Embarking on the exciting journey of homeownership is a dream shared by many, but the process can seem daunting for first-time buyers. Navigating the complexities of real estate, from understanding mortgage options to finding the perfect property, can be overwhelming. But fear not! This comprehensive guide is designed to equip you with the essential tips and insights you need to navigate the real estate market with confidence. Whether you’re just starting your research or ready to make an offer, our expert advice will empower you to unlock the door to your dream home.

From understanding your budget and credit score to negotiating effectively and securing a mortgage, we’ll cover all the crucial aspects of the home buying process. We’ll explore the latest market trends, explain the different types of financing available, and provide valuable tips for finding the perfect home that meets your needs and lifestyle. So, get ready to turn your homeownership aspirations into reality with our insightful guide.

Defining Your Dream Home and Budget

Buying a home is a significant financial commitment, so it’s essential to have a clear understanding of what you want and how much you can afford before you start looking. The first step in this process is defining your dream home and setting a realistic budget.

Your dream home is the house that ticks all the boxes on your wish list. It might have a spacious backyard for entertaining, a gourmet kitchen for cooking, or a luxurious master suite for relaxation. Whatever your priorities are, it’s important to be specific about your desired features and amenities. This will help you narrow down your search and find the perfect property for you.

Next, you need to determine your budget. This involves assessing your financial situation and determining how much you can comfortably afford to spend on a mortgage, property taxes, insurance, and other associated costs. It’s crucial to be realistic and avoid overstretching yourself financially. You can use online mortgage calculators to get an estimate of your monthly payments based on different loan amounts and interest rates.

Once you have a good understanding of your dream home and your budget, you can start exploring different properties in your desired area. It’s a good idea to work with a real estate agent who can provide you with valuable insights and help you navigate the buying process. By taking the time to define your dream home and set a realistic budget, you’ll be in a better position to make informed decisions and find the perfect home for your needs.

Getting Pre-Approved for a Mortgage

Getting pre-approved for a mortgage is a crucial step in the home-buying process. It gives you a clear idea of how much you can borrow and makes you a more attractive buyer in the eyes of sellers.

Benefits of Getting Pre-Approved

Here are some key benefits of getting pre-approved for a mortgage:

- Know your budget: A pre-approval letter provides a specific loan amount you qualify for, giving you a realistic understanding of your purchasing power.

- Competitive advantage: Sellers are more likely to take your offer seriously when you have a pre-approval letter, as it demonstrates your financial readiness.

- Faster closing: The pre-approval process streamlines the loan approval process, potentially shortening the time it takes to close on your home.

- Peace of mind: Knowing you’re financially ready to buy a home can ease the stress and uncertainty of the home-buying journey.

How to Get Pre-Approved

To get pre-approved for a mortgage, you’ll need to provide the following information to a mortgage lender:

- Personal information: This includes your name, address, Social Security number, and employment details.

- Financial information: You’ll need to provide your income, assets, and debts, including your credit score.

- Desired loan terms: This includes the type of loan you want (e.g., conventional, FHA, VA), the loan amount, and the interest rate you’re aiming for.

Tips for Getting Pre-Approved

Here are some tips to increase your chances of getting pre-approved for a mortgage:

- Check your credit report: Review your credit report for any errors and dispute them promptly.

- Pay down debt: Lowering your debt-to-income ratio (DTI) can improve your chances of getting approved and securing a better interest rate.

- Shop around: Compare rates and terms from different lenders to find the best deal for you.

- Gather all necessary documents: Be prepared to provide all required documentation to the lender promptly to expedite the process.

Navigating the Home Search Process

Buying a home is a significant investment and a complex process that requires careful planning and consideration. With so many factors to consider, from location and budget to property type and desired features, it’s crucial to have a solid strategy in place. This article will guide you through the essential steps involved in navigating the home search process successfully.

1. Determine Your Needs and Wants

Before embarking on your home search, it’s essential to define your needs and wants. Consider factors like:

- Location: Proximity to work, schools, amenities, and desired neighborhoods.

- Budget: Determine your affordability range and secure pre-approval for a mortgage.

- Property type: House, condo, townhouse, etc.

- Size and features: Number of bedrooms, bathrooms, square footage, and desired amenities.

- Lifestyle: Consider your daily routines, hobbies, and future plans.

2. Research and Explore

Once you’ve established your criteria, it’s time to research and explore potential properties. Utilize online real estate platforms, attend open houses, and consult with a real estate agent. Explore different neighborhoods to gain a firsthand understanding of their atmosphere and amenities.

3. Work with a Real Estate Agent

A qualified real estate agent can be invaluable in navigating the home search process. They possess market expertise, negotiation skills, and access to exclusive listings. A good agent will understand your needs and help you find properties that align with your criteria.

4. Set Realistic Expectations

It’s essential to set realistic expectations throughout the process. Remember that finding your dream home may take time, and compromises might be necessary. Be prepared for ups and downs and stay patient during the search.

5. Thoroughly Inspect Properties

When considering a property, arrange for a professional home inspection. This comprehensive evaluation will identify any potential issues, such as structural defects, plumbing problems, or electrical hazards. The inspection report can provide valuable insights and help you negotiate the price or request repairs.

6. Make an Offer

Once you’ve found a suitable property, it’s time to make an offer. Your real estate agent can assist you in crafting a compelling offer that reflects your budget and the current market conditions. Be prepared to negotiate and potentially make revisions to your offer.

7. Secure Financing

Once your offer is accepted, it’s essential to secure mortgage financing. Work with a lender to obtain pre-approval and finalize the mortgage terms. This step ensures that you have the financial resources to complete the purchase.

8. Close the Deal

The closing process involves signing legal documents, transferring ownership, and completing the financial transactions. Your real estate agent and attorney will guide you through this final stage to ensure a smooth and successful completion.

Understanding Different Types of Homes

When you’re looking to buy a home, there are a lot of different factors to consider. One of the most important is the type of home you want. There are many different types of homes available, each with its own unique set of advantages and disadvantages. In this blog post, we will discuss some of the most popular types of homes and what makes them unique.

Single-Family Homes

A single-family home is a detached structure that sits on its own lot of land. This means that you own the land and the structure, and you don’t share any walls or common areas with other people. Single-family homes are the most common type of home in the United States, and they offer a variety of advantages, including privacy, independence, and the ability to customize your home to your liking. However, single-family homes can also be expensive to purchase and maintain, and they often require more work than other types of homes.

Townhouses

A townhouse is a multi-level dwelling that shares at least one wall with another unit. Townhouses are often found in urban or suburban areas, and they offer a good balance of space and affordability. They are typically more affordable than single-family homes because they share some common areas, such as the exterior walls and landscaping. Townhouses also offer the benefit of being close to amenities and transportation.

Condominiums

A condominium, or condo, is a unit within a larger building that is owned individually. Condo owners own their unit but share ownership of common areas, such as the lobby, elevators, and swimming pool. Condos are often found in urban areas, and they are a good option for people who want to live in a community setting. Condos can be more affordable than single-family homes and townhouses, and they often come with amenities that are not available in other types of homes.

Apartments

An apartment is a unit within a larger building that is rented from a landlord. Apartments are often the most affordable type of housing, and they offer a variety of amenities, such as laundry facilities, gyms, and swimming pools. However, apartments can lack the privacy and independence of other types of homes, and they may be subject to rules and regulations imposed by the landlord.

Duplexes

A duplex is a building that contains two separate living units. Duplexes can be either single-family or multi-family homes. Duplexes are often found in urban areas, and they offer a good balance of space and affordability. They can be a good option for people who want to live in a community setting but still have some privacy and independence.

Mobile Homes

A mobile home is a prefabricated home that is transported to a site and placed on a foundation. Mobile homes are often more affordable than other types of homes, and they offer a variety of amenities, such as kitchens, bathrooms, and bedrooms. However, mobile homes can be depreciated more quickly than other types of homes, and they may not be as durable or energy-efficient. Mobile homes also require a lot of land for parking.

Tiny Homes

A tiny home is a small, energy-efficient home that is typically less than 400 square feet. Tiny homes are becoming increasingly popular as a way to reduce living expenses and simplify life. Tiny homes can be built on wheels or placed on a foundation. Tiny homes are a good option for people who are looking for a more sustainable and affordable way to live.

Working with a Real Estate Agent

Buying or selling a home is one of the biggest financial decisions you’ll ever make. It’s also a complex process with many moving parts. That’s why it’s crucial to have a real estate agent on your side. A good agent can provide you with expert guidance, negotiate on your behalf, and help you navigate the entire process from start to finish.

Here are some of the key benefits of working with a real estate agent:

Market Expertise

Real estate agents have a deep understanding of the local market. They know the current market trends, average home prices, and what buyers are looking for. This knowledge can be invaluable when it comes to pricing your home or finding the right property for your needs.

Negotiation Skills

Negotiating the price of a home is a delicate process. A real estate agent can help you get the best possible price whether you’re buying or selling. They have the experience and skills to negotiate effectively with the other party, ensuring that you get a fair deal.

Access to Resources

Real estate agents have access to a wide range of resources that can be helpful throughout the buying or selling process. These resources may include:

- Mortgage lenders

- Home inspectors

- Title companies

- Staged homes

Time Savings

Finding the right home or finding a buyer can be time-consuming. A real estate agent can take care of many of the tasks involved in the process, freeing up your time to focus on other things. They’ll handle showings, paperwork, and communication with the other party.

Peace of Mind

Working with a real estate agent can provide you with peace of mind. You’ll know that you have an expert on your side who is looking out for your best interests. This can be especially helpful when dealing with the stress and uncertainty that can come with buying or selling a home.

When choosing a real estate agent, it’s important to do your research and find someone who is experienced, knowledgeable, and a good fit for your needs. Be sure to ask for referrals and interview several agents before making your decision.

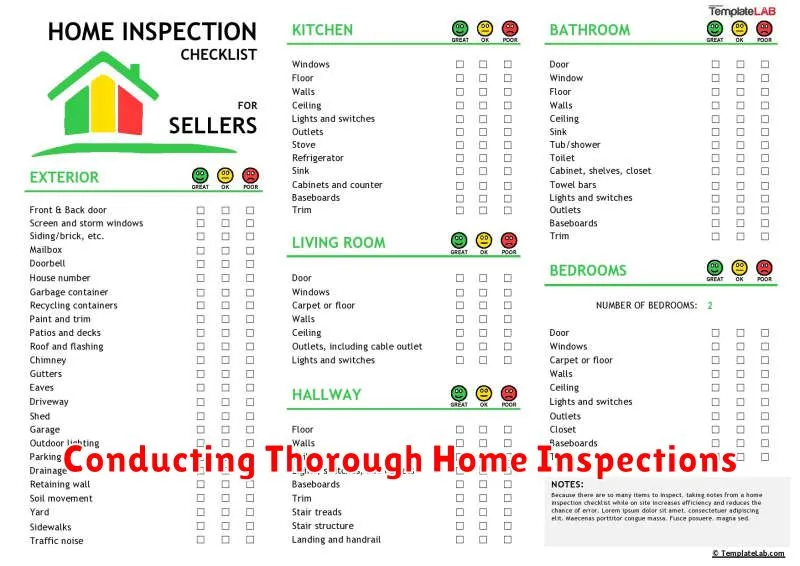

Conducting Thorough Home Inspections

A home inspection is an essential step in the home buying process. It can help you identify any potential problems with the property before you make an offer. A comprehensive home inspection will include a review of the home’s major systems, including the roof, foundation, plumbing, electrical, HVAC, and appliances. The inspector will also look for any signs of damage, deterioration, or safety hazards.

It is important to choose a qualified and experienced home inspector. A reputable inspector will be certified by a recognized professional organization, such as the American Society of Home Inspectors (ASHI) or the National Association of Certified Home Inspectors (NACHI). They will also be insured and bonded.

When you are choosing a home inspector, it is important to ask about their experience and qualifications. You should also ask about the scope of their inspection and what they will cover. A good home inspector will be able to provide you with a detailed report that outlines any problems they find. This report will be valuable to you as you negotiate with the seller.

Here are some tips for conducting a thorough home inspection:

- Be present during the inspection.

- Ask questions.

- Take notes.

- Take photos.

- Review the inspector’s report carefully.

If you are considering purchasing a home, a home inspection is an essential step in the process. It can help you identify any potential problems with the property before you make an offer, and give you the peace of mind you need to make an informed decision.

Negotiating the Offer and Closing Costs

Once your offer has been accepted, you will need to negotiate the terms of the sale, including the final purchase price and closing costs. It is important to understand the difference between the two.

Purchase price is the total amount of money you will pay for the property. This includes the price of the property, plus any additional fees, such as closing costs. Closing costs are expenses incurred in the process of buying a property. These costs include things like:

- Appraisal fees

- Loan origination fees

- Title insurance

- Recording fees

- Property taxes

- Homeowner’s insurance

It is important to remember that closing costs can vary depending on the location, the lender, and the type of property you are purchasing. You should be prepared to negotiate the closing costs with the seller. In many cases, you can negotiate to have the seller pay for some or all of the closing costs. This can be a great way to save money and make the purchase more affordable.

Here are some tips for negotiating the purchase price and closing costs:

- Be prepared to walk away. If you are not happy with the terms of the deal, you should be willing to walk away. This will give you more leverage in negotiations.

- Be realistic about your expectations. Don’t expect to get the property for a significantly lower price than the asking price, especially in a competitive market.

- Get everything in writing. Once you have reached an agreement, make sure that all of the terms are put in writing. This will help to prevent any misunderstandings later on.

- Consider the overall cost of ownership. When negotiating the purchase price and closing costs, it is important to think about the long-term costs of owning the property. This includes things like property taxes, insurance, and maintenance costs.

Negotiating the purchase price and closing costs can be a stressful process. However, it is an important step in the homebuying process. By following these tips, you can increase your chances of getting the best possible deal.

Securing Homeowners Insurance

Owning a home is a significant milestone in life, but it also comes with responsibilities, including securing adequate homeowners insurance. This type of insurance protects your home and belongings against various unforeseen events, providing financial peace of mind. While the process might seem daunting, understanding the basics and following these steps can help you secure the right coverage for your needs.

1. Assess Your Needs

Before diving into the world of insurance policies, take some time to assess your specific needs. Consider factors like:

- The value of your home and belongings

- The level of risk in your area (e.g., natural disasters, crime rates)

- Your personal financial situation

- Your desired level of coverage (e.g., dwelling coverage, personal property, liability)

2. Research and Compare Quotes

Once you understand your needs, start researching different insurance providers. Request quotes from multiple companies to compare coverage options, premiums, and deductibles. Online comparison tools can streamline this process, but don’t hesitate to contact insurance agents directly for personalized advice.

3. Consider Discounts

Most insurance companies offer various discounts that can significantly reduce your premiums. These discounts can range from bundling home and auto insurance to installing security systems or having a good credit score. Inquire about available discounts during your research phase.

4. Understand Your Policy

Once you’ve chosen a policy, take the time to thoroughly understand its terms and conditions. Pay attention to:

- Coverage limits: The maximum amount your insurance will pay for each type of loss.

- Deductibles: The amount you pay out of pocket before your insurance kicks in.

- Exclusions: Specific events or situations not covered by your policy.

5. Update Your Policy Regularly

As your circumstances change, so should your homeowners insurance. Make sure to update your policy periodically to reflect:

- Significant home improvements or renovations

- Changes in your belongings’ value

- Increases in your financial needs

Moving In and Maintaining Your New Home

Moving into a new home is an exciting time, full of possibilities. It’s a chance to start fresh and create a space that truly reflects your personality and needs. However, it’s also important to remember that owning a home comes with responsibilities. One of the most important is maintaining your new home to ensure it remains in good condition and retains its value.

The first step in maintaining your new home is to familiarize yourself with the basics. This includes understanding how your home’s systems work, such as the plumbing, heating, and electrical systems. It’s also a good idea to learn about the different types of materials used in your home and how to care for them. For example, you’ll need to know how to clean wood floors, how to maintain a granite countertop, or how to care for a stainless steel refrigerator.

Preventative Maintenance

One of the best ways to maintain your home is by practicing preventative maintenance. This means regularly checking your home’s systems and addressing any issues before they become major problems. Here are a few examples:

- Inspect your roof for missing or damaged shingles.

- Clean your gutters to prevent clogs and water damage.

- Check your smoke detectors and carbon monoxide detectors regularly and replace the batteries at least twice a year.

- Service your HVAC system annually to ensure it’s running efficiently.

- Inspect your plumbing for leaks or other issues.

Preventative maintenance is like an investment in your home. By addressing small problems early on, you can prevent costly repairs down the road.

Keep Your Home Clean

It may seem obvious, but keeping your home clean is essential for maintaining its condition and for your health and well-being. A clean home is less likely to attract pests and allergens. Here are a few tips for keeping your home clean:

- Dust and vacuum regularly.

- Clean your bathrooms weekly.

- Wash your bedding every week.

- Clean your kitchen counters and sink after each use.

- Wipe down spills immediately.

- Clean your windows and mirrors regularly.

Keeping your home clean doesn’t have to be a chore. It can be a relaxing activity, especially if you listen to music or podcasts while you clean.

Stay Organized

Staying organized is another important aspect of maintaining your new home. It prevents clutter from accumulating and creating a chaotic environment. Here are a few tips:

- Declutter regularly. Get rid of items you no longer need or use.

- Create a system for storing items. This might involve using storage bins, shelves, or other organizers.

- Keep paperwork organized. File important documents in a safe and easily accessible location.

Staying organized can save you time and stress and make your home a more peaceful and enjoyable place to live. It can also help you easily find items when you need them.

Protect Your Home From Damage

One of the most important aspects of maintaining your home is protecting it from damage. This includes taking steps to prevent damage from natural disasters, such as floods, fires, and earthquakes. It also means being careful not to damage your home through negligence. Here are a few tips:

- Keep your home well-maintained. This includes regularly inspecting and repairing any damage or wear and tear.

- Install smoke detectors and carbon monoxide detectors. And remember to test them regularly.

- Install a home security system. This can help deter burglars and protect your home from theft.

- Be careful with fire. Never leave candles unattended and always extinguish them before leaving the room.

- Be mindful of your landscaping. Trees and shrubs should be trimmed regularly to prevent them from growing too close to your home.

- Use caution when using power tools and other equipment. Always read the instructions carefully and follow all safety precautions.

Protecting your home from damage is an ongoing process, but it’s a crucial one. It can help you avoid costly repairs and protect your investment in your home. A well-maintained home is a safe and enjoyable home for you and your family. Plus, it adds value to your home, which is important when you’re ready to sell it.