Are you ready to take control of your financial future and build a solid foundation for a prosperous life? Investing can seem daunting, especially if you’re a beginner, but it doesn’t have to be. The truth is, anyone can start investing, regardless of their experience or starting capital. This article will serve as your guide to unlocking your financial future by exploring beginner-friendly investment strategies that can help you grow your wealth over time.

We’ll cover a range of investment options suitable for all levels, from low-risk savings accounts to high-growth stocks. You’ll gain valuable insights into diversifying your portfolio, managing risk, and making informed investment decisions. Whether you’re aiming to save for retirement, a down payment on a home, or simply building a financial safety net, this guide will equip you with the knowledge and confidence to embark on your investment journey.

Understanding Your Financial Goals

Financial goals are the aspirations you have for your financial future. They can range from short-term goals, like saving for a vacation, to long-term goals, like retirement planning. Having clear and well-defined financial goals is essential for achieving financial success.

Why are Financial Goals Important?

Financial goals provide direction and motivation. They help you prioritize your spending, make informed financial decisions, and stay on track towards your desired outcomes. Without defined goals, it’s easy to lose sight of your financial objectives and end up drifting aimlessly.

Types of Financial Goals

Financial goals can be categorized into various types:

- Short-term goals: These are goals you aim to achieve within a year or less, such as saving for a down payment on a car, paying off debt, or taking a vacation.

- Mid-term goals: These goals typically span 1-5 years and might include buying a home, funding your child’s education, or starting a business.

- Long-term goals: These are goals that extend beyond 5 years, such as retirement planning, investing for your children’s future, or leaving a legacy.

Setting SMART Financial Goals

To ensure your financial goals are achievable, it’s crucial to set SMART goals:

- Specific: Clearly define your goal, leaving no room for ambiguity.

- Measurable: Set a quantifiable target for your goal, such as a specific amount of money or a percentage increase.

- Achievable: Ensure your goal is realistic and within your reach, considering your current financial situation and resources.

- Relevant: Make sure your goal aligns with your values, priorities, and overall financial aspirations.

- Time-bound: Set a deadline for achieving your goal to create a sense of urgency and accountability.

Creating a Financial Plan

Once you have defined your financial goals, you need to create a comprehensive financial plan. This plan should outline your strategies for achieving your goals, including budgeting, saving, investing, and managing debt.

Regularly Review and Adjust Your Goals

Life is unpredictable, and your financial goals may need to be adjusted along the way. It’s essential to regularly review your goals and make necessary modifications based on changes in your circumstances, priorities, or market conditions.

Building a Solid Emergency Fund

Life is full of uncertainties, and unexpected expenses can pop up at the most inconvenient times. Whether it’s a sudden medical emergency, car repair, or job loss, having a solid emergency fund can provide a safety net and prevent financial hardship.

An emergency fund is a pool of money set aside for unexpected expenses. It’s a crucial element of personal finance, acting as a financial cushion that helps you navigate through unexpected events without derailing your financial stability.

Why is an Emergency Fund Important?

An emergency fund offers several benefits, including:

- Financial Security: It provides a safety net to cover unexpected expenses without having to resort to high-interest debt, such as credit cards or payday loans.

- Peace of Mind: Knowing you have a financial buffer for unexpected events can reduce stress and anxiety.

- Flexibility and Options: An emergency fund gives you the freedom to make decisions without financial constraints, such as taking advantage of opportunities or dealing with unexpected challenges.

- Credit Score Protection: By avoiding high-interest debt, you can maintain a good credit score, which is crucial for future borrowing needs.

- Job Loss Protection: In case of job loss, an emergency fund can provide income support while you actively seek new employment.

How Much Should You Save?

The recommended amount for an emergency fund is 3 to 6 months’ worth of living expenses. This means enough money to cover your essential needs like rent, utilities, groceries, and transportation for that period. However, the ideal amount can vary depending on your individual circumstances, such as your income, dependents, and level of risk tolerance.

Tips for Building Your Emergency Fund

Here are some practical tips to help you build your emergency fund:

- Set a Savings Goal: Determine the amount you want to save and set a clear target. It’s easier to stay motivated when you have a specific goal in mind.

- Automate Your Savings: Set up automatic transfers from your checking account to your savings account on a regular basis. This ensures consistent contributions without requiring you to manually transfer funds each time.

- Track Your Expenses: Monitor your spending to identify areas where you can cut back and free up more money for savings.

- Look for Extra Income: Consider part-time work, freelancing, or selling unwanted items to generate additional income for your emergency fund.

- Be Consistent and Patient: Building an emergency fund takes time and effort. Be consistent with your savings and don’t get discouraged if it takes longer than you expected.

Remember, an emergency fund is an essential part of a healthy financial plan. It provides peace of mind and financial security for unexpected situations. By consistently saving and following these tips, you can build a solid emergency fund that will protect your financial well-being in the long run.

Exploring Different Investment Options: From Stocks to Bonds

Investing is an essential part of achieving financial goals, whether it’s buying a house, retiring comfortably, or simply securing your future. But with so many different investment options available, it can be overwhelming to know where to start. This article will explore some of the most popular investment options, including stocks, bonds, real estate, and mutual funds. We’ll delve into their characteristics, potential risks, and rewards to help you make informed investment decisions.

Stocks: Owning a Piece of a Company

Stocks represent ownership in a public company. When you buy a stock, you’re essentially purchasing a share of the company’s profits and assets. Stocks are generally considered higher-risk investments, but they also have the potential for higher returns.

There are two main types of stocks: common stock and preferred stock. Common stockholders have voting rights and receive dividends if the company declares them. Preferred stockholders receive a fixed dividend payment, but they don’t usually have voting rights.

Bonds: Lending Money to Borrowers

Bonds are debt securities issued by governments, corporations, or other entities. When you buy a bond, you’re lending money to the issuer in exchange for regular interest payments and the repayment of the principal amount at maturity.

Bonds are generally considered less risky than stocks because they offer a fixed rate of return. However, bonds also carry some risk, such as the risk that the issuer may default on its debt obligations.

Real Estate: Investing in Tangible Assets

Investing in real estate involves buying properties, such as houses, apartments, or commercial buildings. Real estate can be a profitable investment, but it also requires significant capital and can be illiquid.

There are several ways to invest in real estate, including purchasing rental properties, flipping houses, or investing in real estate investment trusts (REITs).

Mutual Funds: Diversifying Your Portfolio

Mutual funds are investment vehicles that pool money from multiple investors to buy a diversified portfolio of stocks, bonds, or other assets. Mutual funds are managed by professional portfolio managers who make investment decisions on behalf of the fund’s investors.

Mutual funds offer several benefits, including diversification, professional management, and liquidity. They also offer investors a convenient way to access a wide range of investment opportunities with a relatively small amount of capital.

Choosing the Right Investment Options for You

The best investment options for you will depend on your individual financial goals, risk tolerance, and time horizon. It’s essential to carefully consider these factors before making any investment decisions.

Consult with a financial advisor who can help you develop a personalized investment plan. They can provide guidance on asset allocation, diversification, and risk management.

The Power of Diversification: Don’t Put All Your Eggs in One Basket

In the realm of finance, a timeless adage holds true: “Don’t put all your eggs in one basket.” This principle, known as diversification, is the cornerstone of sound investment strategies. It involves spreading your investments across a variety of assets, industries, and geographies to mitigate risk and enhance returns.

The essence of diversification lies in reducing the impact of any single investment’s performance on your overall portfolio. Imagine you have all your savings invested in a single stock. If that company encounters difficulties, the value of your investment could plummet, leaving you with significant losses. However, if you had diversified your investments across multiple stocks, bonds, real estate, or other asset classes, the impact of any one investment’s decline would be cushioned by the gains or stability of other investments.

Diversification is not just about spreading your investments across different asset classes; it also encompasses diversifying within those classes. For instance, within the stock market, it’s crucial to invest in companies from various industries, sectors, and market capitalizations. This approach helps you capture the growth potential of different sectors while mitigating the risk associated with any one industry’s performance.

Diversification also plays a vital role in managing risk over the long term. By spreading your investments across a wide range of assets, you’re less vulnerable to market fluctuations and economic downturns. When one sector or asset class experiences a downturn, others may perform well, providing a buffer against overall losses. This strategy helps you maintain a consistent return over time, even during periods of market volatility.

While diversification is a powerful tool for managing risk, it’s important to note that it doesn’t eliminate risk entirely. Every investment carries some degree of risk, and diversification simply helps to reduce that risk. It’s also crucial to tailor your diversification strategy to your individual circumstances, financial goals, and risk tolerance.

In conclusion, embracing the power of diversification is a key element of responsible investing. By spreading your investments across a variety of assets, you can reduce risk, enhance returns, and build a more resilient portfolio for the long term. Remember the old adage: “Don’t put all your eggs in one basket.” Diversification is the cornerstone of financial security and can help you achieve your investment goals with greater confidence.

Dollar-Cost Averaging: Investing Consistently Over Time

Dollar-cost averaging (DCA) is a popular investment strategy that involves investing a fixed amount of money at regular intervals, regardless of the market’s current price. This strategy aims to reduce the impact of market volatility and mitigate the risk of buying high and selling low. By investing consistently over time, DCA helps you average out your purchase price, potentially leading to higher returns in the long run.

One of the key benefits of DCA is that it promotes discipline and consistency. It encourages investors to stick to their investment plan, regardless of market fluctuations. This can be especially helpful during periods of market uncertainty or when emotions are running high. By investing regularly, you avoid trying to time the market, which is a notoriously difficult task even for experienced investors.

Another advantage of DCA is that it helps to reduce the overall risk of your investment portfolio. By investing gradually, you are less likely to invest a large sum of money at an unfavorable time. This can be particularly beneficial during market downturns, as you are buying more shares at lower prices, effectively averaging out your cost basis.

While DCA can be an effective investment strategy, it’s important to understand that it’s not a guaranteed path to wealth. Market returns can vary significantly over time, and there’s no way to predict future performance. It’s also important to consider your investment goals and risk tolerance when deciding if DCA is the right strategy for you.

Here are some key considerations when using DCA:

Choosing the Right Investment

The first step in implementing DCA is to choose the right investment vehicle. This could be a broad market index fund, a sector-specific ETF, or even individual stocks. Consider your investment goals, risk tolerance, and time horizon when making this decision.

Determining the Investment Amount

The next step is to determine the amount you’re comfortable investing regularly. This should be an amount that you can afford to invest without jeopardizing your financial security. Start small if necessary and gradually increase your investment amount as your financial situation improves.

Setting a Schedule

Decide on a regular schedule for your investments, such as monthly, quarterly, or even annually. Consistency is key to successful DCA, so stick to your chosen schedule as much as possible.

Staying Patient

DCA is a long-term strategy, so it’s important to be patient and avoid getting discouraged by short-term market fluctuations. Remember that the goal is to average out your purchase price over time, not to time the market perfectly.

Dollar-cost averaging can be a valuable tool for investors of all experience levels. By investing consistently over time, you can reduce the impact of market volatility and increase your chances of achieving long-term investment success.

Starting Small: Your Investment Journey Begins with a Single Step

Investing can seem daunting, especially if you’re just starting out. You might feel like you need a lot of money to get started, or that you need to understand complex financial jargon. But the truth is, investing can be accessible to everyone, regardless of your income or experience level. The key is to start small and build your knowledge gradually.

One of the biggest misconceptions about investing is that you need a lot of money to begin. This simply isn’t true. There are many investment options available that allow you to start with just a few dollars. For example, you can invest in fractional shares of stocks or ETFs, which means you can purchase a portion of a share rather than the entire share. This makes investing more affordable for people with limited capital.

Another great way to start small is to take advantage of automatic investing apps. These apps allow you to set up recurring investments, often for as little as $1 per day. This can help you build a portfolio over time without even having to think about it. The power of compounding returns means even small, regular investments can grow significantly over time.

Don’t let the fear of making a mistake hold you back. Everyone makes mistakes when they’re first starting out. The important thing is to learn from your mistakes and keep moving forward. There are many resources available to help you learn about investing, from online articles and videos to books and financial advisors.

Remember, investing is a marathon, not a sprint. The most important thing is to get started and be consistent with your investments. Even if you only start with a small amount, over time, your investments can grow into something significant. So don’t wait any longer. Take that first step today and start building your financial future!

Seeking Expert Advice: Financial Advisors and Their Role

In today’s complex and ever-changing financial landscape, it can be overwhelming to navigate the myriad of investment options, retirement planning strategies, and tax implications. This is where financial advisors come in, providing invaluable guidance and expertise to help individuals achieve their financial goals.

A financial advisor, also known as a wealth manager, is a professional who provides financial advice and services to individuals and families. They assist with a wide range of financial matters, including:

- Investment planning: Developing a personalized investment strategy that aligns with your risk tolerance, time horizon, and financial objectives.

- Retirement planning: Creating a comprehensive retirement plan to ensure you have enough savings to meet your future needs.

- Tax planning: Minimizing your tax liability through strategies such as tax-advantaged accounts and charitable giving.

- Estate planning: Preparing for the transfer of your assets to your heirs, including wills, trusts, and power of attorney documents.

- Insurance planning: Assessing your insurance needs and recommending appropriate coverage for life, health, disability, and property.

- Debt management: Developing strategies to reduce or eliminate high-interest debt.

- College savings: Planning for the costs of higher education for your children or grandchildren.

Financial advisors offer a variety of services, from basic advice to comprehensive wealth management. The level of service you need will depend on your individual circumstances and financial goals. Some common types of financial advisors include:

- Registered Investment Advisors (RIAs): These advisors are fiduciaries, meaning they are legally obligated to act in their clients’ best interests.

- Brokers: These advisors work for brokerage firms and may earn commissions based on the products they sell.

- Certified Financial Planners (CFPs): These advisors have met specific educational and experience requirements and have passed a rigorous certification exam.

- Chartered Financial Analyst (CFA): These advisors are highly trained in investment analysis and portfolio management.

When choosing a financial advisor, it’s essential to do your research and find someone who is qualified, experienced, and a good fit for your needs. You should consider factors such as their credentials, fees, investment philosophy, and communication style.

A financial advisor can be a valuable asset in your financial journey. They can provide the guidance and support you need to make informed decisions, manage your finances effectively, and achieve your financial goals.

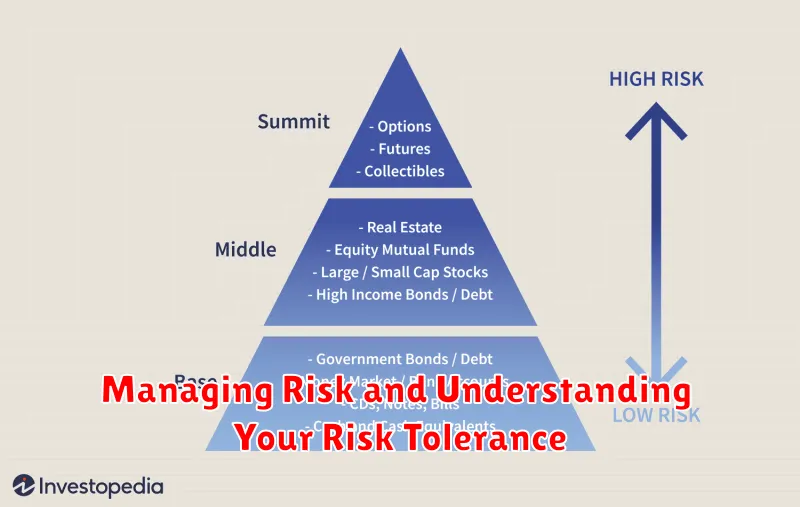

Managing Risk and Understanding Your Risk Tolerance

Risk is an inherent part of investing. It’s the possibility that an investment may not perform as expected, resulting in a loss of value. While no one can predict the future, understanding and managing risk is crucial for achieving your financial goals. This involves assessing your risk tolerance, which is your ability and willingness to handle potential losses in pursuit of potential gains.

Your risk tolerance is influenced by factors such as:

- Age: Younger investors generally have a higher risk tolerance as they have more time to recover from potential losses.

- Financial situation: Investors with a strong financial foundation and emergency savings may be more comfortable with risk.

- Investment goals: Short-term goals typically require lower-risk investments, while long-term goals may allow for greater risk-taking.

- Personal values: Your comfort level with risk can also be influenced by your values and beliefs.

There are different ways to assess your risk tolerance:

- Risk questionnaires: Many financial institutions offer online questionnaires to gauge your risk tolerance.

- Discussions with a financial advisor: A financial advisor can help you understand your risk tolerance and develop a portfolio that aligns with your goals.

Once you understand your risk tolerance, you can implement strategies to manage risk:

- Diversification: Spreading your investments across different asset classes, such as stocks, bonds, and real estate, can reduce overall risk.

- Rebalancing: Regularly adjusting your portfolio to maintain your desired asset allocation can help mitigate risk over time.

- Understanding investment options: Each investment has a unique risk profile. Choose investments that align with your risk tolerance and investment goals.

It’s important to remember that risk management is an ongoing process. Your circumstances and goals can change over time, so regularly reviewing your risk tolerance and investment strategy is essential. By understanding your risk tolerance and implementing effective management strategies, you can increase your chances of achieving your financial goals while minimizing potential losses.

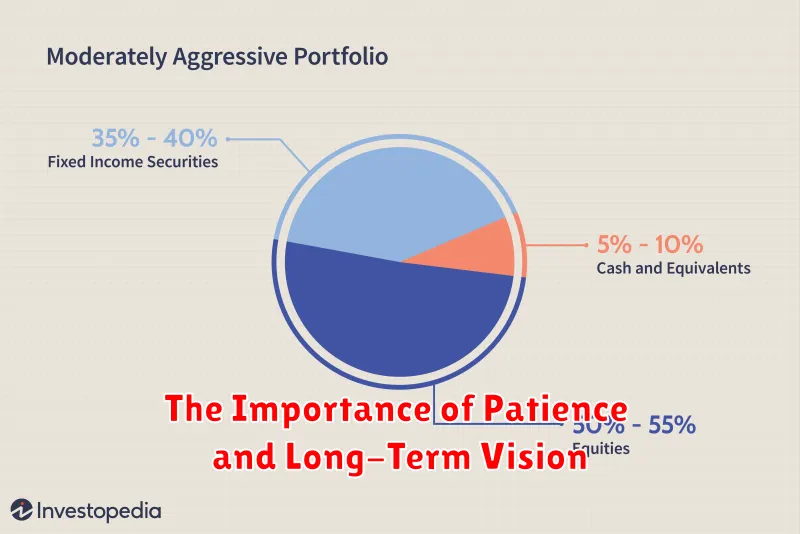

The Importance of Patience and Long-Term Vision

In a world that constantly bombards us with instant gratification, it can be challenging to cultivate patience and embrace a long-term vision. The allure of quick wins and immediate results often overshadows the value of sustained effort and strategic planning. However, it is precisely in the pursuit of long-term goals that true success and fulfillment lie.

Patience is not merely about waiting; it is about embracing the process, understanding that growth takes time and that setbacks are inevitable. It requires a steadfast belief in one’s goals, even when faced with obstacles and disappointments. When we practice patience, we allow ourselves to learn from mistakes, adapt our strategies, and develop resilience.

A long-term vision provides a roadmap for our journey. It gives us a sense of direction, purpose, and motivation. By envisioning a future state, we can align our actions and decisions with our aspirations. This vision acts as a compass, guiding us through the complexities of life and reminding us of our ultimate goals.

The benefits of patience and long-term vision are numerous. When we adopt this mindset, we cultivate a sense of inner peace and emotional stability. We are less likely to be swayed by fleeting desires or impulsive decisions. Instead, we make choices that are aligned with our values and our long-term objectives.

Furthermore, patience and long-term vision allow us to build lasting relationships. By investing in our connections and nurturing them over time, we cultivate trust, understanding, and a sense of community. These bonds provide support and encouragement during challenging times, ultimately enriching our lives.

In a society obsessed with instant gratification, cultivating patience and embracing a long-term vision can be a powerful antidote. By prioritizing the journey over the destination, we can unlock our true potential and achieve lasting success, both personally and professionally. The rewards of this mindset extend far beyond material gain, bringing a sense of purpose, fulfillment, and inner peace that is truly invaluable.

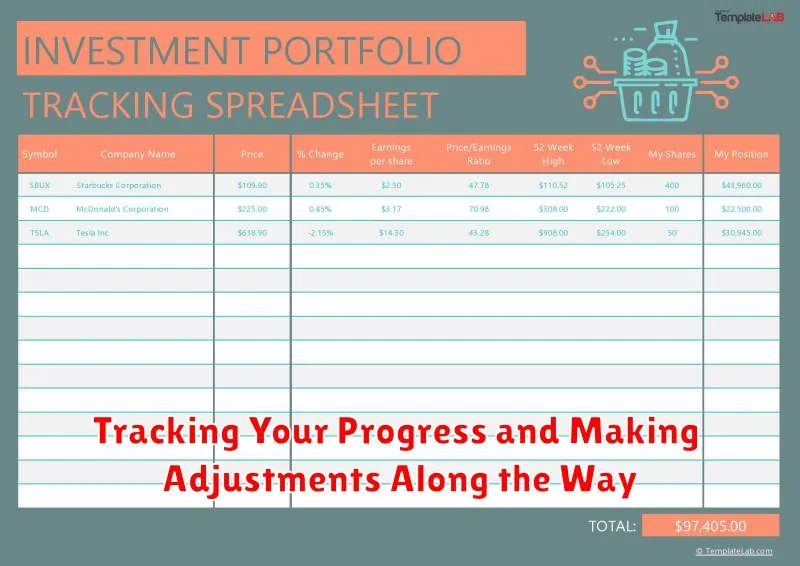

Tracking Your Progress and Making Adjustments Along the Way

It’s important to track your progress and make adjustments along the way. You can do this by setting up a system for tracking your progress and by being willing to change your plan if needed.

There are a few different ways to track your progress. One way is to keep a journal. In your journal, you can write down your goals, your progress, and any challenges you face. Another way is to use a spreadsheet or a tracking app. This can be helpful for tracking your progress in a more organized way.

Once you have a system for tracking your progress, it’s important to be willing to make adjustments along the way. If you’re not making progress on a particular goal, you may need to change your approach. You may also need to adjust your goals as you learn more about yourself and your capabilities.

Making adjustments along the way is an important part of the process. It’s how you ensure that you’re staying on track and that you’re making progress towards your goals. Don’t be afraid to change your plan if it’s not working. The important thing is to keep moving forward.