Are you looking to make a smart investment in 2024? Look no further than the real estate market! With the right research and guidance, you can unlock significant financial gains and secure your future. This year promises exciting opportunities in various hot markets across the globe. Whether you’re a seasoned investor or just starting your journey, our guide will equip you with the insights you need to navigate the real estate landscape and identify the most lucrative areas to invest in.

From booming urban centers to up-and-coming suburban hotspots, we’ll explore the key factors driving growth in each market, analyze current trends, and highlight the best properties to target. We’ll delve into factors like population growth, economic development, infrastructure improvements, and more, providing you with a comprehensive understanding of the real estate investment potential in each location. Get ready to discover hidden gems and capitalize on the most promising real estate opportunities in 2024. Let’s unlock those real estate riches together!

Why Invest in Real Estate in 2024?

The real estate market is a complex and ever-changing beast. While some experts predict a cooling off period in 2024, others believe that the market will continue to grow. So, why should you consider investing in real estate in the coming year?

One of the biggest reasons to invest in real estate is that it is a tangible asset. Unlike stocks or bonds, which are simply pieces of paper, real estate is something you can physically touch and see. This makes it a more secure investment, as it is less likely to be wiped out by a market crash.

Another reason to invest in real estate is that it can provide passive income. If you buy a rental property, you can collect rent from tenants, which can help to cover your mortgage payments and even generate a profit. This can be a great way to supplement your income or even build wealth over time.

Of course, there are also some risks associated with investing in real estate. For example, the value of your property could go down, or you could have difficulty finding tenants. However, with careful planning and research, you can mitigate these risks and increase your chances of success.

Overall, investing in real estate in 2024 could be a smart move. The market is expected to remain stable, and there are a number of benefits to owning real estate. If you are looking for a way to grow your wealth, consider adding real estate to your portfolio.

Emerging Trends Shaping the Real Estate Landscape

The real estate landscape is constantly evolving, shaped by a confluence of factors including technological advancements, shifting demographics, and evolving consumer preferences. From the rise of smart homes and proptech to the growing demand for sustainable living and flexible workspaces, several emerging trends are poised to redefine the way we live, work, and invest in real estate.

The Rise of Smart Homes

Technology is playing an increasingly important role in our lives, and the real estate sector is no exception. Smart homes are becoming increasingly popular, offering homeowners greater control over their living environment and enhanced convenience. From voice-activated assistants and automated lighting systems to security cameras and smart thermostats, these technologies are transforming the way we interact with our homes.

The Impact of Proptech

Proptech, or property technology, is revolutionizing the real estate industry by leveraging technology to streamline processes and improve the overall experience for both buyers and sellers. From online platforms for property searches and virtual tours to blockchain-based transactions and data analytics tools, proptech is enhancing efficiency, transparency, and accessibility in the real estate market.

Sustainable Living Takes Center Stage

Sustainability is no longer a niche concern; it’s a mainstream priority for many consumers. As awareness of climate change and its impacts grows, people are increasingly seeking out homes that are environmentally responsible and energy-efficient. Sustainable building materials, renewable energy sources, and water conservation are becoming key considerations in the real estate market.

The Future of Work: Flexibility and Remote Work

The rise of remote work has fundamentally changed the way we think about workspaces. Many professionals are now seeking out homes that offer dedicated office spaces or flexible living arrangements that accommodate both work and leisure. This trend is driving demand for multi-functional spaces and home offices, as well as co-working spaces and hybrid work models.

The Importance of Community and Lifestyle

Beyond the physical features of a home, buyers are increasingly prioritizing the sense of community and lifestyle that a neighborhood offers. This has led to a growing demand for walkable neighborhoods with amenities, green spaces, and a strong sense of community. This trend is also driving the popularity of mixed-use developments that integrate residential, commercial, and recreational spaces.

The Rise of Data and Analytics

Data and analytics are playing an increasingly important role in real estate decision-making. From predictive modeling to market trend analysis, data is being used to inform pricing strategies, identify investment opportunities, and understand consumer behavior. This trend is creating new opportunities for real estate professionals and investors who can leverage data effectively.

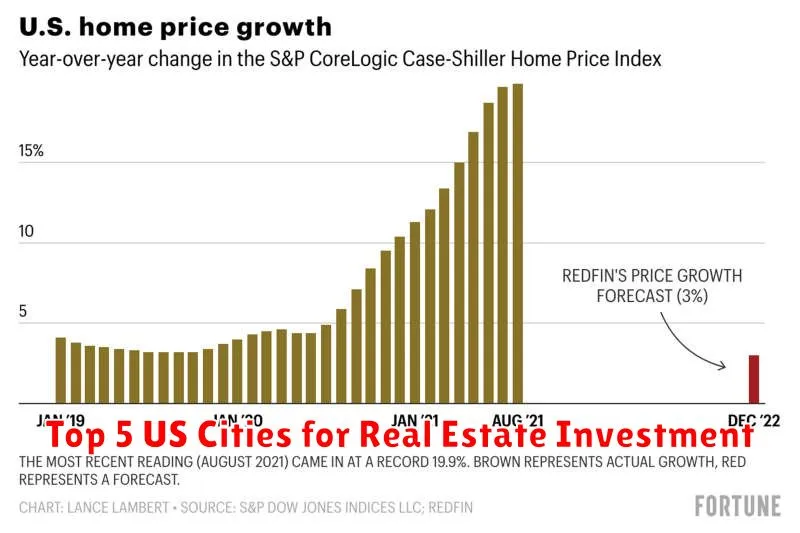

Top 5 US Cities for Real Estate Investment

Investing in real estate can be a lucrative way to build wealth and secure your financial future. With the right research and strategy, you can find properties that appreciate in value over time, providing you with passive income and long-term gains. The United States is a diverse and expansive country with a vast array of real estate markets, making it an ideal location for investors to explore. In this article, we will delve into the top 5 US cities that are currently attracting significant attention from real estate investors.

1. Austin, Texas:

Known for its booming tech industry, vibrant culture, and attractive lifestyle, Austin has become a magnet for both residents and investors. The city boasts a strong job market, a rapidly growing population, and a low cost of living relative to other major metropolitan areas. With increasing demand for housing, Austin’s real estate market is experiencing consistent appreciation, making it a prime location for long-term investments. The city’s cultural attractions, music scene, and outdoor recreation opportunities add to its allure, further driving investor interest.

2. Denver, Colorado:

Nestled amidst the stunning Rocky Mountains, Denver has emerged as a thriving hub for businesses, entrepreneurs, and families. The city’s strong economy, fueled by industries like technology, energy, and healthcare, has led to a surge in demand for housing. Denver’s real estate market offers a wide range of property types, from affordable apartments to luxury homes, catering to diverse investor needs. The city’s proximity to natural beauty and recreational activities further enhances its appeal to both residents and investors.

3. Charlotte, North Carolina:

Charlotte, often referred to as the “Queen City,” has witnessed a remarkable transformation in recent years. Its growing financial sector, coupled with a burgeoning tech industry, has spurred economic growth and job creation. As a result, Charlotte’s real estate market has experienced significant appreciation, making it a sought-after destination for investors. The city’s affordability compared to other major cities on the East Coast is another key factor that attracts investors looking for value and potential for long-term gains.

4. Atlanta, Georgia:

Known as the “Gate City of the South,” Atlanta has established itself as a major transportation hub, a center for commerce, and a cultural melting pot. The city’s strong economy, driven by industries like finance, healthcare, and technology, has fueled a steady rise in property values. Atlanta’s real estate market offers a diverse range of options, from historic neighborhoods to modern developments, catering to a variety of investor preferences. The city’s vibrant arts scene, culinary delights, and accessibility to the Southeast make it a popular choice for both residents and investors.

5. Phoenix, Arizona:

Phoenix, the capital of Arizona, has experienced a significant population boom in recent years, driven by its favorable climate, low cost of living, and growing economy. The city’s robust job market, fueled by industries like healthcare, technology, and manufacturing, has created a strong demand for housing. Phoenix’s real estate market offers a range of property types, from affordable single-family homes to luxury condominiums, catering to a diverse investor base. The city’s proximity to natural beauty, including the Sonoran Desert and the Grand Canyon, further enhances its appeal to those seeking a desirable location for investment.

International Havens for Property Investors

Investing in real estate can be a lucrative endeavor, but it’s important to consider the various factors that influence returns and risks. In today’s globalized world, international property investments offer a unique opportunity to diversify portfolios and explore alternative markets. From thriving metropolises to serene coastal havens, numerous destinations cater to the discerning investor seeking a slice of global real estate.

One of the most sought-after international havens for property investors is Dubai, a cosmopolitan city in the United Arab Emirates. Its thriving economy, tax-free income, and world-class infrastructure have attracted investors from across the globe. With a diverse property market offering luxury apartments, villas, and commercial spaces, Dubai presents a compelling investment proposition. The city’s iconic skyline, renowned attractions, and booming tourism industry contribute to its strong rental yields and capital appreciation potential.

Another promising destination is Portugal, a European country known for its stunning coastline, rich history, and favorable tax incentives. The “Golden Visa” program, which grants residency to non-EU citizens who invest in Portuguese real estate, has made Portugal a popular choice for international investors. The country’s attractive tax regime, coupled with its growing tourism sector and increasing demand for rental properties, presents a solid investment opportunity.

Across the Atlantic, Miami, Florida, stands out as a vibrant city with a thriving real estate market. The city’s strategic location, beautiful beaches, and cosmopolitan lifestyle have drawn investors seeking high-end residential and commercial properties. Miami’s strong rental market, fueled by a steady influx of tourists and residents, makes it an appealing choice for those seeking consistent income streams. The city’s growing technology sector and proximity to Latin America also contribute to its economic dynamism and future prospects.

For those seeking a tranquil lifestyle in a picturesque setting, Thailand offers a compelling investment opportunity. The country’s pristine beaches, vibrant culture, and affordable cost of living make it a popular destination for expats and investors. The government’s “Thailand Elite” program provides long-term visa options for those who invest in real estate, further enhancing the country’s appeal. Thailand’s strong tourism industry and growing economy offer investors the potential for both capital appreciation and rental income.

While these are just a few examples, the world offers a wide range of international property havens for investors to explore. It’s crucial to conduct thorough research, consult with financial advisors, and understand the legal and regulatory landscape before making any investment decisions. By carefully evaluating factors such as economic growth, rental yields, capital appreciation potential, and local market conditions, investors can make informed decisions that align with their financial goals and risk tolerance.

Analyzing Market Indicators for Smart Decisions

In the dynamic world of finance, making informed decisions is paramount. Market indicators serve as valuable tools, offering insights into market trends and potential future movements. By understanding and analyzing these indicators, investors can gain a competitive edge and make more informed investment choices.

Technical indicators, derived from historical price and volume data, provide insights into market sentiment and momentum. Popular technical indicators include:

- Moving averages: These indicators smooth out price fluctuations, highlighting trends and potential support and resistance levels.

- Relative Strength Index (RSI): This momentum oscillator measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

- MACD (Moving Average Convergence Divergence): This indicator compares two moving averages to identify potential trend changes and momentum shifts.

Fundamental indicators, on the other hand, focus on the underlying economic and financial factors that influence market performance. Key fundamental indicators include:

- Gross Domestic Product (GDP): This measure of a country’s economic output provides insights into overall economic growth.

- Inflation Rate: This indicator reflects the rate at which prices increase over time, impacting consumer spending and corporate profits.

- Interest Rates: Central bank interest rates influence borrowing costs and investment decisions.

Analyzing market indicators involves:

- Identifying relevant indicators based on the specific asset class, time horizon, and investment strategy.

- Interpreting the data to understand current market conditions and potential future movements.

- Combining different indicators to gain a comprehensive view of the market landscape.

By diligently analyzing market indicators, investors can enhance their decision-making process, navigate market volatility, and potentially achieve their financial goals.

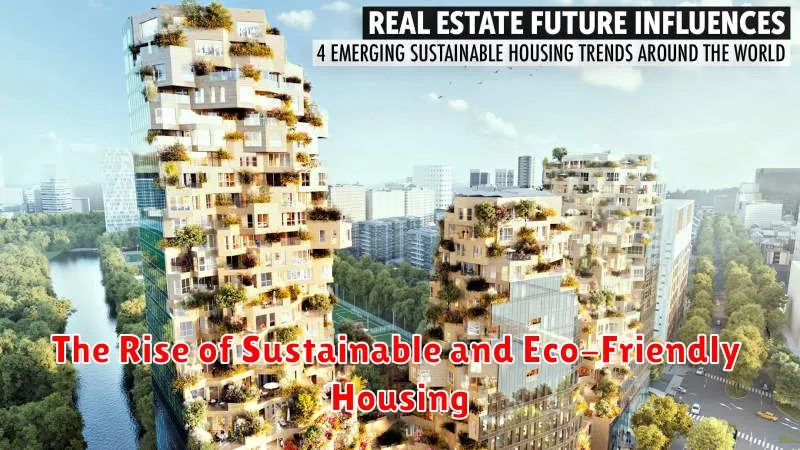

The Rise of Sustainable and Eco-Friendly Housing

In a world increasingly conscious of its environmental impact, the real estate industry is undergoing a significant transformation. The demand for sustainable and eco-friendly housing is on the rise, as individuals seek homes that minimize their footprint and contribute to a healthier planet. This trend is driven by several factors, including growing awareness of climate change, rising energy costs, and a desire for healthier living spaces.

What is Sustainable and Eco-Friendly Housing?

Sustainable and eco-friendly housing encompasses a broad range of features and practices designed to reduce environmental impact and promote resource conservation. This includes:

- Energy efficiency: Utilizing energy-efficient appliances, insulation, and renewable energy sources like solar panels to minimize energy consumption.

- Water conservation: Implementing water-saving fixtures, rainwater harvesting systems, and drought-tolerant landscaping to reduce water usage.

- Material selection: Choosing sustainable materials like bamboo, recycled wood, and locally sourced products to minimize embodied carbon.

- Green building practices: Adhering to green building standards like LEED (Leadership in Energy and Environmental Design) to ensure environmentally responsible construction.

- Healthy indoor air quality: Utilizing low-VOC (volatile organic compound) paints, natural ventilation, and air filtration systems to create a healthier living environment.

Benefits of Sustainable and Eco-Friendly Housing

The benefits of embracing sustainable and eco-friendly housing extend beyond environmental preservation. Here are some key advantages:

- Reduced energy bills: Energy efficiency measures lead to lower utility costs, saving homeowners money in the long run.

- Increased property value: Eco-friendly homes are often more desirable and command higher prices in the real estate market.

- Improved health and well-being: Healthy indoor air quality and reduced exposure to harmful chemicals contribute to a healthier living environment.

- Reduced environmental impact: By minimizing energy and water consumption, homeowners can make a positive difference in combating climate change and preserving natural resources.

- Enhanced lifestyle: Sustainable homes often incorporate features that enhance quality of life, such as outdoor living spaces, natural light, and green spaces.

The Future of Sustainable Housing

The demand for sustainable and eco-friendly housing is only expected to grow in the coming years. As awareness of climate change and environmental concerns continues to rise, more people will prioritize green living. The real estate industry is responding by offering a wider range of sustainable housing options, from new construction to renovations of existing properties. Government policies and incentives are also playing a role in promoting the adoption of sustainable building practices.

Navigating the Rental Market in 2024

The rental market is a dynamic beast, constantly evolving and presenting new challenges and opportunities for renters and landlords alike. In 2024, a confluence of factors is shaping the landscape, demanding a nuanced approach to navigating this crucial aspect of housing.

One of the most prominent trends is the rising cost of rent. Driven by a combination of inflation, high demand, and limited housing inventory, rent prices have been steadily climbing in many major cities across the globe. This trend is likely to continue in 2024, putting significant pressure on renters’ budgets.

However, amidst the rising costs, there are glimmers of hope. In some regions, rental growth is slowing down, suggesting a potential plateau in the near future. Additionally, the increasing availability of alternative housing options, such as co-living spaces and short-term rentals, can provide renters with more affordable and flexible choices.

For those seeking to secure a rental, the competition is fierce. With limited availability and high demand, it’s crucial to stand out as a strong candidate. Having a solid credit score, a stable income, and a strong rental history are essential. Proactively demonstrating your trustworthiness and commitment to being a responsible tenant can significantly increase your chances of securing your dream rental.

Landlords are also navigating a complex landscape. They face the pressure of keeping up with rising operating costs while providing a competitive rental experience. Investing in property upgrades, offering flexible lease terms, and prioritizing tenant satisfaction can help landlords retain tenants and attract new ones.

As we move forward in 2024, staying informed and adaptable is key. Understanding the evolving trends in the rental market can help both renters and landlords make informed decisions and navigate this dynamic environment successfully.

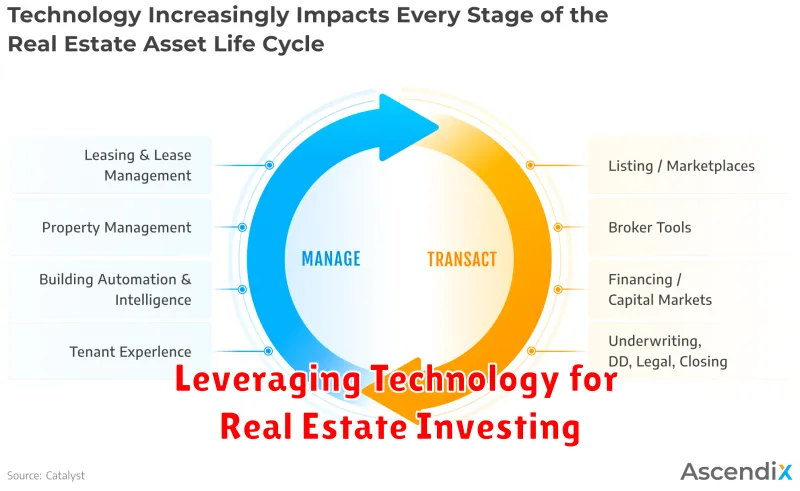

Leveraging Technology for Real Estate Investing

The real estate industry has undergone a significant transformation in recent years, driven by advancements in technology. From online platforms to data analytics tools, technology is empowering investors with unprecedented capabilities to make informed decisions, optimize operations, and maximize returns. This article explores how investors can leverage technology to enhance their real estate investing journey.

Data Analytics and Market Research

Data analytics plays a crucial role in understanding market trends, identifying investment opportunities, and assessing risk. Online platforms provide access to comprehensive data sets on property values, rental rates, demographics, and economic indicators. By analyzing this data, investors can gain valuable insights into market dynamics and make informed investment decisions.

Property Search and Listing Platforms

Real estate technology has revolutionized the property search process. Online platforms like Zillow, Redfin, and Trulia offer extensive listings, property details, and interactive maps. Investors can filter properties based on their criteria, view virtual tours, and contact agents directly. These platforms streamline the search process and provide greater transparency.

Virtual Tours and 3D Modeling

Virtual tours and 3D modeling have become increasingly popular, allowing investors to virtually experience properties without physically visiting them. This technology is particularly beneficial for investors who are looking to invest in properties located in remote locations or for properties that are still under construction. Virtual tours provide a realistic representation of the property, allowing investors to make informed decisions.

Property Management Software

Technology has significantly simplified property management. Software solutions like Buildium, AppFolio, and Yardi provide comprehensive features for managing tenants, collecting rent, tracking expenses, and automating tasks. These platforms streamline operations, enhance efficiency, and reduce the administrative burden associated with property management.

Crowdfunding Platforms

Crowdfunding platforms have opened up new avenues for real estate investing. Platforms like Fundrise and RealtyMogul allow investors to participate in commercial and residential real estate projects with relatively small investments. Crowdfunding provides access to diversified portfolios and potentially higher returns, making it an attractive option for investors with limited capital.

Artificial Intelligence (AI) and Machine Learning

AI and machine learning are transforming the real estate industry by automating tasks, analyzing data, and predicting future trends. AI-powered tools can assess property values, identify potential risks, and generate reports based on complex algorithms. These technologies empower investors with data-driven insights and improve decision-making.

Conclusion

Technology is reshaping the real estate investing landscape, empowering investors with tools to make informed decisions, optimize operations, and maximize returns. By embracing these advancements, investors can gain a competitive edge, enhance their portfolio performance, and navigate the complexities of the real estate market.

Expert Predictions for the Future of Real Estate

The real estate market is constantly evolving, and it can be difficult to predict what the future holds. However, there are some experts who have made predictions based on current trends and economic indicators. In this article, we will explore some of the most common predictions for the future of real estate.

One of the most common predictions is that the demand for rental properties will continue to increase. This is due to a number of factors, including the rising cost of homeownership, the increasing number of millennials who are choosing to rent rather than buy, and the growing popularity of short-term rentals. As a result, investors are likely to continue to see strong returns on their rental property investments.

Another common prediction is that technology will play a larger role in the real estate industry. This includes everything from online listings and virtual tours to smart home technology and AI-powered property management tools. As technology continues to advance, it is likely to streamline the real estate process and make it more efficient for both buyers and sellers.

Finally, many experts predict that sustainability will become increasingly important in the real estate market. Consumers are becoming more aware of the environmental impact of their choices, and they are increasingly demanding sustainable homes and buildings. This is leading to a growing demand for green building materials, energy-efficient appliances, and other sustainable features.

Overall, the future of real estate looks bright. While there are always uncertainties in the market, the long-term trends point to continued growth and innovation. Whether you are a homeowner, a renter, or an investor, it is important to stay informed about the latest trends and predictions in the real estate market. By doing so, you can make informed decisions that will help you achieve your financial goals.