks, or unstable structures.

- Decreased property value: Unresolved issues can decrease the value of your home and make it difficult to sell in the future.

- Increased insurance premiums: Some insurers may charge higher premiums for homes with known problems,

A professional home inspection can provide valuable insights into the condition of a property, helping you make informed decisions about your purchase. It’s a small investment that can save you significant costs and headaches down the road. Don’t let the temptation to skip this vital step lead to costly and unforeseen consequences.

Underestimating the Costs of Homeownership: Beyond the Down Payment

Buying a home is a significant financial decision, and while the down payment often takes center stage, it’s crucial to understand that it’s just the tip of the iceberg. Homeownership comes with a plethora of ongoing costs that can easily catch new homeowners off guard. Failing to factor in these expenses can lead to financial strain and even jeopardize your dream of homeownership.

Beyond the Mortgage Payment: Hidden Costs of Homeownership

While the monthly mortgage payment is a major expense, it’s far from the only cost associated with owning a home. Here’s a breakdown of some often-overlooked expenses:

Property Taxes

Property taxes are levied by local governments and can vary significantly depending on your location. They are typically calculated based on the assessed value of your home and are usually paid annually or semi-annually. Be sure to factor in these taxes when budgeting for your homeownership expenses.

Homeowner’s Insurance

Homeowner’s insurance is essential to protect your investment in case of unforeseen events like fire, theft, or natural disasters. The cost of homeowner’s insurance varies based on factors such as your location, the age and condition of your home, and the amount of coverage you choose.

Maintenance and Repairs

Homes require regular maintenance and repairs to keep them in good condition. This includes everything from routine tasks like landscaping and cleaning gutters to unexpected repairs like replacing a leaky roof or fixing a malfunctioning appliance. It’s wise to set aside a dedicated fund for unexpected repairs, as they can quickly add up.

Utilities

Utilities such as electricity, gas, water, and garbage collection are essential for everyday living. These costs can fluctuate based on your usage and the season. Be prepared for a spike in energy bills during the summer months and winter months.

Homeowners Association (HOA) Fees

If you live in a community with a homeowners association, you’ll be responsible for paying monthly or annual fees. These fees cover common area maintenance, amenities, and other services provided by the HOA.

The Importance of Budgeting for Homeownership Expenses

Accurately accounting for all the costs associated with homeownership is critical to avoid financial surprises. Create a comprehensive budget that includes all the expenses listed above, as well as any other potential costs you anticipate. This will help you make informed decisions about your home purchase and ensure you can comfortably afford your new home.

By understanding the true costs of homeownership beyond the down payment, you can set yourself up for financial success and enjoy the joys of owning your own home without the burden of unexpected expenses.

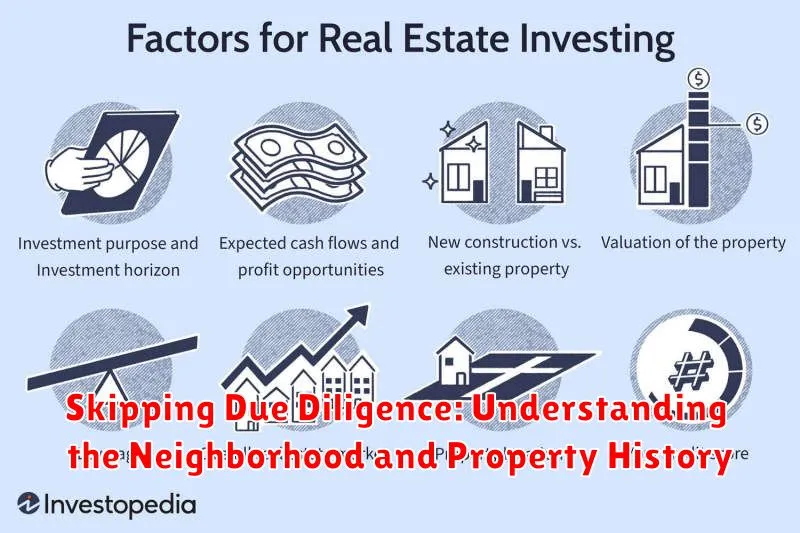

Skipping Due Diligence: Understanding the Neighborhood and Property History

In the fast-paced world of real estate, it’s easy to get swept up in the excitement of finding the perfect home. But before you sign on the dotted line, it’s crucial to conduct thorough due diligence. This involves more than just inspecting the property itself; it also entails understanding the neighborhood and the property’s history.

Skipping due diligence can have serious consequences. You might end up purchasing a property with hidden issues, such as structural problems, environmental concerns, or even a history of crime. These issues can significantly impact your investment and your future enjoyment of the property.

Delving into the Neighborhood

A neighborhood’s character and quality of life can significantly impact your experience as a homeowner. It’s essential to explore the neighborhood thoroughly before making a decision.

- Walk or drive around the area, paying attention to the condition of homes, the presence of parks and green spaces, and the overall ambiance.

- Check the crime statistics for the neighborhood. You can find this information on websites like CrimeMapper or NeighborhoodScout.

- Speak to local residents. They can provide valuable insights into the neighborhood’s strengths and weaknesses, including schools, transportation, and local amenities.

Unveiling the Property’s History

Understanding the history of a property can shed light on potential issues that might not be immediately apparent during an inspection. Here are some steps you can take:

- Obtain a property disclosure statement. This document provides information about the property’s condition, including any known defects or repairs.

- Review the property records, which can be accessed through the county recorder’s office. These records will reveal past transactions, permits, and any legal actions related to the property.

- Hire a professional inspector to conduct a thorough assessment of the property’s condition. They can identify potential issues such as structural problems, plumbing problems, or electrical wiring issues.

By taking the time to conduct thorough due diligence, you can protect yourself from costly surprises and ensure that your real estate investment is a sound one. Remember, it’s always better to be safe than sorry when it comes to purchasing a home.

Falling for Emotional Buying: Making Rational Decisions in Real Estate

Purchasing a home is a significant financial commitment and one that should not be taken lightly. It’s easy to get caught up in the excitement of finding the “perfect” property, but it’s crucial to remain objective and make rational decisions. Emotional buying can lead to costly mistakes and regret down the line. In this article, we’ll explore the pitfalls of emotional buying in real estate and provide practical tips for making wise and informed choices.

The Allure of Emotional Buying

It’s natural to feel a rush of emotions when you find a property that checks off all the boxes on your wish list. The spacious kitchen, the picturesque backyard, or the charming neighborhood can evoke feelings of happiness, excitement, and even a sense of belonging. These emotions can cloud your judgment and make it difficult to assess the property objectively.

Avoiding Emotional Pitfalls

To avoid succumbing to emotional buying, it’s essential to take a step back and approach the process with a rational mindset. Here are some strategies to help you stay grounded:

- Define your needs and wants: Before you start your search, create a clear list of your non-negotiable requirements and your preferred features. This will provide a framework for evaluating properties and prevent you from getting sidetracked by superficial elements.

- Stick to your budget: It’s tempting to stretch your finances for the “dream home,” but it’s crucial to stay within your predetermined budget. Overextending yourself can lead to financial hardship and long-term regret.

- Get a pre-approval for a mortgage: Having a pre-approval in hand will give you a clear understanding of your purchasing power and help you narrow down your search to properties that are within your reach.

- Don’t be afraid to walk away: If a property feels too good to be true or you have doubts about its value, don’t be afraid to walk away. There are other properties out there that may better align with your needs and financial situation.

- Seek expert advice: Working with a reputable real estate agent can provide valuable insights and help you avoid common pitfalls. They can offer objective opinions and help you navigate the complex world of real estate.

- Take your time: Don’t rush into a decision. Spend time researching properties, comparing options, and considering the long-term implications of your purchase. Allow yourself ample time to make a well-informed decision.

The Benefits of Rational Decision-Making

Making rational decisions in real estate can lead to numerous benefits. By prioritizing your needs, sticking to your budget, and avoiding emotional impulses, you can:

- Secure a property that meets your requirements

- Avoid overpaying for a property

- Minimize the risk of financial hardship

- Experience peace of mind and satisfaction with your purchase

Conclusion

Purchasing a home is a significant investment, and it’s crucial to approach the process with a rational mindset. By avoiding emotional buying and making informed decisions, you can ensure that your purchase aligns with your needs, budget, and long-term goals. Remember, your home should be a source of comfort and stability, not a source of stress and regret.

Not Having a Clear Investment Strategy: Define Your Goals and Timeline

Many people are intimidated by the idea of investing, and for good reason. There’s a lot to learn, and the market can be volatile. However, one of the biggest mistakes people make is not having a clear investment strategy. If you don’t know where you’re going, it’s difficult to get there.

A clear investment strategy is essential for anyone who wants to be successful in the market. It provides you with a roadmap to follow and helps you to stay on track, even when things get tough. But what exactly goes into creating a clear investment strategy?

1. Define Your Goals

The first step in creating an investment strategy is to define your goals. What are you hoping to achieve with your investments? Are you saving for retirement? Buying a house? Paying for your child’s education? Once you know what you’re aiming for, you can start to develop a plan to reach those goals.

2. Determine Your Timeline

The next step is to determine your timeline. How long do you have to reach your goals? The longer your timeline, the more risk you can take on. If you need your money sooner, you’ll need to be more conservative with your investments.

3. Assess Your Risk Tolerance

Once you know your goals and timeline, it’s time to assess your risk tolerance. How much risk are you comfortable taking on? This is an important factor to consider when choosing investments. If you’re not comfortable with risk, you should stick to investments that are considered low-risk, such as bonds or money market accounts. If you’re willing to take on more risk, you might consider investing in stocks or real estate.

4. Choose Your Investments

Now that you know your goals, timeline, and risk tolerance, you can start to choose your investments. There are many different types of investments available, so it’s important to do your research and choose investments that are right for you. It’s also important to diversify your portfolio, which means spreading your money across different types of investments. This helps to reduce risk.

5. Monitor Your Portfolio

Once you’ve made your investments, it’s important to monitor your portfolio regularly. This will help you to ensure that you’re still on track to reach your goals. You should also review your portfolio at least once a year to make sure that your investments are still aligned with your goals and risk tolerance. You may need to adjust your strategy over time as your circumstances change.

Not having a clear investment strategy can lead to costly mistakes. It can also make it difficult to stay motivated and disciplined. With a clear investment strategy in place, you’ll be able to make more informed decisions about your money and increase your chances of achieving your financial goals.

Ignoring the Importance of Location: The Prime Factor in Real Estate

In the realm of real estate, location is king. It’s a phrase that’s been repeated countless times, yet somehow, it still manages to be overlooked by many. While factors like property size, design, and amenities are important, location trumps all. It’s the bedrock upon which the value of your investment is built. It’s the defining element that shapes your lifestyle, your community, and even your financial future.

When you choose a property, you’re not just choosing a house, you’re choosing a neighborhood, a community, and a way of life. The location determines your proximity to schools, hospitals, parks, shopping centers, and transportation hubs. It impacts your daily commute, your access to amenities, and your overall sense of belonging.

Imagine living in a beautiful house with all the bells and whistles, but in a neighborhood riddled with crime, noise, and pollution. The appeal of your home instantly diminishes, doesn’t it? On the other hand, a modest house in a safe, vibrant, and well-connected neighborhood could offer a far superior quality of life.

Location plays a crucial role in determining the appreciation potential of your property. Neighborhoods with strong infrastructure, amenities, and future development plans typically see higher appreciation rates. This means your investment has a better chance of growing in value over time, ensuring a healthy return on your investment.

The influence of location extends beyond just the immediate surroundings. It influences your access to job opportunities, cultural attractions, and recreational activities. A location that offers a good balance of work, life, and play is often considered highly desirable. It can lead to a more fulfilling and balanced lifestyle, adding another layer of value to your real estate investment.

While the allure of a luxurious home may be tempting, don’t let it blind you to the significance of location. Remember, location is not just a factor, it’s the foundation. It’s the anchor that determines the long-term value, desirability, and quality of life associated with your property.

Overlooking Property Taxes and Insurance: Budgeting for Ongoing Expenses

Owning a home is a dream for many, but it’s crucial to understand the ongoing costs beyond the mortgage payment. While the monthly mortgage is often the most significant expense, overlooking property taxes and insurance can lead to unexpected financial strain.

Property taxes are levied by local governments and vary widely based on the property’s assessed value and location. These taxes are typically paid annually or semi-annually, and they can represent a substantial portion of your overall housing costs.

Home insurance, on the other hand, is essential to protect your investment. It provides coverage against various risks like fire, theft, and natural disasters. The premium for home insurance is determined by factors such as the home’s value, location, and coverage options you choose.

Here’s how to effectively budget for property taxes and insurance:

- Research Your Area’s Average Rates: Before purchasing a home, research the average property taxes and insurance rates in your desired neighborhood. This will give you a good estimate of what to expect.

- Factor Them into Your Budget: When calculating your monthly housing costs, include the estimated annual property taxes and insurance premiums. Divide these figures by 12 to determine your monthly payment.

- Consider Escrow: Many mortgage lenders offer escrow accounts where they collect funds for property taxes and insurance alongside your mortgage payment. This ensures that your taxes and insurance are paid on time, eliminating the risk of late payments or penalties.

- Shop Around for Insurance: Don’t settle for the first insurance quote you receive. Shop around for the best rates and coverage options to ensure you’re getting the best deal.

- Consider Deductions: Property taxes and insurance premiums can be tax-deductible in some cases. Consult with a tax professional to see if you qualify for these deductions.

By properly budgeting for property taxes and insurance, you can avoid surprises and financial stress. Remember that these costs are ongoing expenses that are crucial to consider when evaluating the overall cost of homeownership.

Misunderstanding Mortgage Terms: Interest Rates, Loan Types, and More

The process of buying a home is a complex one, and it’s easy to get lost in the sea of information. One area that often causes confusion is the terminology used in mortgage lending. Understanding these terms is crucial for making informed decisions about your mortgage, so let’s break down some of the most important ones.

Interest Rates

The interest rate is the cost of borrowing money, expressed as a percentage of the loan amount. A lower interest rate means you’ll pay less in interest over the life of the loan. Here are some key terms related to interest rates:

- Fixed-rate mortgage: This type of mortgage has an interest rate that stays the same for the entire loan term. It provides predictable monthly payments.

- Adjustable-rate mortgage (ARM): This type of mortgage has an interest rate that can change over time, usually tied to an index like the prime rate. ARMs can offer lower initial rates, but they come with the risk of higher payments in the future.

Loan Types

There are several different types of mortgages available, each with its own unique features and terms. Here are a few common ones:

- Conventional mortgage: This is the most common type of mortgage. They are typically offered by private lenders and usually require a down payment of 20% or more.

- FHA mortgage: These mortgages are insured by the Federal Housing Administration, making them more accessible to borrowers with lower credit scores and down payments.

- VA mortgage: These mortgages are guaranteed by the Department of Veterans Affairs, making them available to veterans, active-duty military personnel, and surviving spouses.

Other Important Terms

Here are some other important mortgage terms to be aware of:

- Loan term: This is the length of time you have to repay the mortgage. Common terms are 15, 20, and 30 years.

- Principal: This is the original amount of money borrowed.

- Down payment: This is the initial amount of money you pay upfront towards the purchase of the home.

- Closing costs: These are the fees associated with finalizing the mortgage and purchasing the home, including appraisal, title insurance, and other fees.

By understanding these terms, you can navigate the mortgage process with confidence. Be sure to consult with a mortgage lender to get personalized advice and ensure you choose the mortgage that best meets your needs.

Failing to Account for Potential Repairs and Renovations

One of the biggest financial mistakes homeowners make is failing to account for potential repairs and renovations. It’s easy to get caught up in the excitement of buying a new home and forget about the unexpected costs that can pop up down the road. After all, who wants to think about plumbing leaks or roof repairs when you’re dreaming of hosting dinner parties in your new kitchen?

But the truth is, even the newest homes require maintenance and repairs. And older homes, well, they come with a whole new set of potential problems.

Here are just a few things to consider when budgeting for repairs and renovations:

- Age of the home: Older homes are more likely to need repairs, so it’s important to factor that into your budget.

- Condition of the home: If the home has been neglected, you can expect to spend more money on repairs.

- Local building codes: You may need to make repairs or upgrades to meet local building codes.

- Your personal preferences: Do you want to renovate the kitchen or bathroom? If so, you’ll need to budget for those costs.

The best way to prepare for unexpected repairs and renovations is to create an emergency fund. This fund should be separate from your regular savings and should be easily accessible in case of an emergency. Experts recommend having at least 3-6 months worth of living expenses saved in an emergency fund.

You should also consider setting aside a small amount of money each month for routine maintenance. This will help you cover the costs of things like oil changes, lawn care, and appliance repairs.

Failing to account for potential repairs and renovations can lead to financial stress and even debt. By taking the time to plan ahead, you can avoid these problems and ensure that you have the financial resources you need to maintain your home.